This version of the form is not currently in use and is provided for reference only. Download this version of

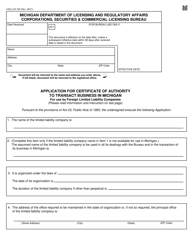

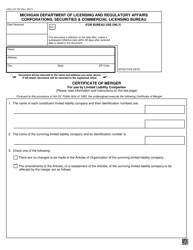

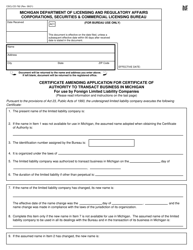

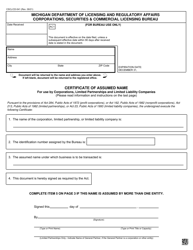

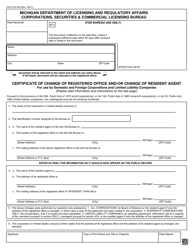

Form CSCL/CD-731

for the current year.

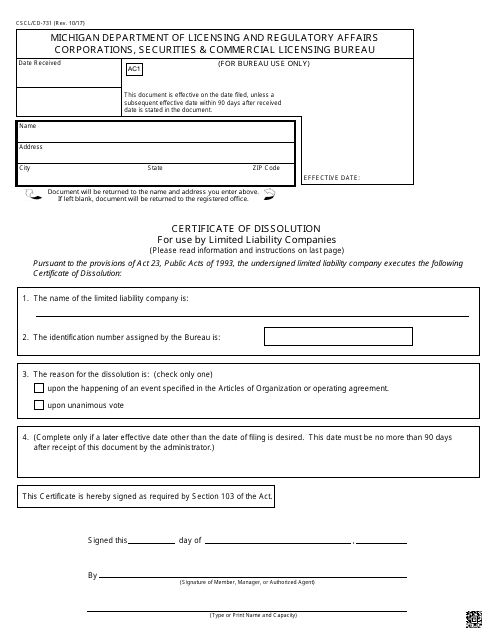

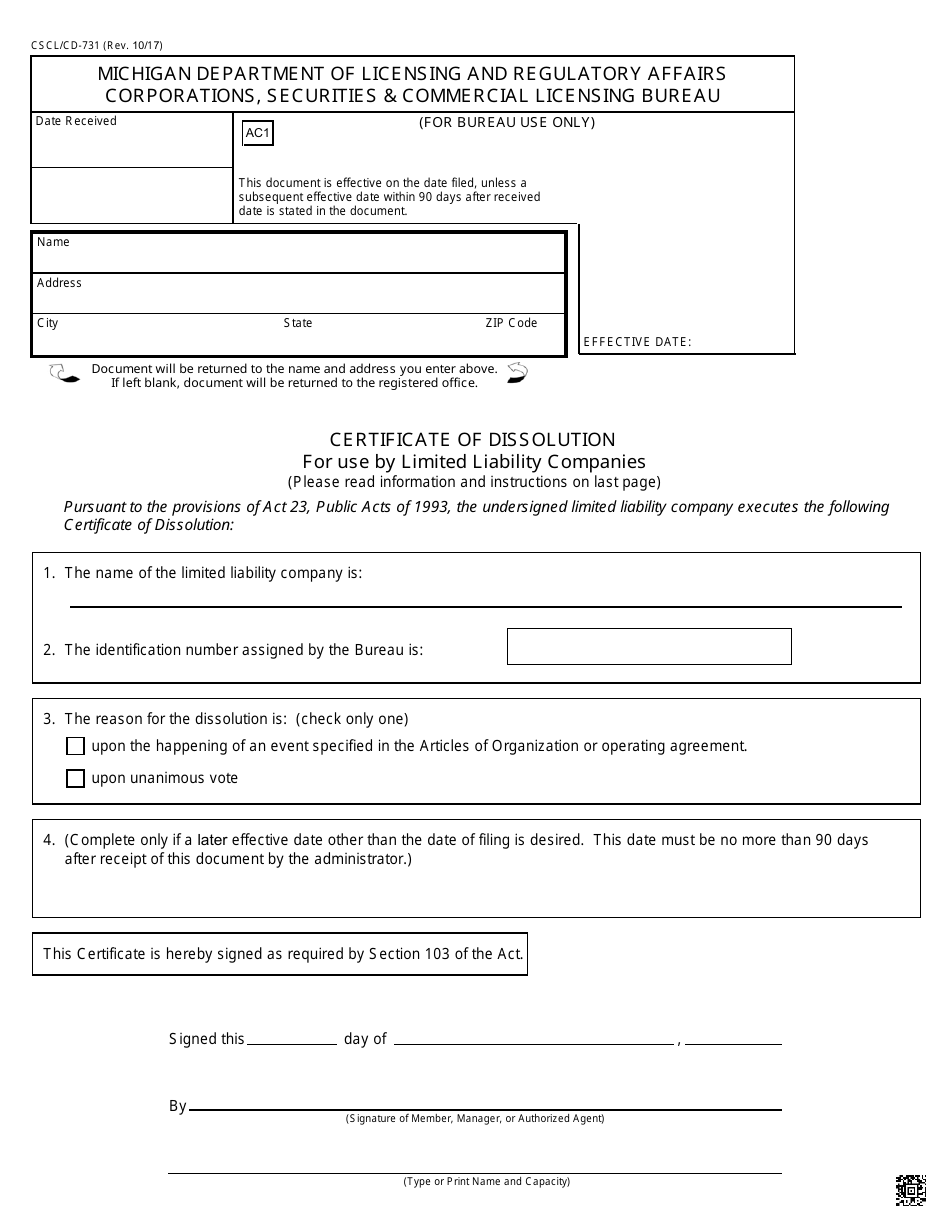

Form CSCL / CD-731 Certificate of Dissolution for Use by Limited Liability Companies - Michigan

What Is Form CSCL/CD-731?

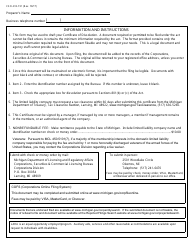

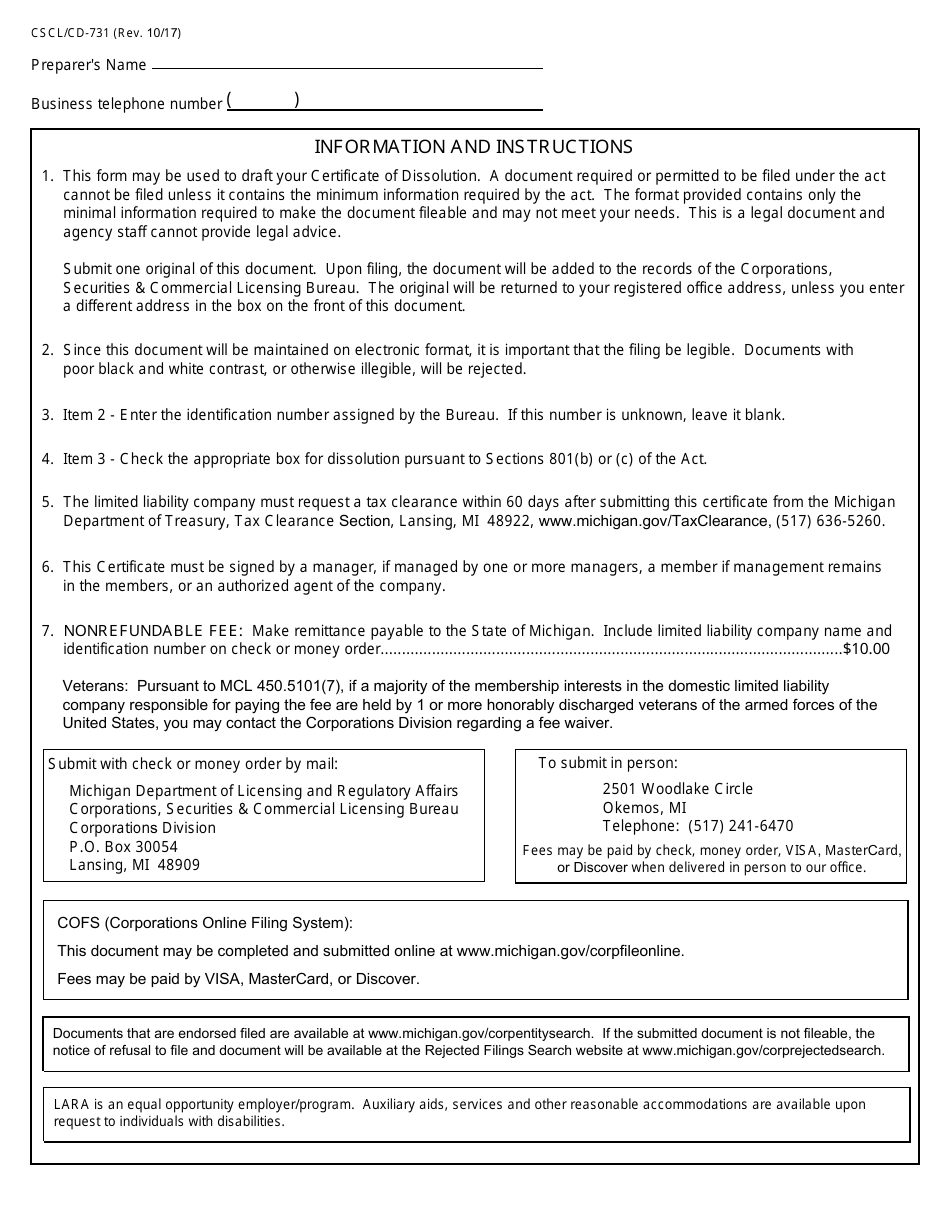

This is a legal form that was released by the Michigan Department of Licensing and Regulatory Affairs - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

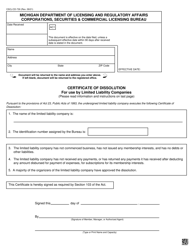

Q: What is the CSCL/CD-731 Certificate of Dissolution?

A: The CSCL/CD-731 Certificate of Dissolution is a form used by Limited Liability Companies (LLCs) in Michigan to officially dissolve their company.

Q: Why would an LLC need to file a CSCL/CD-731 Certificate of Dissolution?

A: An LLC would need to file a CSCL/CD-731 Certificate of Dissolution if they are permanently closing their business and no longer want to operate as an LLC in Michigan.

Q: What information is required on the CSCL/CD-731 Certificate of Dissolution?

A: The CSCL/CD-731 Certificate of Dissolution requires the LLC's name, date of dissolution, and the signature of an authorized representative.

Q: Are there any fees associated with filing a CSCL/CD-731 Certificate of Dissolution?

A: Yes, there is a fee of $10.00 to file a CSCL/CD-731 Certificate of Dissolution with the Michigan Department of Licensing and Regulatory Affairs (LARA).

Q: What happens after I file a CSCL/CD-731 Certificate of Dissolution?

A: After filing a CSCL/CD-731 Certificate of Dissolution, your LLC will be officially dissolved and will no longer be recognized as a legal entity in Michigan.

Q: Do I need to notify any other government agencies or entities after filing a CSCL/CD-731 Certificate of Dissolution?

A: Yes, you may need to notify other government agencies, such as the Internal Revenue Service (IRS) and the Michigan Department of Treasury, about the dissolution of your LLC.

Q: Can I restore my LLC after filing a CSCL/CD-731 Certificate of Dissolution?

A: Yes, you may be able to restore your LLC after filing a CSCL/CD-731 Certificate of Dissolution. However, there may be additional steps and fees involved in the restoration process.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Michigan Department of Licensing and Regulatory Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CSCL/CD-731 by clicking the link below or browse more documents and templates provided by the Michigan Department of Licensing and Regulatory Affairs.