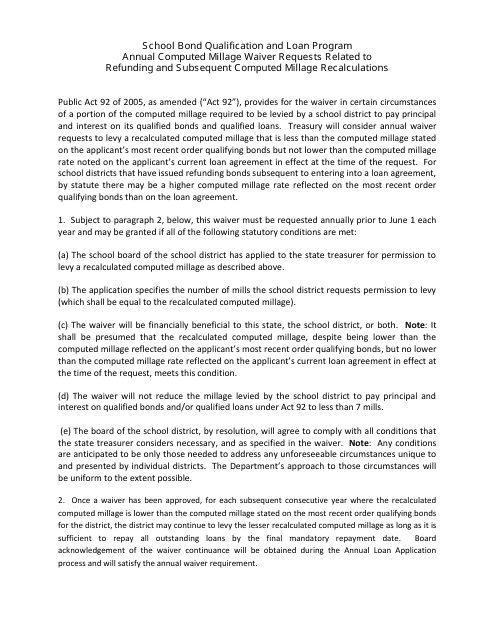

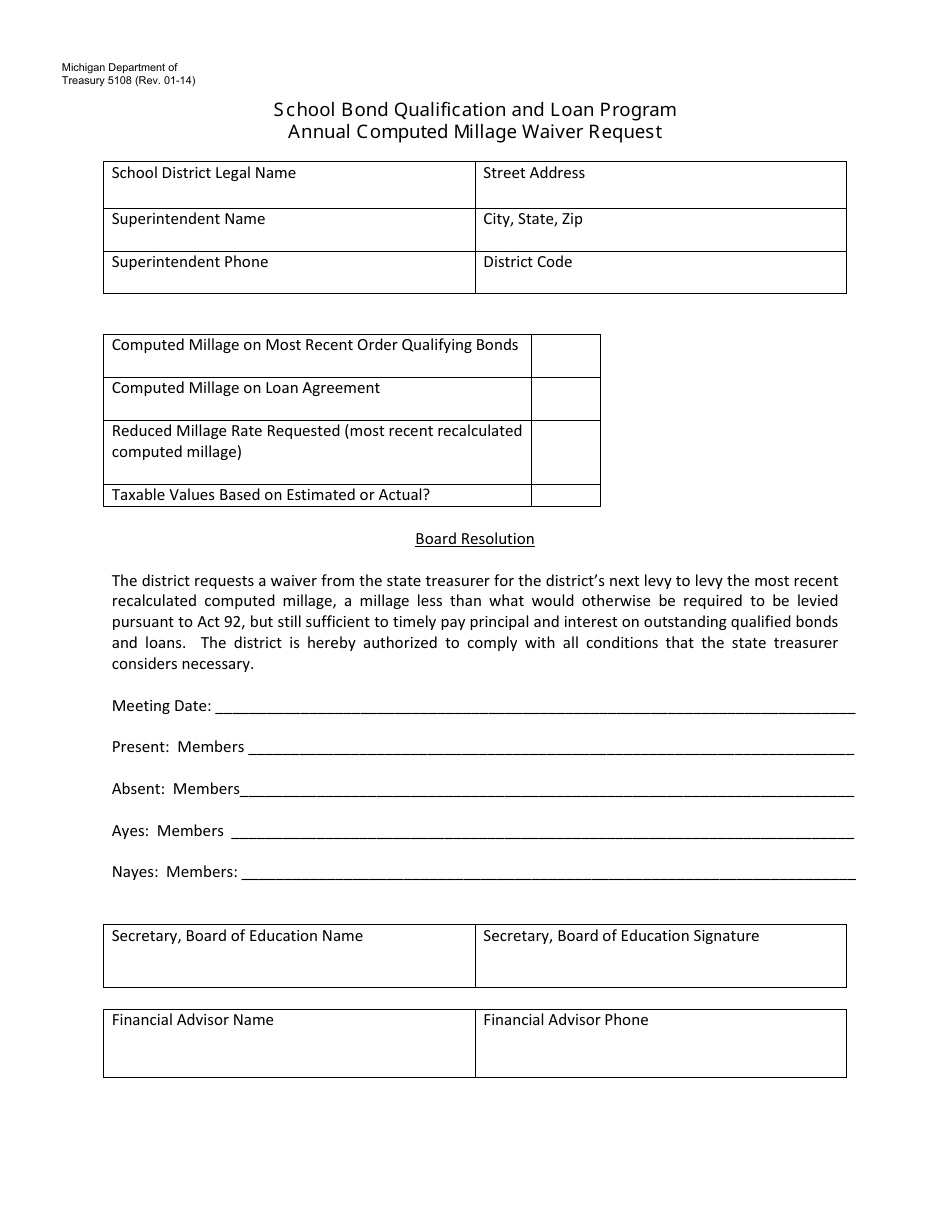

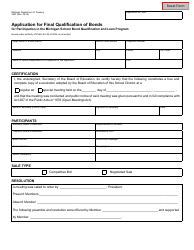

Form 5108 Annual Computed Millage Waiver Request - School Bond Qualification and Loan Program - Michigan

What Is Form 5108?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5108?

A: Form 5108 is the Annual Computed Millage Waiver Request form.

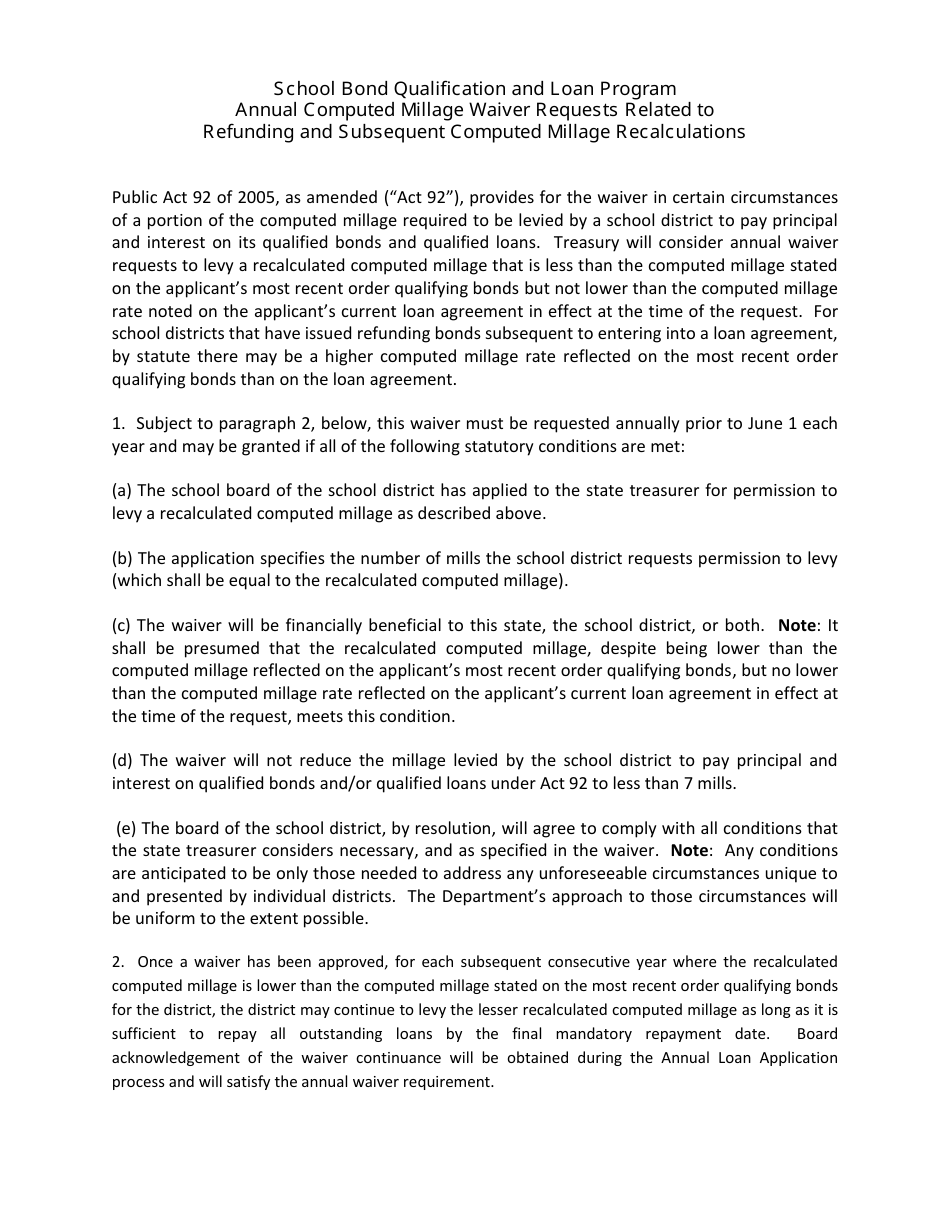

Q: What is the purpose of Form 5108?

A: Form 5108 is used for the School Bond Qualification and Loan Program in Michigan.

Q: Who needs to file Form 5108?

A: Schools participating in the School Bond Qualification and Loan Program in Michigan need to file Form 5108.

Q: What does the form request?

A: The form requests a waiver of the annual computed millage requirement.

Q: What is the annual computed millage requirement?

A: The annual computed millage requirement is the minimum tax levy required for participating schools.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5108 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.