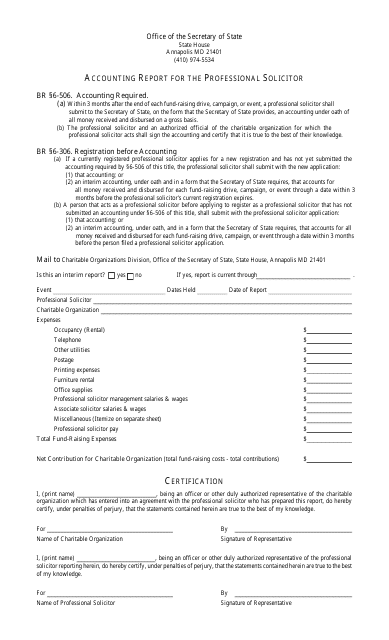

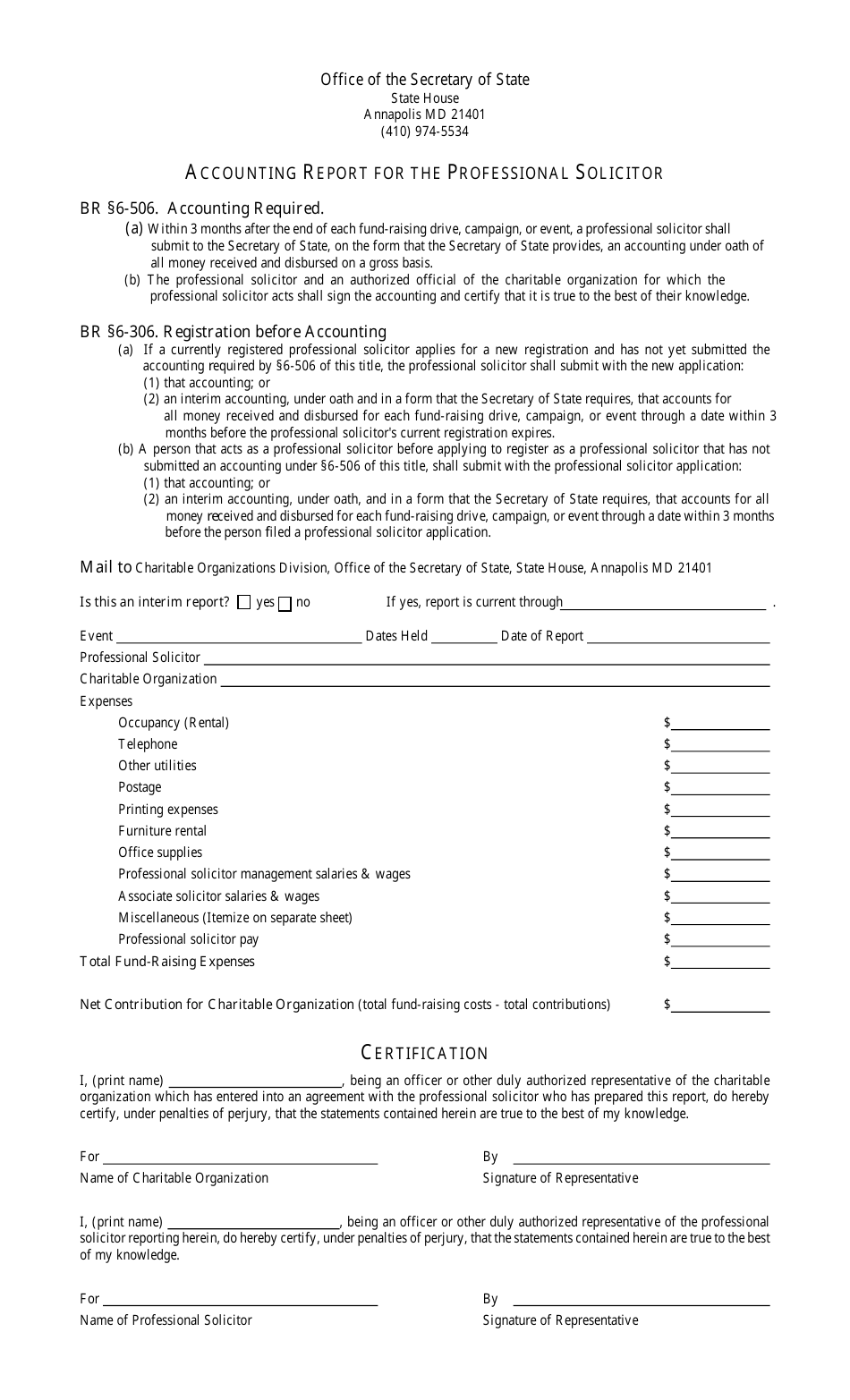

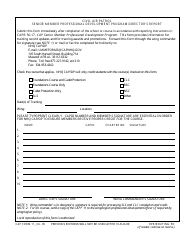

Accounting Report for the Professional Solicitor - Maryland

Accounting Report for the Professional Solicitor is a legal document that was released by the Maryland Secretary of State - a government authority operating within Maryland.

FAQ

Q: What is the purpose of an accounting report for a professional solicitor in Maryland?

A: The purpose of an accounting report is to provide a financial summary of a professional solicitor's activities in Maryland.

Q: Who is required to submit an accounting report in Maryland?

A: Professional solicitors are required to submit an accounting report in Maryland.

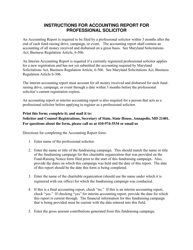

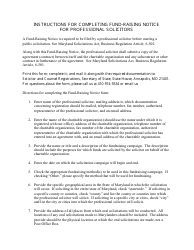

Q: What information should be included in an accounting report for a professional solicitor in Maryland?

A: An accounting report should include information about the solicitor's income, expenses, and fundraising activities.

Q: When is the deadline for submitting an accounting report in Maryland?

A: The deadline for submitting an accounting report in Maryland is within 90 days after the end of the solicitor's fiscal year.

Q: Are there any penalties for not submitting an accounting report in Maryland?

A: Yes, there are penalties for not submitting an accounting report in Maryland, which may include fines or suspension of the solicitor's registration.

Form Details:

- The latest edition currently provided by the Maryland Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Secretary of State.