This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

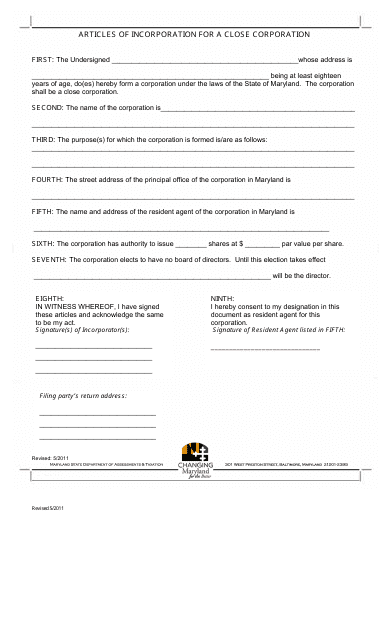

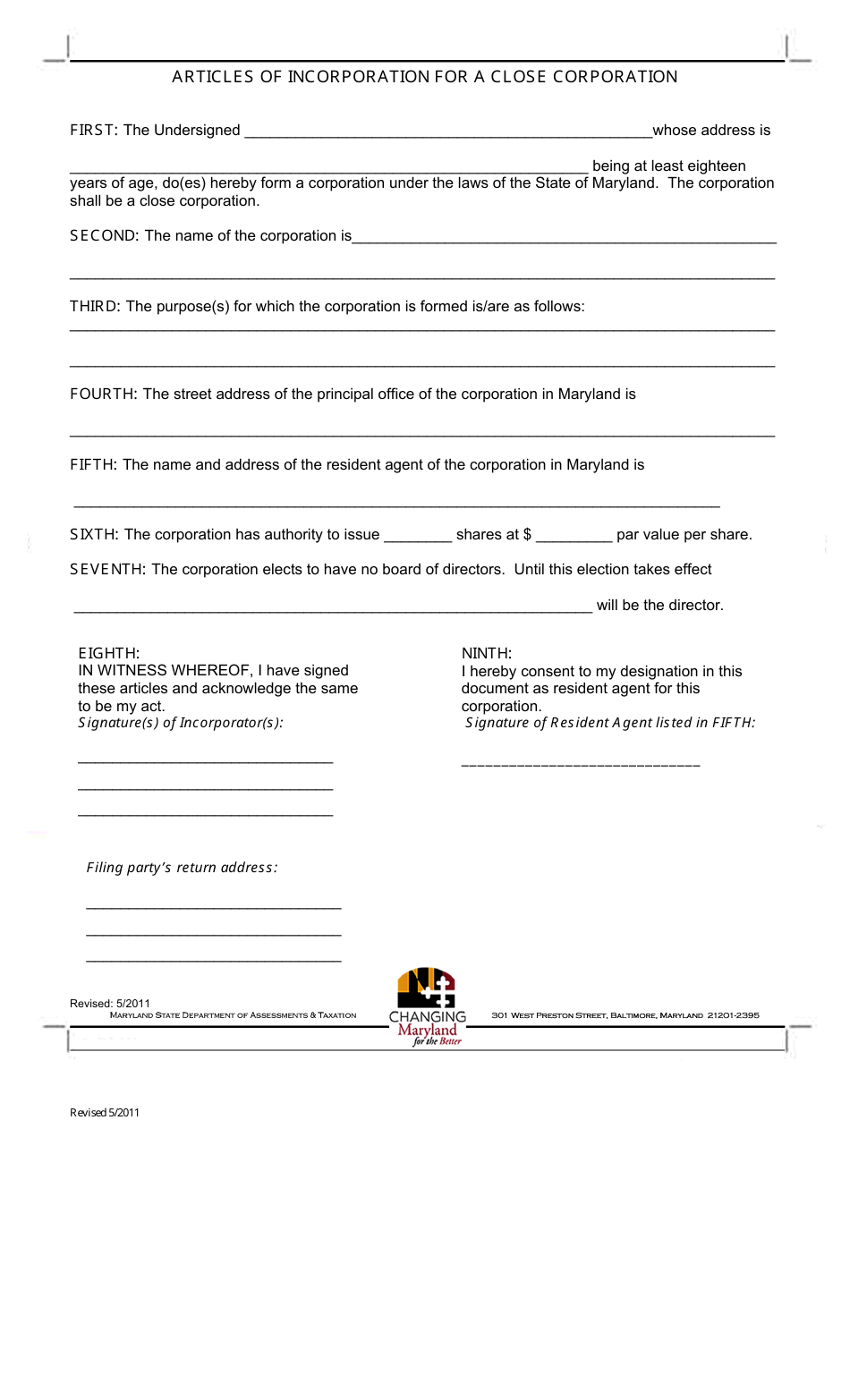

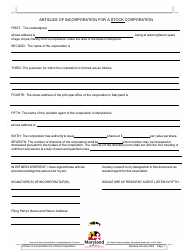

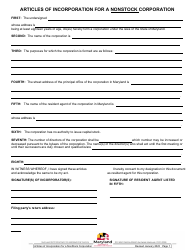

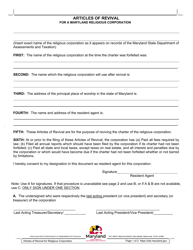

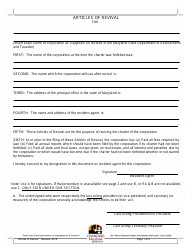

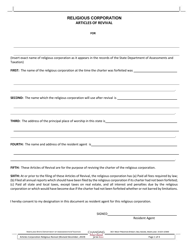

Articles of Incorporation for a Close Corporation - Maryland

Articles of Incorporation for a Close Corporation is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a Close Corporation?

A: A close corporation is a type of corporation that is designed for a small number of shareholders, often family members or close friends.

Q: What is the purpose of Articles of Incorporation for a Close Corporation?

A: The purpose of Articles of Incorporation is to formally establish a close corporation and outline its basic structure and governance.

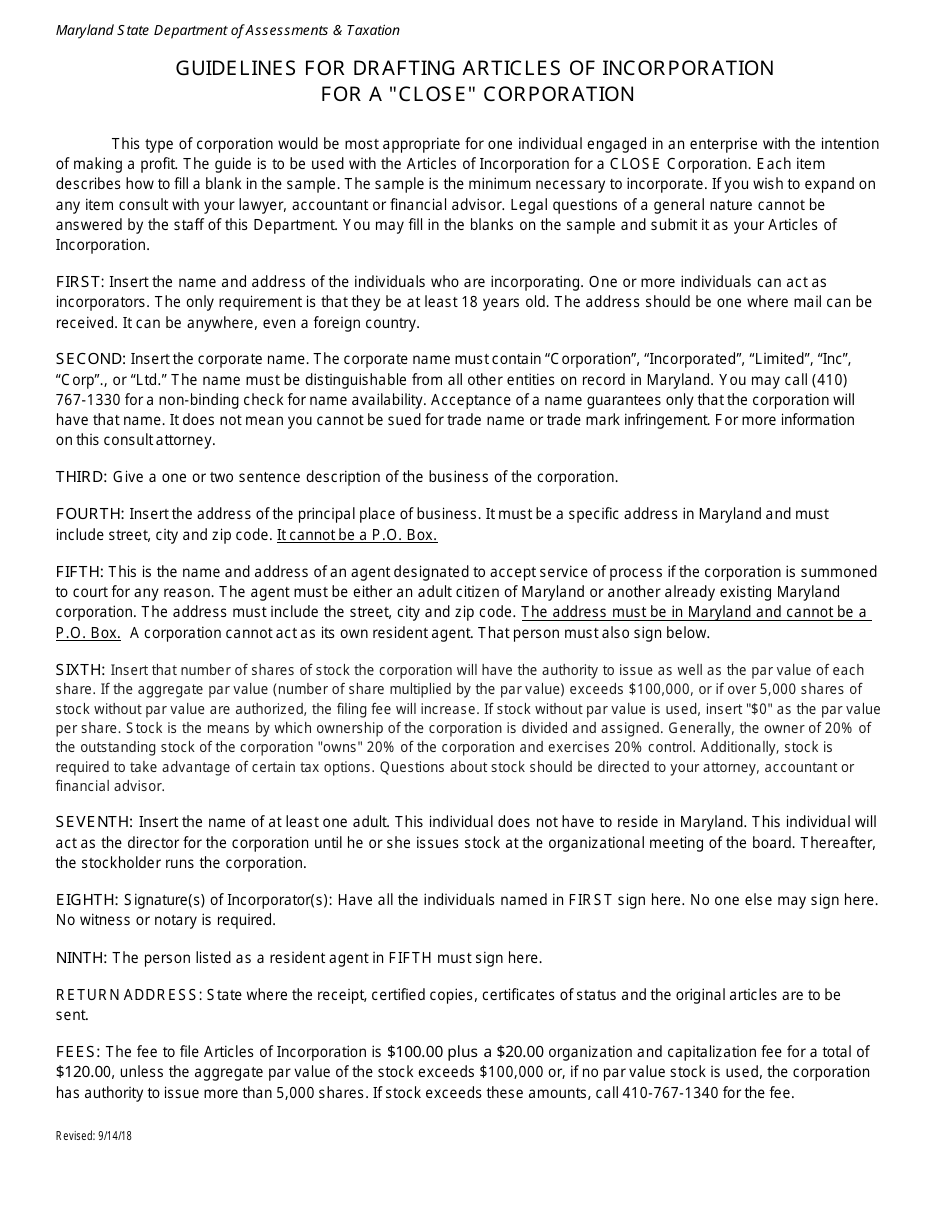

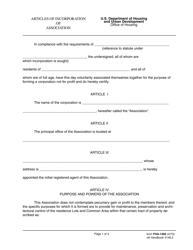

Q: What information is required in the Articles of Incorporation for a Close Corporation?

A: The Articles of Incorporation typically require information such as the corporation's name, the names and addresses of the incorporators, and the number and type of shares to be issued.

Q: Do I need a lawyer to draft the Articles of Incorporation?

A: While it is not required to hire a lawyer, it is often recommended to ensure that the Articles of Incorporation comply with state laws and accurately reflect the intentions of the shareholders.

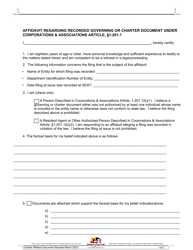

Q: How do I file the Articles of Incorporation for a Close Corporation in Maryland?

A: The Articles of Incorporation must be filed with the Maryland State Department of Assessments and Taxation along with the required filing fee.

Q: What is the cost to file the Articles of Incorporation in Maryland?

A: The filing fee for the Articles of Incorporation in Maryland is $120.

Q: Can I amend the Articles of Incorporation for a Close Corporation?

A: Yes, the Articles of Incorporation can be amended by filing an amendment form with the Maryland State Department of Assessments and Taxation.

Q: What happens after the Articles of Incorporation are filed?

A: Once the Articles of Incorporation are filed and approved, the close corporation is legally established and can begin its operations.

Form Details:

- Released on May 1, 2011;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.