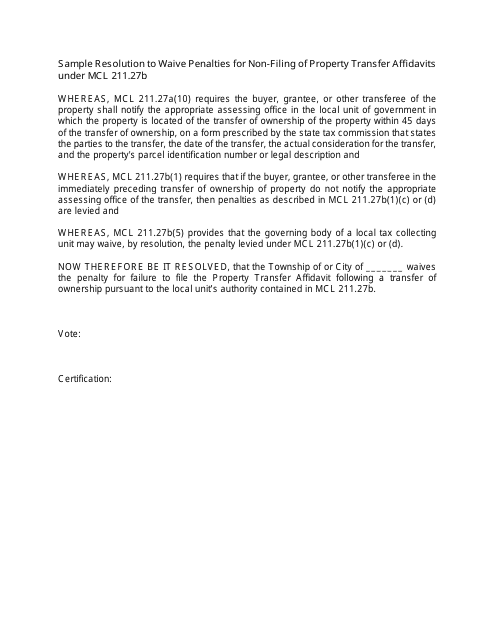

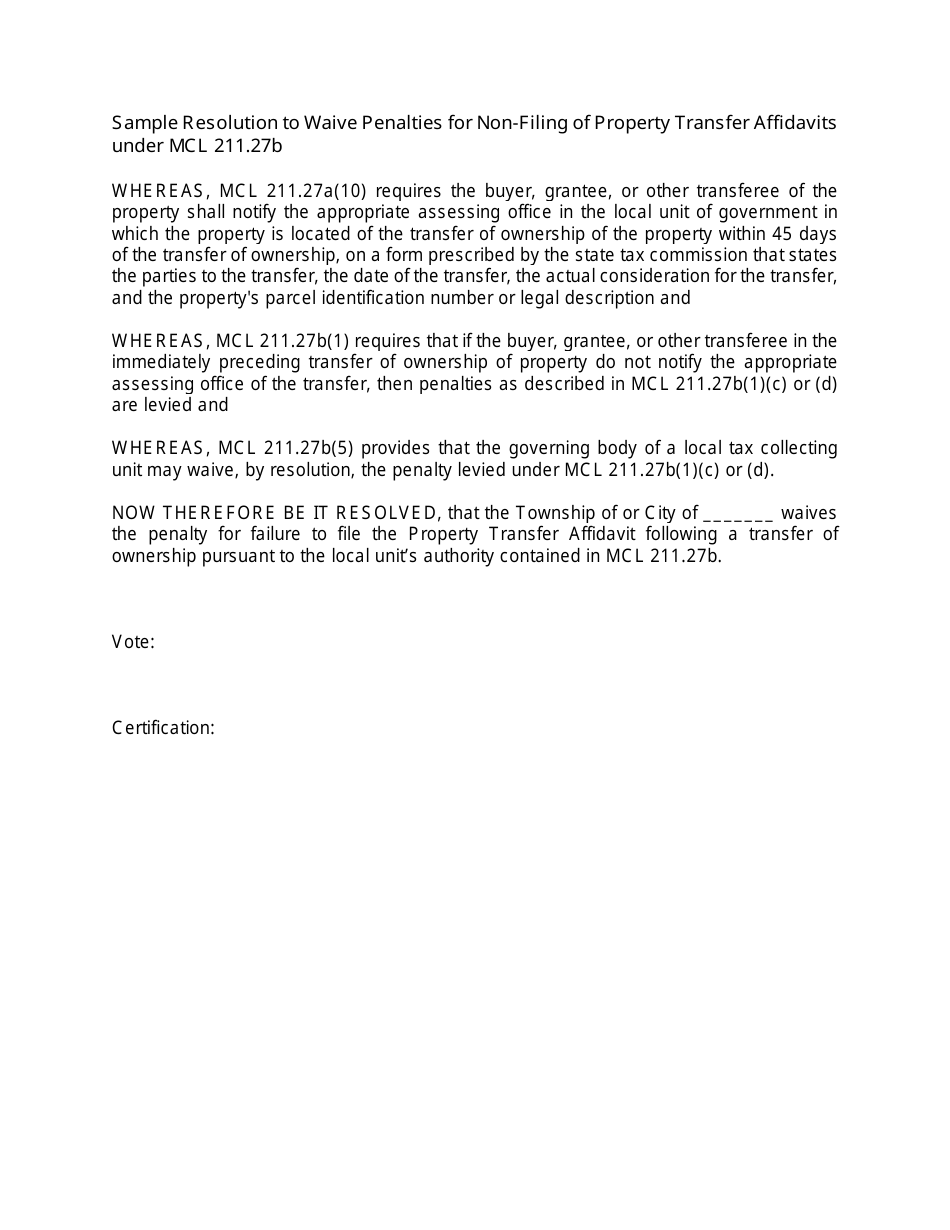

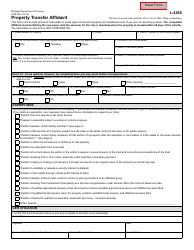

Resolution to Waive Penalties for Non-filing of Property Transfer Affidavits Under Mcl 211.27b - Michigan

Resolution to Waive Penalties for Non-filing of Property Transfer Affidavits Under Mcl 211.27b is a legal document that was released by the Michigan Department of Treasury - a government authority operating within Michigan.

FAQ

Q: What is MCL 211.27b in Michigan?

A: MCL 211.27b in Michigan refers to the law that requires the filing of Property Transfer Affidavits.

Q: What is a Property Transfer Affidavit?

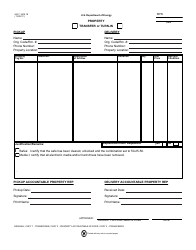

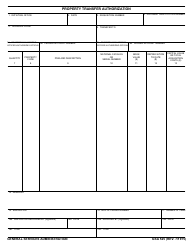

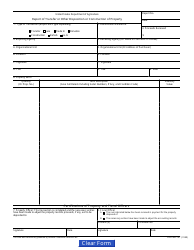

A: A Property Transfer Affidavit is a document that provides information about the transfer of property ownership in Michigan.

Q: What are the penalties for non-filing of Property Transfer Affidavits?

A: The penalties for non-filing of Property Transfer Affidavits in Michigan include late filing fees and potential property tax assessments.

Q: What does the resolution to waive penalties mean?

A: The resolution to waive penalties means that the government has decided to temporarily suspend or eliminate the penalties for non-filing of Property Transfer Affidavits.

Q: Who is eligible for the penalty waiver?

A: The specific criteria for eligibility for the penalty waiver may vary, so it is advisable to refer to the official guidelines or contact the relevant authorities in Michigan.

Q: How long is the penalty waiver in effect?

A: The duration of the penalty waiver may vary and depends on the specific resolution or legislation in Michigan.

Form Details:

- The latest edition currently provided by the Michigan Department of Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.