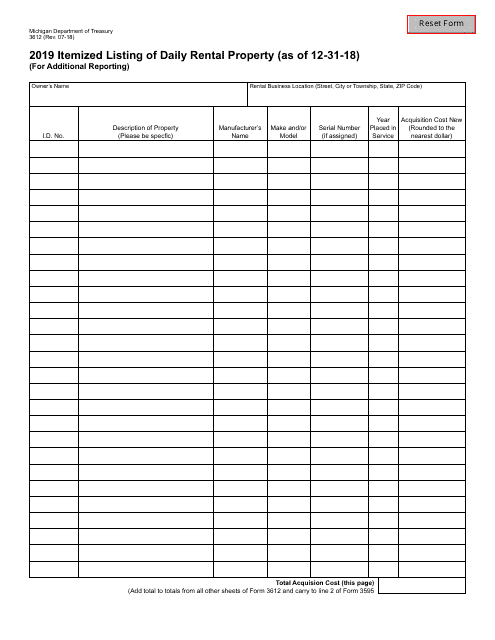

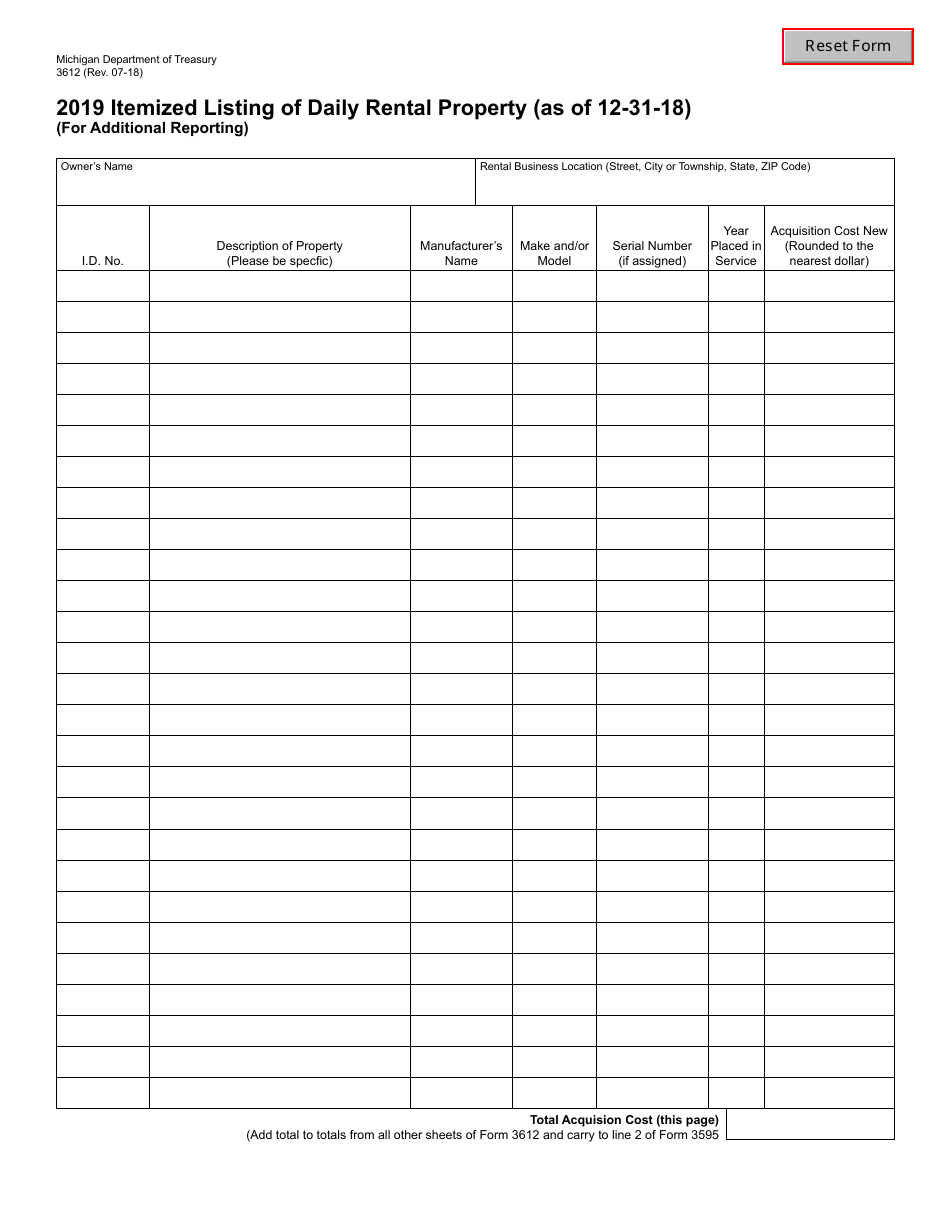

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 3612

for the current year.

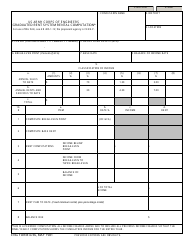

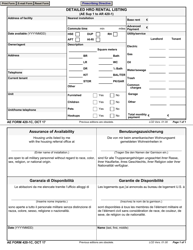

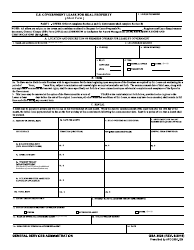

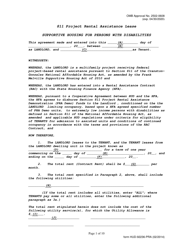

Form 3612 Itemized Listing of Daily Rental Property (For Additional Reporting) - Michigan

What Is Form 3612?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3612?

A: Form 3612 is an itemized listing of daily rental property for additional reporting.

Q: What is the purpose of Form 3612?

A: The purpose of Form 3612 is to provide detailed information about daily rental property for reporting purposes.

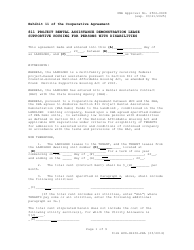

Q: Who needs to fill out Form 3612?

A: Individuals or businesses who own daily rental property in Michigan may need to fill out Form 3612.

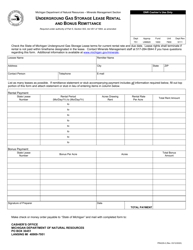

Q: What information is required on Form 3612?

A: Form 3612 requires an itemized listing of daily rental property, including details such as the property address, daily rental rate, rental period, and the total amount received.

Q: Are there any deadlines for filing Form 3612?

A: The deadlines for filing Form 3612 may vary. It is recommended to check with the Michigan Department of Treasury for specific deadline information.

Q: Is there a fee for filing Form 3612?

A: There is no fee for filing Form 3612.

Q: What should I do with Form 3612 once it is completed?

A: Once Form 3612 is completed, it should be submitted to the Michigan Department of Treasury.

Q: Are there any penalties for not filing Form 3612?

A: Penalties for not filing Form 3612 may apply. It is important to comply with the reporting requirements to avoid any penalties.

Form Details:

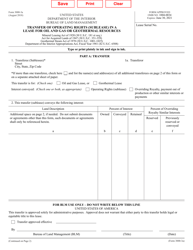

- Released on July 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3612 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.