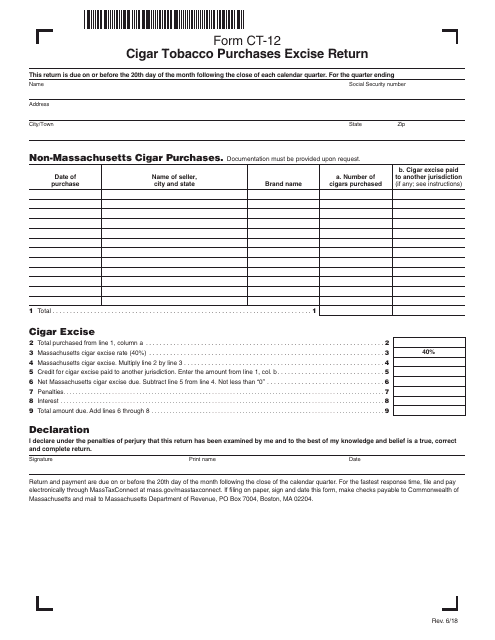

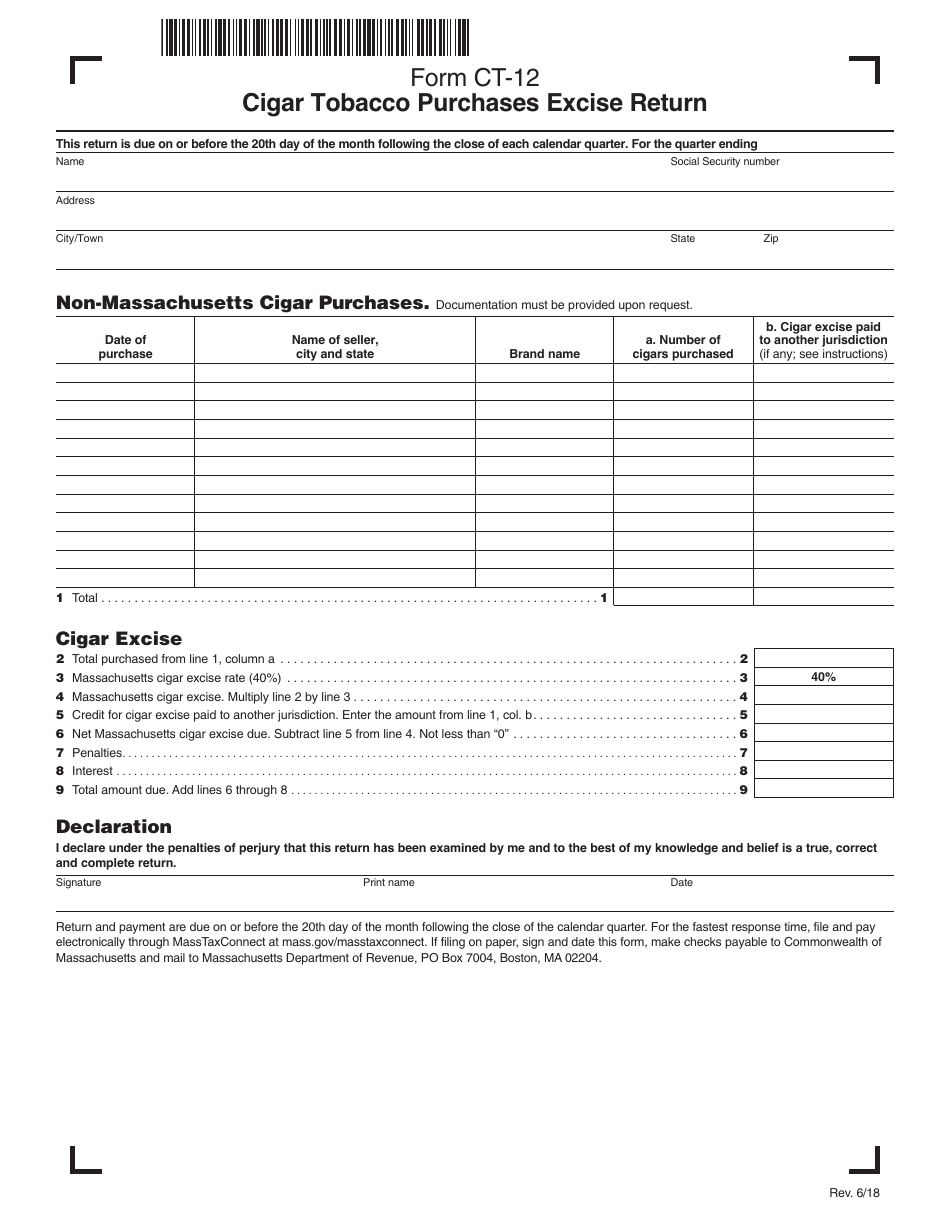

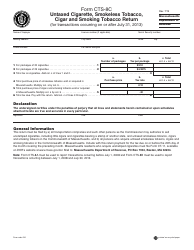

Form CT-12 Cigar Tobacco Purchases Excise Return - Massachusetts

What Is Form CT-12?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-12?

A: Form CT-12 is the Cigar Tobacco Purchases Excise Return.

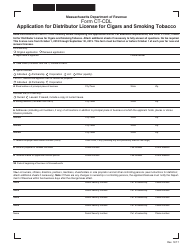

Q: Who needs to file Form CT-12?

A: Businesses that purchase cigar tobacco in Massachusetts need to file Form CT-12.

Q: What is the purpose of Form CT-12?

A: Form CT-12 is used to report and pay the excise tax on purchases of cigar tobacco.

Q: What information is required on Form CT-12?

A: Form CT-12 requires the taxpayer to provide information about their purchases of cigar tobacco, including the quantity and cost.

Q: When is Form CT-12 due?

A: Form CT-12 is due on a quarterly basis, with the due dates typically falling on the last day of the month following the end of the quarter.

Q: Are there any penalties for not filing Form CT-12?

A: Yes, failure to file or pay the excise tax on time may result in penalties and interest charges.

Q: Is Form CT-12 only for businesses based in Massachusetts?

A: No, businesses located outside of Massachusetts that make purchases of cigar tobacco in the state are also required to file Form CT-12.

Q: Is there an alternative to filing Form CT-12?

A: No, Form CT-12 is the official form to be used for reporting and paying the excise tax on purchases of cigar tobacco in Massachusetts.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-12 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.