This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

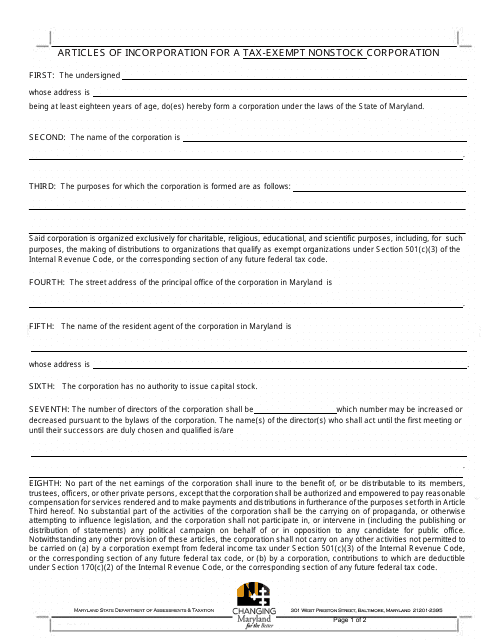

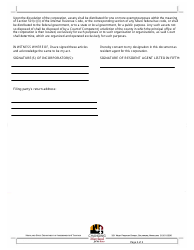

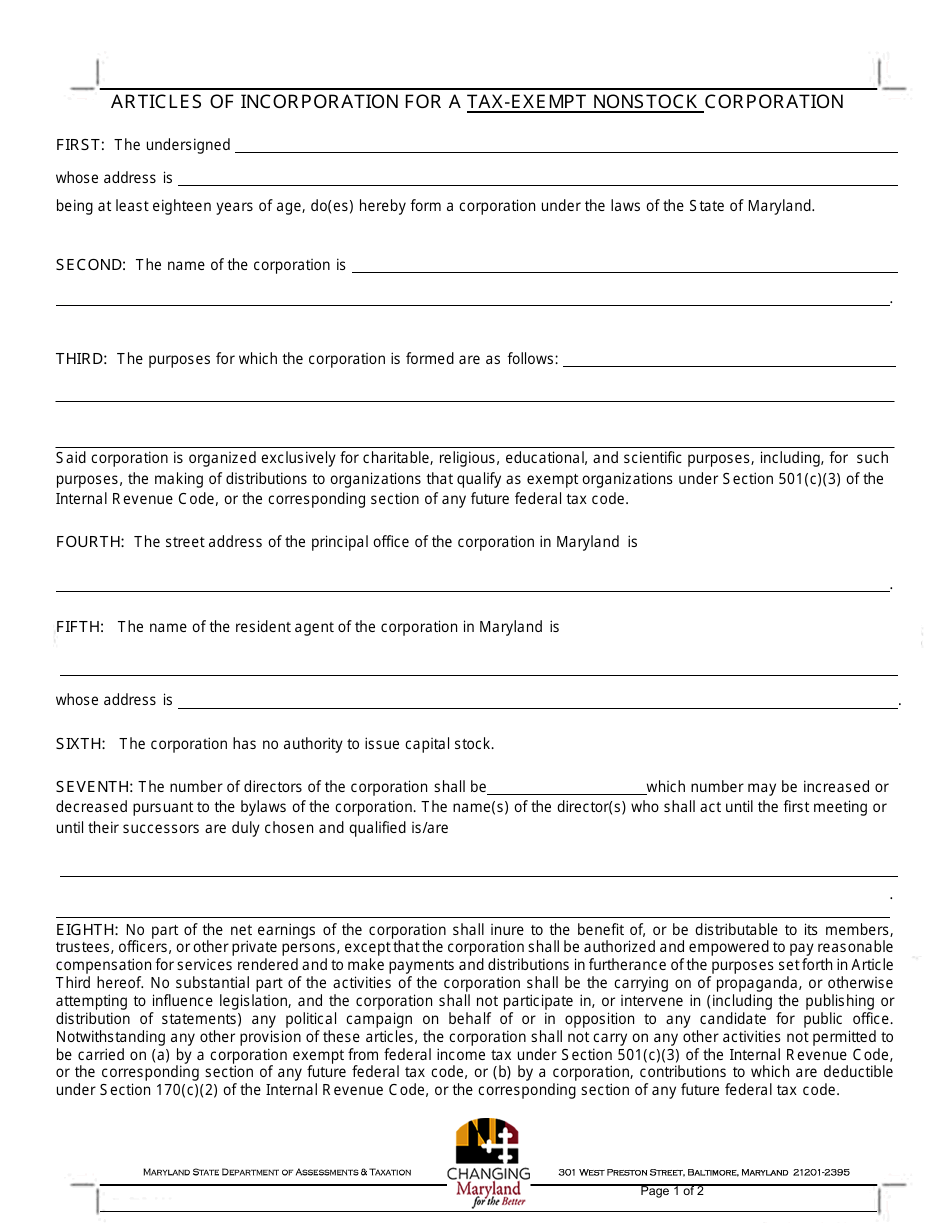

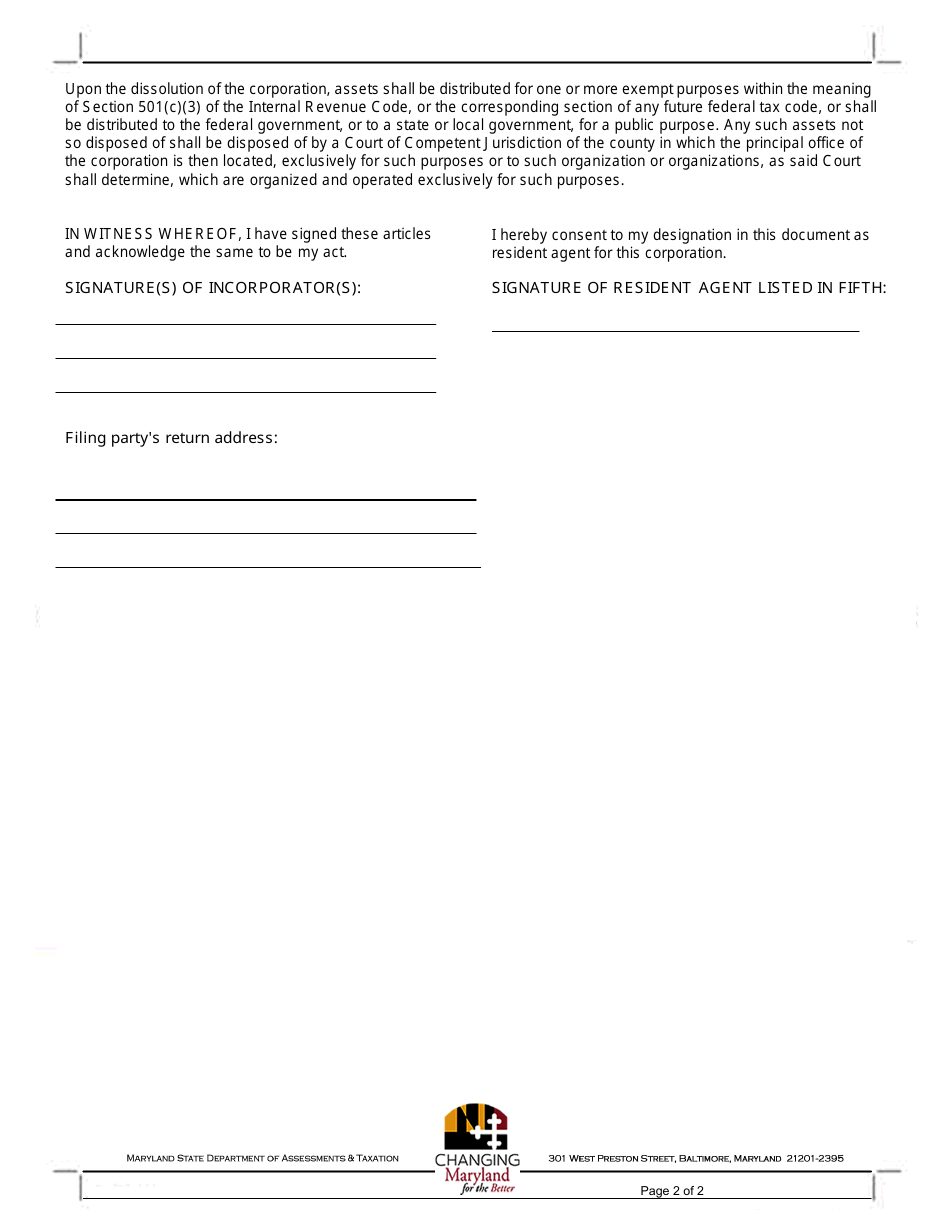

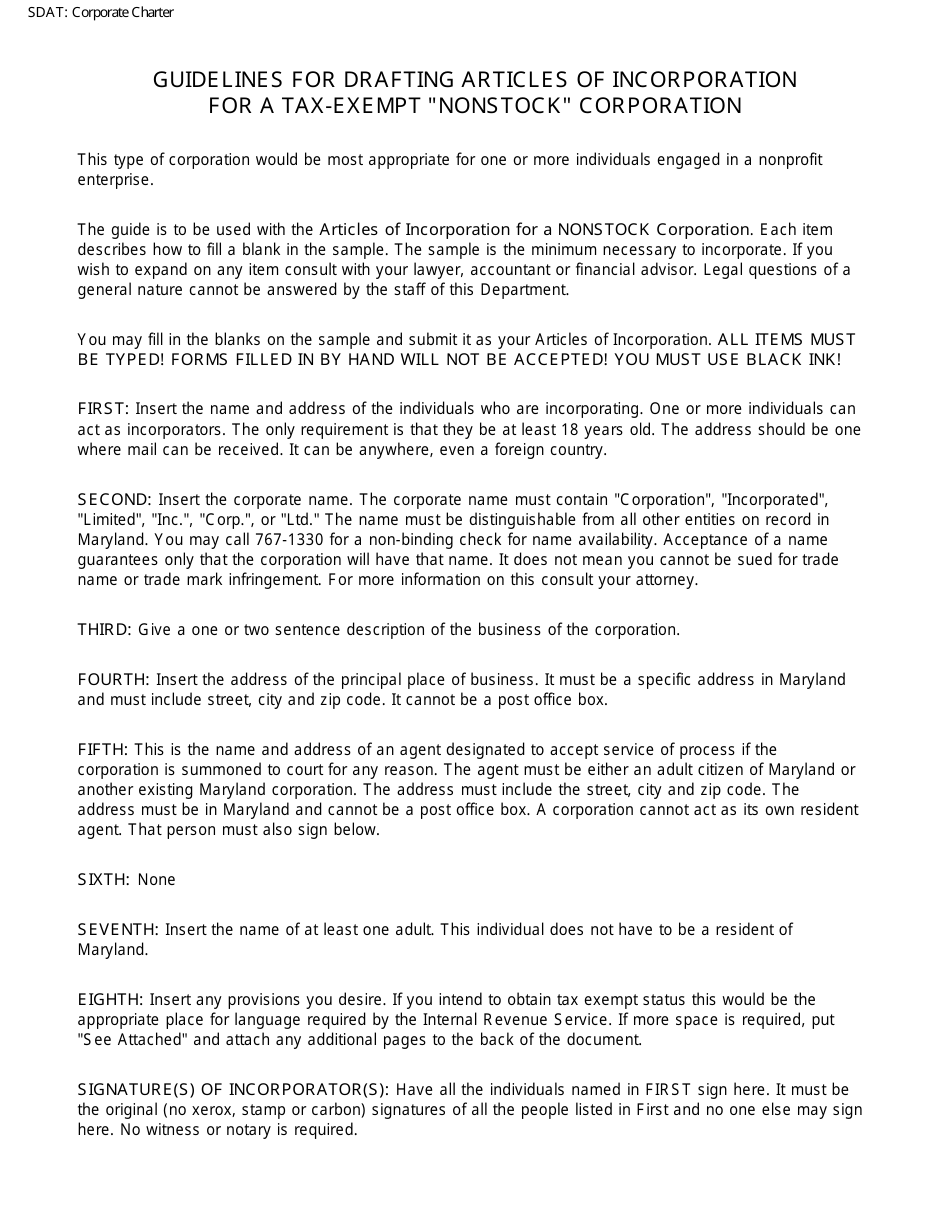

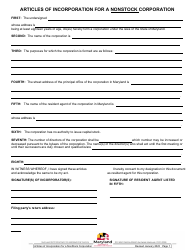

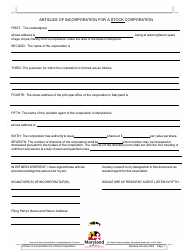

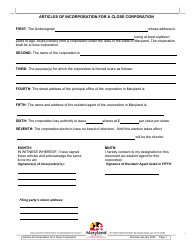

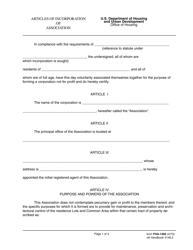

Articles of Incorporation for a Tax-Exempt Nonstock Corporation - Maryland

Articles of Incorporation for a Tax-Exempt Nonstock Corporation is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is an Articles of Incorporation?

A: Articles of Incorporation is a legal document that establishes the existence of a corporation.

Q: What is a Tax-Exempt Nonstock Corporation?

A: A Tax-Exempt Nonstock Corporation is a type of corporation that is organized for nonprofit purposes and is exempt from paying taxes.

Q: What is the process to incorporate a Tax-Exempt Nonstock Corporation in Maryland?

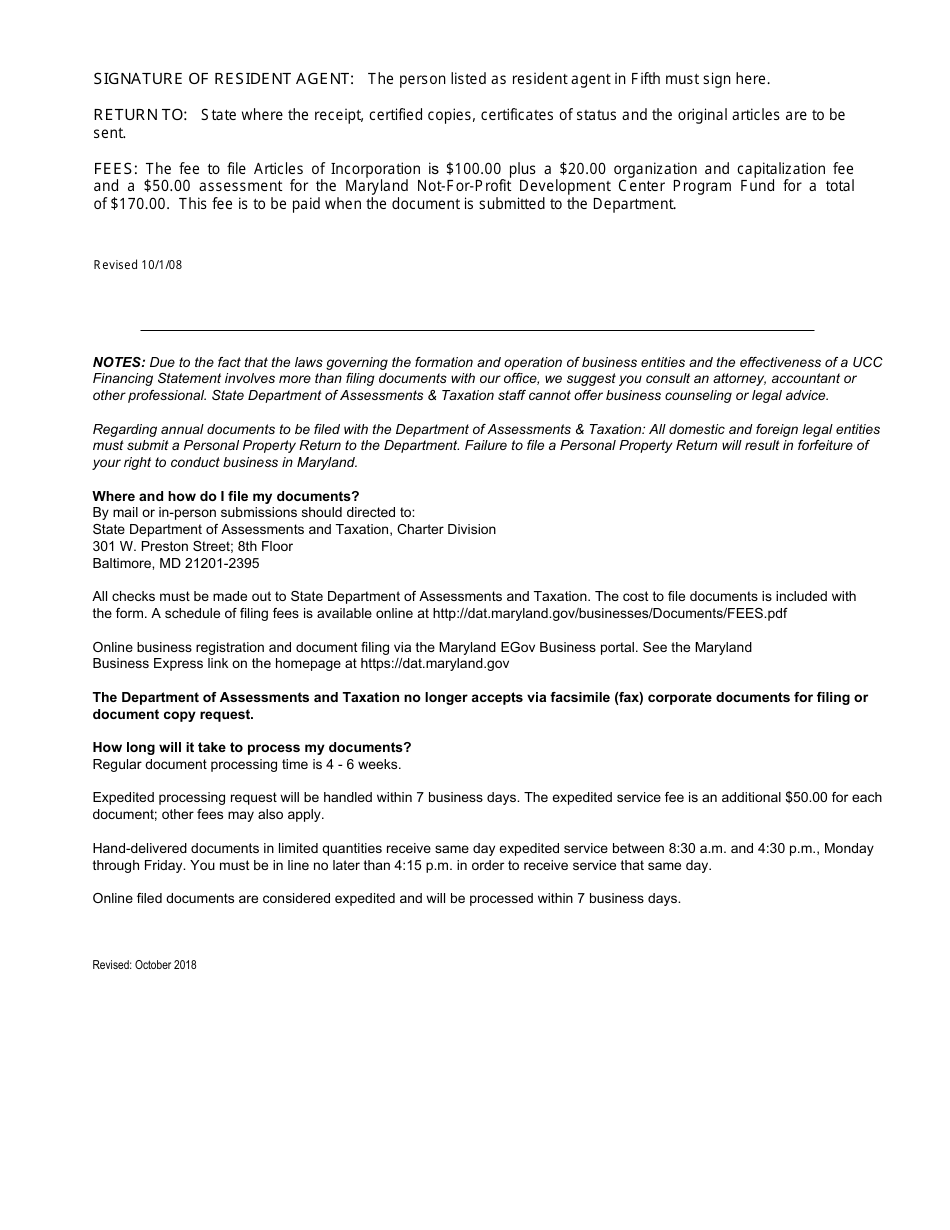

A: The process to incorporate a Tax-Exempt Nonstock Corporation in Maryland involves filing the Articles of Incorporation with the Maryland Department of Assessments and Taxation.

Q: What information is required in the Articles of Incorporation for a Tax-Exempt Nonstock Corporation in Maryland?

A: The Articles of Incorporation for a Tax-Exempt Nonstock Corporation in Maryland must include the corporation's name, purpose, duration, registered agent, and the names and addresses of the incorporators.

Q: What are the benefits of forming a Tax-Exempt Nonstock Corporation in Maryland?

A: Forming a Tax-Exempt Nonstock Corporation in Maryland allows for tax-exempt status, limited liability for members, and the ability to engage in nonprofit activities.

Q: Are there any ongoing requirements for a Tax-Exempt Nonstock Corporation in Maryland?

A: Yes, a Tax-Exempt Nonstock Corporation in Maryland must file annual reports and maintain proper records.

Q: Can a Tax-Exempt Nonstock Corporation in Maryland engage in for-profit activities?

A: While the primary purpose of a Tax-Exempt Nonstock Corporation is to engage in nonprofit activities, it can also engage in limited for-profit activities as long as they support the nonprofit mission.

Q: Can a Tax-Exempt Nonstock Corporation in Maryland distribute profits to its members?

A: No, a Tax-Exempt Nonstock Corporation in Maryland cannot distribute profits to its members. All funds must be used for nonprofit purposes.

Q: How long does it take to incorporate a Tax-Exempt Nonstock Corporation in Maryland?

A: The processing time for incorporating a Tax-Exempt Nonstock Corporation in Maryland varies, but it typically takes a few weeks.

Q: Can I amend the Articles of Incorporation for a Tax-Exempt Nonstock Corporation in Maryland?

A: Yes, the Articles of Incorporation for a Tax-Exempt Nonstock Corporation in Maryland can be amended if necessary.

Form Details:

- Released on October 1, 2018;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.