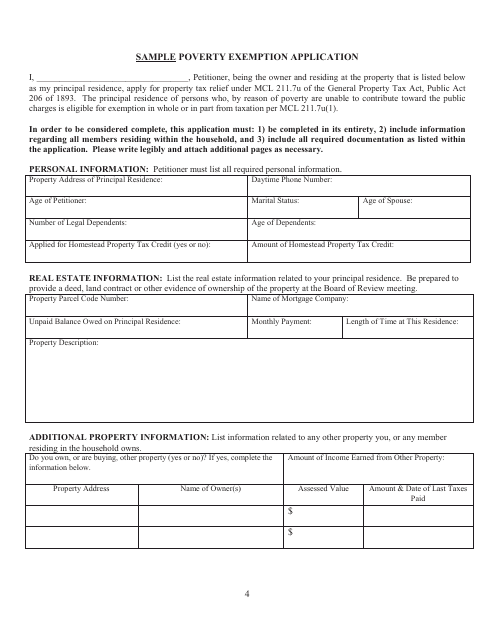

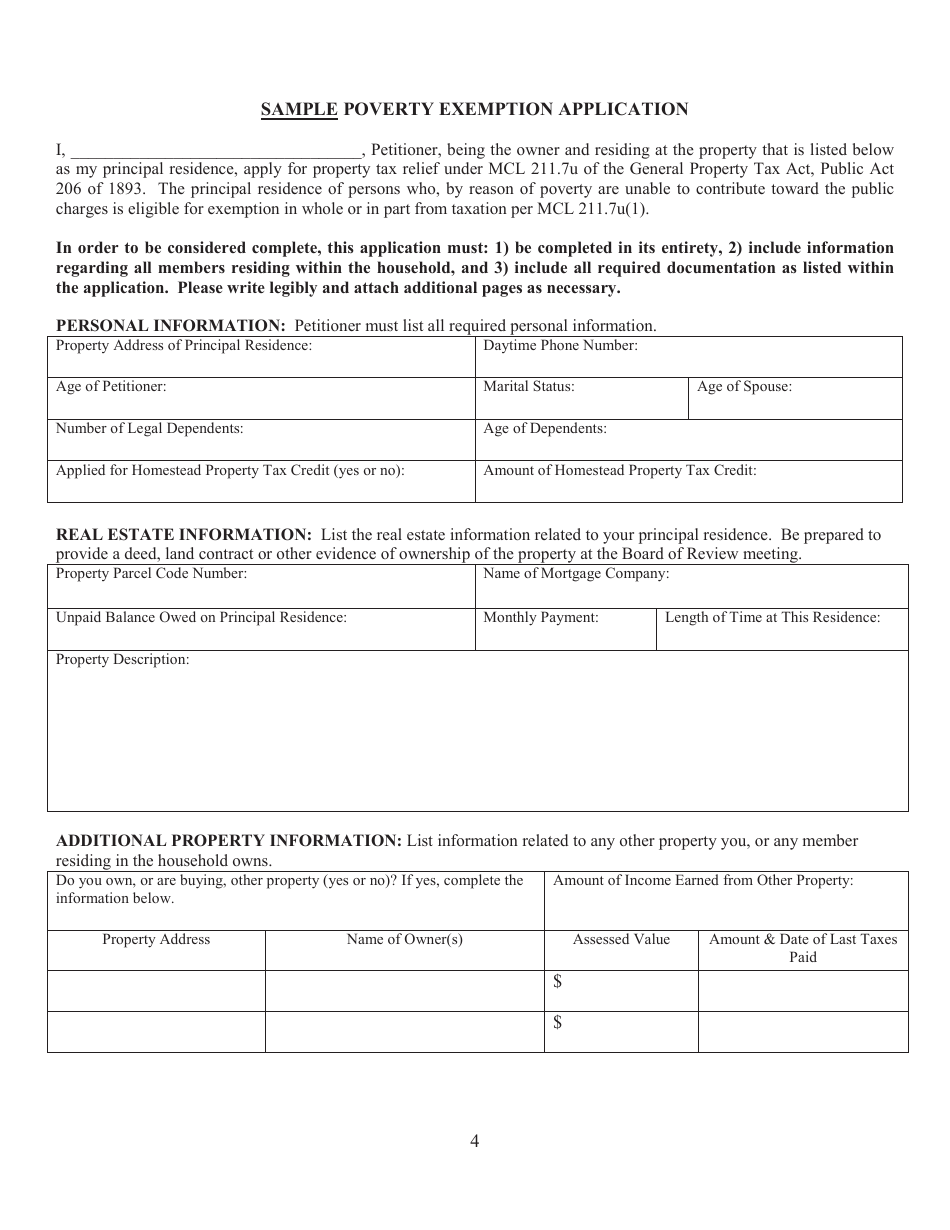

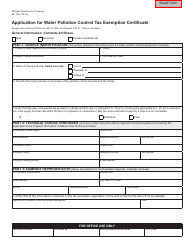

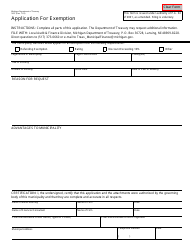

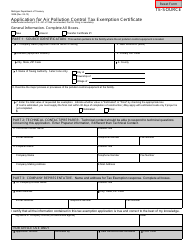

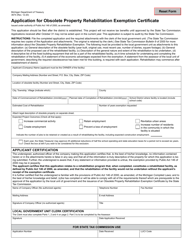

Sample Poverty Exemption Application - Michigan

Poverty Exemption Application is a legal document that was released by the Michigan Department of Treasury - a government authority operating within Michigan.

FAQ

Q: What is a Poverty Exemption Application?

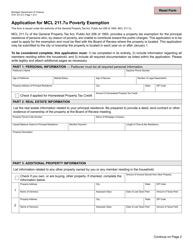

A: A Poverty Exemption Application is a form used in the state of Michigan to request a reduction or exemption from property taxes based on financial hardship.

Q: Who is eligible to apply for a Poverty Exemption?

A: Individuals and families with limited income and assets may be eligible to apply for a Poverty Exemption.

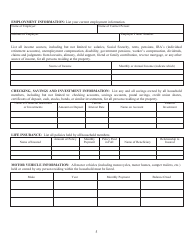

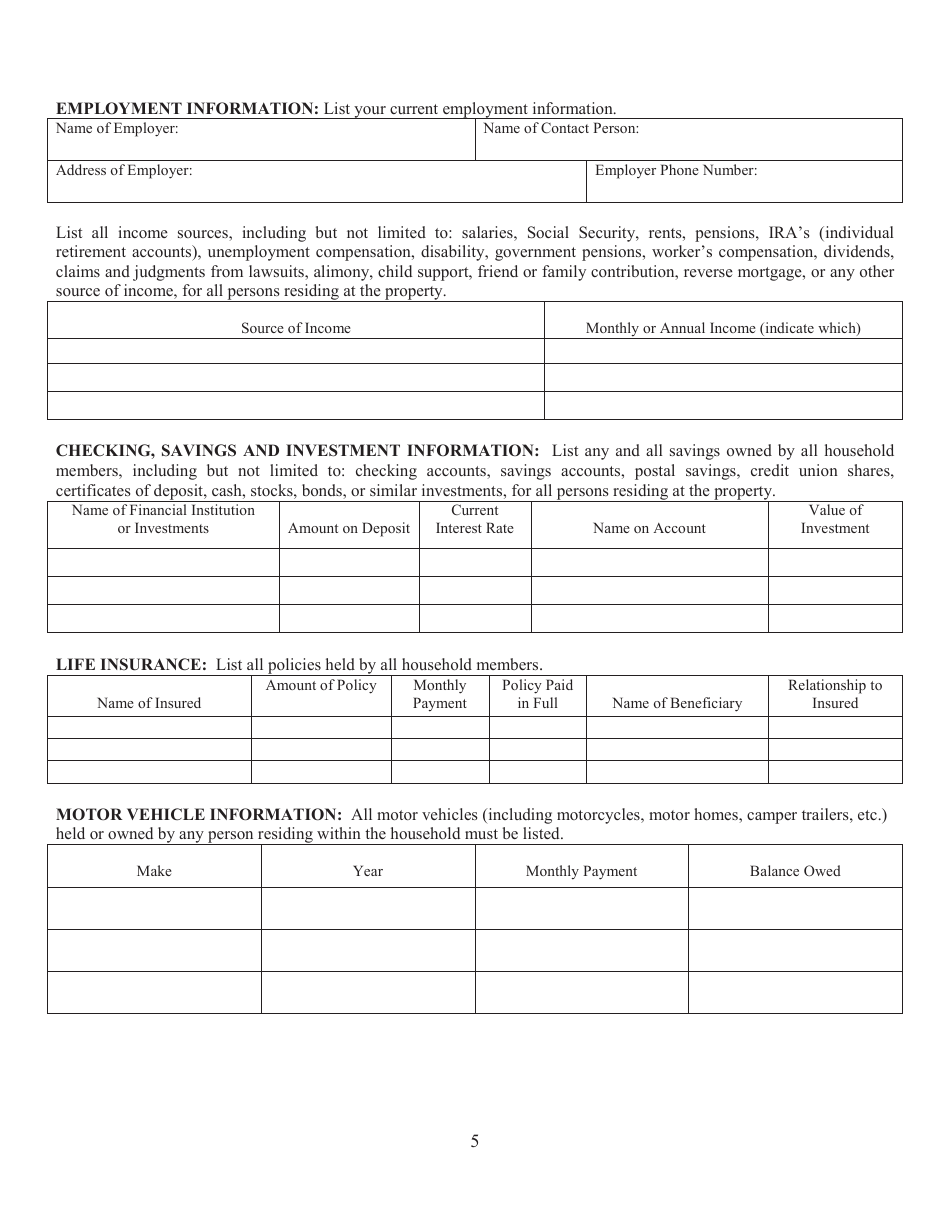

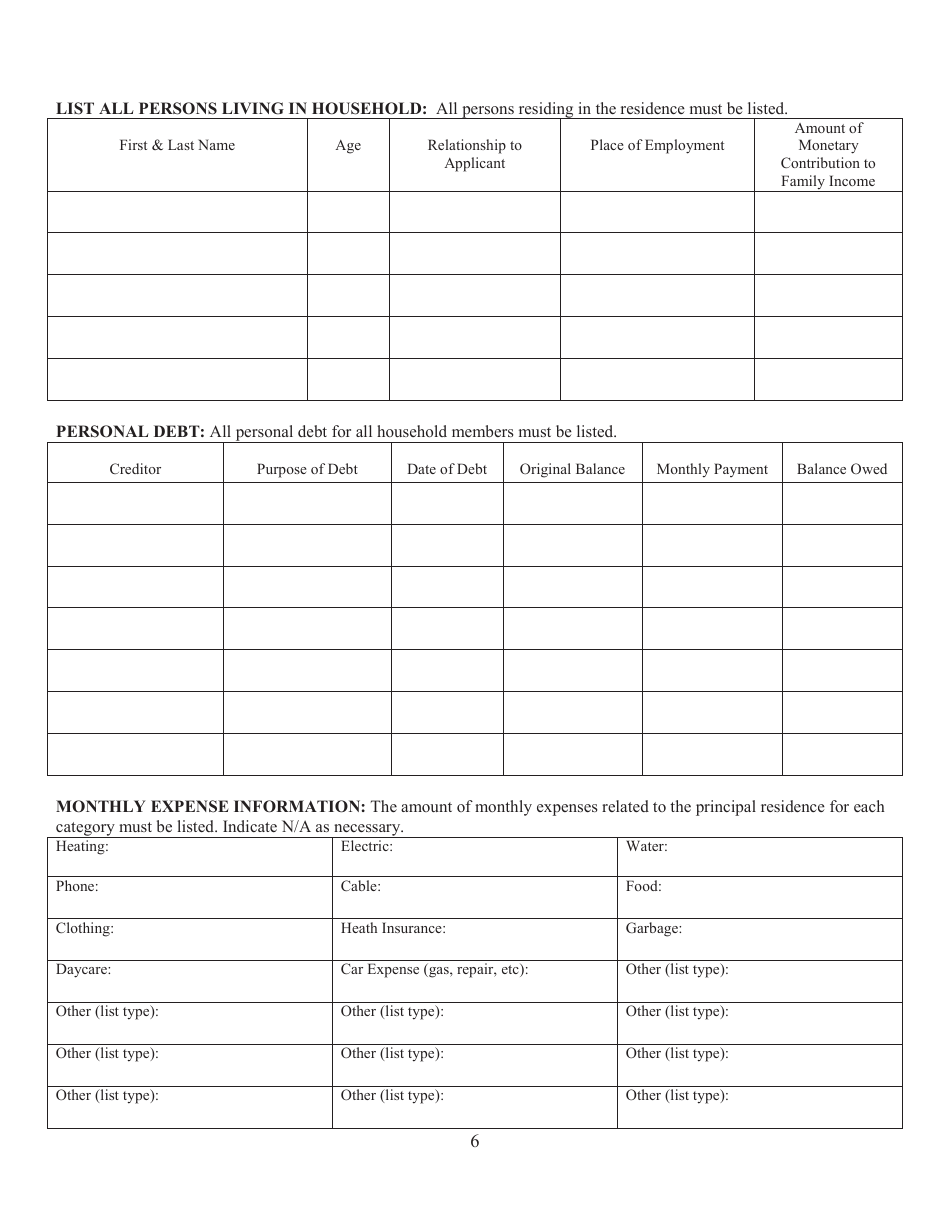

Q: What information do I need to provide on the application?

A: The application will typically require you to provide information about your income, assets, expenses, and any other relevant financial details.

Q: When is the deadline to submit a Poverty Exemption Application?

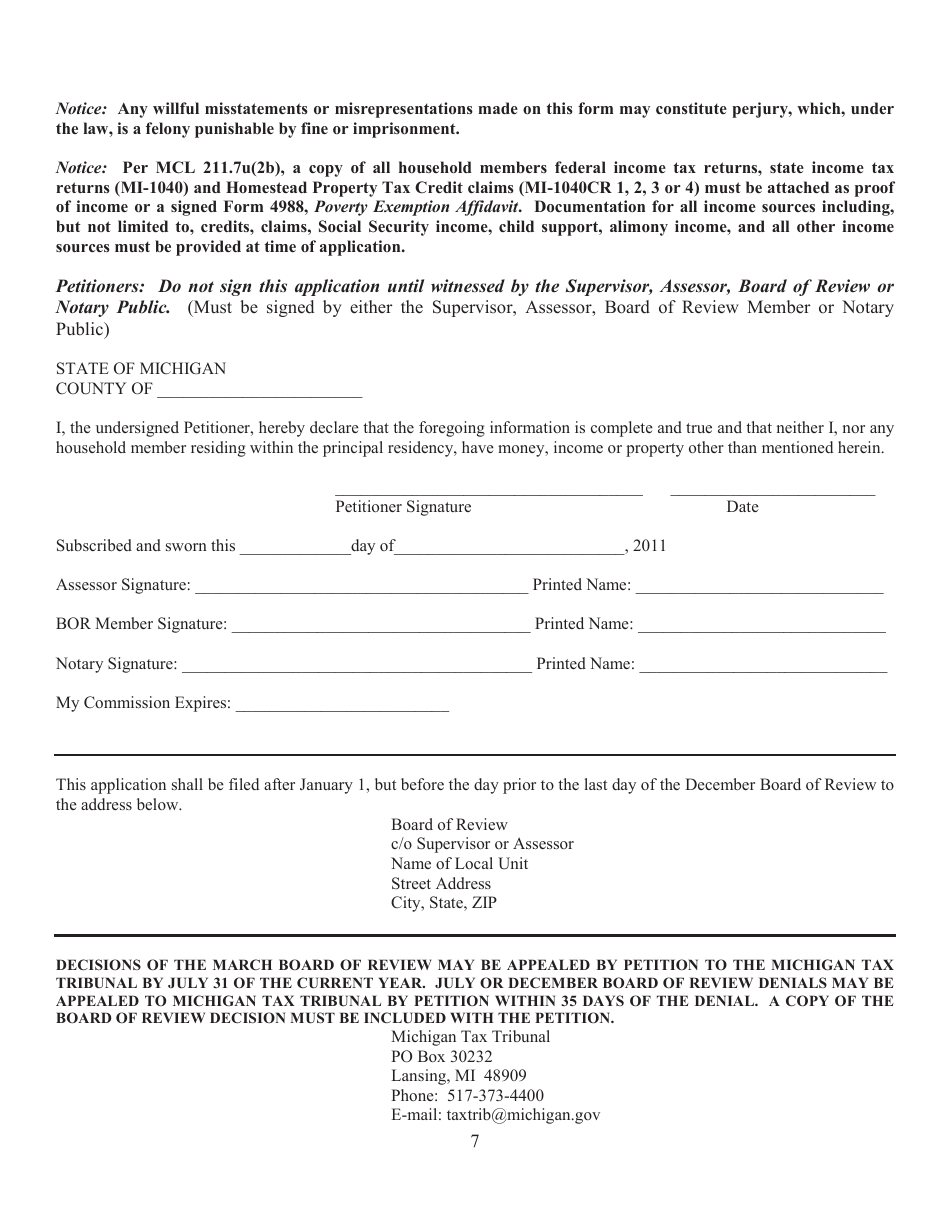

A: The deadline to submit a Poverty Exemption Application is usually set by your local government and may vary depending on the municipality.

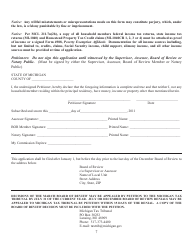

Q: What happens after I submit my application?

A: After you submit your application, the local assessor's office will review your financial information and determine if you meet the criteria for a poverty exemption.

Q: Can I appeal if my application is denied?

A: Yes, if your application is denied, you have the right to appeal the decision and provide further evidence of your financial hardship.

Q: What documentation should I include with my application?

A: You should include supporting documentation such as pay stubs, bank statements, tax returns, and any other documents that prove your financial situation.

Q: What if my property is owned jointly with someone else?

A: If your property is jointly owned, both owners must complete and sign the Poverty Exemption Application.

Q: Can I reapply for a Poverty Exemption every year?

A: Yes, you may need to reapply for a Poverty Exemption each year, as the eligibility requirements and financial circumstances can change.

Form Details:

- The latest edition currently provided by the Michigan Department of Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.