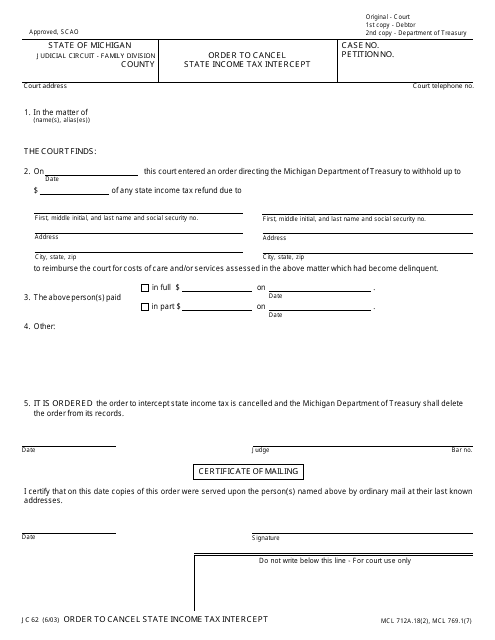

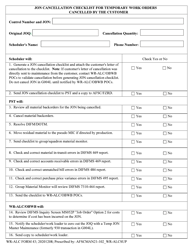

This version of the form is not currently in use and is provided for reference only. Download this version of

Form JC62

for the current year.

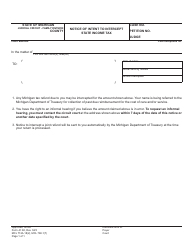

Form JC62 Order to Cancel State Income Tax Intercept - Michigan

What Is Form JC62?

This is a legal form that was released by the Michigan Juvenile Court - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

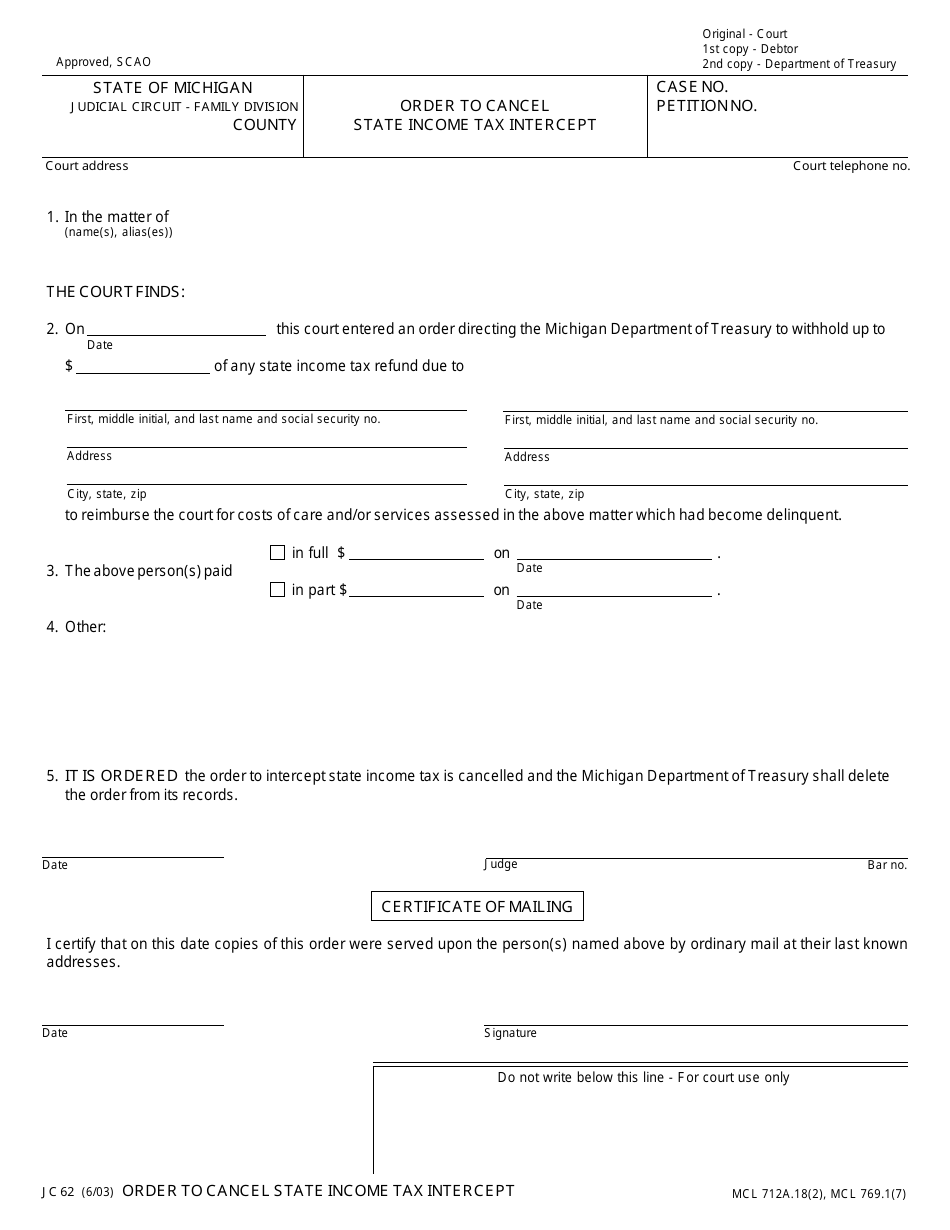

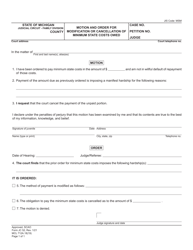

Q: What is JC62?

A: JC62 is an order form used to cancel a state income tax intercept.

Q: What is a state income tax intercept?

A: A state income tax intercept is a process where the state government can deduct money from an individual's tax refund to repay certain debts, such as unpaid taxes or child support payments.

Q: Why would someone need to cancel a state income tax intercept?

A: Someone may need to cancel a state income tax intercept if they believe there is an error in the intercept or if they have resolved the debt that triggered the intercept.

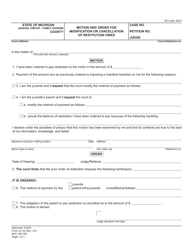

Q: How can someone cancel a state income tax intercept?

A: To cancel a state income tax intercept in Michigan, one can use the JC62 form to request the cancellation. The form must be filled out and submitted to the appropriate department, along with any required supporting documentation.

Q: What supporting documentation might be required to cancel a state income tax intercept?

A: The specific documentation required may vary depending on the reason for canceling the intercept. It is best to contact the Michigan Department of Treasury for guidance on what documentation should be included with the JC62 form.

Form Details:

- Released on June 1, 2003;

- The latest edition provided by the Michigan Juvenile Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form JC62 by clicking the link below or browse more documents and templates provided by the Michigan Juvenile Court.