This version of the form is not currently in use and is provided for reference only. Download this version of

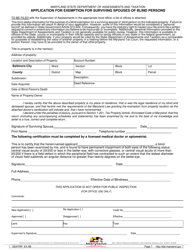

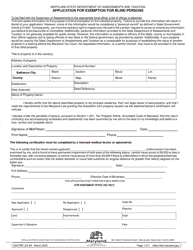

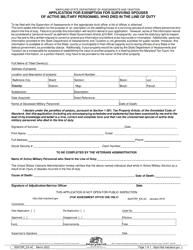

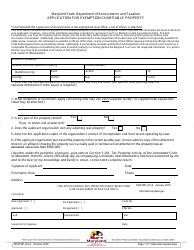

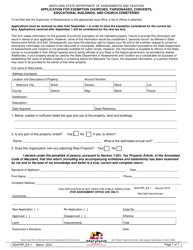

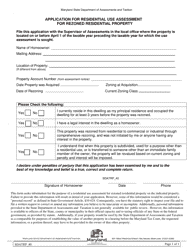

Form SDATRP_EX-6A

for the current year.

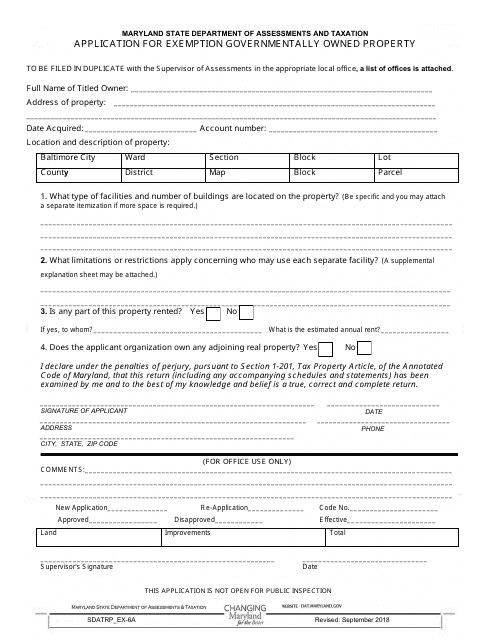

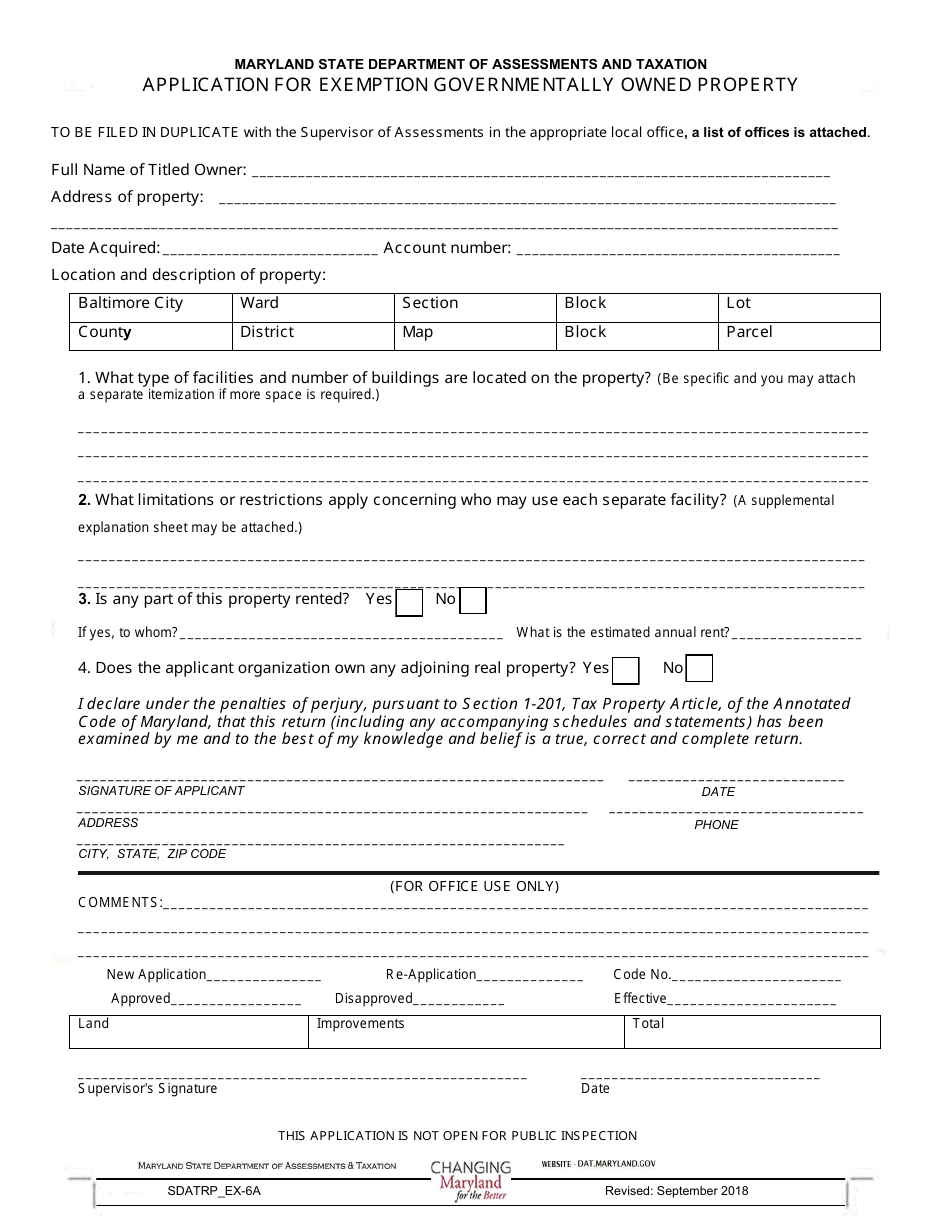

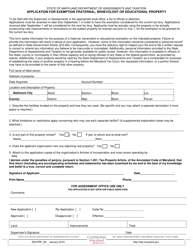

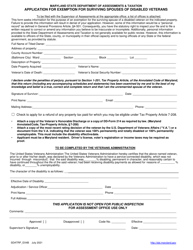

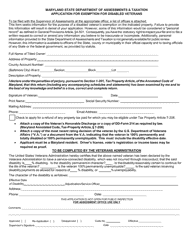

Form SDATRP_EX-6A Application for Exemption Governmentally Owned Property - Maryland

What Is Form SDATRP_EX-6A?

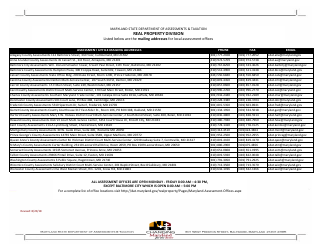

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SDATRP_EX-6A?

A: SDATRP_EX-6A is an application form for exemption of governmentally owned property in Maryland.

Q: Who can use SDATRP_EX-6A?

A: Government entities in Maryland can use SDATRP_EX-6A to apply for property tax exemption.

Q: What is the purpose of SDATRP_EX-6A?

A: The purpose of SDATRP_EX-6A is to request an exemption for government-owned properties from property taxes in Maryland.

Q: What documents are required to be submitted with SDATRP_EX-6A?

A: The application should be accompanied by supporting documents, such as proof of ownership and a detailed description of the property.

Q: Are there any fees associated with SDATRP_EX-6A?

A: No, there are no fees associated with submitting SDATRP_EX-6A.

Q: What is the deadline for submitting SDATRP_EX-6A?

A: The application should be submitted to SDAT within 60 days of the acquisition or January 1.

Q: How long does it take to process SDATRP_EX-6A?

A: The processing time for SDATRP_EX-6A may vary, but it is typically reviewed within a few weeks.

Q: Can an exemption be granted for governmentally owned property in Maryland?

A: Yes, if the property meets the eligibility criteria, an exemption can be granted for government-owned property in Maryland.

Q: Is SDATRP_EX-6A applicable for properties owned by non-government entities?

A: No, SDATRP_EX-6A is specifically for governmentally owned properties and cannot be used by non-government entities.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDATRP_EX-6A by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.