This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

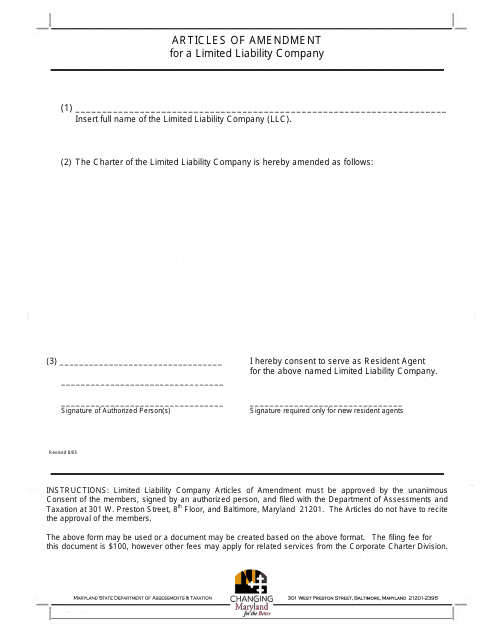

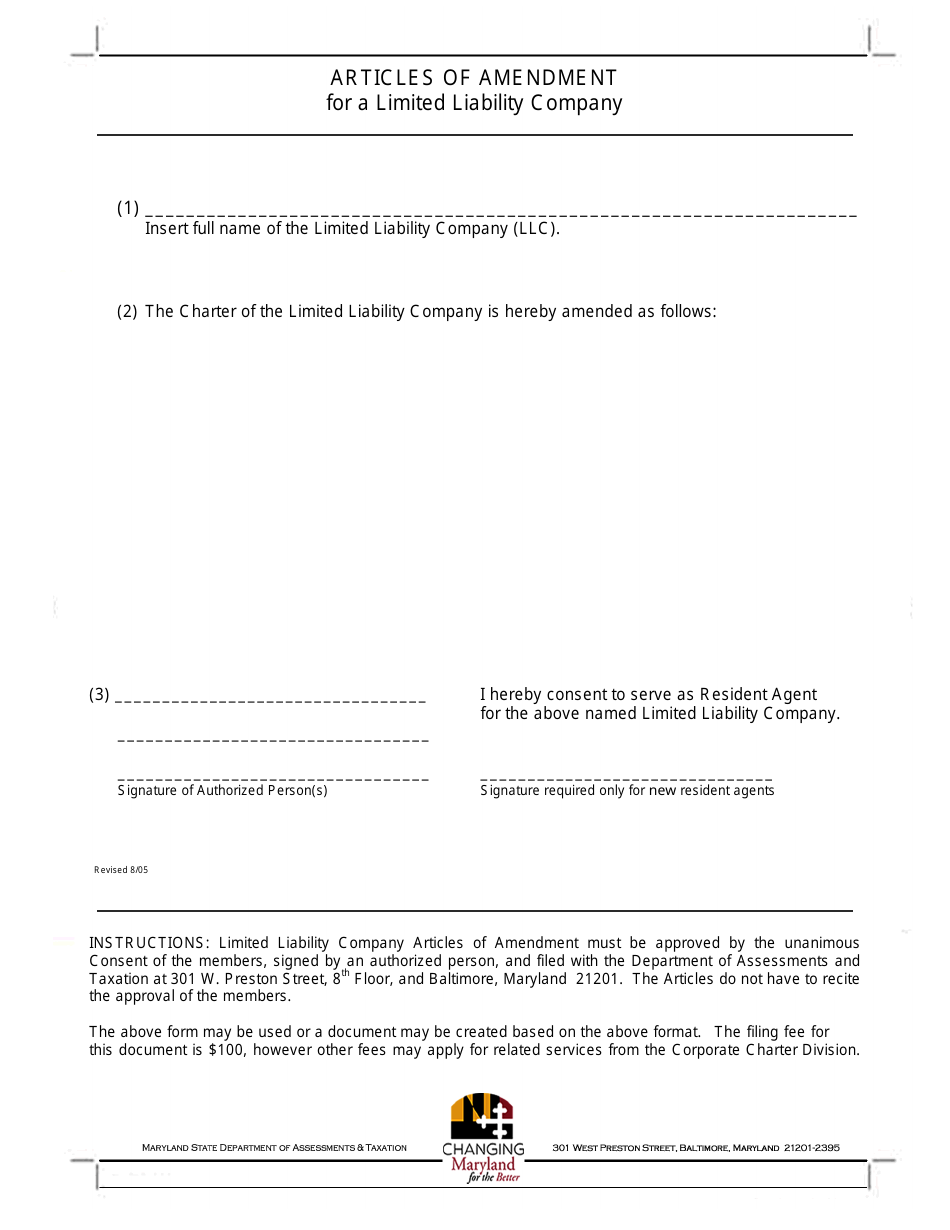

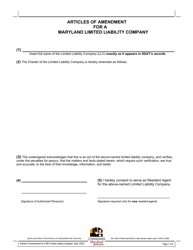

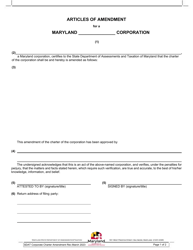

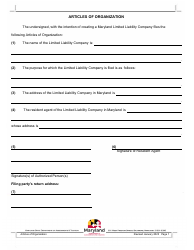

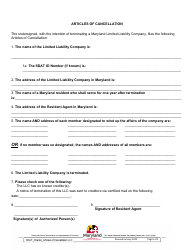

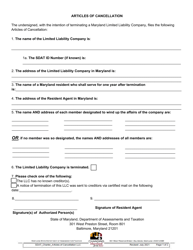

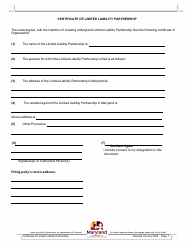

Articles of Amendment for a Limited Liability Company - Maryland

Articles of Amendment for a Limited Liability Company is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What are Articles of Amendment?

A: Articles of Amendment are official documents filed with the state to make changes to a limited liability company's information.

Q: Why would a limited liability company file Articles of Amendment?

A: A limited liability company may file Articles of Amendment to update information such as the company name, registered agent, business address, or member/manager names.

Q: How do I file Articles of Amendment for a limited liability company in Maryland?

A: To file Articles of Amendment in Maryland, you need to complete the appropriate form provided by the state and submit it along with the required fee to the Maryland Department of Assessments and Taxation.

Q: What information is required in the Articles of Amendment form?

A: The Articles of Amendment form requires you to provide the current name of the limited liability company, the specific information being amended, and the new information being filed.

Q: Is there a fee to file Articles of Amendment?

A: Yes, there is a fee to file Articles of Amendment in Maryland. The fee amount can vary, so it's best to check with the Maryland Department of Assessments and Taxation for the current fee schedule.

Q: Are there any specific guidelines to follow when filing Articles of Amendment?

A: Yes, when filing Articles of Amendment in Maryland, it's important to ensure that the form is completed accurately and all required information is provided. It's also advisable to seek legal advice if you're unsure about the process.

Q: How long does it take for Articles of Amendment to be processed?

A: The processing time for Articles of Amendment in Maryland can vary, but it typically takes several weeks for the state to review and approve the filing.

Q: Do I need to notify anyone else about the filing of Articles of Amendment?

A: In Maryland, you are not required to notify any other parties about the filing of Articles of Amendment. However, it's a good idea to inform key stakeholders such as business partners and financial institutions.

Q: Can I make multiple changes on one Articles of Amendment form?

A: Yes, you can make multiple changes on one Articles of Amendment form in Maryland. Just make sure to clearly indicate all the changes being made and provide the necessary information for each change.

Form Details:

- Released on August 1, 2005;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.