This version of the form is not currently in use and is provided for reference only. Download this version of

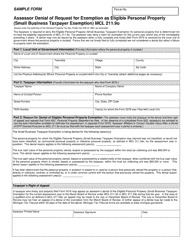

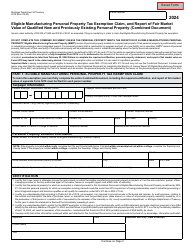

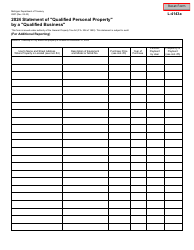

Form 5076

for the current year.

Form 5076 Small Business Property Tax Exemption Claim Under Mcl 211.9o - Michigan

What Is Form 5076?

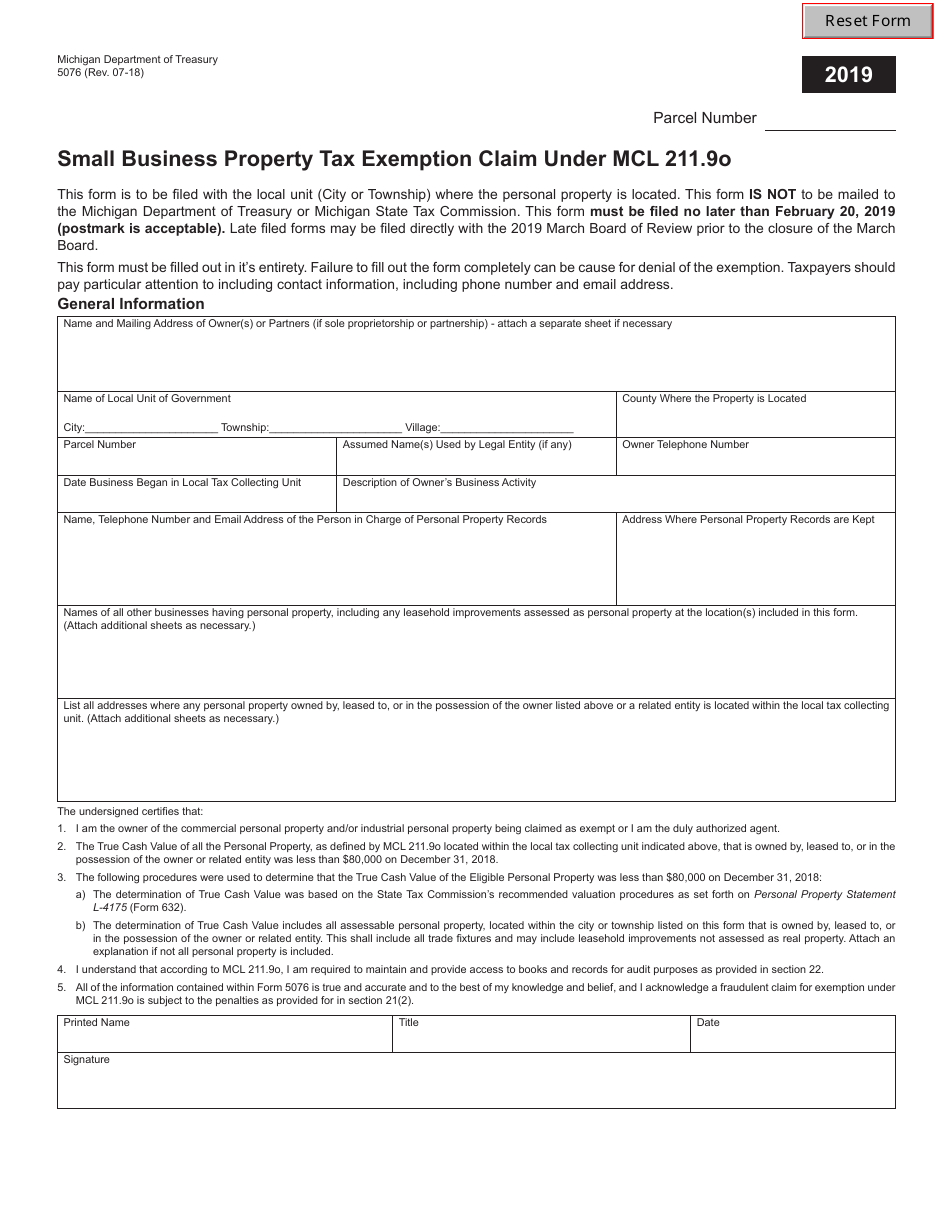

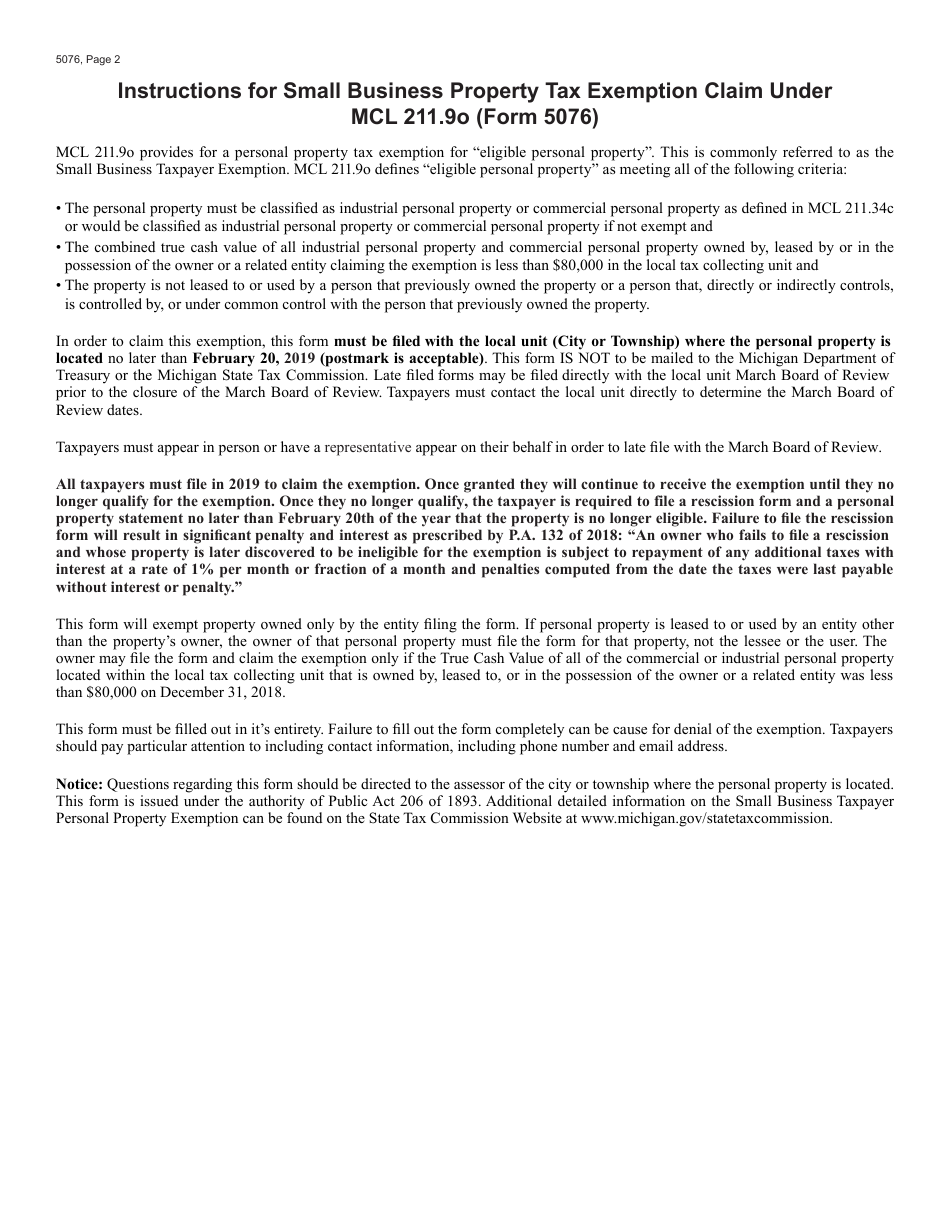

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5076?

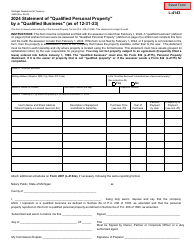

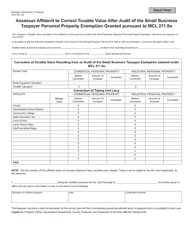

A: Form 5076 is the Small Business Property Tax Exemption Claim under MCL 211.9o in Michigan.

Q: Who is eligible for the Small Business Property Tax Exemption?

A: Small businesses in Michigan that meet the criteria outlined in MCL 211.9o are eligible for the exemption.

Q: What is the purpose of the Small Business Property Tax Exemption?

A: The exemption aims to provide relief on property taxes for qualifying small businesses.

Q: What is the criteria to qualify for the exemption?

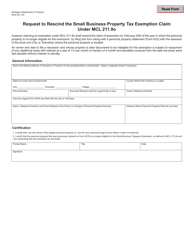

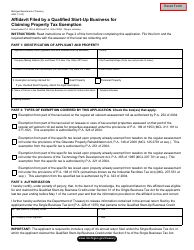

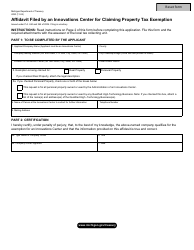

A: To qualify, the business must meet certain size and ownership requirements, and the property must be used for agricultural, industrial, commercial, or developmental purposes.

Q: How can I claim the Small Business Property Tax Exemption?

A: To claim the exemption, you need to complete and submit Form 5076 to your local assessor's office.

Q: Are there any deadlines for submitting the exemption claim?

A: Yes, the deadline for submitting the claim is February 10th of the year for which you are seeking the exemption.

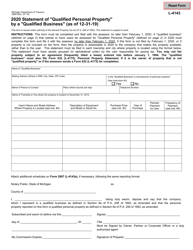

Q: Is there any fee to submit the Form 5076?

A: No, there is no fee to submit the Form 5076.

Q: Can I claim the Small Business Property Tax Exemption if I am a large corporation?

A: No, the exemption is specifically for small businesses and does not apply to large corporations.

Q: What should I do if I have more questions about the Small Business Property Tax Exemption?

A: If you have additional questions, you can contact your local assessor's office or the Michigan Department of Treasury for clarification.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5076 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.