This version of the form is not currently in use and is provided for reference only. Download this version of

Form 4070

for the current year.

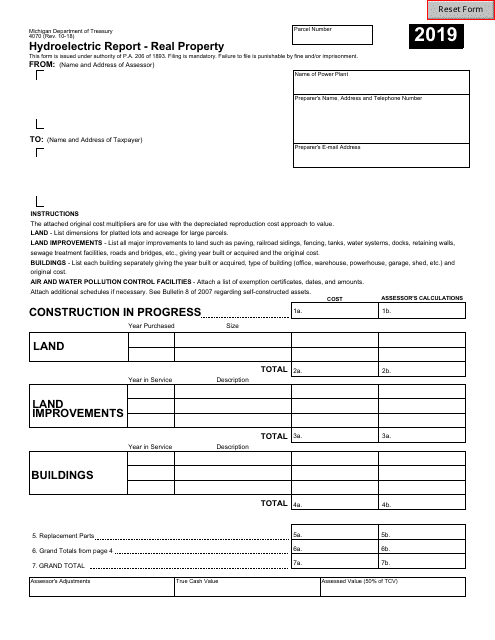

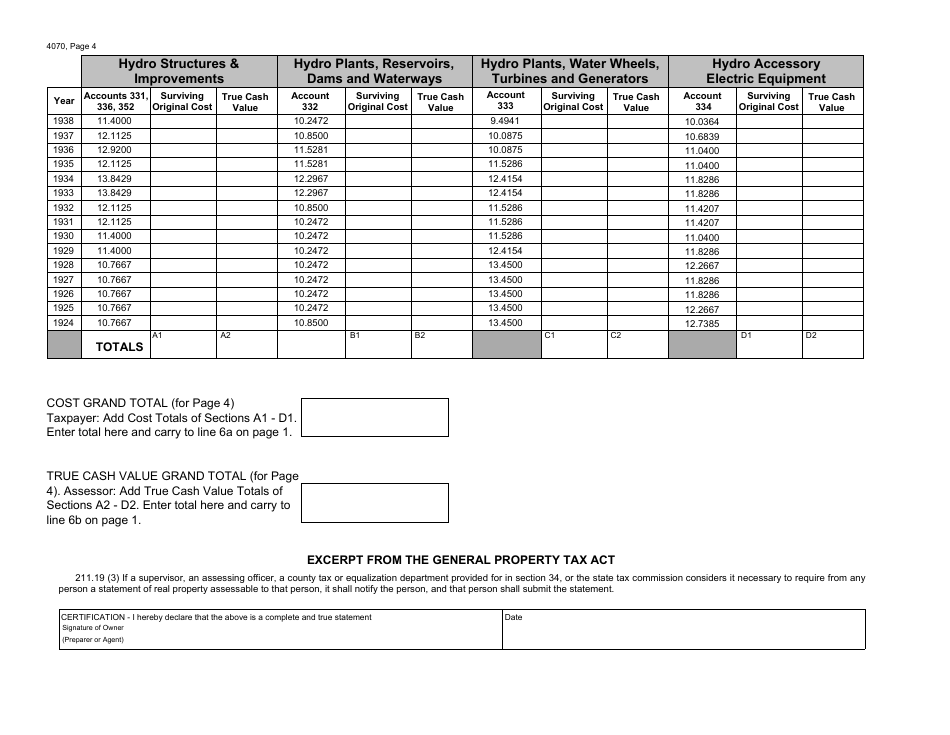

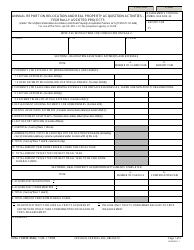

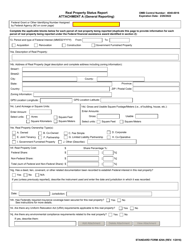

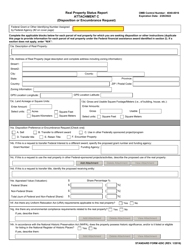

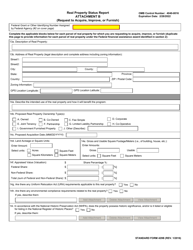

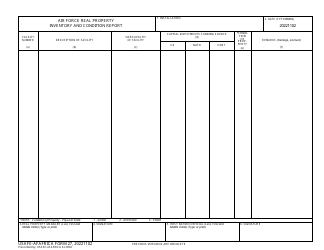

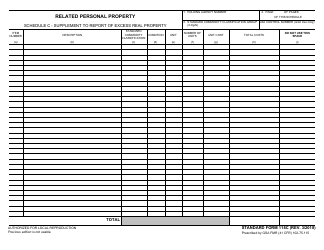

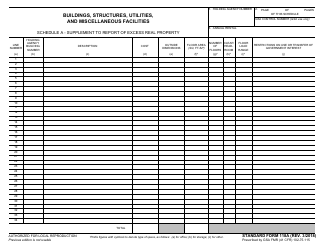

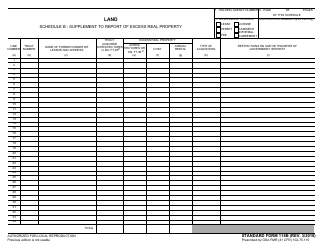

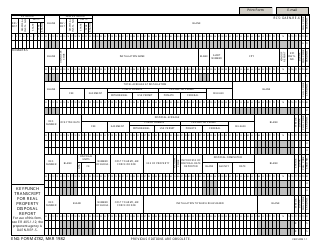

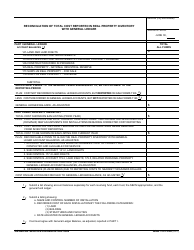

Form 4070 Hydroelectric Report - Real Property - Michigan

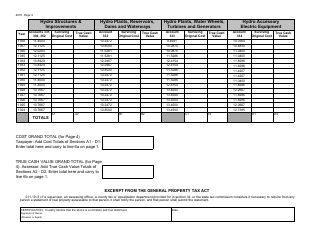

What Is Form 4070?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4070?

A: Form 4070 is a hydroelectric report for real property in Michigan.

Q: What does Form 4070 pertain to?

A: Form 4070 specifically pertains to hydroelectric properties in Michigan.

Q: What is the purpose of Form 4070?

A: The purpose of Form 4070 is to report information related to hydroelectric properties in Michigan.

Q: Who needs to fill out Form 4070?

A: Property owners or operators of hydroelectric facilities in Michigan need to fill out Form 4070.

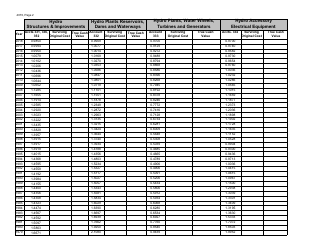

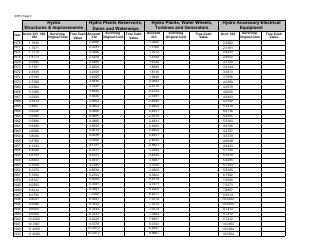

Q: What information is required on Form 4070?

A: Form 4070 requires information such as property details, operational information, and financial data related to the hydroelectric facility.

Q: Are there any deadlines associated with Form 4070?

A: Yes, there are specific deadlines for submitting Form 4070 as outlined by the Michigan government.

Q: What are the consequences of not filing Form 4070?

A: Failure to file Form 4070 or submitting inaccurate information may result in penalties or legal consequences.

Q: Can I seek assistance in filling out Form 4070?

A: Yes, you can consult with a tax professional or seek assistance from the relevant authorities in completing Form 4070.

Q: Is Form 4070 specific to Michigan only?

A: Yes, Form 4070 is specific to hydroelectric properties in the state of Michigan.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4070 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.