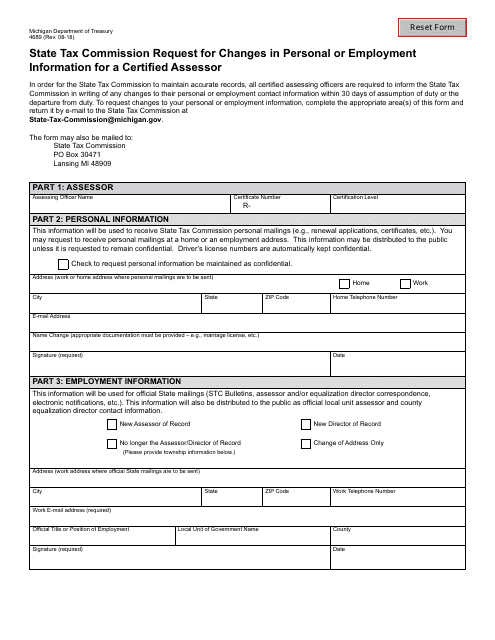

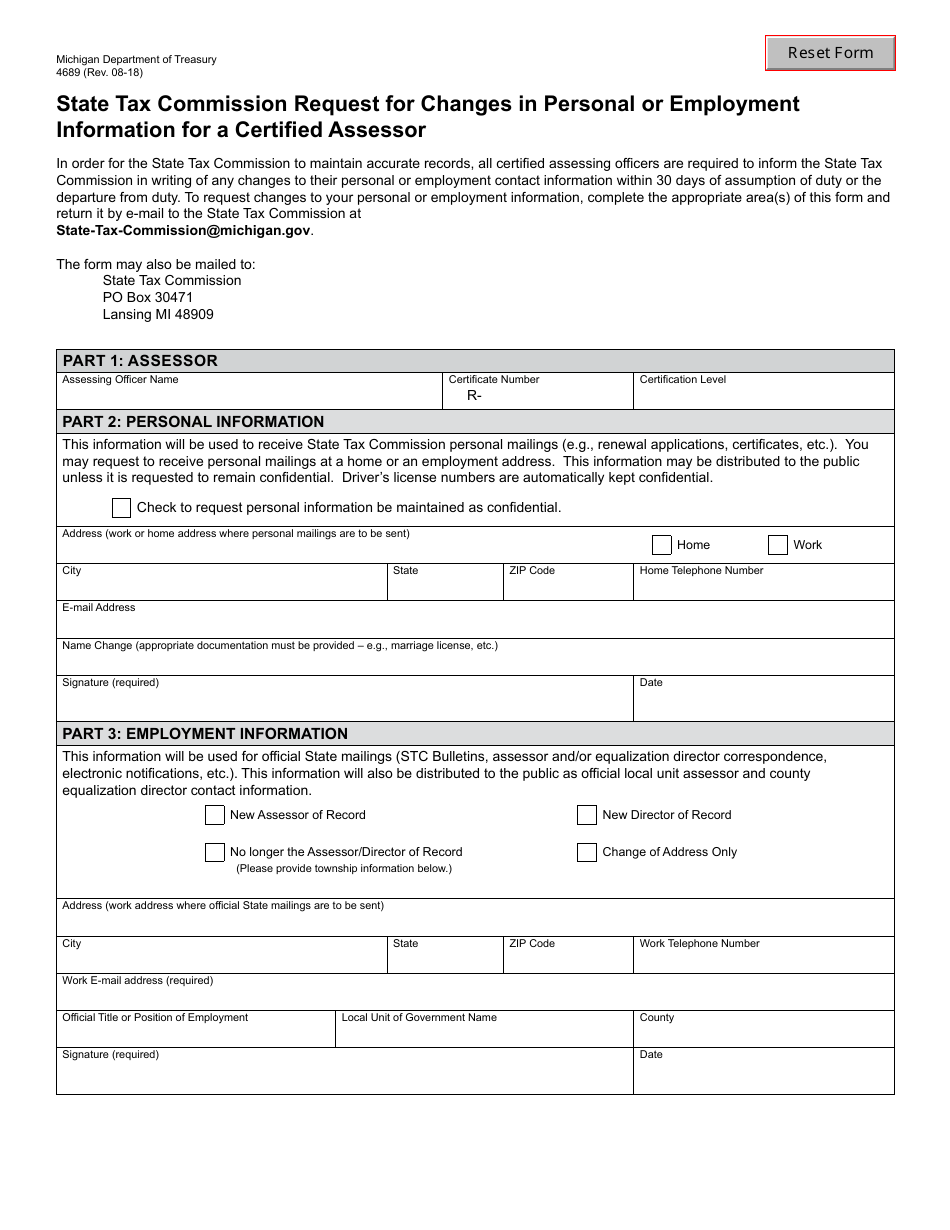

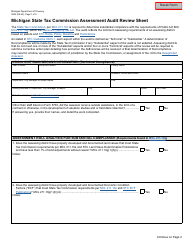

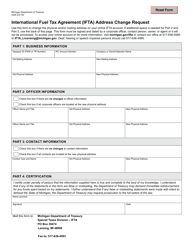

Form 4689 State Tax Commission Request for Changes in Personal or Employment Information for a Certified Assessor - Michigan

What Is Form 4689?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

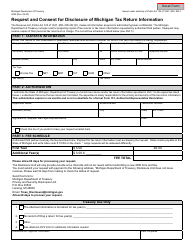

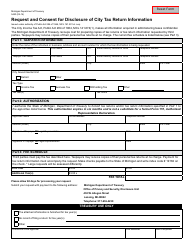

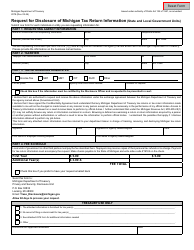

Q: What is Form 4689?

A: Form 4689 is a State Tax CommissionRequest for Changes in Personal or Employment Information for a Certified Assessor in Michigan.

Q: What is the purpose of Form 4689?

A: The purpose of Form 4689 is to request changes in personal or employment information for a certified assessor in Michigan.

Q: Who needs to fill out Form 4689?

A: Certified assessors in Michigan who need to update their personal or employment information must fill out Form 4689.

Q: Is there a fee for submitting Form 4689?

A: No, there is no fee for submitting Form 4689.

Q: What information do I need to provide on Form 4689?

A: You need to provide your personal and employment information, including name, address, social security number, and changes to your employment status.

Q: Are there any supporting documents required with Form 4689?

A: No, there are no supporting documents required with Form 4689.

Q: How long does it take to process Form 4689?

A: The processing time for Form 4689 may vary. It is recommended to allow a few weeks for processing.

Q: Can I make changes to Form 4689 after submitting?

A: No, you cannot make changes to Form 4689 after submitting. Make sure to review the information carefully before submitting the form.

Q: What should I do if I have additional questions about Form 4689?

A: If you have additional questions about Form 4689, you should contact the State Tax Commission of Michigan for assistance.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4689 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.