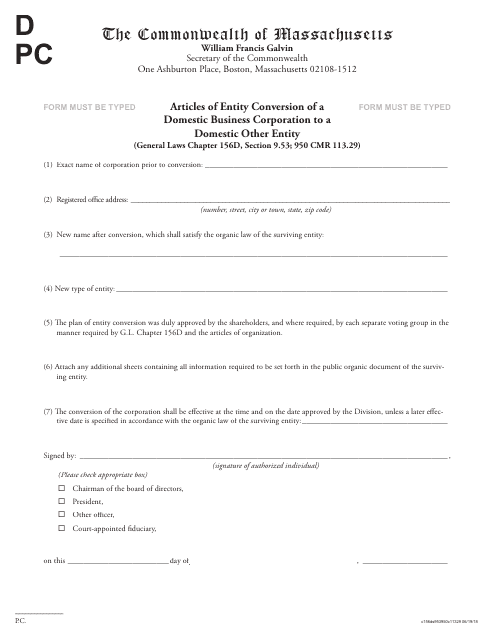

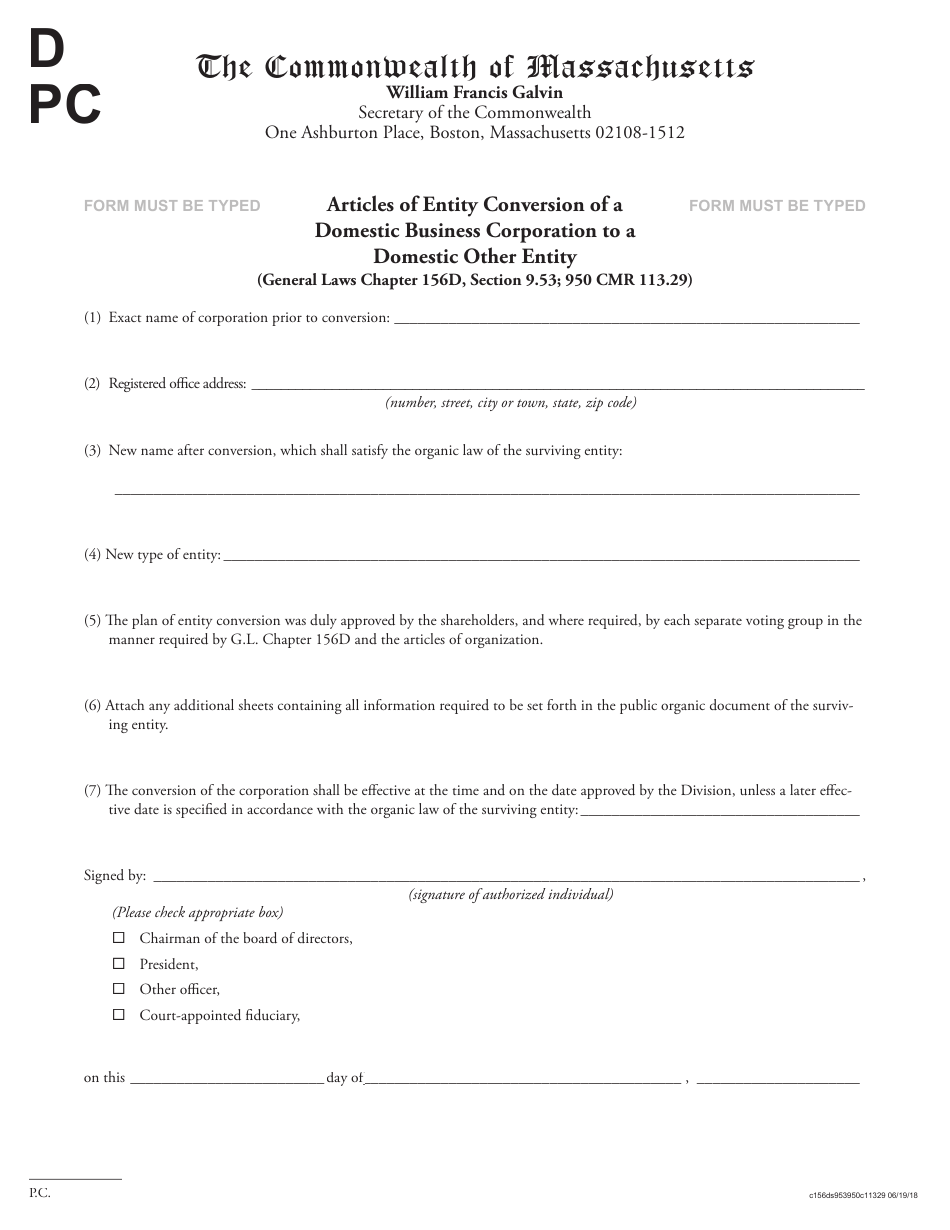

Articles of Entity Conversion of a Domestic Business Corporation to a Domestic Other Entity - Massachusetts

Articles of Business Corporation to a Domestic Other Entity is a legal document that was released by the Secretary of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is an Entity Conversion?

A: Entity conversion is the process of changing the legal structure of a business. It allows a domestic business corporation in Massachusetts to become a domestic other entity, such as a limited liability company (LLC) or a partnership.

Q: Why would a business corporation want to convert to another entity?

A: Business corporations may choose to convert to another entity to take advantage of different tax benefits, liability protections, or governance structures. It can also help facilitate a change in ownership or management.

Q: What types of other entities can a business corporation convert to?

A: In Massachusetts, a business corporation can convert to a limited liability company (LLC), a partnership, a limited partnership (LP), a limited liability partnership (LLP), or a professional limited liability company (PLLC).

Q: What is required to complete an entity conversion?

A: To complete an entity conversion, the business corporation must file Articles of Entity Conversion with the Massachusetts Secretary of the Commonwealth. The articles must include various information about the corporation and the new entity it is converting to.

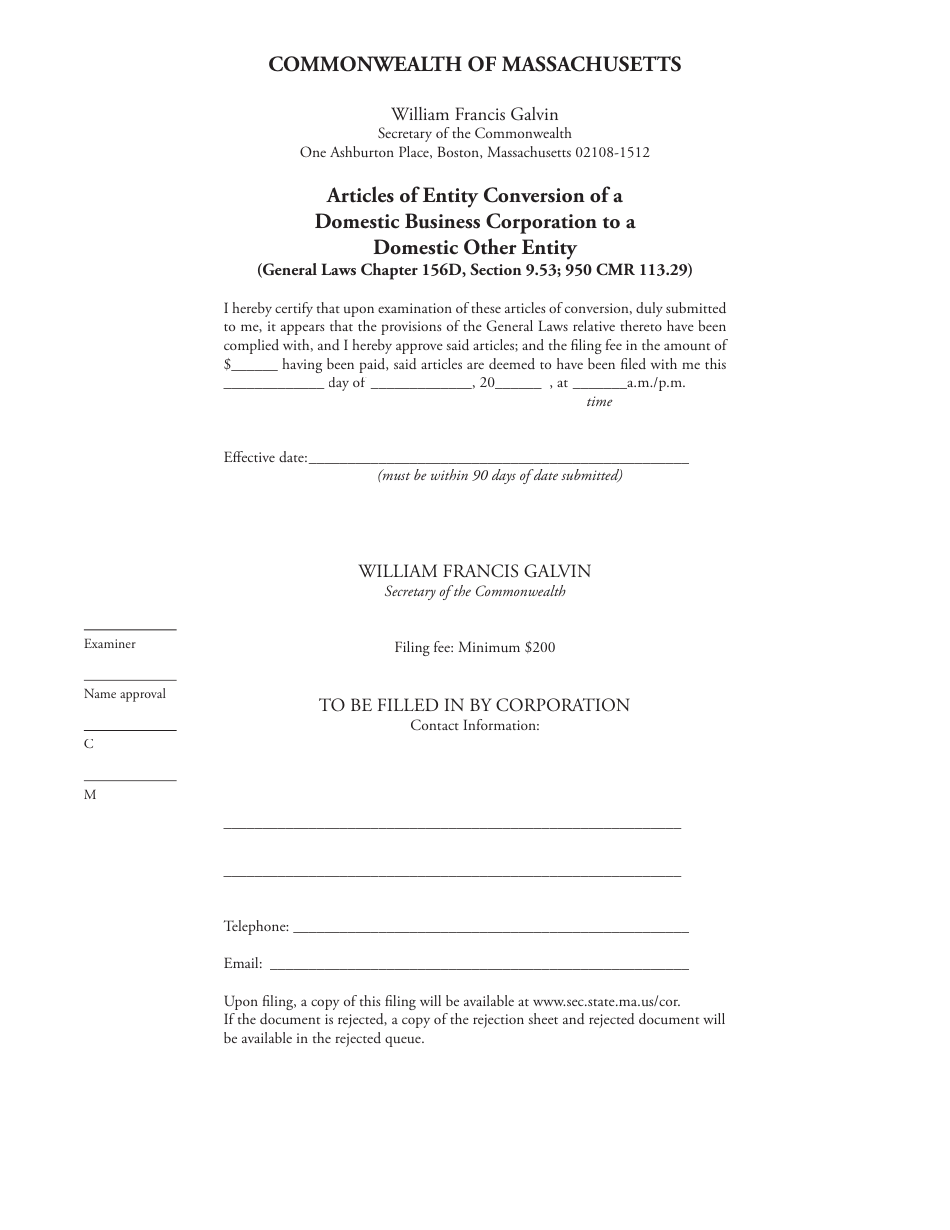

Q: Are there any fees associated with filing Articles of Entity Conversion?

A: Yes, there are filing fees associated with filing Articles of Entity Conversion. The fees vary depending on the type of conversion and the new entity being formed. It is important to check the current fee schedule with the Secretary of the Commonwealth.

Q: What happens after the Articles of Entity Conversion are filed?

A: Once the Articles of Entity Conversion are filed and approved by the Secretary of the Commonwealth, the corporation's legal structure is officially changed to the new entity type. The corporation will then operate under the laws and regulations applicable to that entity type.

Q: Can a business corporation convert back to a business corporation after converting to another entity?

A: Yes, in some cases a business corporation can convert back to a business corporation after converting to another entity. However, the specific rules and requirements for converting back may vary depending on the entity type and state laws.

Form Details:

- Released on June 19, 2018;

- The latest edition currently provided by the Secretary of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Secretary of the Commonwealth of Massachusetts.