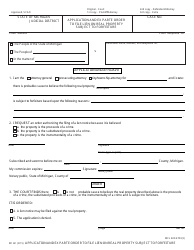

This version of the form is not currently in use and is provided for reference only. Download this version of

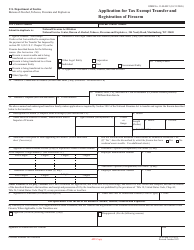

Form 2796

for the current year.

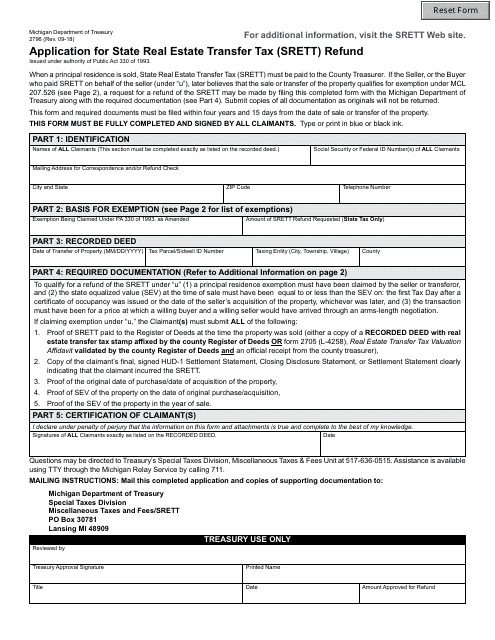

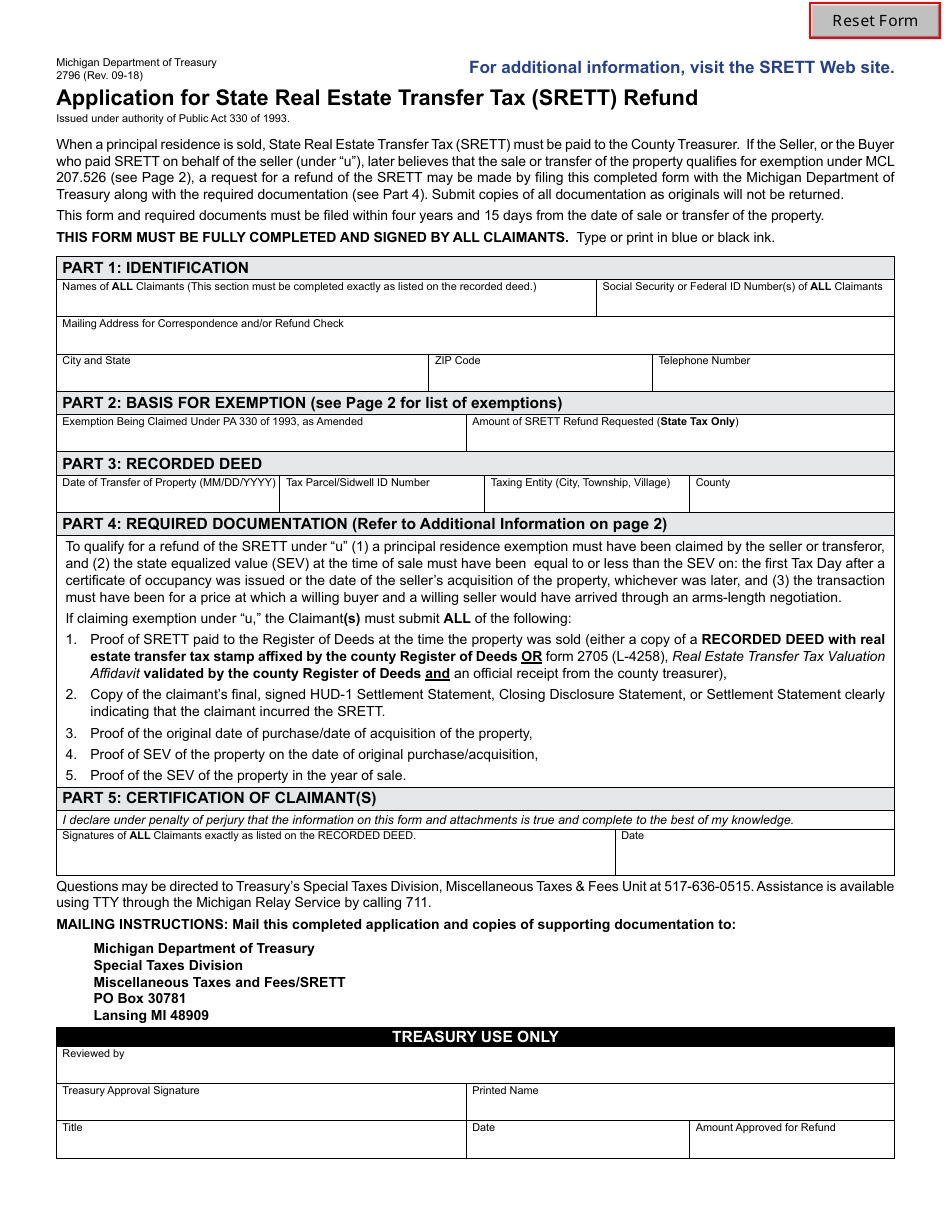

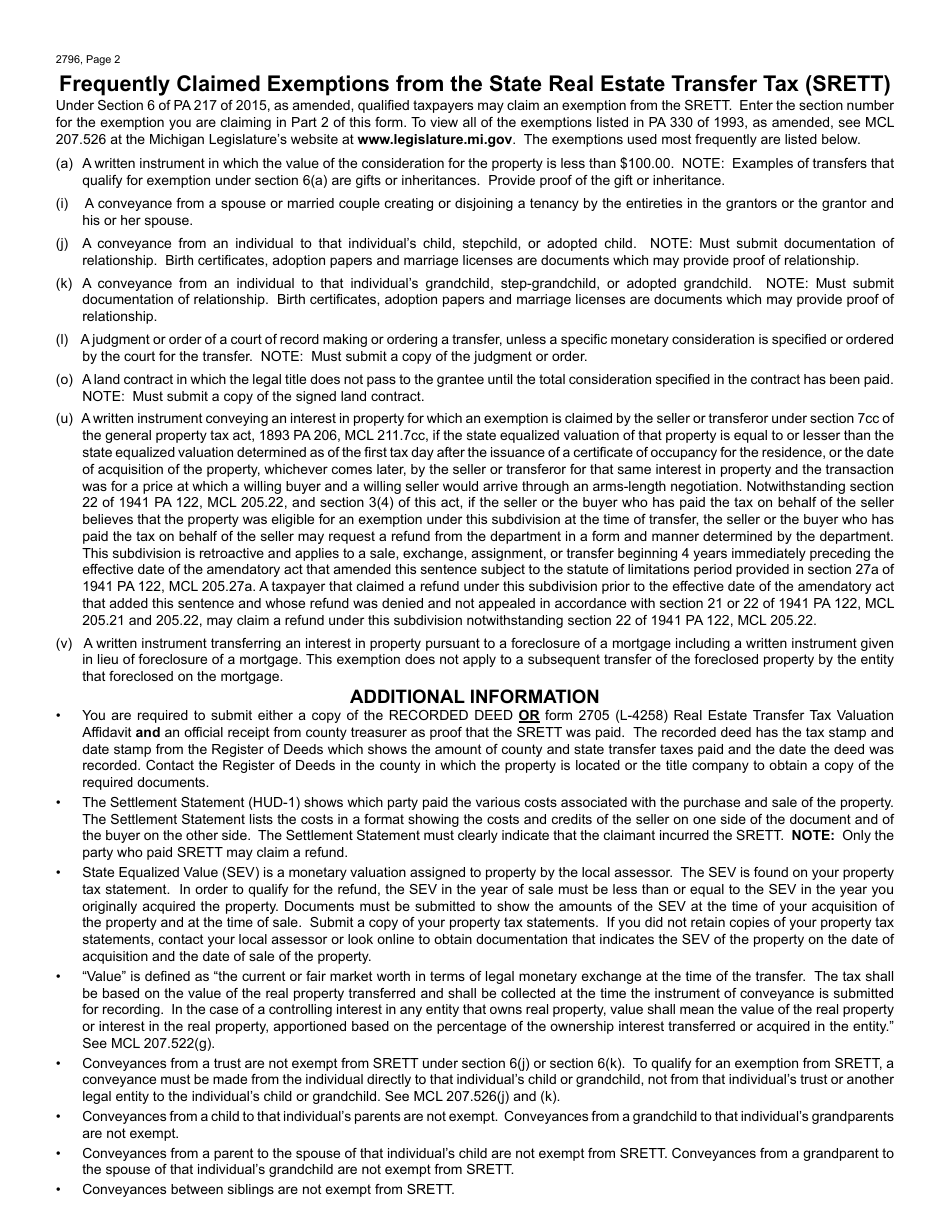

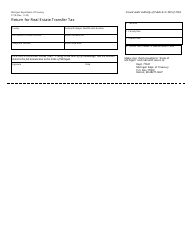

Form 2796 Application for State Real Estate Transfer Tax (Srett) Refund - Michigan

What Is Form 2796?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2796?

A: Form 2796 is the Application for State Real Estate Transfer Tax (SRETT) Refund in Michigan.

Q: What is the purpose of Form 2796?

A: The purpose of Form 2796 is to apply for a refund of the State Real Estate Transfer Tax in Michigan.

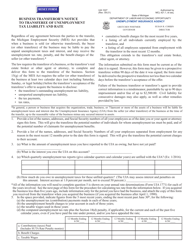

Q: Who can use Form 2796?

A: Form 2796 can be used by individuals or entities who have paid the State Real Estate Transfer Tax in Michigan and are eligible for a refund.

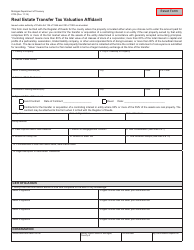

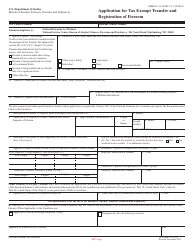

Q: What information is required on Form 2796?

A: Form 2796 requires information such as the transferor's and transferee's names, property description, amount of tax paid, and supporting documentation.

Q: Are there any fees to submit Form 2796?

A: No, there are no fees to submit Form 2796.

Q: What is the deadline for submitting Form 2796?

A: Form 2796 must be submitted within four years from the date of payment of the State Real Estate Transfer Tax in order to be eligible for a refund.

Q: How long does it take to process Form 2796?

A: The processing time for Form 2796 can vary, but it typically takes several weeks to receive a refund.

Q: Can I check the status of my Form 2796 refund?

A: Yes, you can check the status of your Form 2796 refund by contacting the Michigan Department of Treasury.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2796 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.