This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

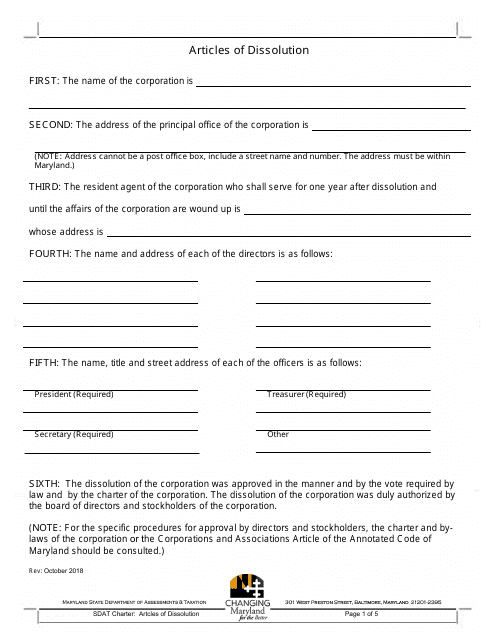

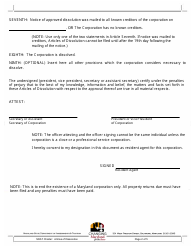

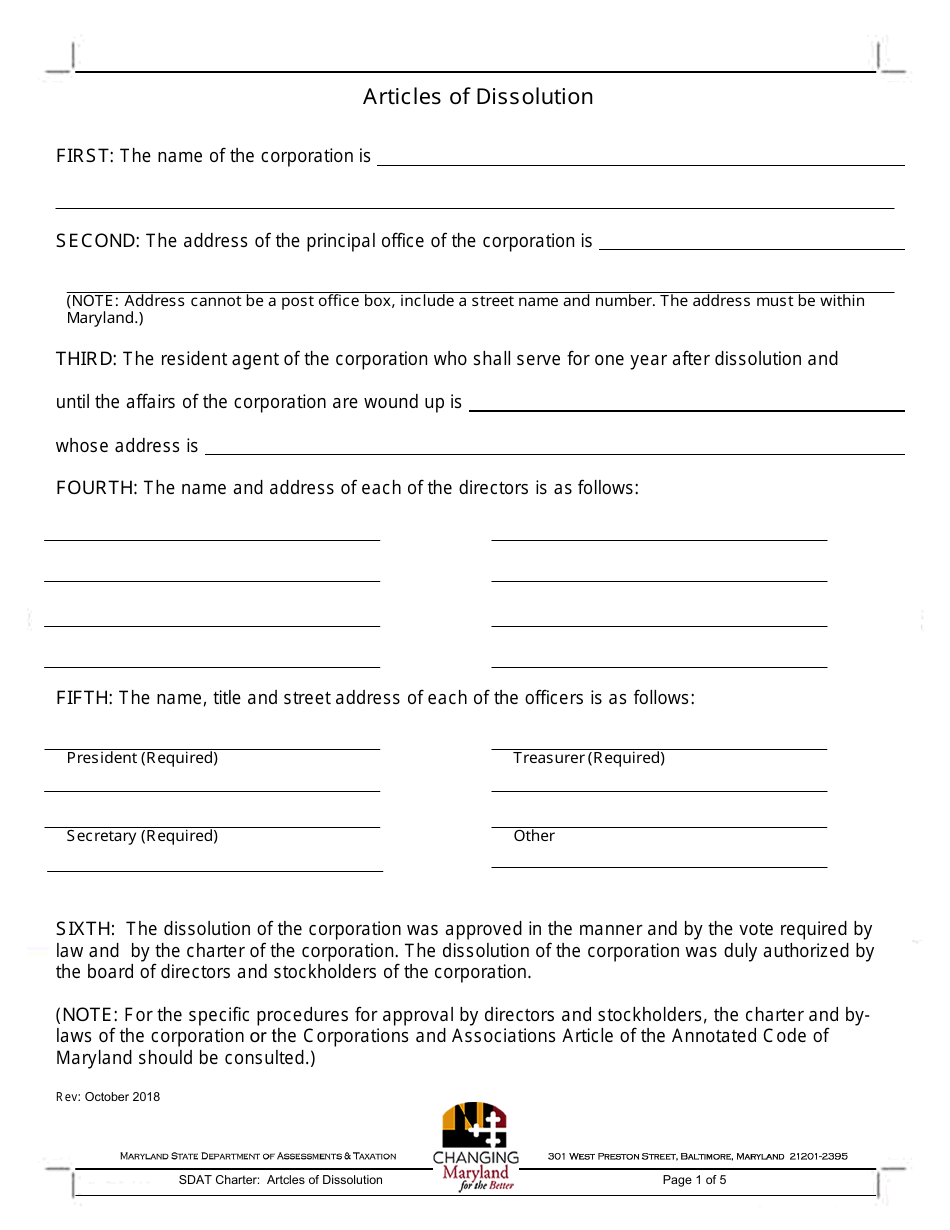

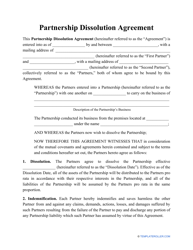

Articles of Dissolution - Maryland

Articles of Dissolution is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What are the Articles of Dissolution?

A: The Articles of Dissolution are legal documents that formally terminate a corporation in Maryland.

Q: When can I file the Articles of Dissolution?

A: You can file the Articles of Dissolution once the corporation has ceased all business activities and no longer has any assets or liabilities.

Q: What information is required in the Articles of Dissolution?

A: The Articles of Dissolution require the name and address of the corporation, the date of dissolution, and a statement confirming that the corporation has been properly dissolved.

Q: Is there a fee to file the Articles of Dissolution?

A: Yes, there is a filing fee to submit the Articles of Dissolution.

Q: Are there any additional requirements after filing the Articles of Dissolution?

A: Yes, you should also notify the Internal Revenue Service (IRS) and the Maryland Comptroller of the corporation's dissolution.

Q: Can I revive a dissolved corporation in Maryland?

A: Yes, it is possible to revive a dissolved corporation in Maryland by filing a Revival Application with the Maryland Department of Assessments and Taxation.

Form Details:

- Released on October 1, 2018;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.