This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

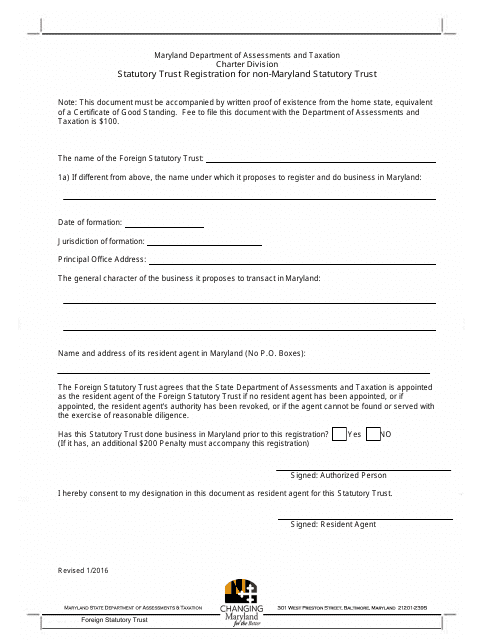

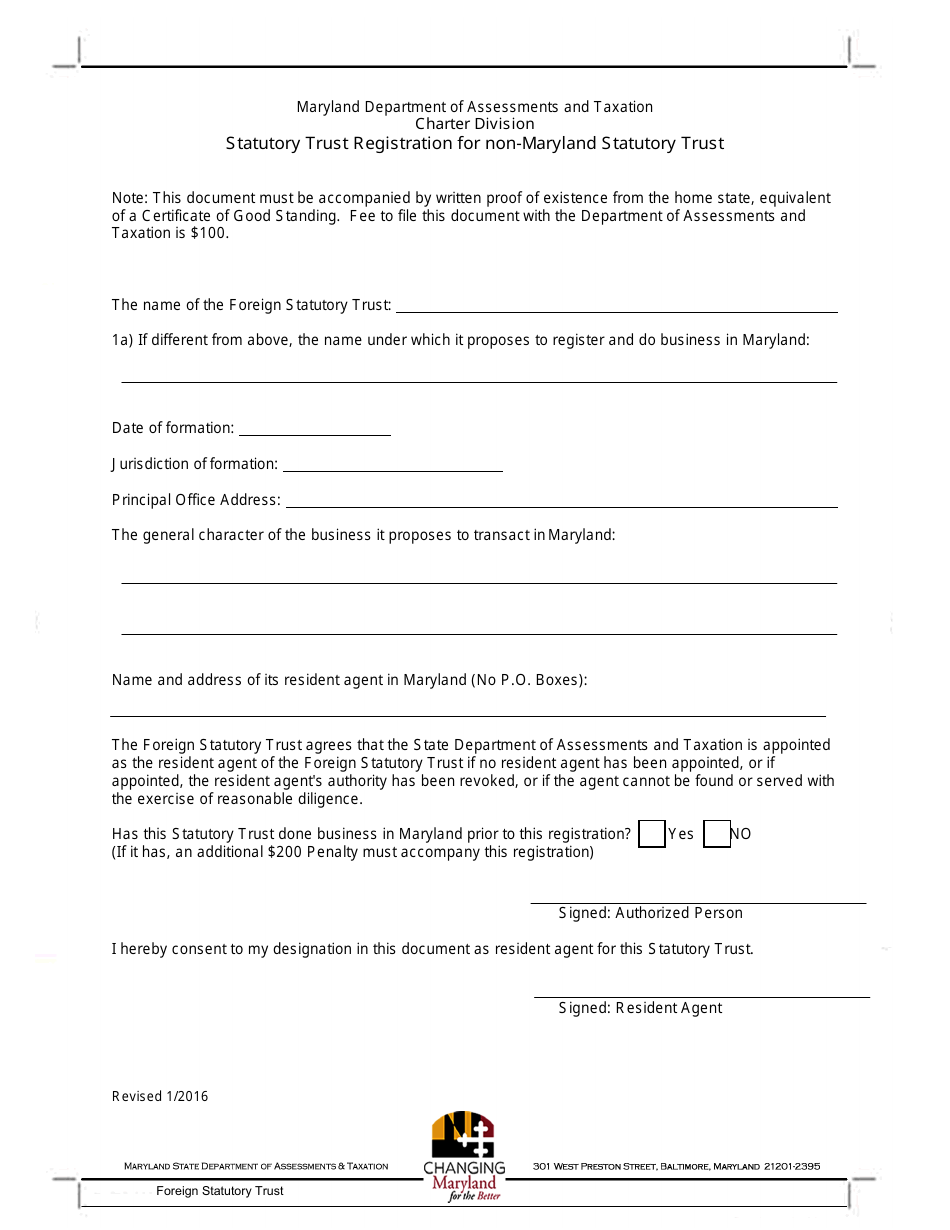

Statutory Trust Registration for Non-maryland Statutory Trust - Maryland

Statutory Trust Registration for Non-maryland Statutory Trust is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a statutory trust?

A: A statutory trust is a legal entity that is created through a specific statute or legislation.

Q: What is a non-Maryland statutory trust?

A: A non-Maryland statutory trust is a statutory trust that is established under the laws of a state other than Maryland.

Q: Do non-Maryland statutory trusts need to register in Maryland?

A: Yes, non-Maryland statutory trusts need to register in Maryland if they conduct business or hold assets in the state.

Q: How can a non-Maryland statutory trust register in Maryland?

A: To register, the trust needs to file an application with the Maryland State Department of Assessments and Taxation and pay the required fees.

Q: What information is required for the registration of a non-Maryland statutory trust?

A: The registration application typically requires information about the trust's name, principal place of business, registered agent, and a copy of the trust agreement or governing instrument.

Q: Is there a deadline for registering a non-Maryland statutory trust in Maryland?

A: There is no specific deadline, but the trust should register before conducting business or holding assets in Maryland.

Form Details:

- Released on January 1, 2016;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.