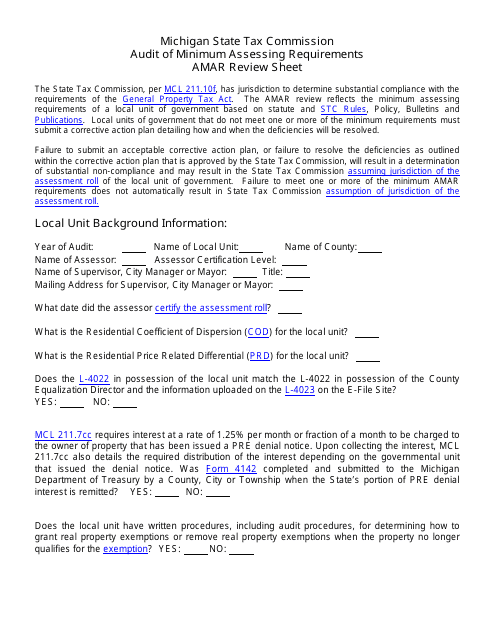

Audit of Minimum Assessing Requirements Review Sheet - Michigan

Audit of Minimum Assessing Requirements Review Sheet is a legal document that was released by the Michigan Department of Treasury - a government authority operating within Michigan.

FAQ

Q: What is the Audit of Minimum Assessing Requirements Review Sheet?

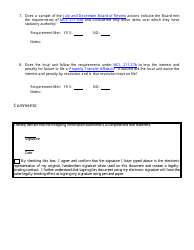

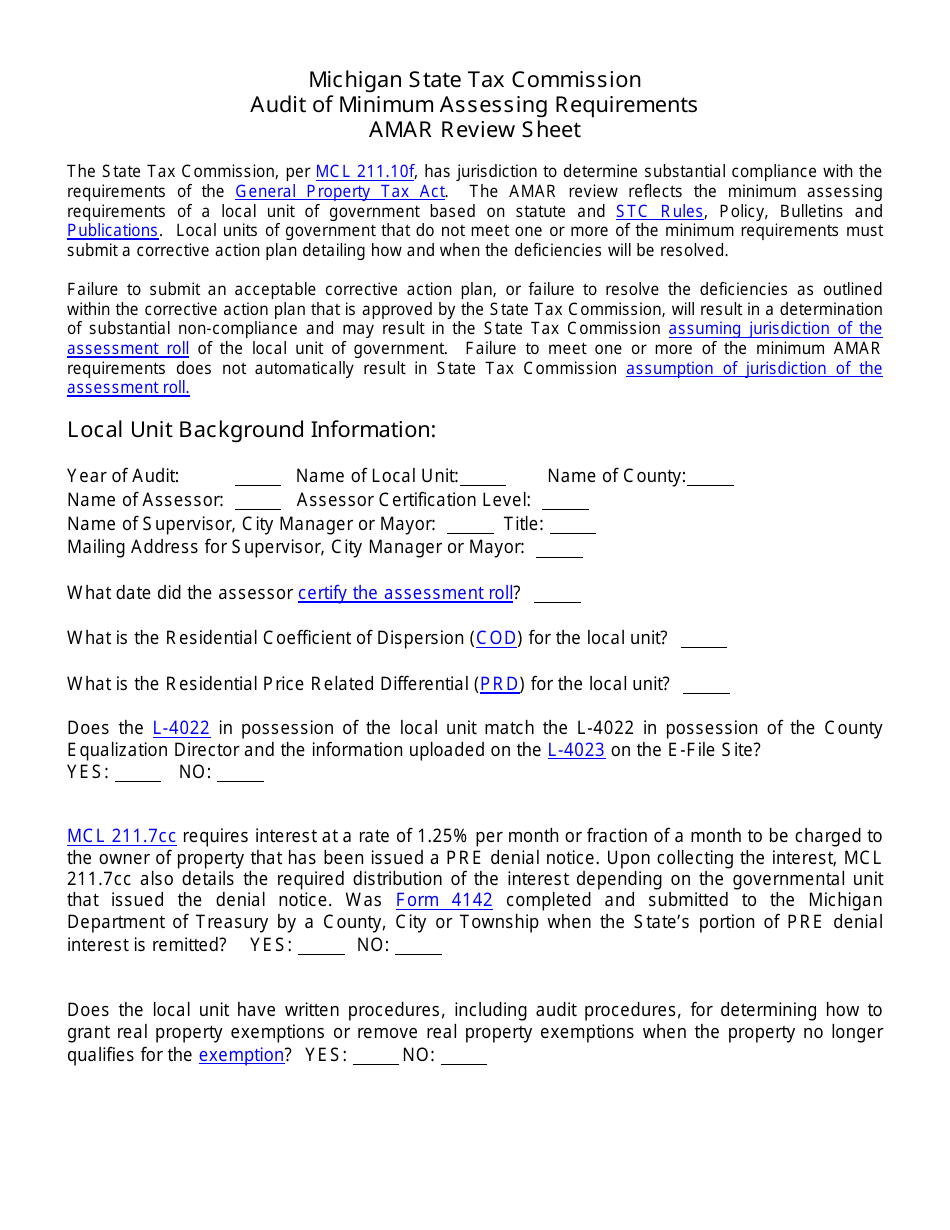

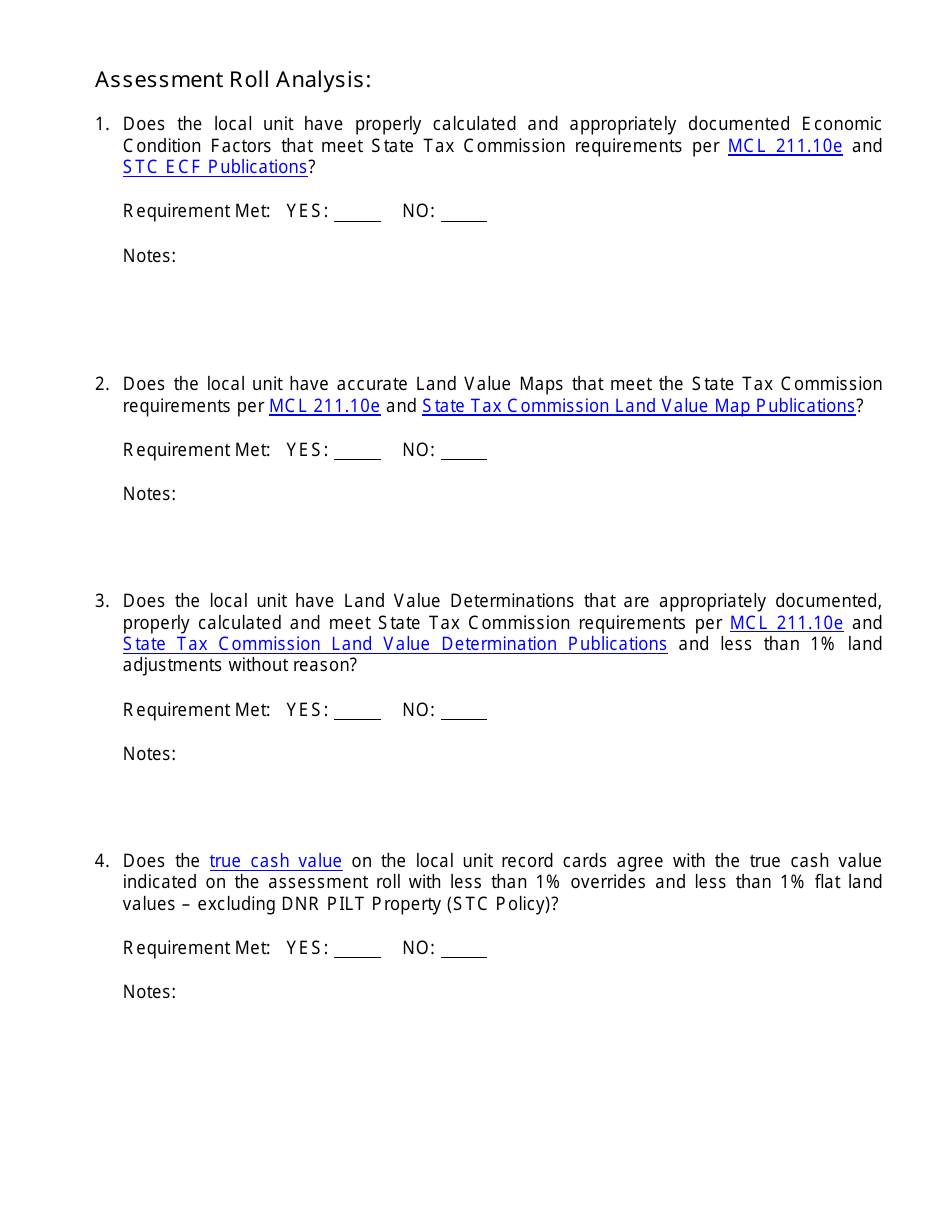

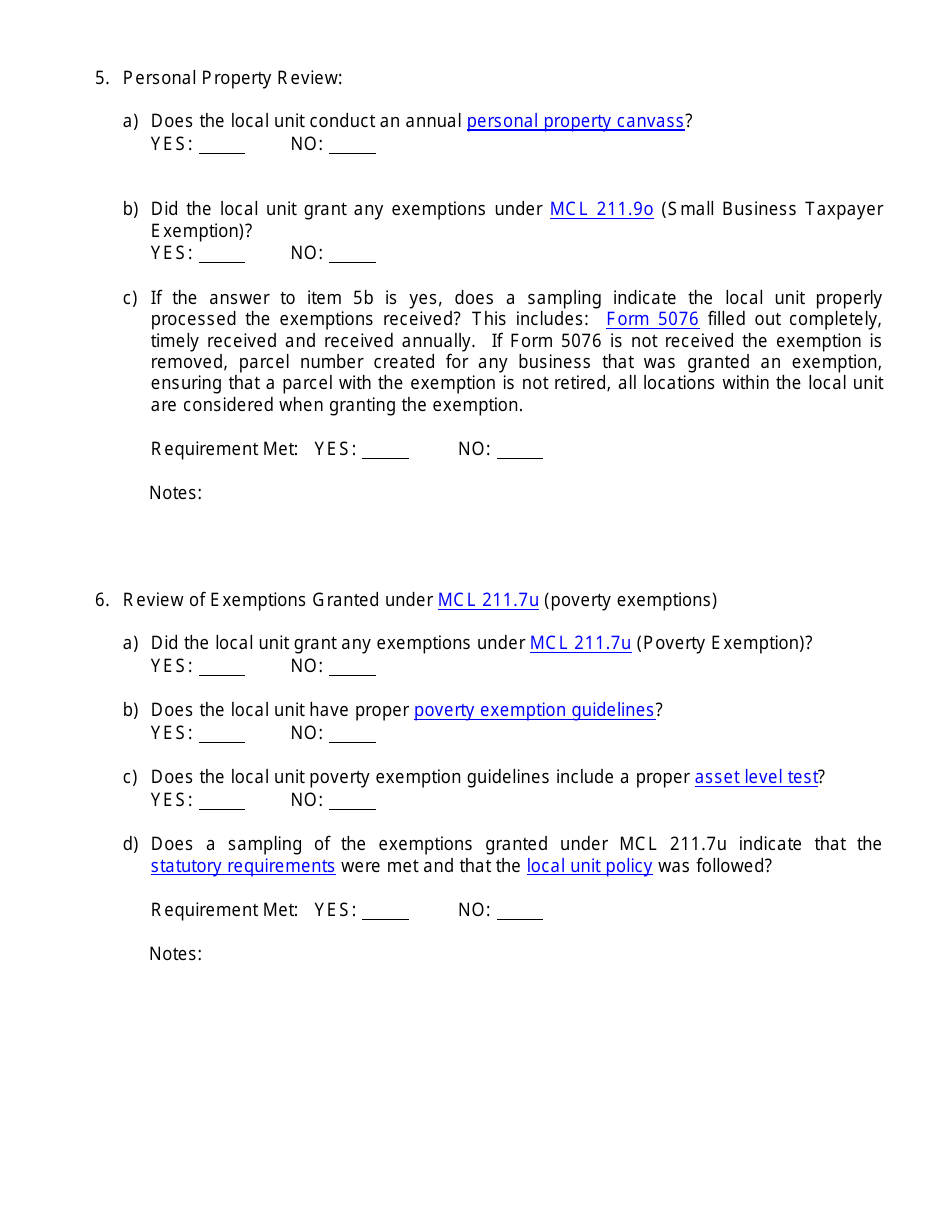

A: The Audit of Minimum Assessing Requirements Review Sheet is a document that outlines the minimum requirements for property assessment in Michigan.

Q: What does the Audit of Minimum Assessing Requirements Review Sheet cover?

A: The Audit of Minimum Assessing Requirements Review Sheet covers topics such as property classification, valuation methods, and assessment administration.

Q: Who is responsible for conducting the audit?

A: The Michigan State Tax Commission is responsible for conducting the audit of minimum assessing requirements.

Q: How often is the audit conducted?

A: The audit is conducted annually to ensure compliance with the minimum assessing requirements.

Q: Why is the audit important?

A: The audit is important to ensure fair and accurate property assessments, which in turn affects property tax calculations and distributions.

Form Details:

- The latest edition currently provided by the Michigan Department of Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.