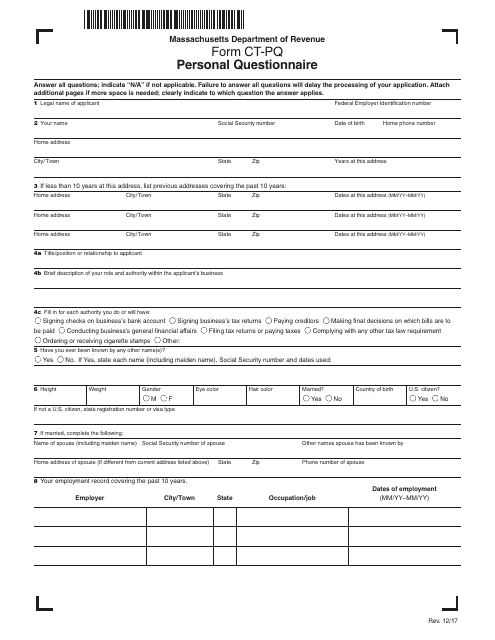

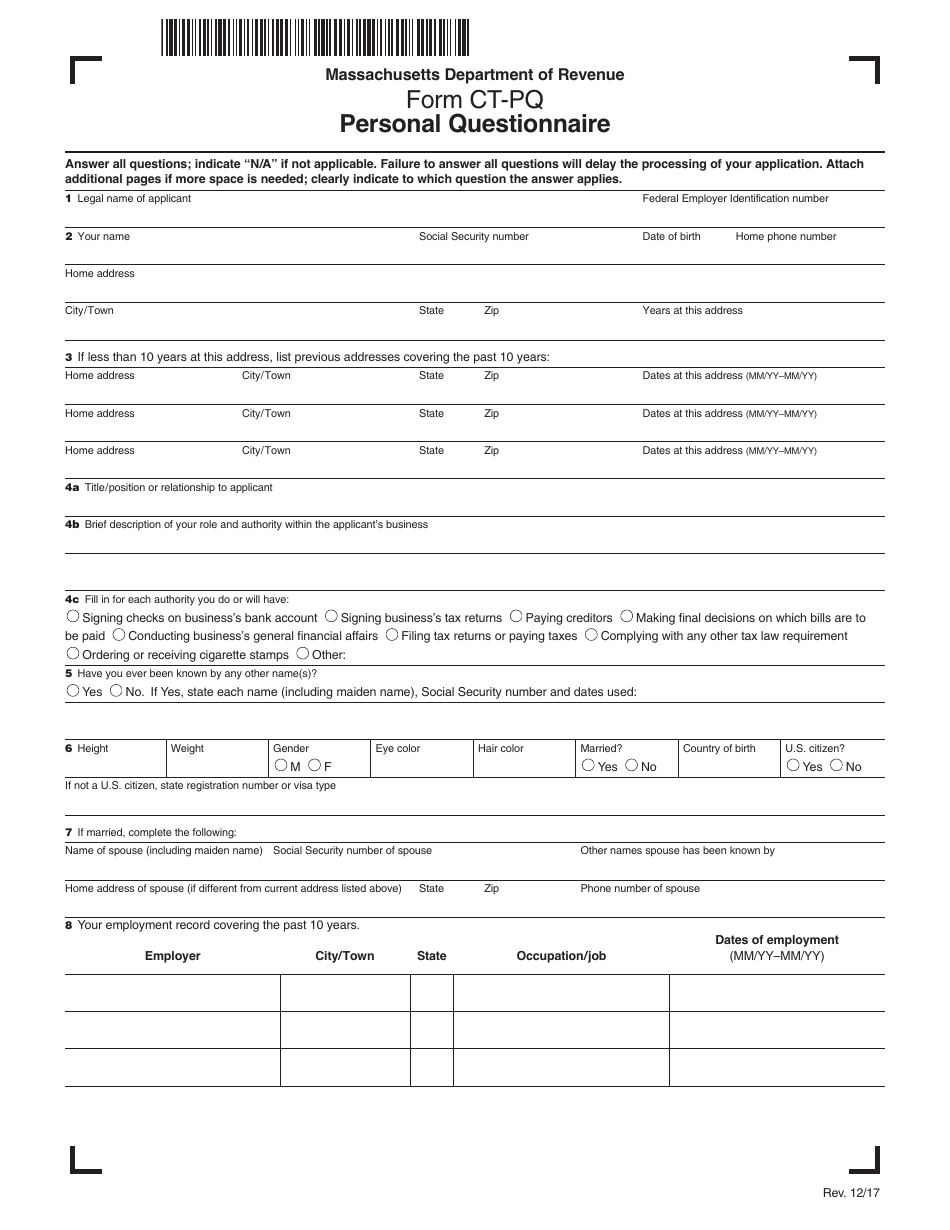

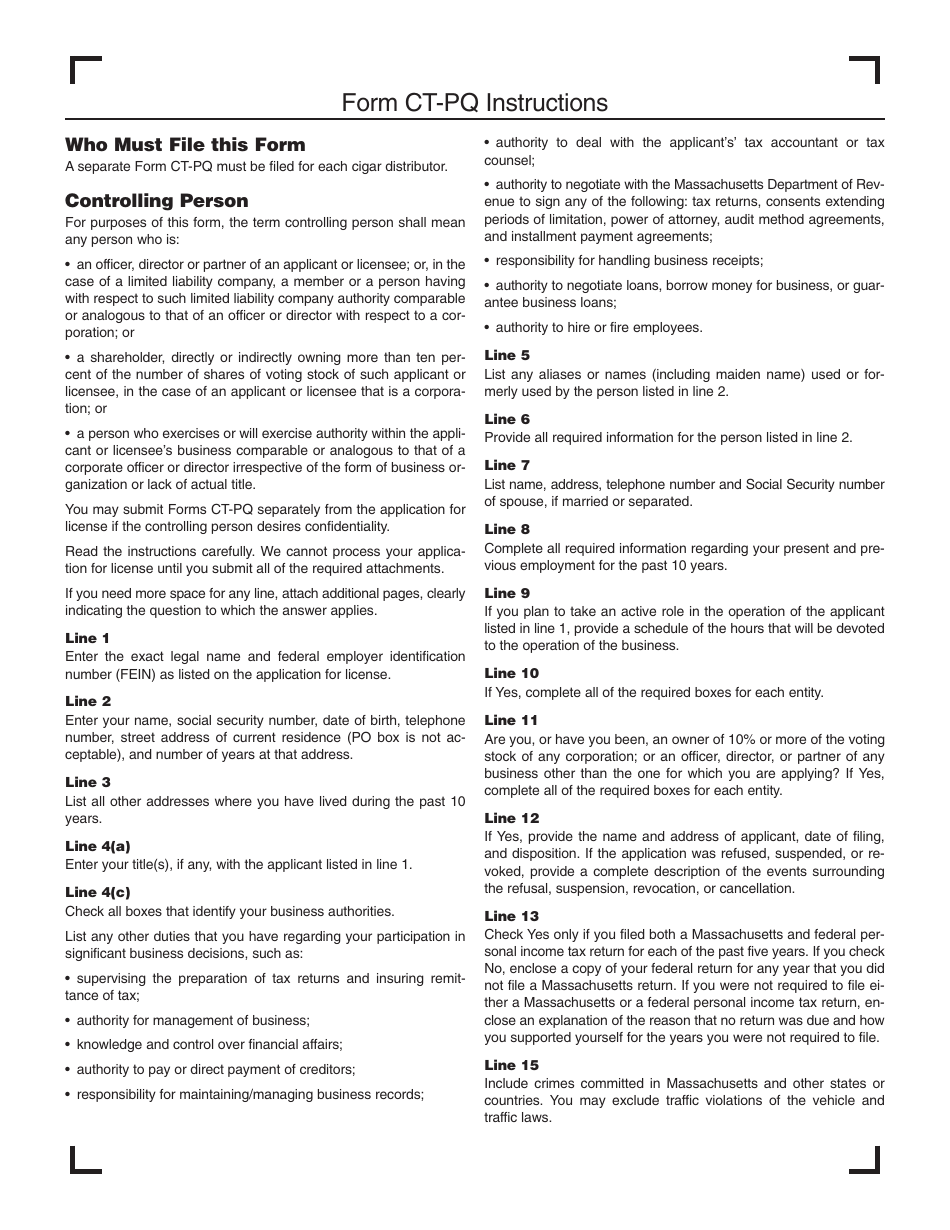

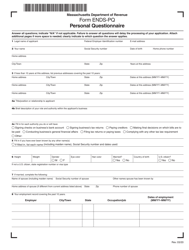

Form CT-PQ Personal Questionnaire - Massachusetts

What Is Form CT-PQ?

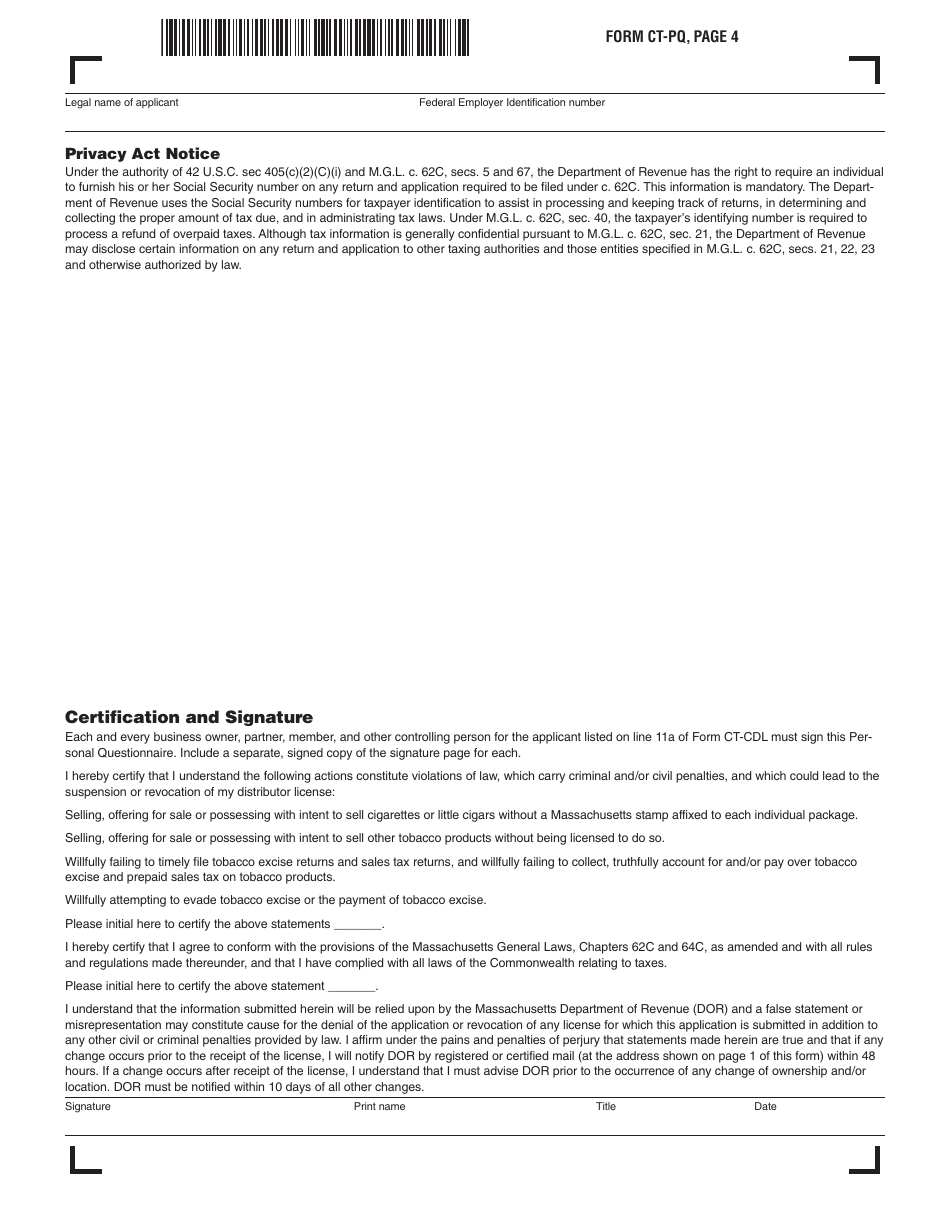

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-PQ?

A: Form CT-PQ is the Personal Questionnaire required by the Massachusetts Department of Revenue for individuals who are starting or expanding a business in Massachusetts.

Q: Who needs to file Form CT-PQ?

A: Individuals who are starting or expanding a business in Massachusetts need to file Form CT-PQ.

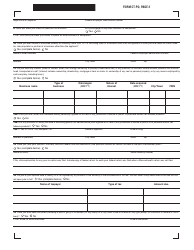

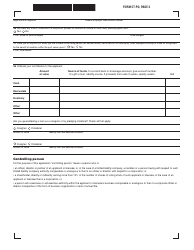

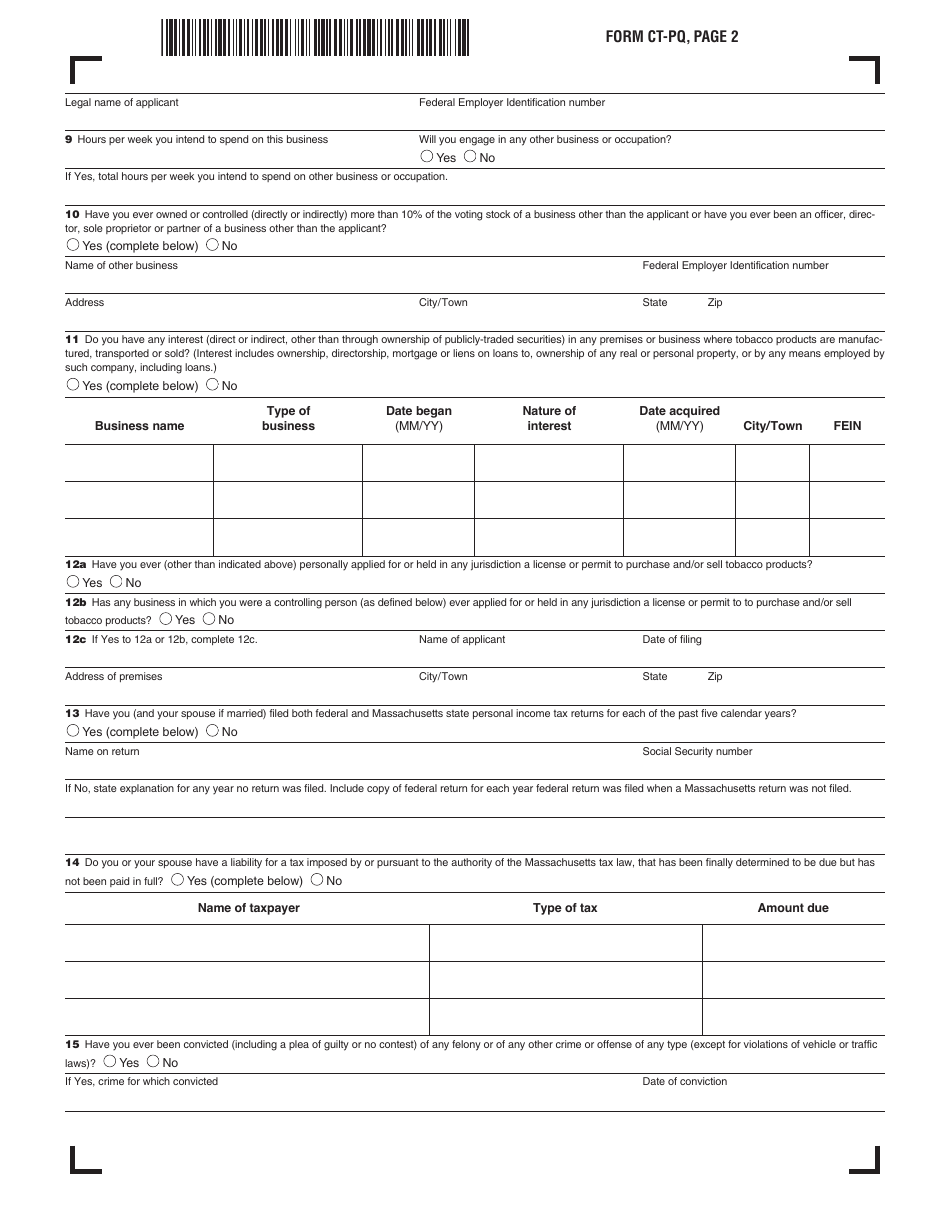

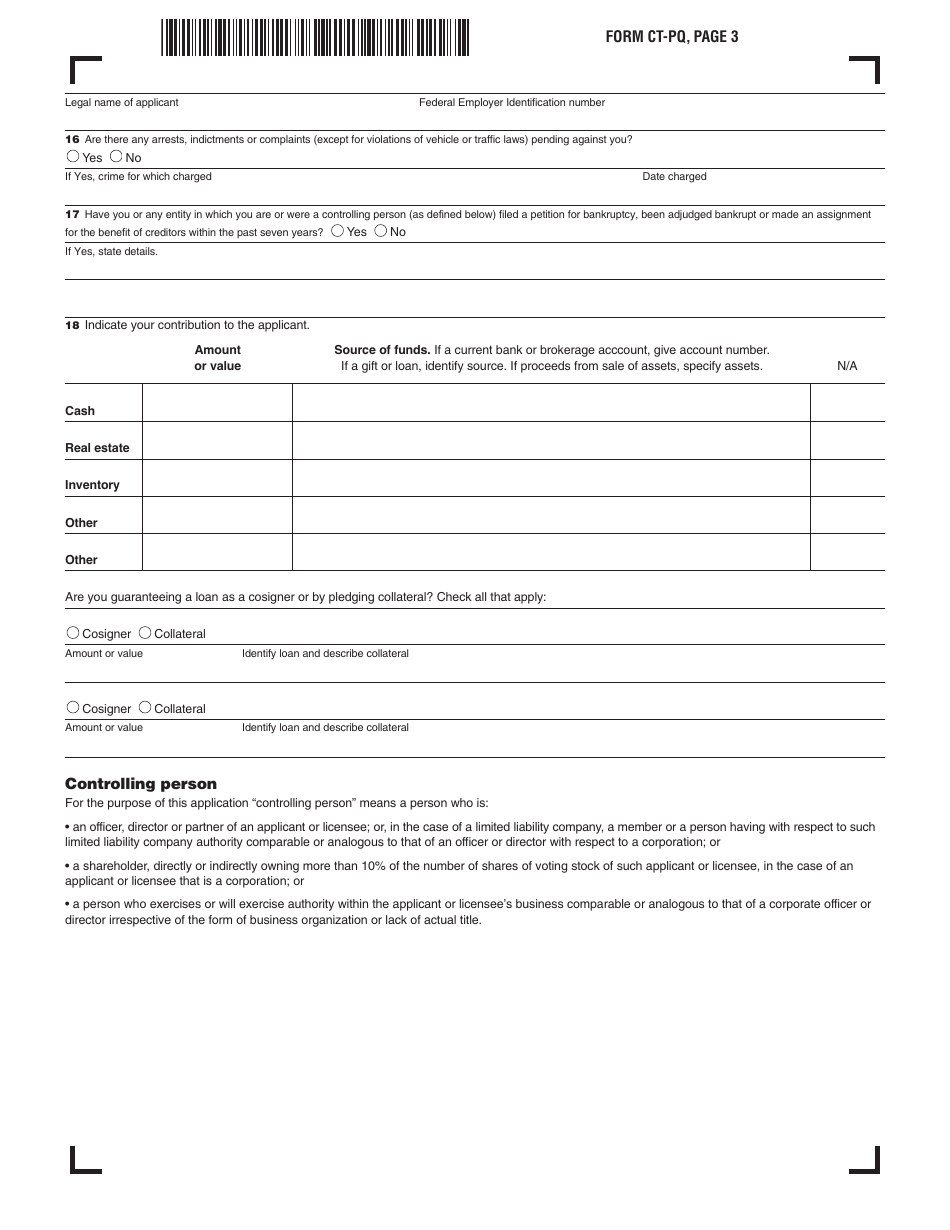

Q: What information is required on Form CT-PQ?

A: Form CT-PQ requires information about the individual's personal background, business activities, financial information, and tax liability.

Q: When is Form CT-PQ due?

A: Form CT-PQ is due before starting or expanding a business in Massachusetts.

Q: Are there any filing fees for Form CT-PQ?

A: There are no filing fees for Form CT-PQ.

Q: What should I do if I need help with Form CT-PQ?

A: If you need assistance with Form CT-PQ, you can contact the Massachusetts Department of Revenue's office for guidance.

Q: Is Form CT-PQ only required for Massachusetts residents?

A: No, Form CT-PQ is required for individuals who are starting or expanding a business in Massachusetts, regardless of their residency.

Q: What happens if I don't file Form CT-PQ?

A: Failure to file Form CT-PQ may result in penalties or delays in starting or expanding a business in Massachusetts.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-PQ by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.