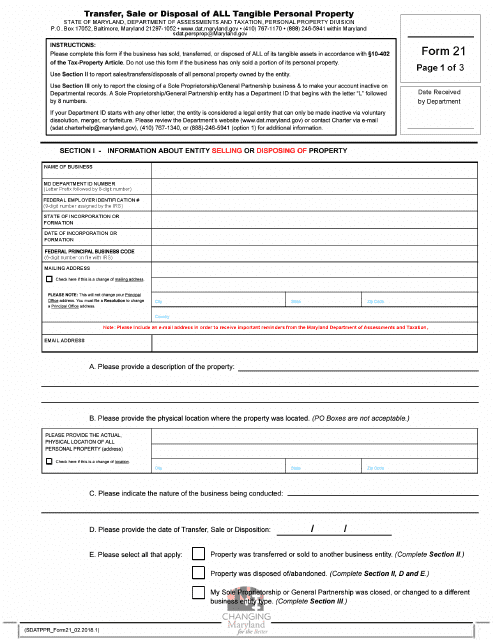

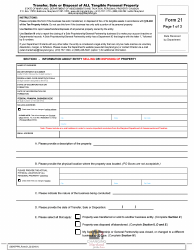

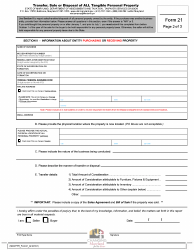

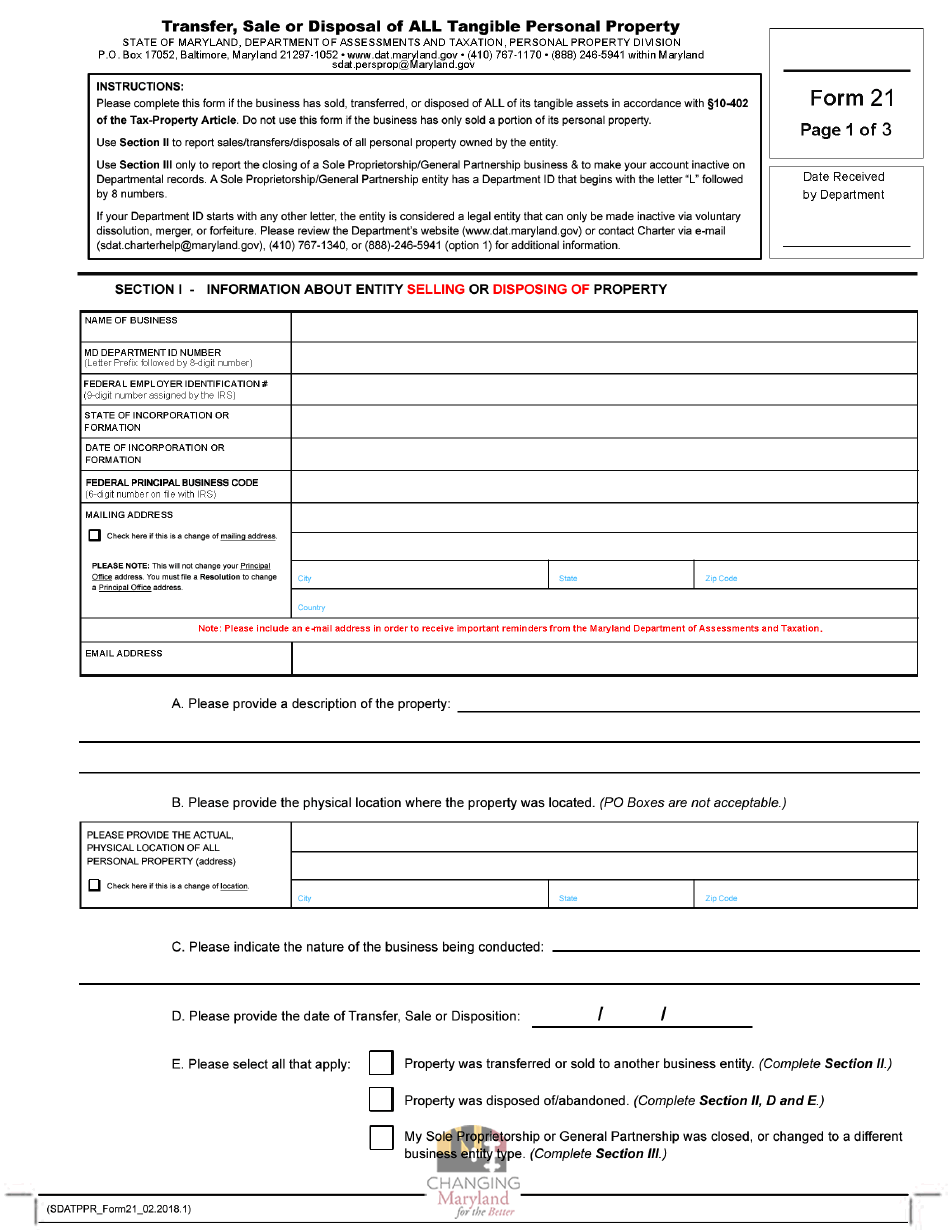

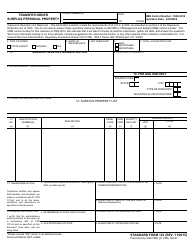

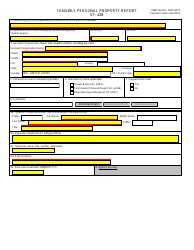

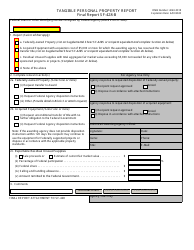

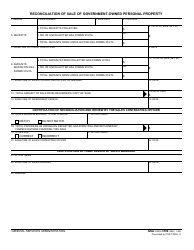

Form 21 Transfer, Sale or Disposal of All Tangible Personal Property - Maryland

What Is Form 21?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 21?

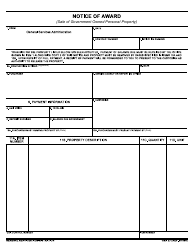

A: Form 21 is a document used in Maryland for reporting the transfer, sale, or disposal of all tangible personal property.

Q: When is Form 21 used?

A: Form 21 is used when you are transferring, selling, or disposing of all tangible personal property in Maryland.

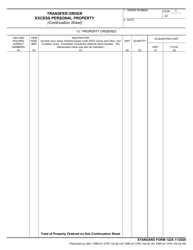

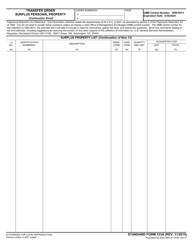

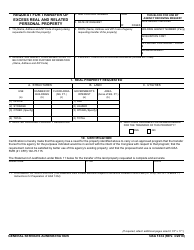

Q: What qualifies as tangible personal property?

A: Tangible personal property includes physical items such as furniture, equipment, vehicles, and other assets that are not real estate.

Q: Who needs to file Form 21?

A: Anyone who is transferring, selling, or disposing of all tangible personal property in Maryland needs to file Form 21.

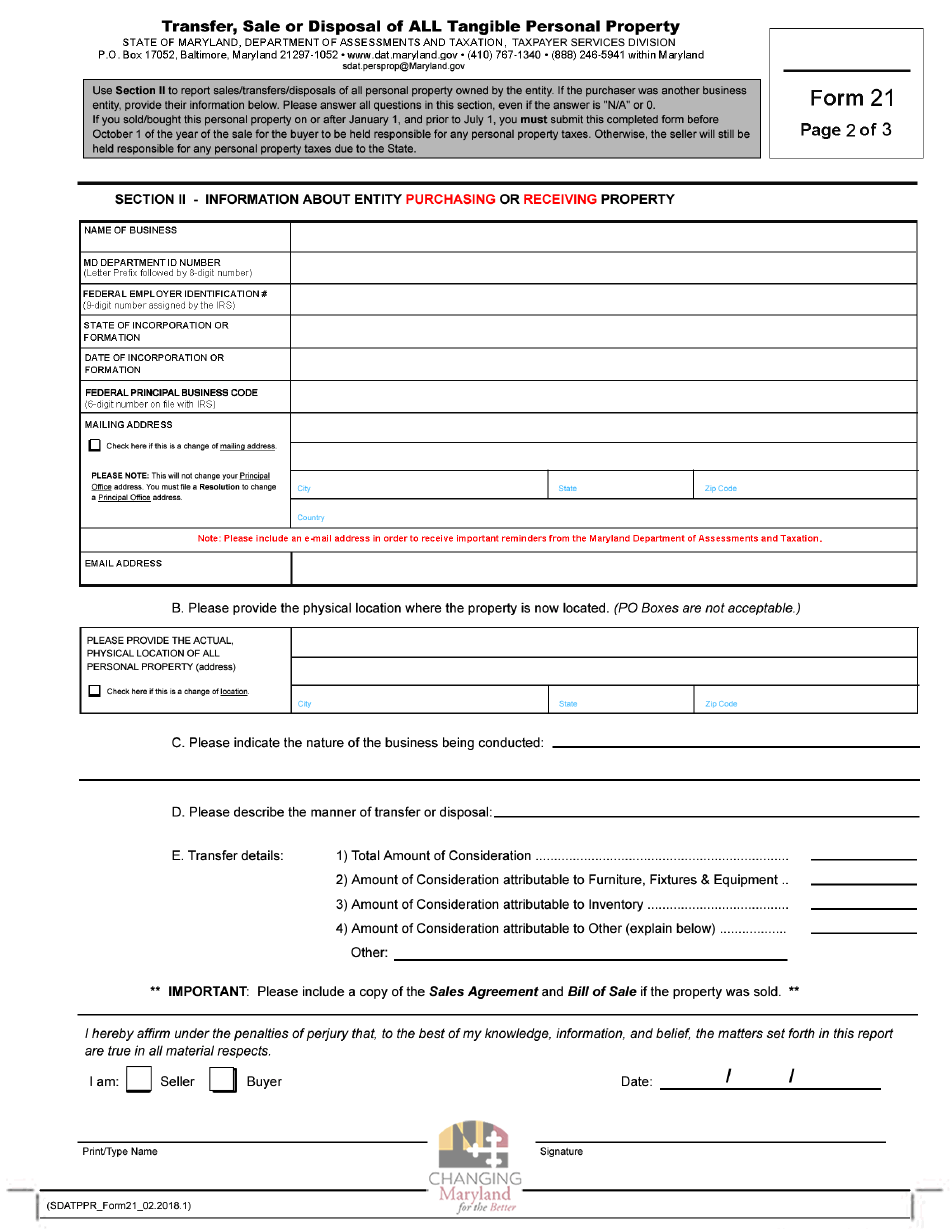

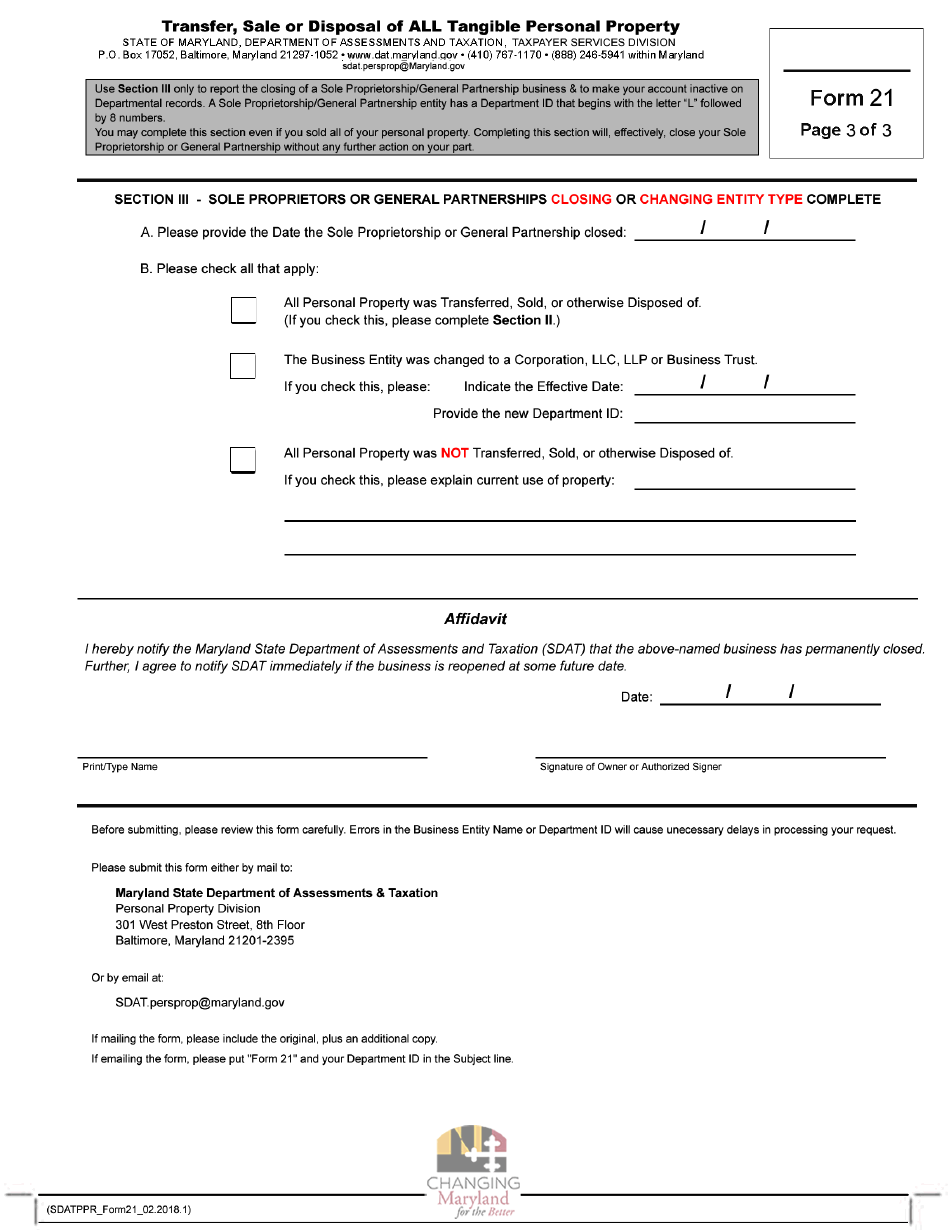

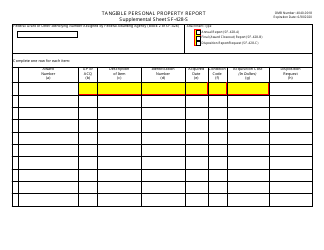

Q: What information is required on Form 21?

A: Form 21 requires information about the transferor, transferee, and details about the property being transferred, sold, or disposed of.

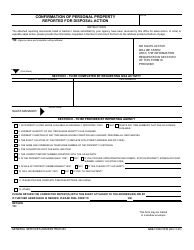

Q: Are there any fees associated with filing Form 21?

A: There are no fees required for filing Form 21 in Maryland.

Q: When should Form 21 be filed?

A: Form 21 should be filed within 60 days of the transfer, sale, or disposal of the tangible personal property.

Q: What are the consequences of not filing Form 21?

A: Failure to file Form 21 can result in penalties and interest being assessed by the Maryland Comptroller.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 21 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.