This version of the form is not currently in use and is provided for reference only. Download this version of

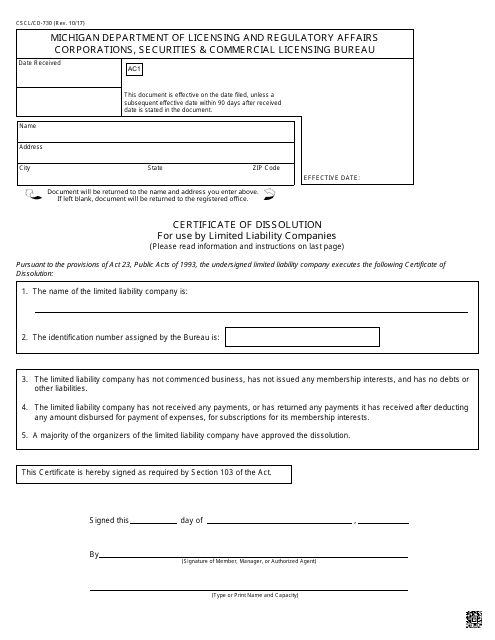

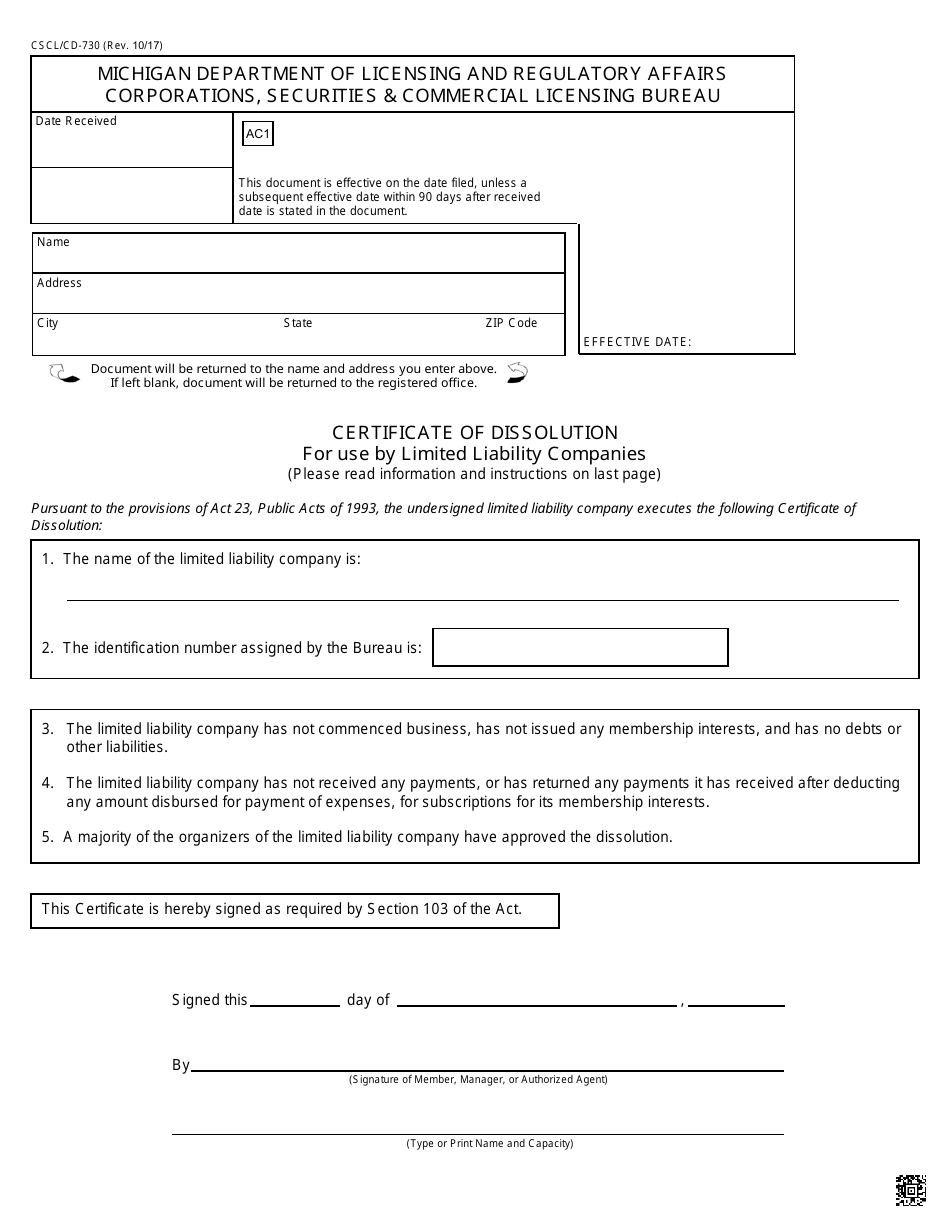

Form CSCL/CD-730

for the current year.

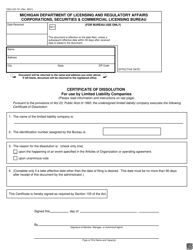

Form CSCL / CD-730 Certificate of Dissolution for Use by Limited Liability Companies - Michigan

What Is Form CSCL/CD-730?

This is a legal form that was released by the Michigan Department of Licensing and Regulatory Affairs - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CSCL/CD-730?

A: The Form CSCL/CD-730 is the Certificate of Dissolution for Use by Limited Liability Companies in Michigan.

Q: What is the purpose of Form CSCL/CD-730?

A: The purpose of Form CSCL/CD-730 is to dissolve a Limited Liability Company (LLC) in Michigan.

Q: What information is required on Form CSCL/CD-730?

A: Form CSCL/CD-730 requires information such as the name of the LLC, the date of dissolution, and the signature of an authorized person.

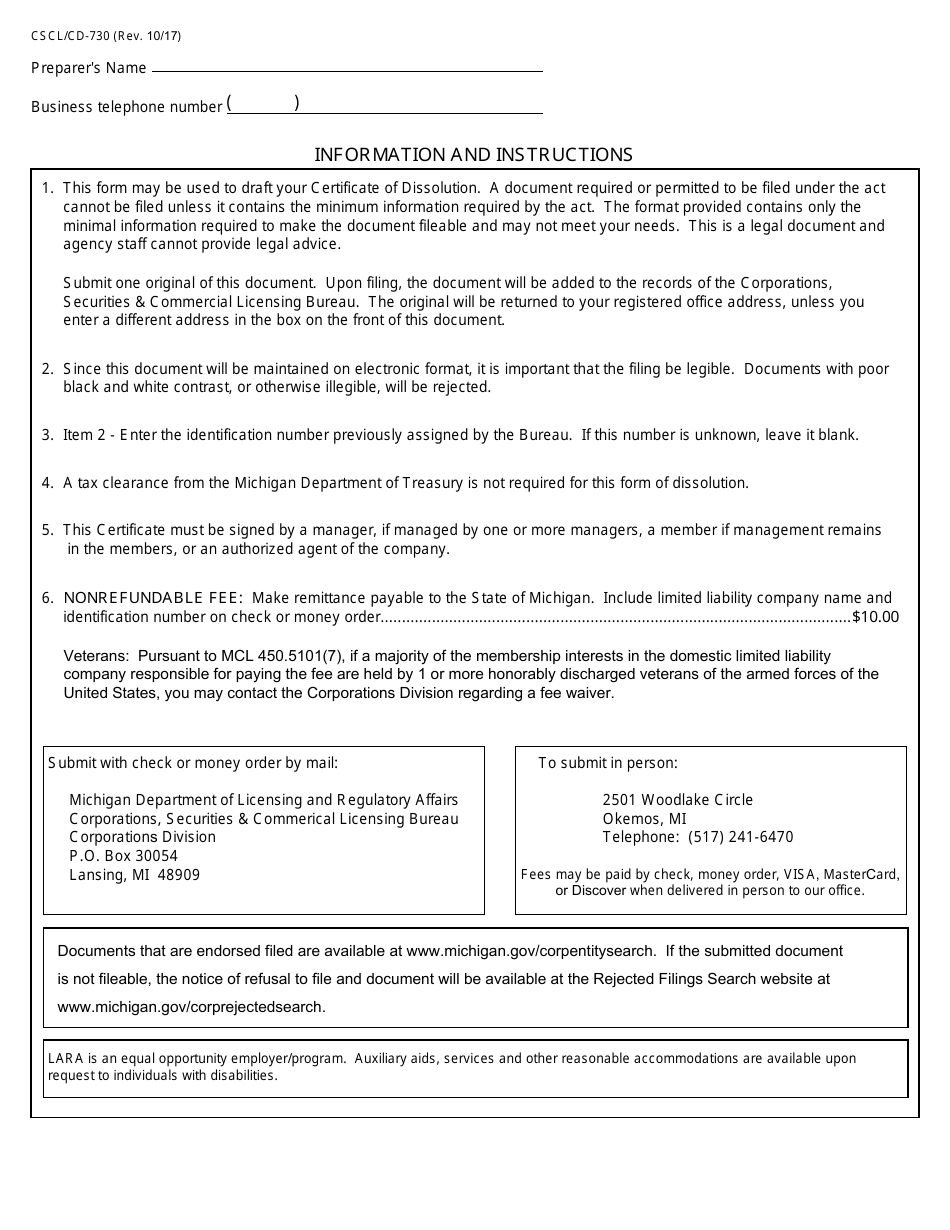

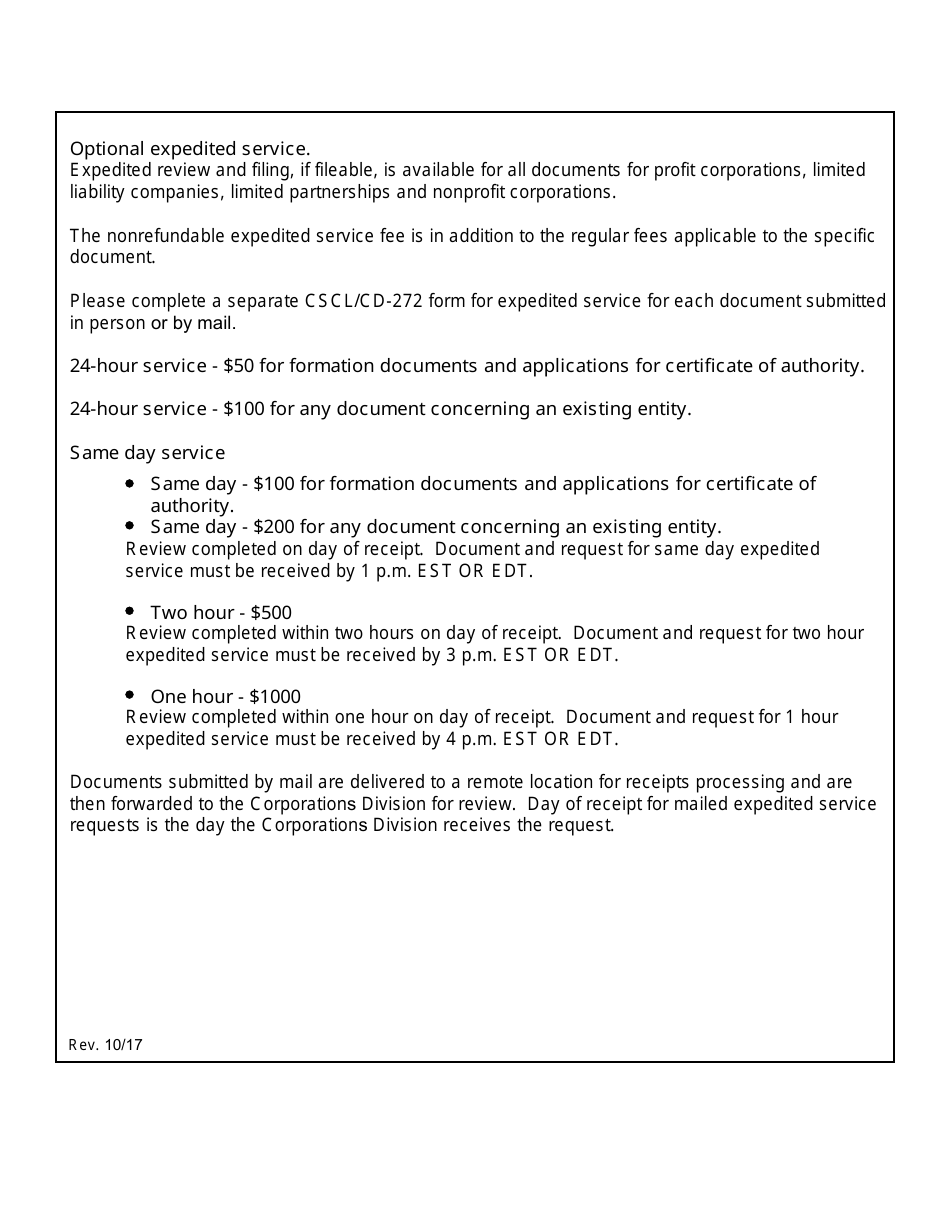

Q: Are there any filing fees for Form CSCL/CD-730?

A: Yes, there is a filing fee for Form CSCL/CD-730. The fee amount may vary, so it's best to check the current fee schedule with LARA.

Q: Can I dissolve my LLC using Form CSCL/CD-730 if I have outstanding debts or obligations?

A: No, if your LLC has outstanding debts or obligations, you should consult with an attorney or accountant before using Form CSCL/CD-730 to dissolve the LLC.

Q: How long does it take for Form CSCL/CD-730 to be processed?

A: The processing time for Form CSCL/CD-730 may vary, but it typically takes a few weeks for the dissolution to be processed.

Q: After submitting Form CSCL/CD-730, do I need to notify any other agencies or individuals?

A: Yes, after submitting Form CSCL/CD-730, you may need to notify other agencies and individuals, such as creditors, employees, and customers. It's important to follow all necessary steps to ensure a proper dissolution of your LLC.

Q: Can I reinstate my LLC after it has been dissolved using Form CSCL/CD-730?

A: Yes, it is possible to reinstate your LLC after it has been dissolved using Form CSCL/CD-730. However, there may be specific requirements and fees associated with reinstatement, so it's best to consult with LARA or seek legal advice for the reinstatement process.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Michigan Department of Licensing and Regulatory Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CSCL/CD-730 by clicking the link below or browse more documents and templates provided by the Michigan Department of Licensing and Regulatory Affairs.