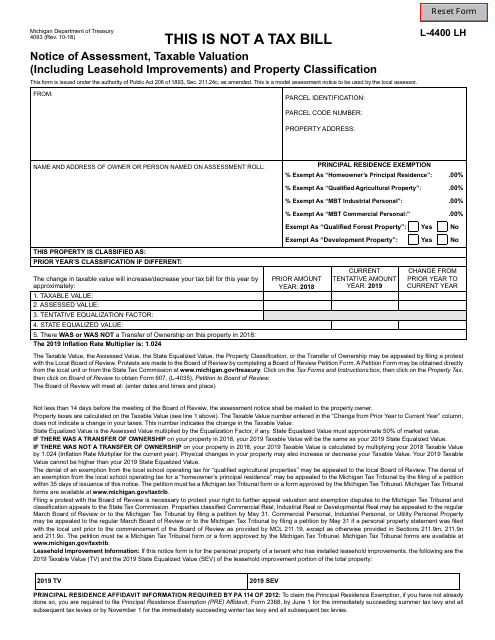

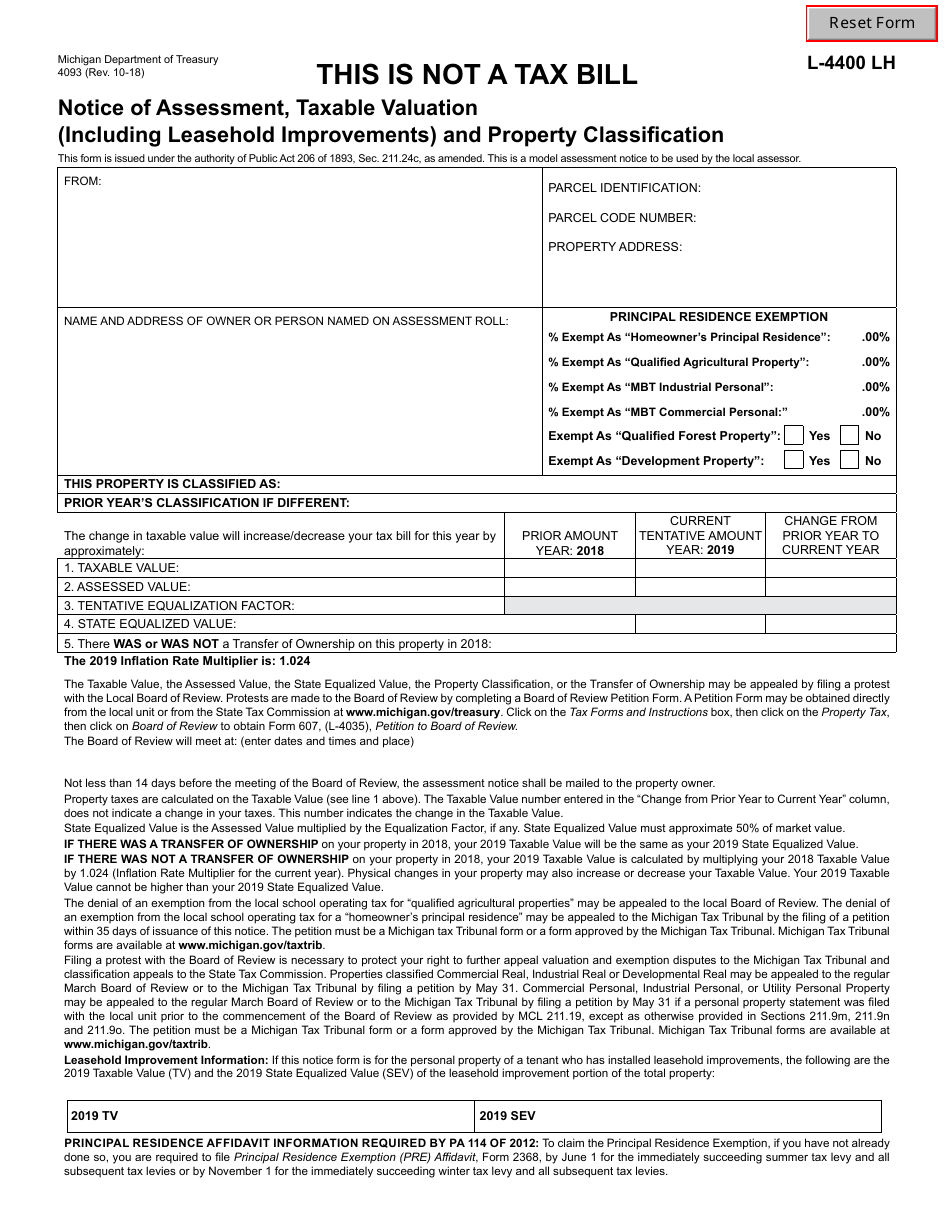

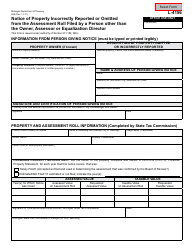

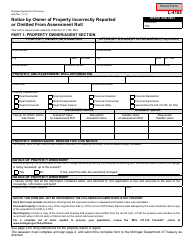

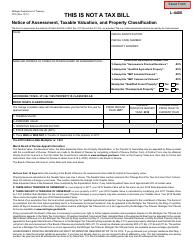

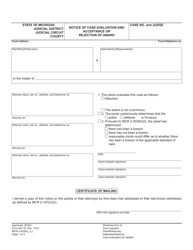

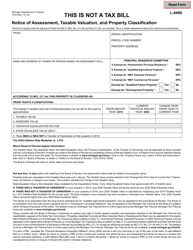

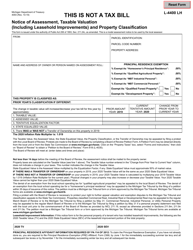

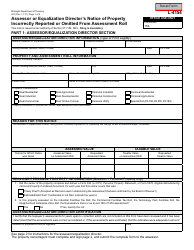

Form 4093 (L-440 LH; L-4400 LH) Notice of Assessment, Taxable Valuation (Including Leasehold Improvements) and Property Classification - Michigan

What Is Form 4093 (L-440 LH; L-4400 LH)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4093?

A: Form 4093 is the Notice of Assessment, Taxable Valuation (Including Leasehold Improvements) and Property Classification form in Michigan.

Q: What does Form 4093 include?

A: Form 4093 includes information about your property assessment, taxable valuation, and property classification.

Q: What is the purpose of Form 4093?

A: The purpose of Form 4093 is to inform property owners about their property assessment, taxable valuation, and property classification in Michigan.

Q: What is taxable valuation?

A: Taxable valuation is the value of your property that is subject to property taxes.

Q: What are leasehold improvements?

A: Leasehold improvements are improvements made to a property by a tenant, usually with the landlord's permission.

Q: Why is property classification important?

A: Property classification determines how different types of properties are assessed and taxed in Michigan.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4093 (L-440 LH; L-4400 LH) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.