This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

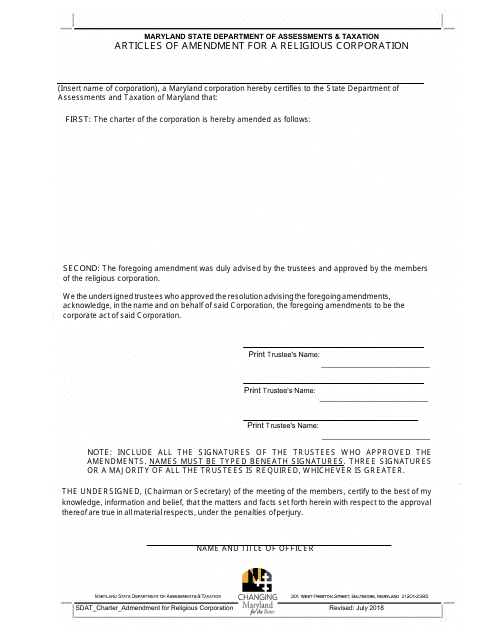

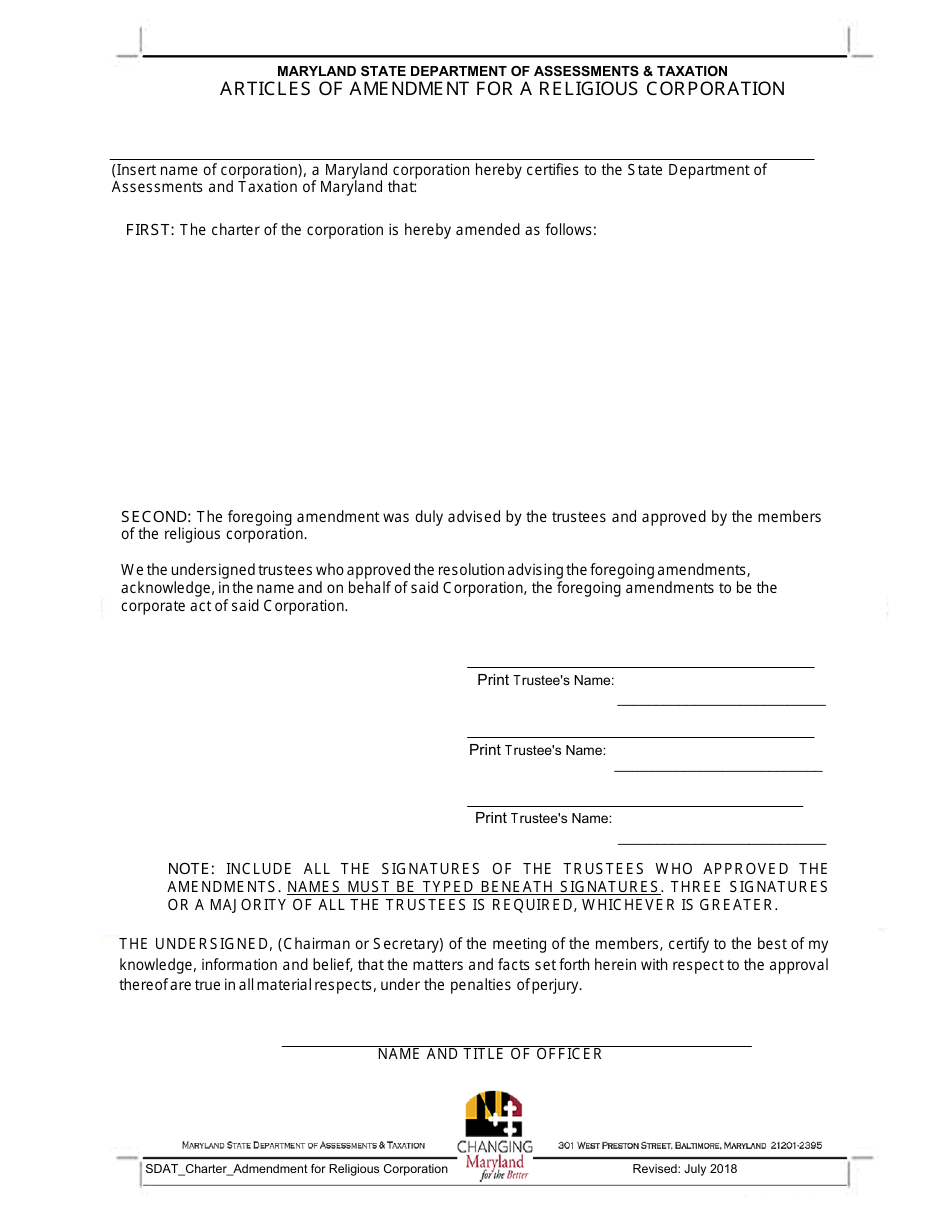

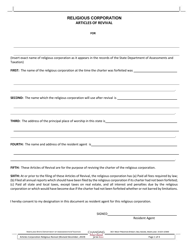

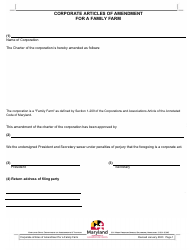

Articles of Amendment for a Religious Corporation - Maryland

Articles of Amendment for a Religious Corporation is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is an Articles of Amendment?

A: An Articles of Amendment is a legal document that makes changes or updates to the original articles of incorporation of a corporation.

Q: What is a religious corporation?

A: A religious corporation is a type of non-profit corporation that is organized for religious purposes, such as the promotion of a particular religion or religious activities.

Q: Why would a religious corporation need to file Articles of Amendment?

A: A religious corporation may need to file Articles of Amendment if they need to make changes to their original articles of incorporation, such as updating their purpose, changing their name, or making other administrative changes.

Q: What changes can be made through Articles of Amendment?

A: Through Articles of Amendment, a religious corporation can make changes to their purpose, name, registered agent, registered office, or other provisions of their articles of incorporation.

Q: How do you file Articles of Amendment in Maryland?

A: To file Articles of Amendment in Maryland, you will need to complete the appropriate form provided by the Maryland Department of Assessments and Taxation, pay the required filing fee, and submit the form by mail or in person.

Q: Are there any specific requirements for a religious corporation to file Articles of Amendment in Maryland?

A: Yes, there may be specific requirements for a religious corporation to file Articles of Amendment in Maryland. It is recommended to consult with an attorney or review the relevant laws and regulations to ensure compliance.

Q: Can a religious corporation revert or modify changes made through Articles of Amendment?

A: Yes, a religious corporation can file additional Articles of Amendment to revert or modify the changes made through previous Articles of Amendment, as long as it is within the legal requirements and procedures.

Q: How long does it take to process Articles of Amendment in Maryland?

A: The processing time for Articles of Amendment in Maryland may vary. It is recommended to check with the Maryland Department of Assessments and Taxation for the current processing times.

Form Details:

- Released on July 1, 2018;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.