This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

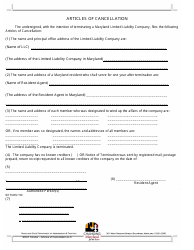

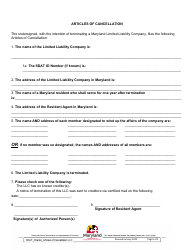

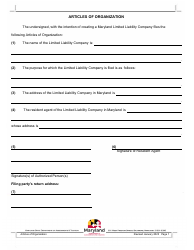

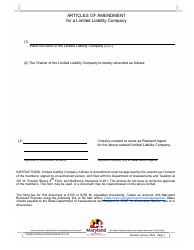

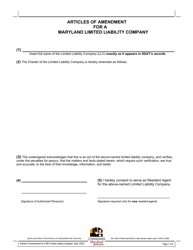

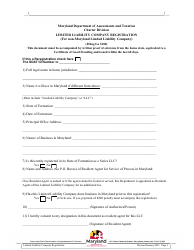

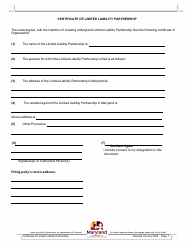

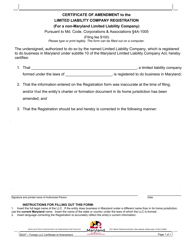

Articles of Cancellation for a Maryland Limited Liability Company - Maryland

Articles of Cancellation for a Maryland Limited Liability Company is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a Maryland Limited Liability Company?

A: A Maryland Limited Liability Company (LLC) is a legal business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability protection of a corporation.

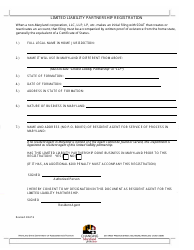

Q: What is an Article of Cancellation?

A: An Article of Cancellation is a legal document that is filed with the state to formally dissolve a Maryland Limited Liability Company.

Q: Why would a Maryland LLC need to file an Article of Cancellation?

A: A Maryland LLC would need to file an Article of Cancellation if it is no longer operating or if the owners have decided to dissolve the company.

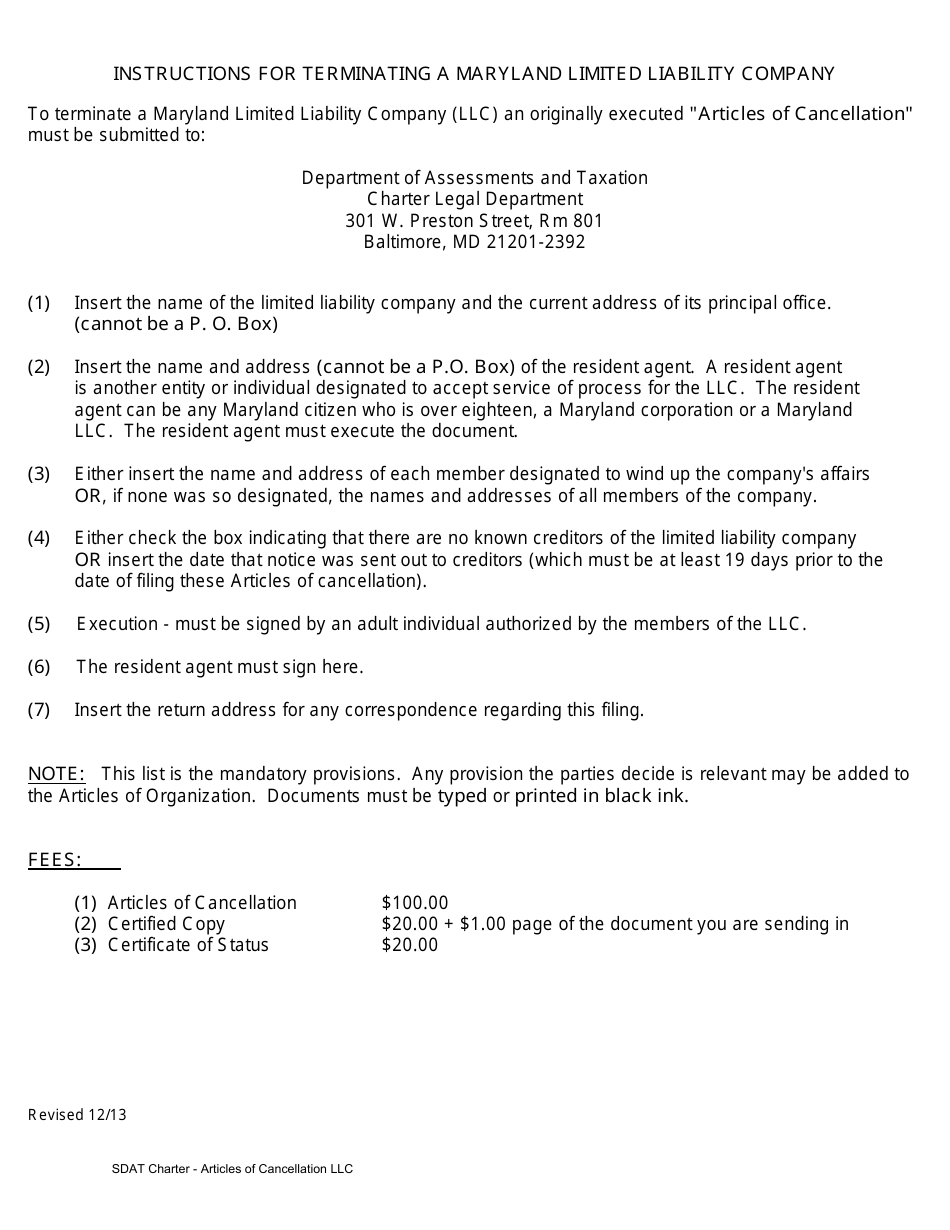

Q: How do I file an Article of Cancellation for a Maryland LLC?

A: To file an Article of Cancellation for a Maryland LLC, you will need to complete the appropriate form provided by the Maryland Department of Assessments and Taxation and submit it along with the required filing fee.

Q: What information is required in an Article of Cancellation?

A: An Article of Cancellation typically requires information such as the name of the LLC, its identification number, the reason for cancellation, and the signature of a member or authorized representative.

Form Details:

- Released on December 1, 2013;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.