This version of the form is not currently in use and is provided for reference only. Download this version of

Form 4640

for the current year.

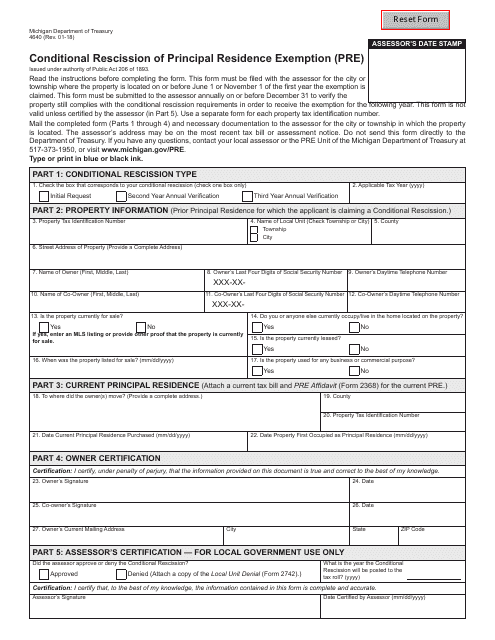

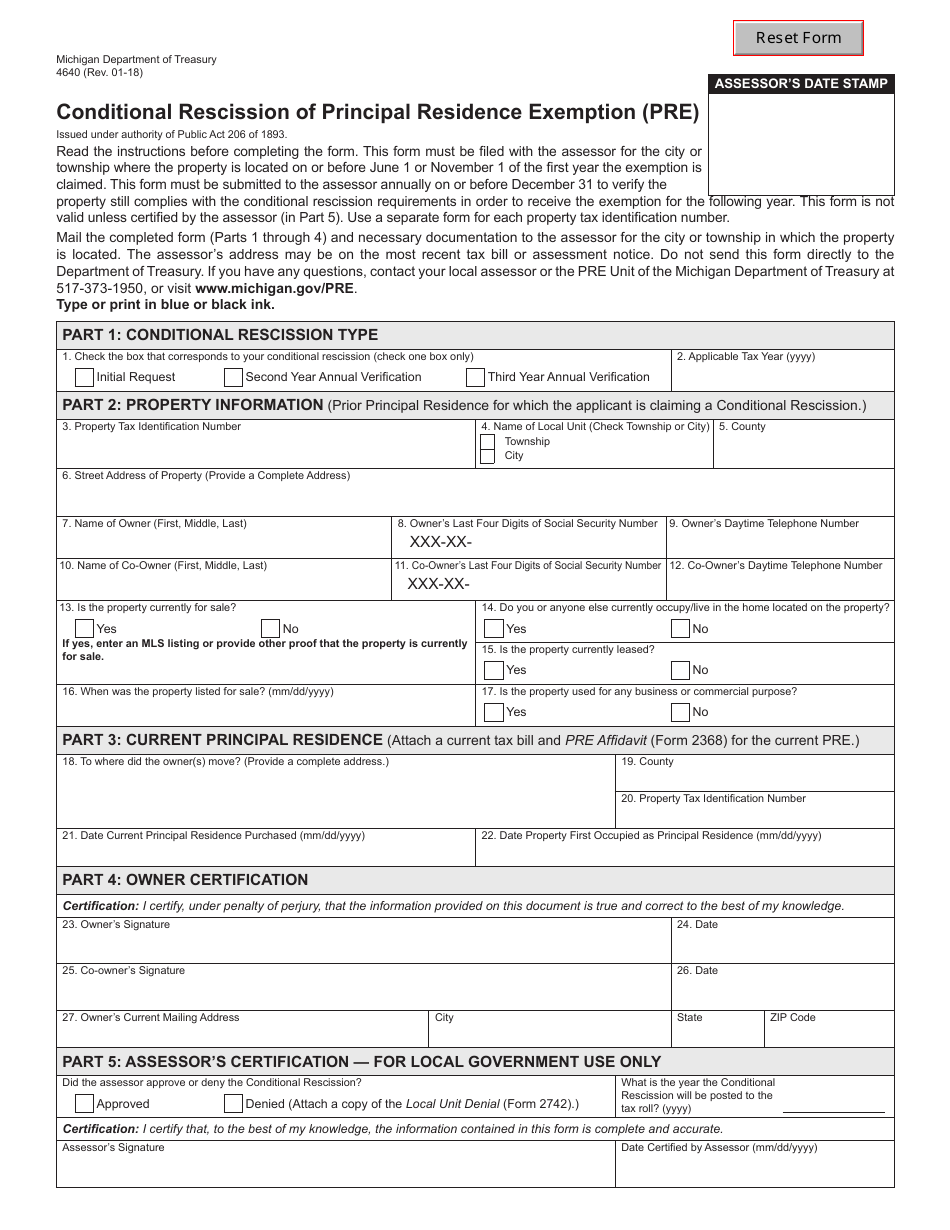

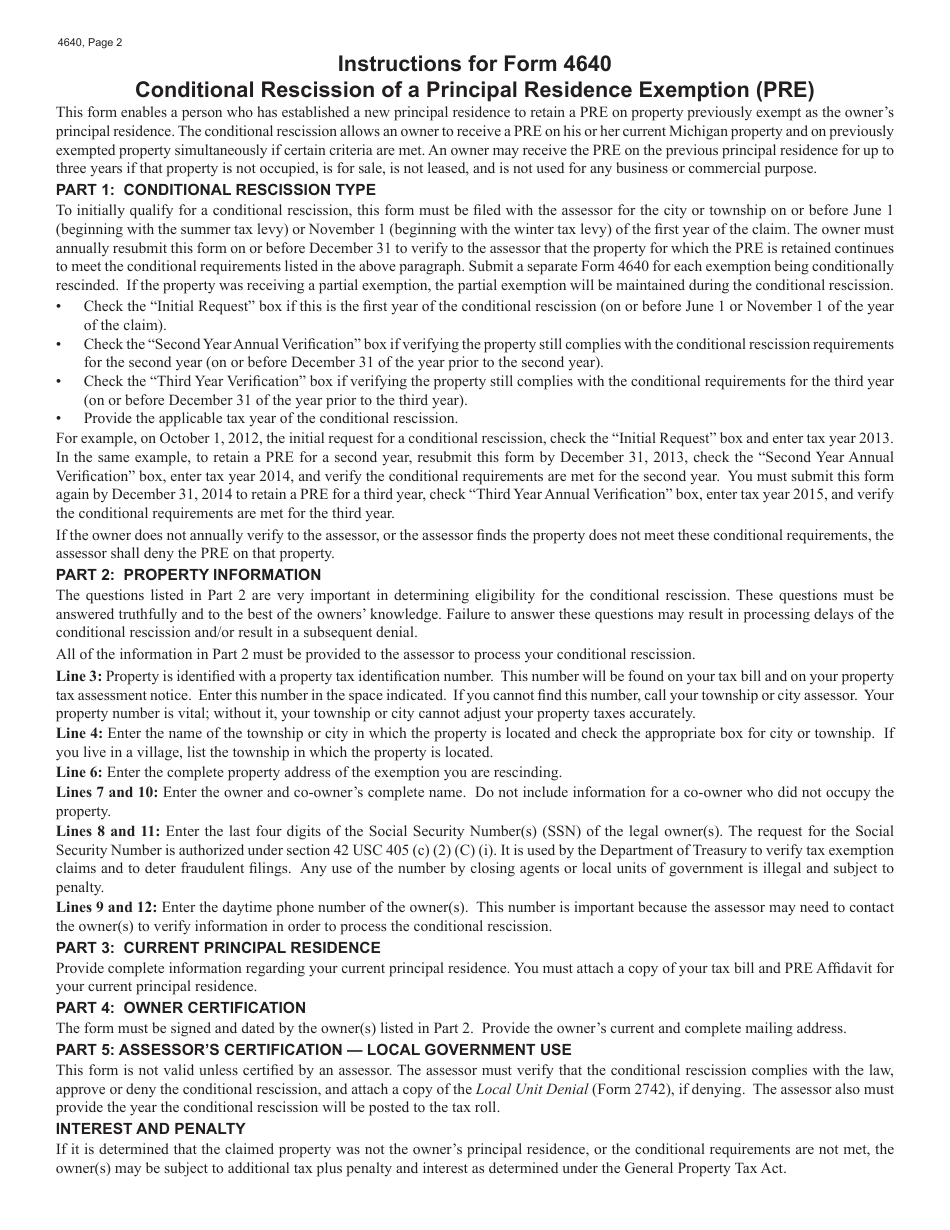

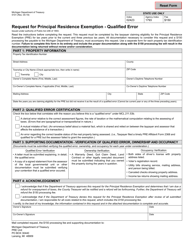

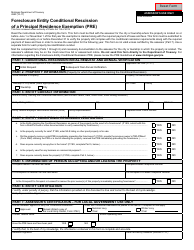

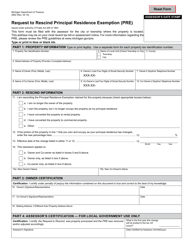

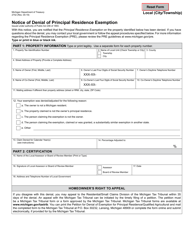

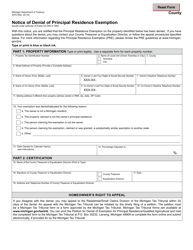

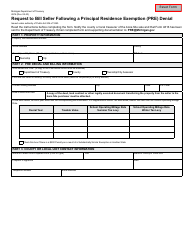

Form 4640 Conditional Rescission of Principal Residence Exemption (Pre) - Michigan

What Is Form 4640?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4640?

A: Form 4640 is the Conditional Rescission of Principal Residence Exemption (PRE) form used in Michigan.

Q: What is the purpose of Form 4640?

A: The purpose of Form 4640 is to request a conditional rescission of the Principal Residence Exemption (PRE) in Michigan.

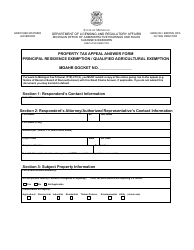

Q: Who needs to fill out Form 4640?

A: Property owners in Michigan who want to temporarily rescind their Principal Residence Exemption (PRE) need to fill out Form 4640.

Q: When should Form 4640 be filed?

A: Form 4640 should be filed with the local assessor's office on or before May 1st of the year following the rescission.

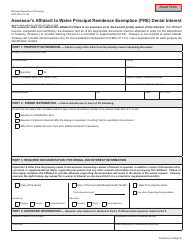

Q: What are the conditions for rescinding the Principal Residence Exemption (PRE)?

A: The conditions for rescinding the Principal Residence Exemption (PRE) in Michigan include moving out of the property and no longer using it as your primary residence.

Q: How long does the conditional rescission last?

A: The conditional rescission of the Principal Residence Exemption (PRE) lasts for up to three years.

Q: What happens if the property is sold during the conditional rescission period?

A: If the property is sold during the conditional rescission period, the new owner must file a new Principal Residence Exemption (PRE) form.

Q: What are the penalties for falsely claiming or failing to file Form 4640?

A: Penalties for falsely claiming or failing to file Form 4640 include repayment of exempted taxes, interest, and penalty fees.

Form Details:

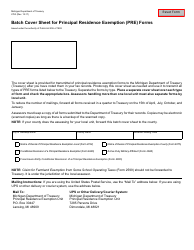

- Released on January 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4640 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.