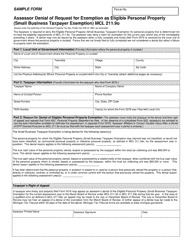

This version of the form is not currently in use and is provided for reference only. Download this version of

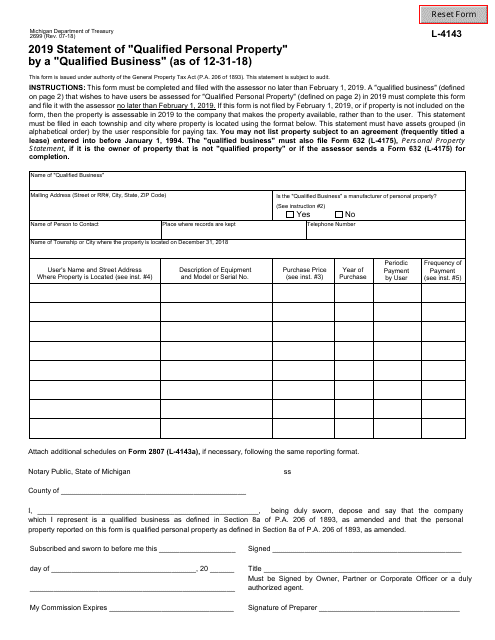

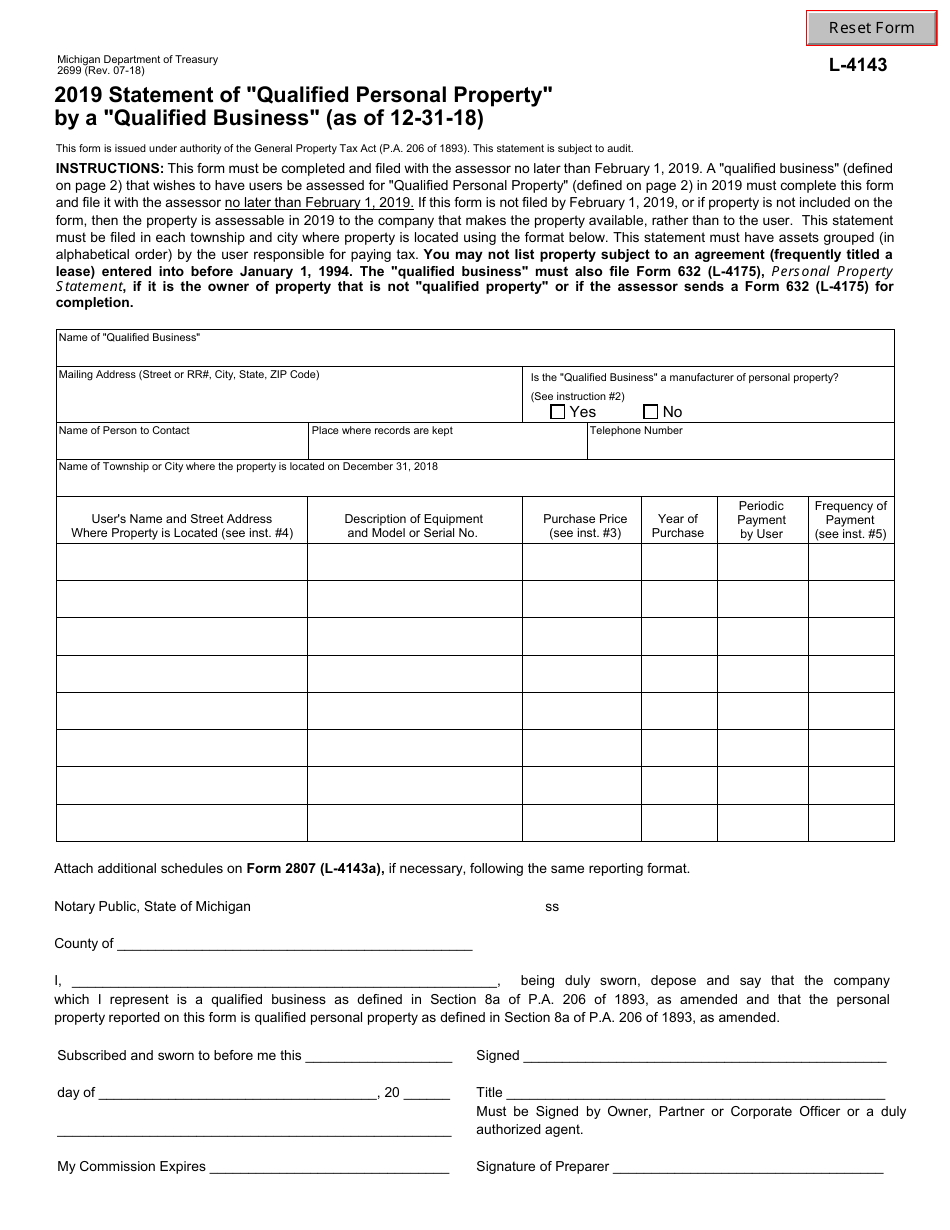

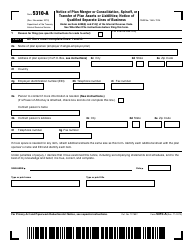

Form 2699 (L-4143)

for the current year.

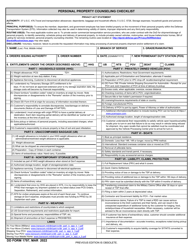

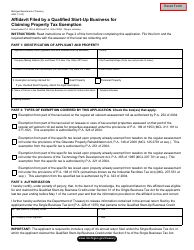

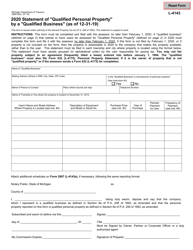

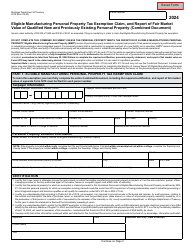

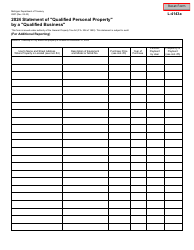

Form 2699 (L-4143) Statement of "qualified Personal Property" by a "qualified Business" - Michigan

What Is Form 2699 (L-4143)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2699 (L-4143)?

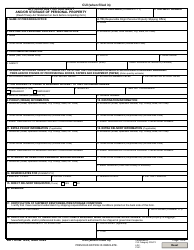

A: Form 2699 (L-4143) is the Statement of 'Qualified Personal Property' by a 'Qualified Business' in Michigan.

Q: What is the purpose of Form 2699 (L-4143)?

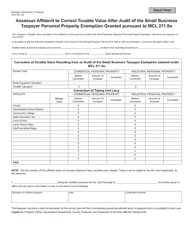

A: The purpose of Form 2699 (L-4143) is to report qualified personal property owned by qualified businesses in Michigan for tax assessment purposes.

Q: Who needs to file Form 2699 (L-4143)?

A: Qualified businesses in Michigan that own qualified personal property need to file Form 2699 (L-4143).

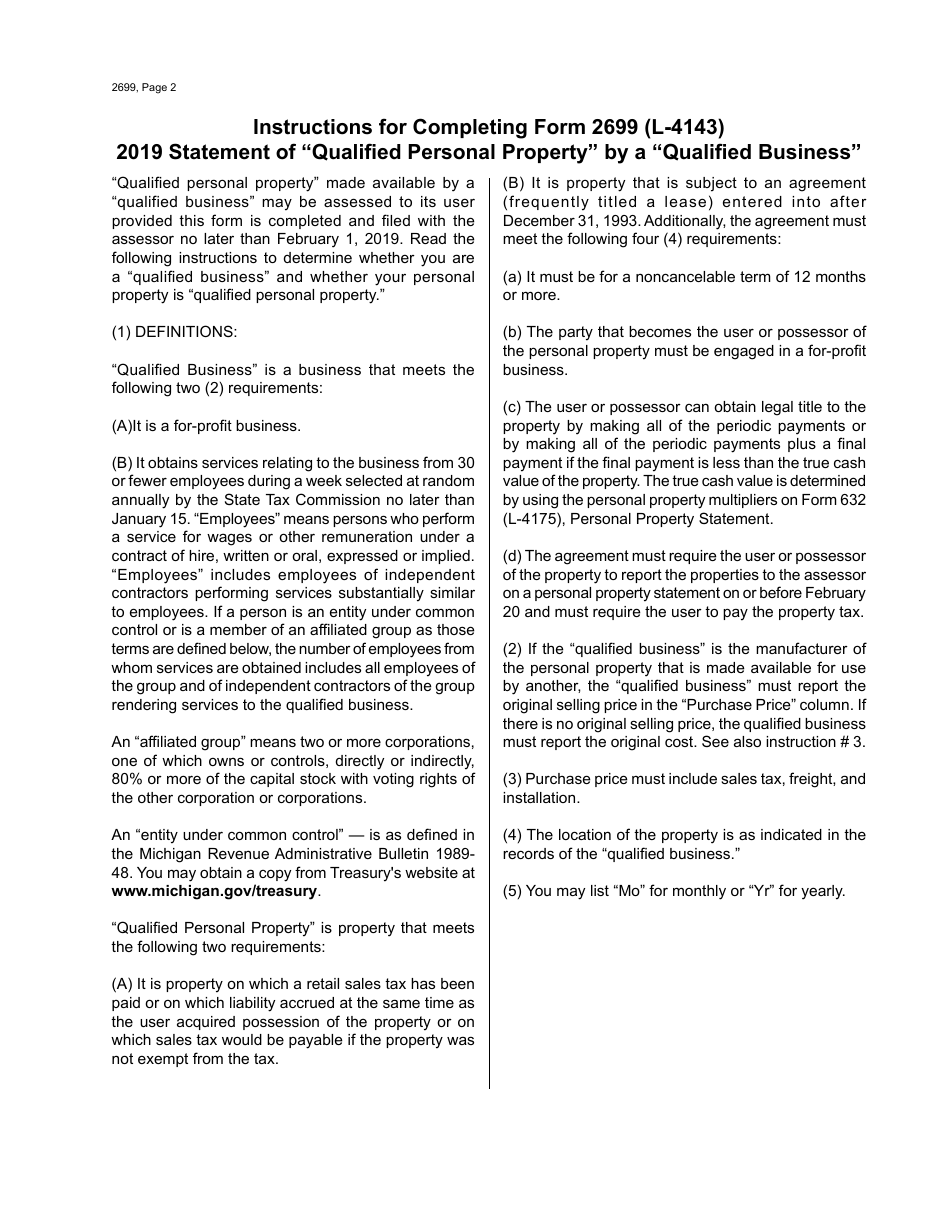

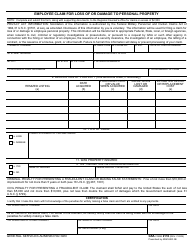

Q: What is qualified personal property?

A: Qualified personal property includes machinery, equipment, furniture, and any other tangible property used for business purposes.

Q: What is a qualified business?

A: A qualified business refers to a business that meets certain criteria specified by the Michigan Department of Treasury.

Q: When is the deadline for filing Form 2699 (L-4143)?

A: The deadline for filing Form 2699 (L-4143) is February 20th of each year.

Q: Are there any penalties for not filing Form 2699 (L-4143)?

A: Yes, there may be penalties for not filing Form 2699 (L-4143) or for filing it late. It is important to comply with the filing requirements to avoid potential penalties.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2699 (L-4143) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.