This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

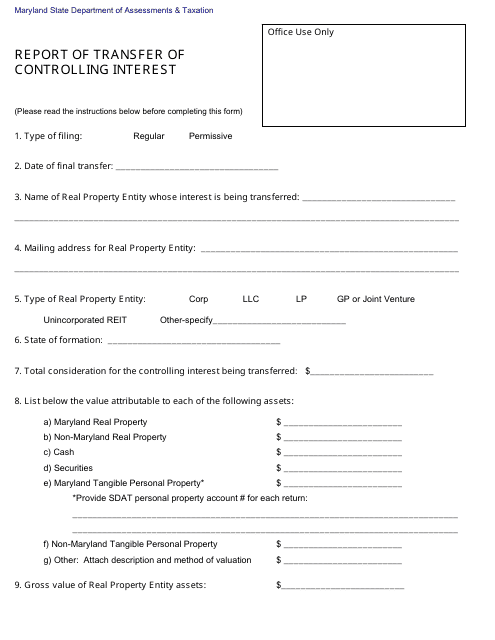

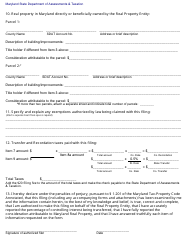

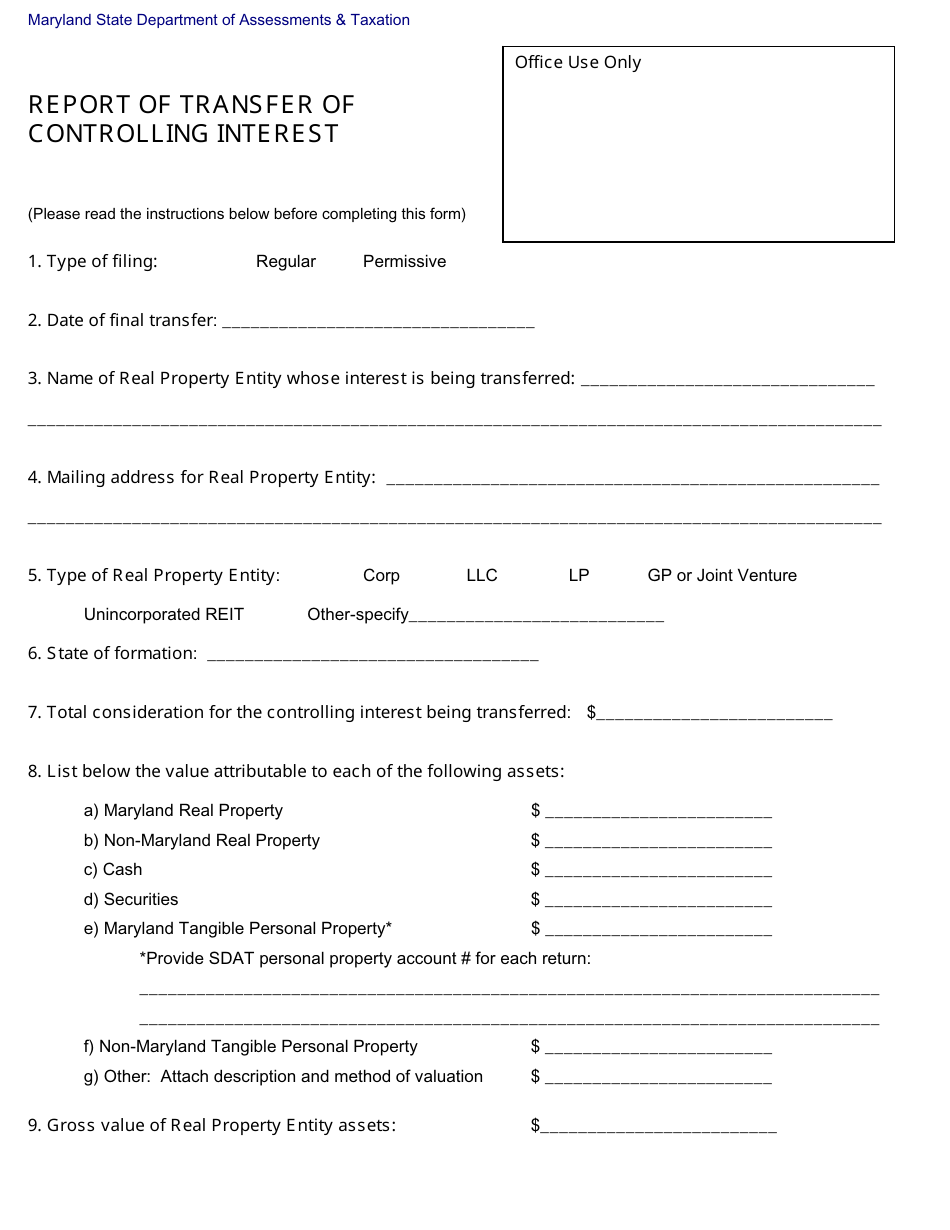

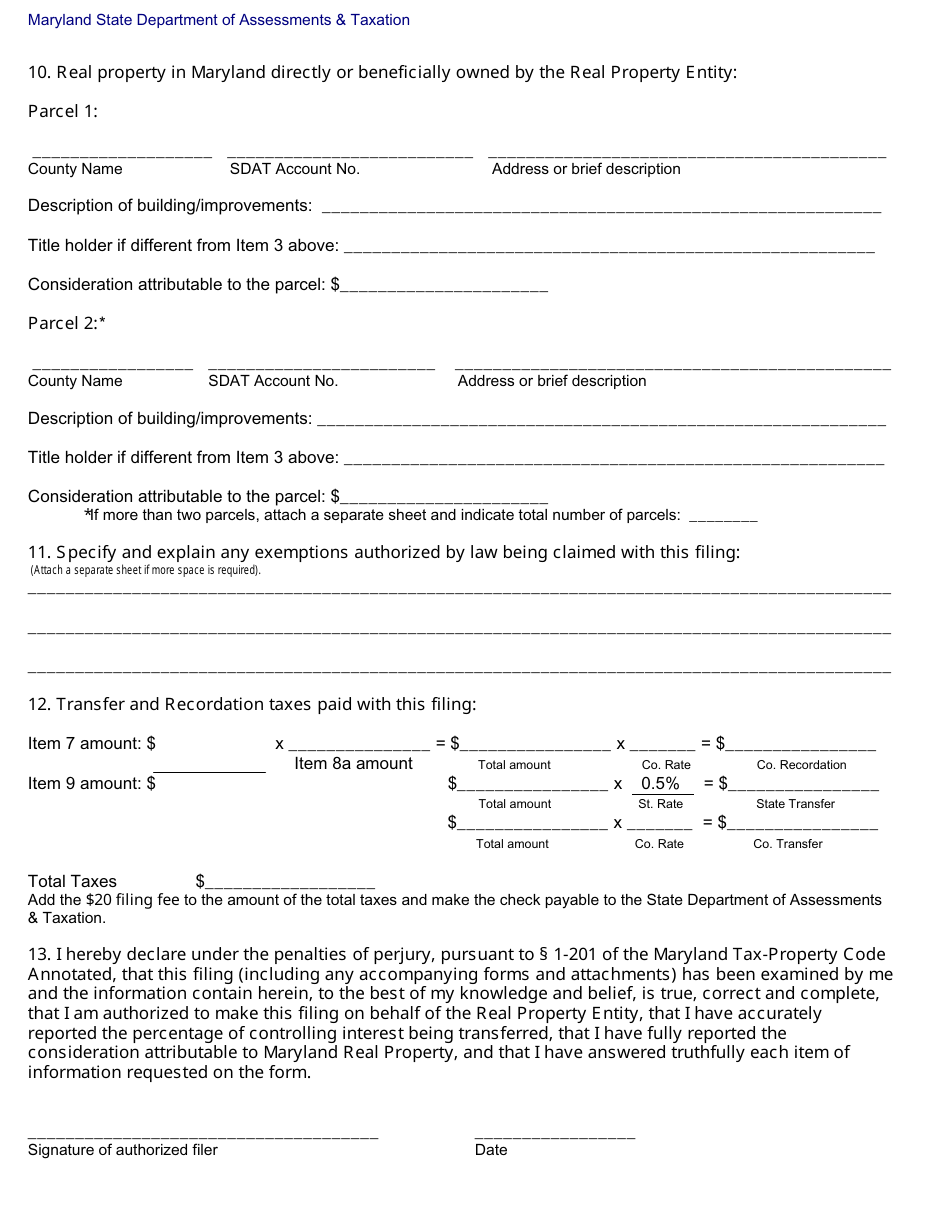

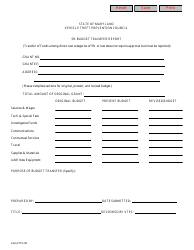

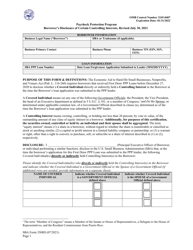

Report of Transfer of Controlling Interest - Maryland

Report of Transfer of Controlling Interest is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is the purpose of the Report of Transfer of Controlling Interest?

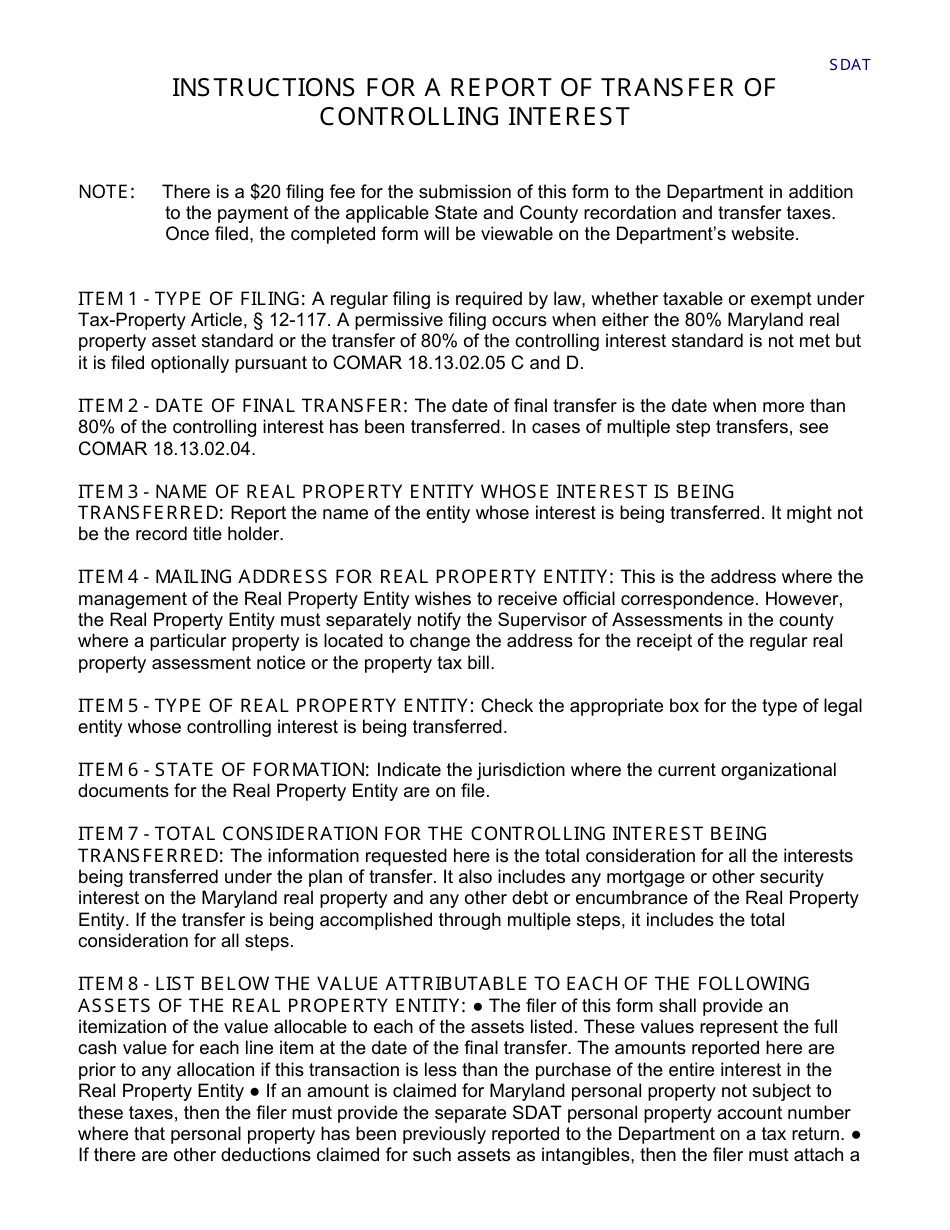

A: The purpose is to notify the State of Maryland about a change in control of a business entity.

Q: Who is required to file the Report of Transfer of Controlling Interest?

A: Any business entity that undergoes a change in control is required to file the report with the State of Maryland.

Q: What information is required to be included in the report?

A: The report must include the name and address of the business entity, as well as detailed information about the transfer of controlling interest.

Q: Is there a filing fee for the Report of Transfer of Controlling Interest?

A: Yes, there is a filing fee that must be paid when submitting the report.

Q: What are the consequences of not filing the Report of Transfer of Controlling Interest?

A: Failure to file the report can result in penalties and may affect the legal standing of the business entity.

Form Details:

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.