This version of the form is not currently in use and is provided for reference only. Download this version of

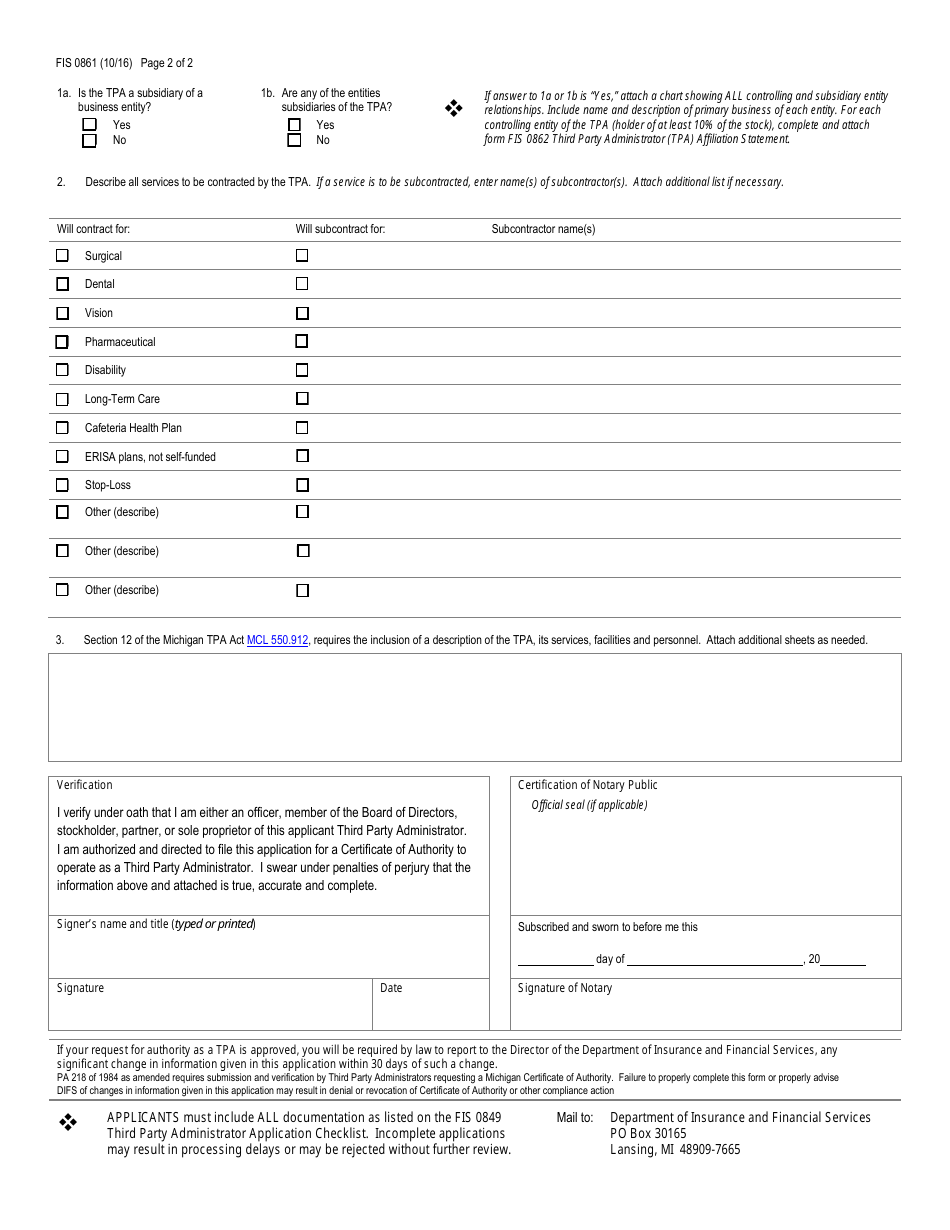

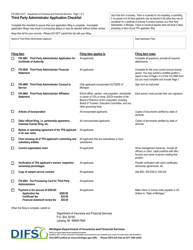

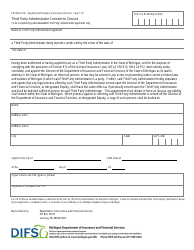

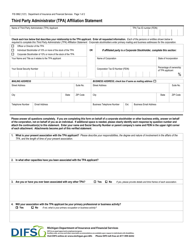

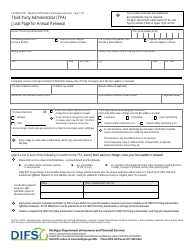

Form FIS0861

for the current year.

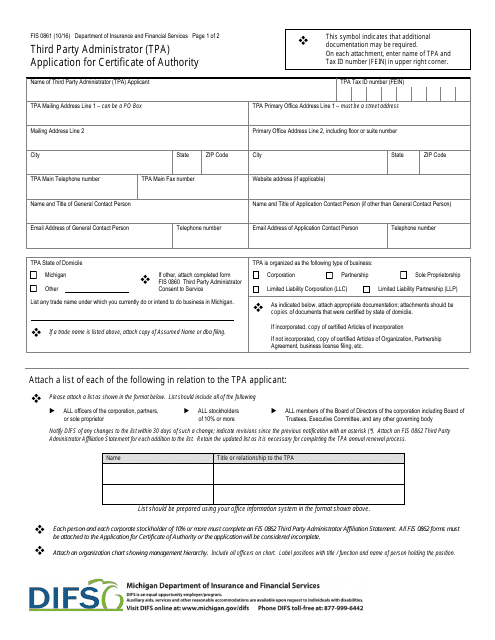

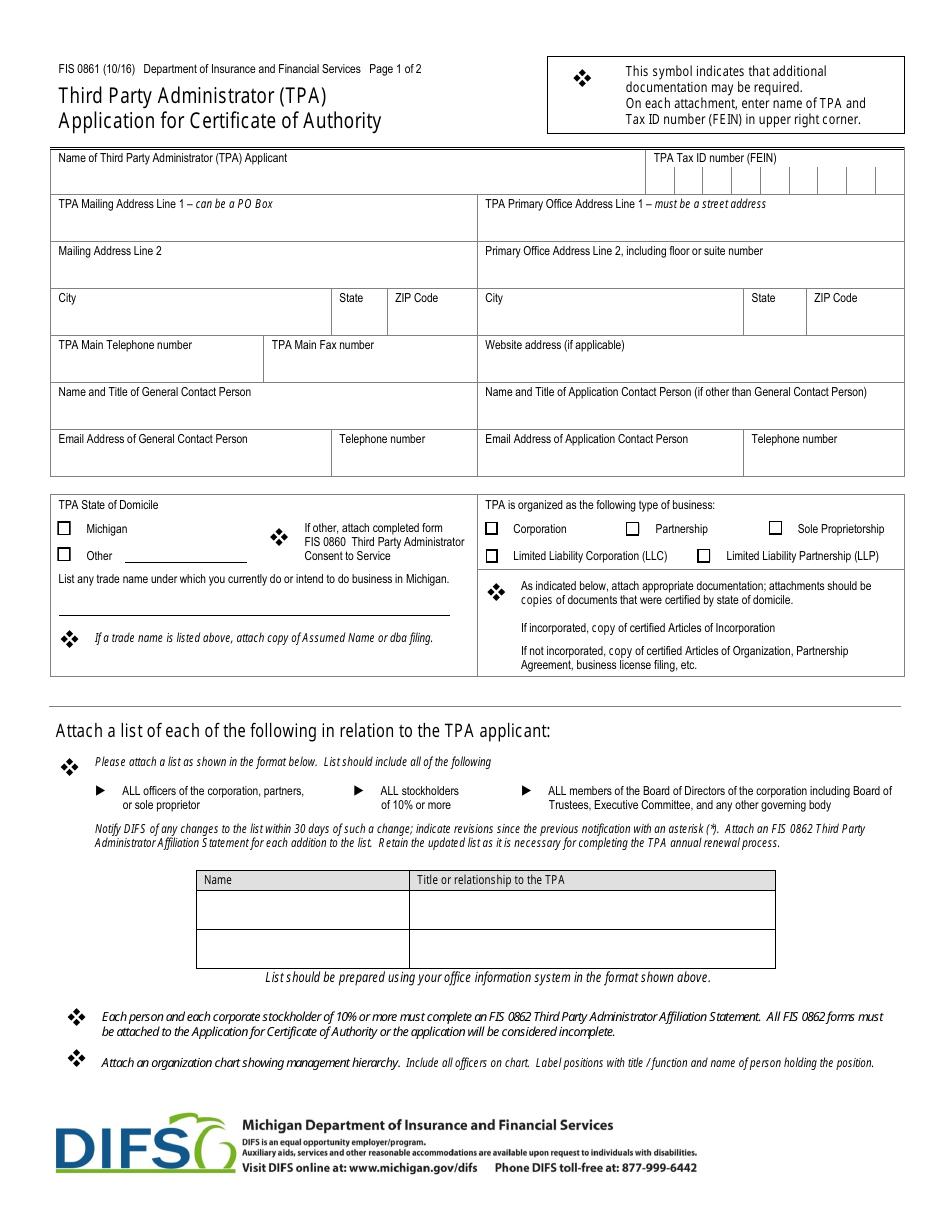

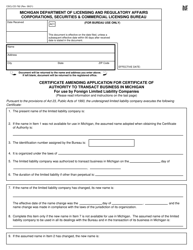

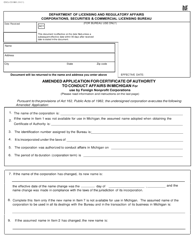

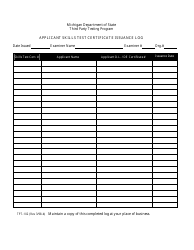

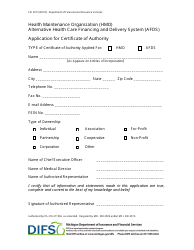

Form FIS0861 Third Party Administrator (Tpa) Application for Certificate of Authority - Michigan

What Is Form FIS0861?

This is a legal form that was released by the Michigan Department of Insurance and Financial Services - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Third Party Administrator?

A: A Third Party Administrator (TPA) is an entity that administers employee benefit programs on behalf of employers.

Q: What is a Certificate of Authority?

A: A Certificate of Authority is an official document that grants permission to a TPA to operate in a specific state.

Q: Why do TPAs need a Certificate of Authority?

A: TPAs need a Certificate of Authority to ensure that they meet the regulatory requirements and standards set by the state.

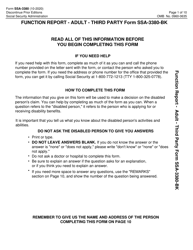

Q: Who needs to file the Form FIS0861?

A: TPAs who wish to obtain a Certificate of Authority in Michigan need to file the Form FIS0861.

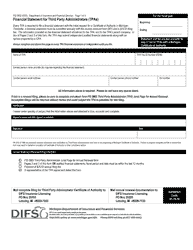

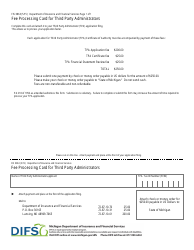

Q: What information is required in the Form FIS0861?

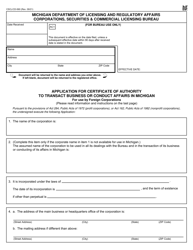

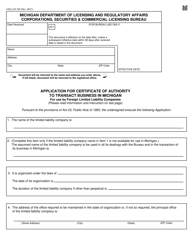

A: The Form FIS0861 requires information about the TPA's ownership, financial stability, qualifications, and compliance with state laws and regulations.

Q: Is there a fee for filing the Form FIS0861?

A: Yes, there is a fee associated with filing the Form FIS0861. The fee amount can be found in the instructions provided with the form.

Q: How long does it take to process the Form FIS0861?

A: The processing time for the Form FIS0861 can vary. It is recommended to submit the form well in advance to allow for processing and review.

Q: What happens after the Form FIS0861 is approved?

A: After the Form FIS0861 is approved, the TPA will receive a Certificate of Authority, allowing them to operate in Michigan.

Q: What if there are changes to the TPA's information after filing the Form FIS0861?

A: If there are any changes to the TPA's information, such as ownership or contact details, the TPA should notify the Michigan Department of Insurance and Financial Services.

Q: Are TPAs required to renew their Certificate of Authority?

A: Yes, TPAs are required to renew their Certificate of Authority on an annual basis.

Q: What happens if a TPA operates without a Certificate of Authority?

A: Operating without a Certificate of Authority is a violation of state law and can result in penalties and legal consequences for the TPA.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Michigan Department of Insurance and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIS0861 by clicking the link below or browse more documents and templates provided by the Michigan Department of Insurance and Financial Services.