This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

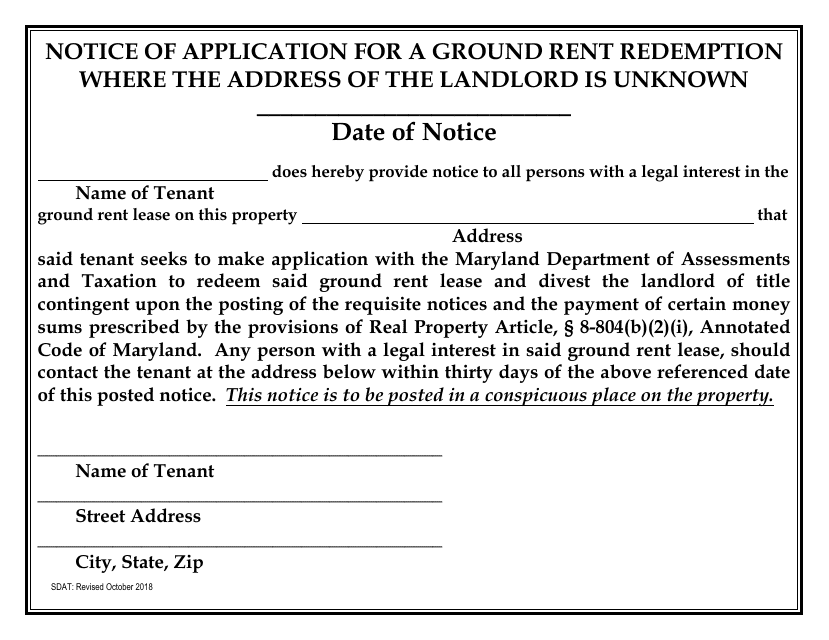

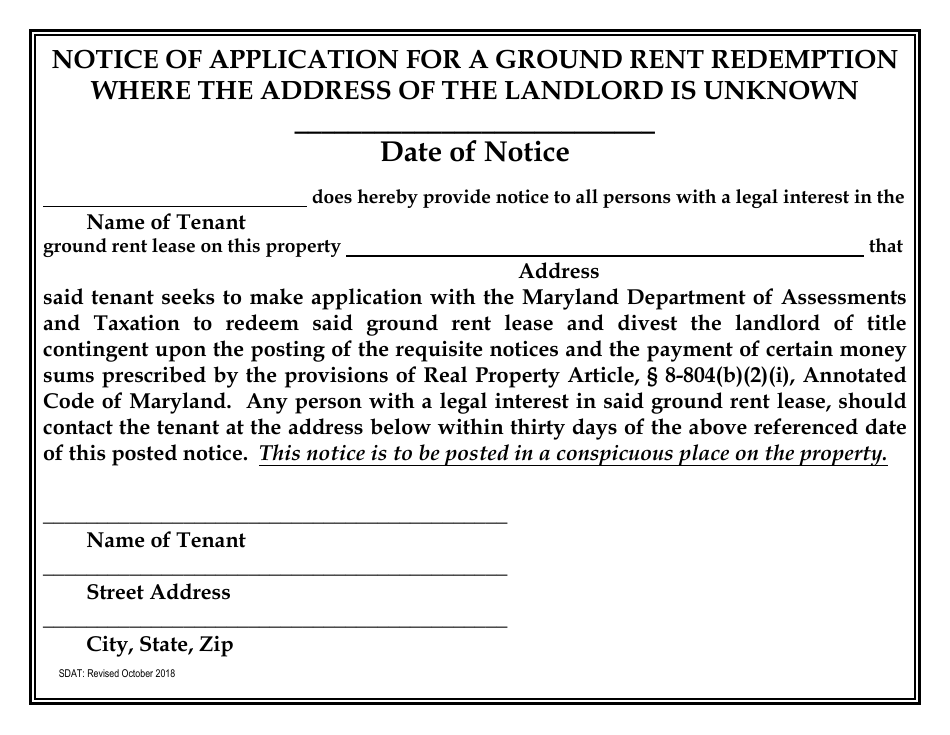

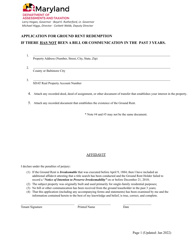

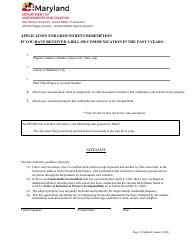

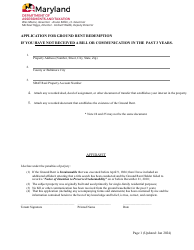

Notice of Application for a Ground Rent Redemption Where the Address of the Landlord Is Unknown - Maryland

Notice of Application for a Ground Rent Redemption Where the Address of the Landlord Is Unknown is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a Notice of Application for a Ground Rent Redemption?

A: It is a legal document related to redeeming ground rent in Maryland.

Q: What is ground rent?

A: Ground rent is a fee paid by the owner of a property to the ground rent holder in Maryland.

Q: What is a Ground Rent Redemption?

A: Ground Rent Redemption is the process of purchasing the ground rent from the landlord.

Q: Why would someone want to redeem ground rent?

A: Redeeming ground rent allows the property owner to have complete ownership of the land and eliminates the need to make regular ground rent payments.

Q: What is the Notice of Application used for?

A: The Notice of Application is used to inform the landlord about the intent to redeem the ground rent when the landlord's address is unknown.

Q: What happens if the landlord's address is unknown?

A: If the landlord's address is unknown, the Notice of Application is published in a newspaper to satisfy the notice requirement.

Q: Is the Notice of Application a legal requirement?

A: Yes, providing notice to the landlord is a legal requirement when redeeming ground rent in Maryland.

Q: What is the process to redeem ground rent?

A: The process involves filing a Notice of Application, publishing the notice in a newspaper, and completing other necessary legal steps.

Q: Can anyone redeem ground rent?

A: Yes, any property owner in Maryland has the right to redeem ground rent as long as they follow the legal process.

Q: How long does the process take?

A: The length of the process can vary, but it typically takes a few months to complete the ground rent redemption process.

Form Details:

- Released on October 1, 2018;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.