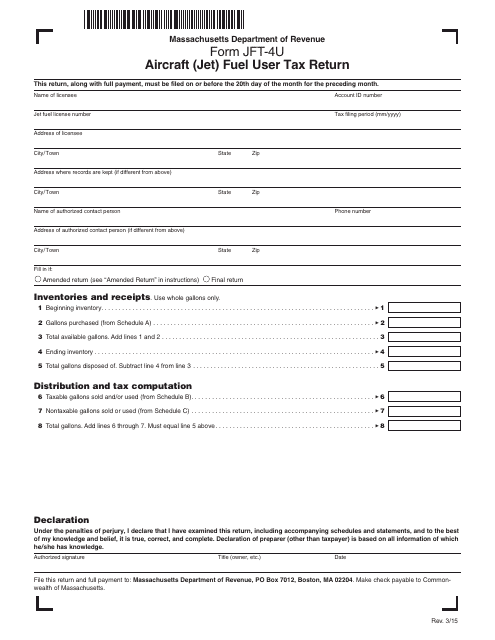

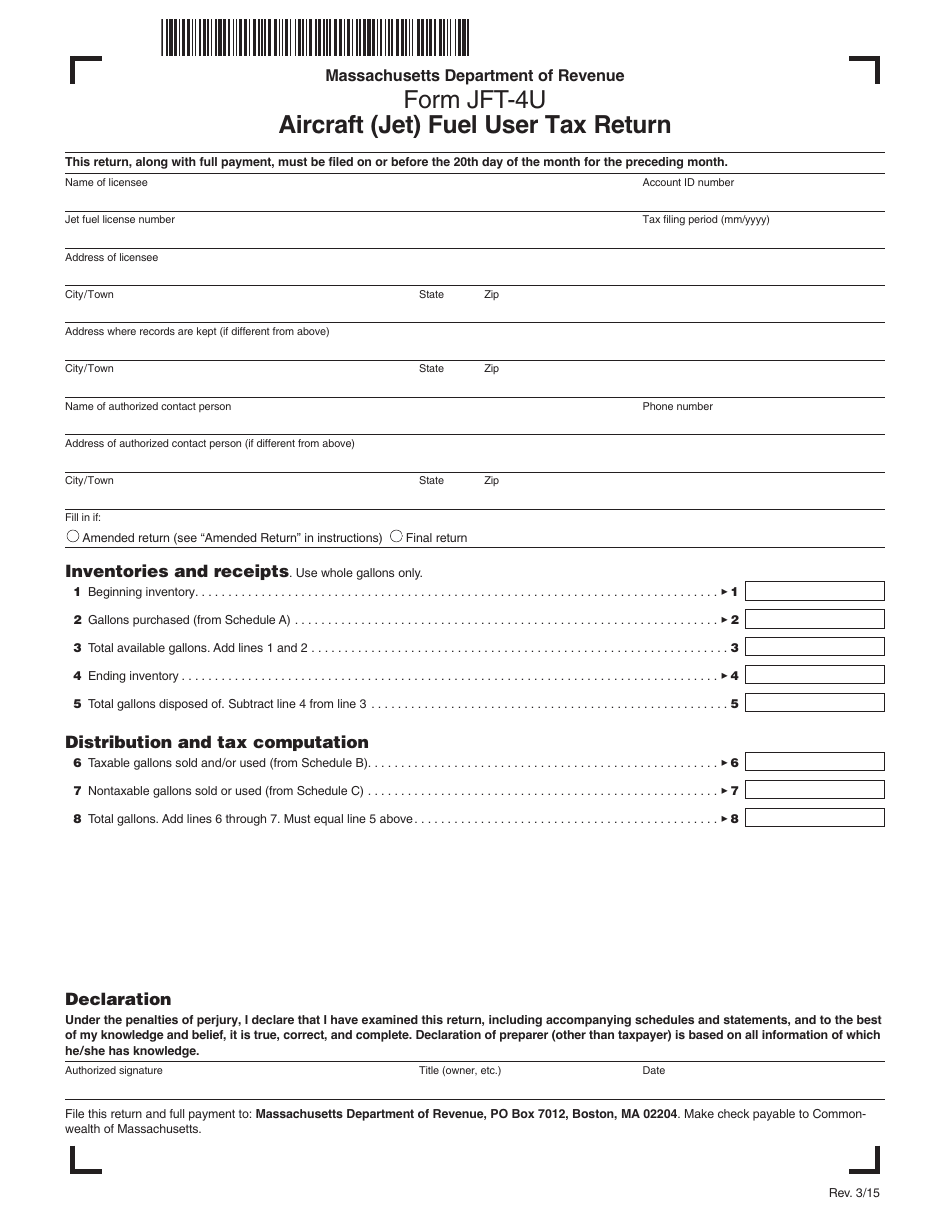

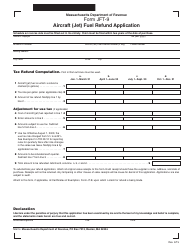

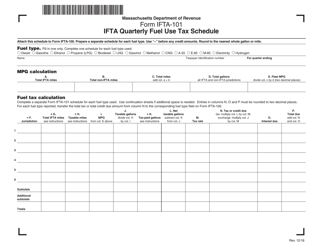

Form JFT-4U Aircraft (Jet) Fuel User Tax Return - Massachusetts

What Is Form JFT-4U?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form JFT-4U?

A: Form JFT-4U is the Aircraft (Jet) Fuel User Tax Return for Massachusetts.

Q: Who needs to file Form JFT-4U?

A: Any person or entity that uses jet fuel in an aircraft within Massachusetts needs to file Form JFT-4U.

Q: What is the purpose of Form JFT-4U?

A: Form JFT-4U is used to report and pay the user tax on jet fuel consumed in aircraft within Massachusetts.

Q: How often do I need to file Form JFT-4U?

A: Form JFT-4U is filed quarterly, with the deadlines falling on the last day of April, July, October, and January.

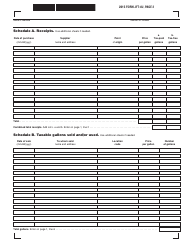

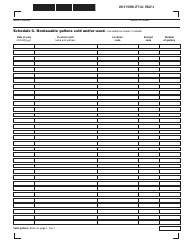

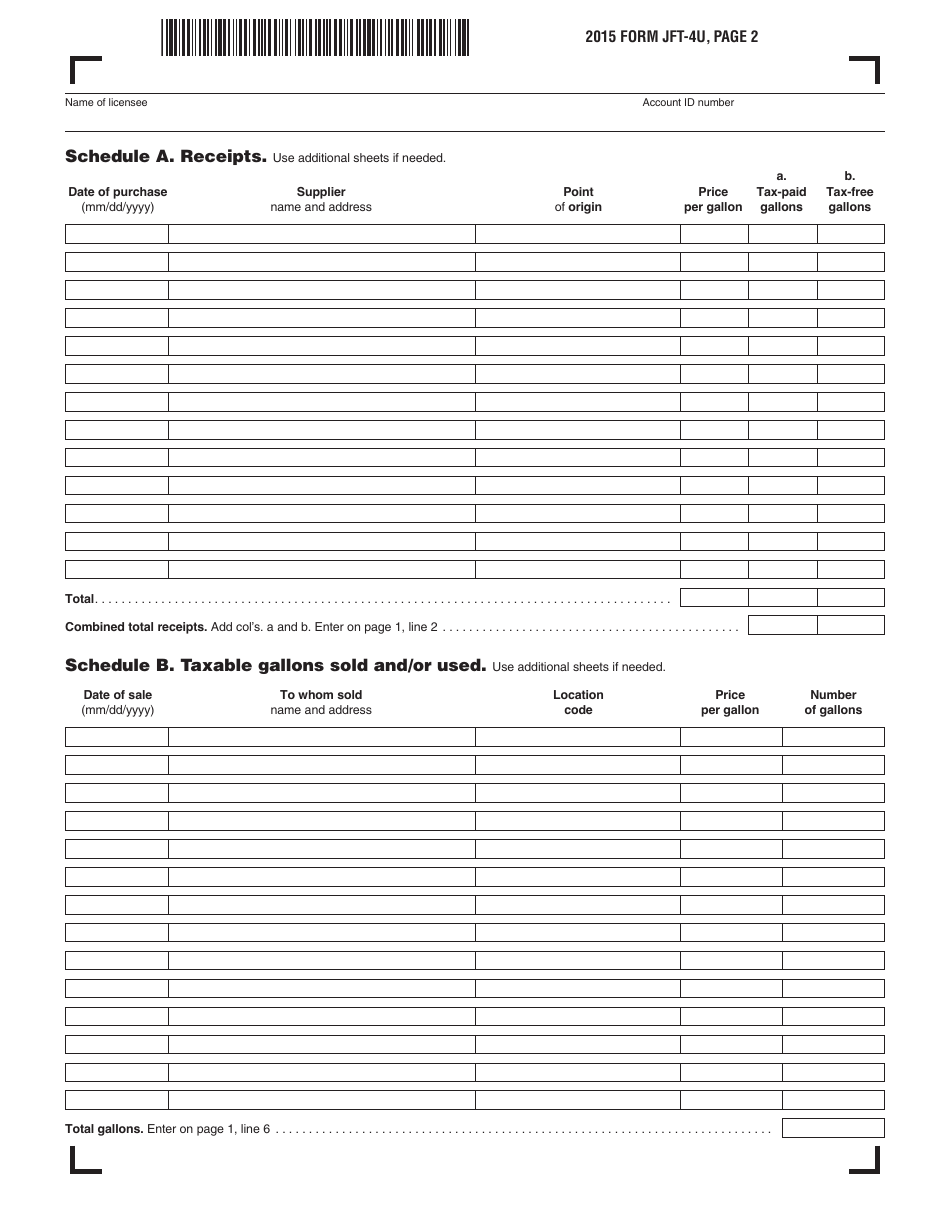

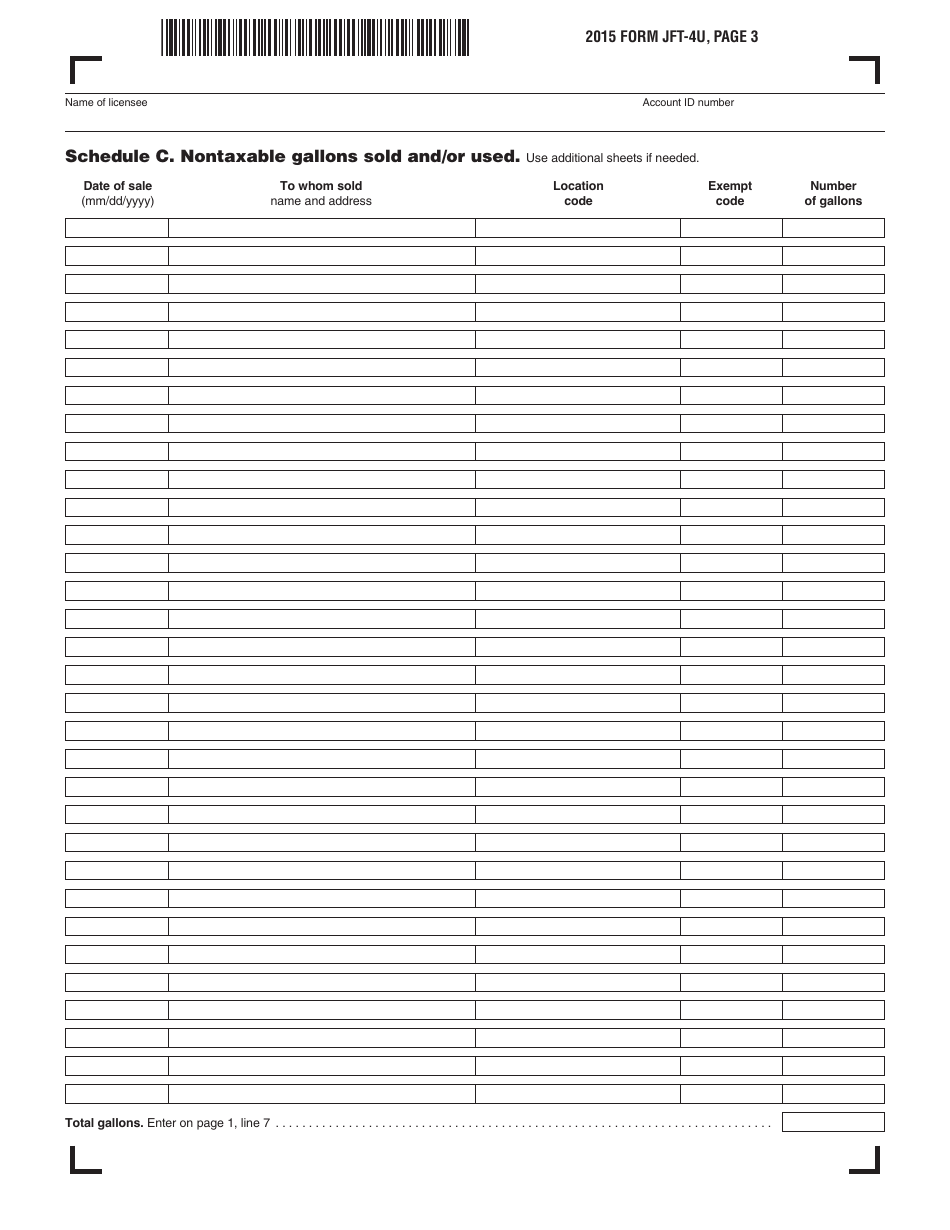

Q: What information is required on Form JFT-4U?

A: Form JFT-4U requires information such as the total gallons of jet fuel used, the tax due, and contact information of the taxpayer.

Q: Are there any penalties for late filing of Form JFT-4U?

A: Yes, penalties may apply for late filing or failure to file Form JFT-4U.

Q: Is there any other documentation required with Form JFT-4U?

A: Generally, you do not need to attach any additional documentation with Form JFT-4U unless specifically requested by the Massachusetts Department of Revenue.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form JFT-4U by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.