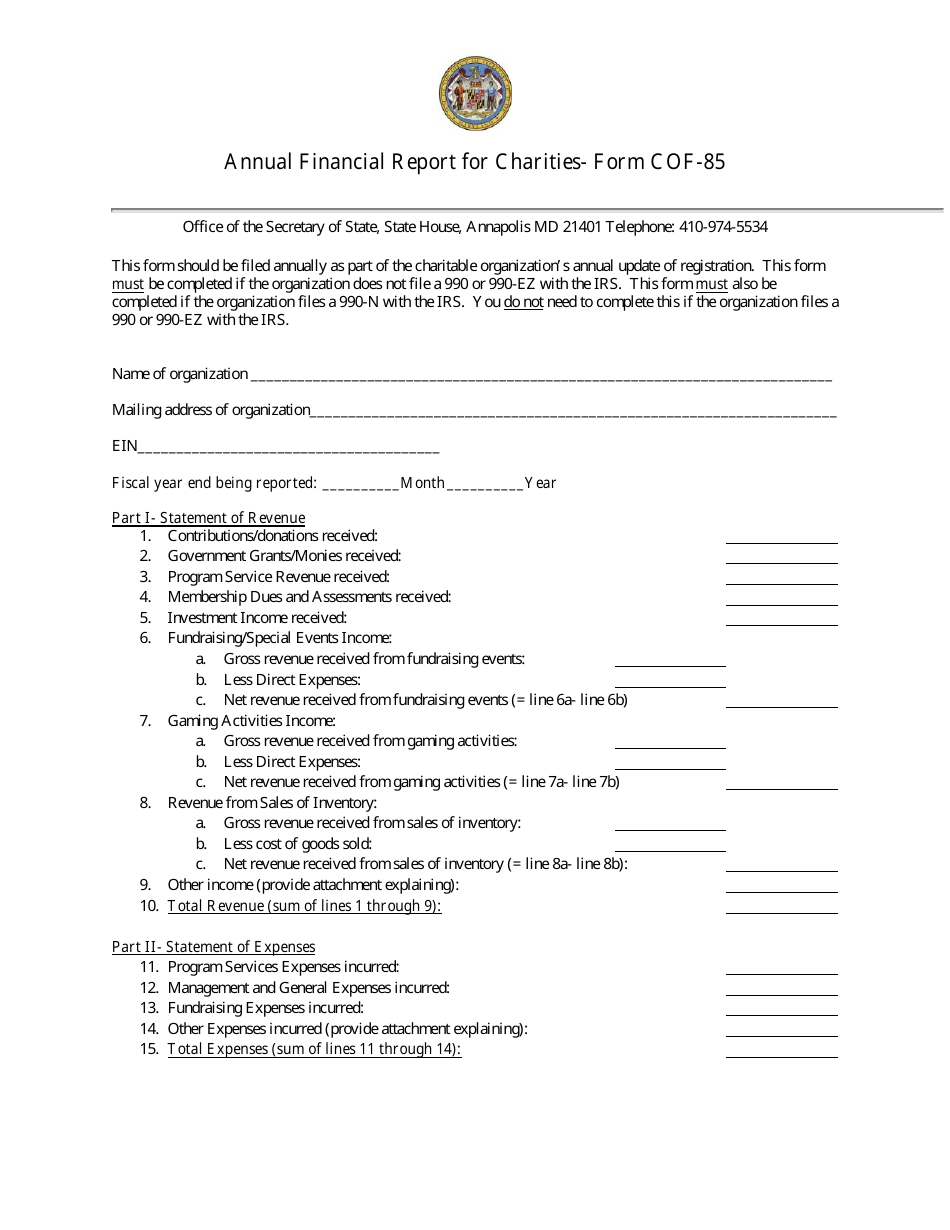

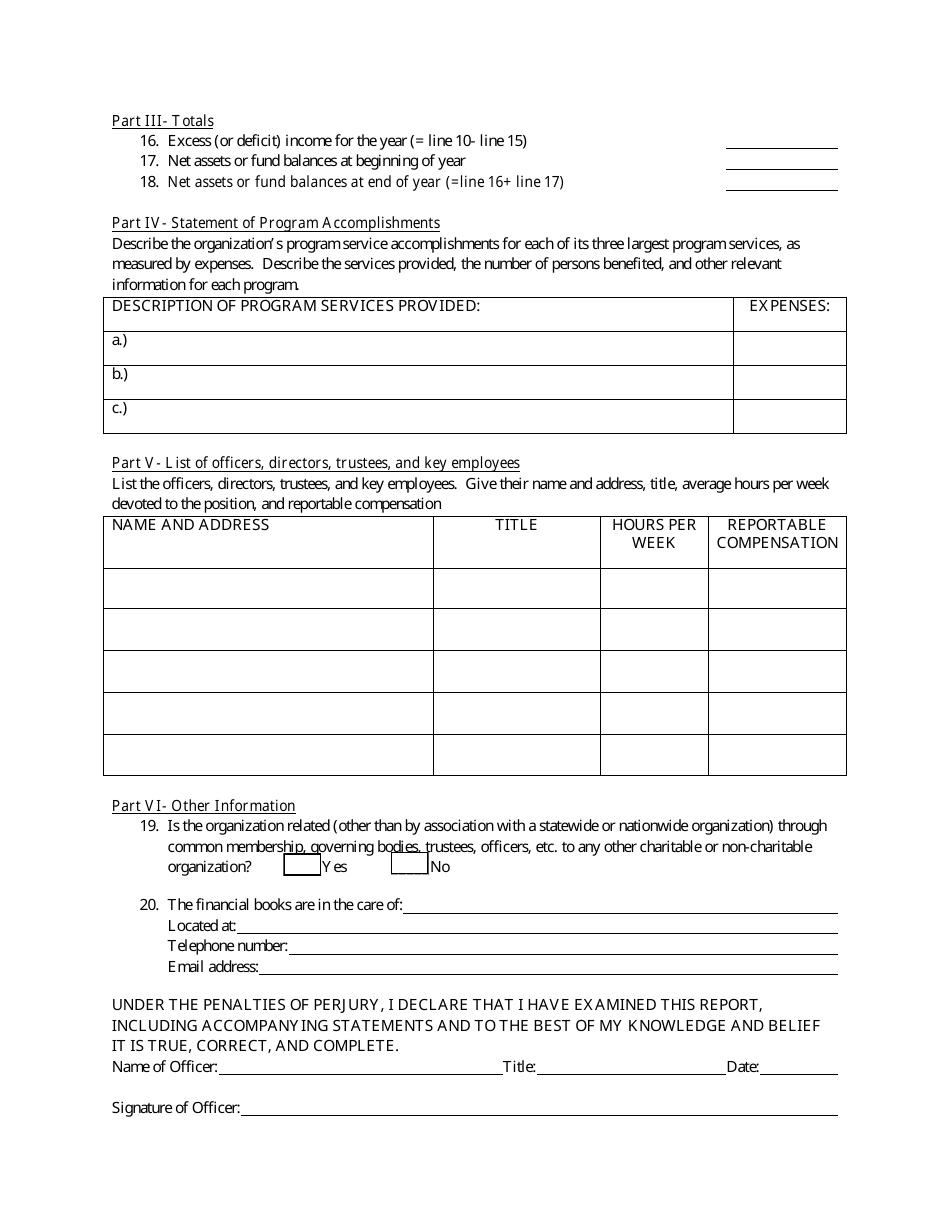

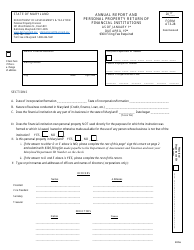

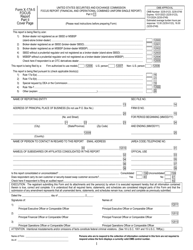

Form COF-85 Annual Financial Report for Charities - Maryland

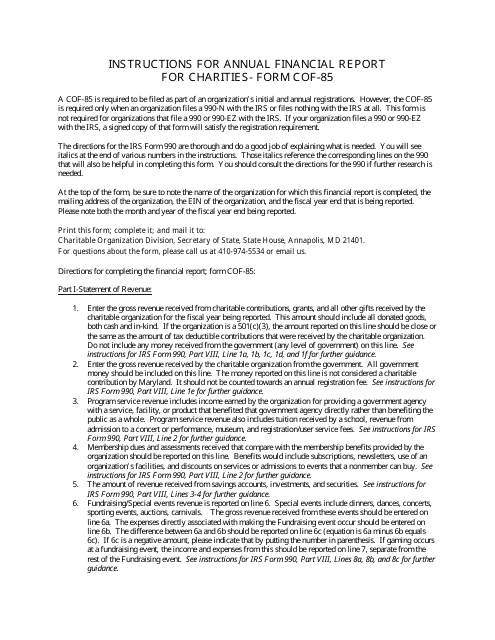

What Is Form COF-85?

This is a legal form that was released by the Maryland Secretary of State - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COF-85?

A: Form COF-85 is the Annual Financial Report for Charities in Maryland.

Q: Who needs to file Form COF-85?

A: Charities operating in Maryland that have gross contributions of $250,000 or more in the previous fiscal year are required to file Form COF-85.

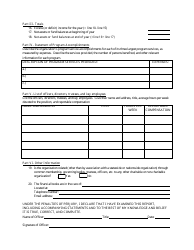

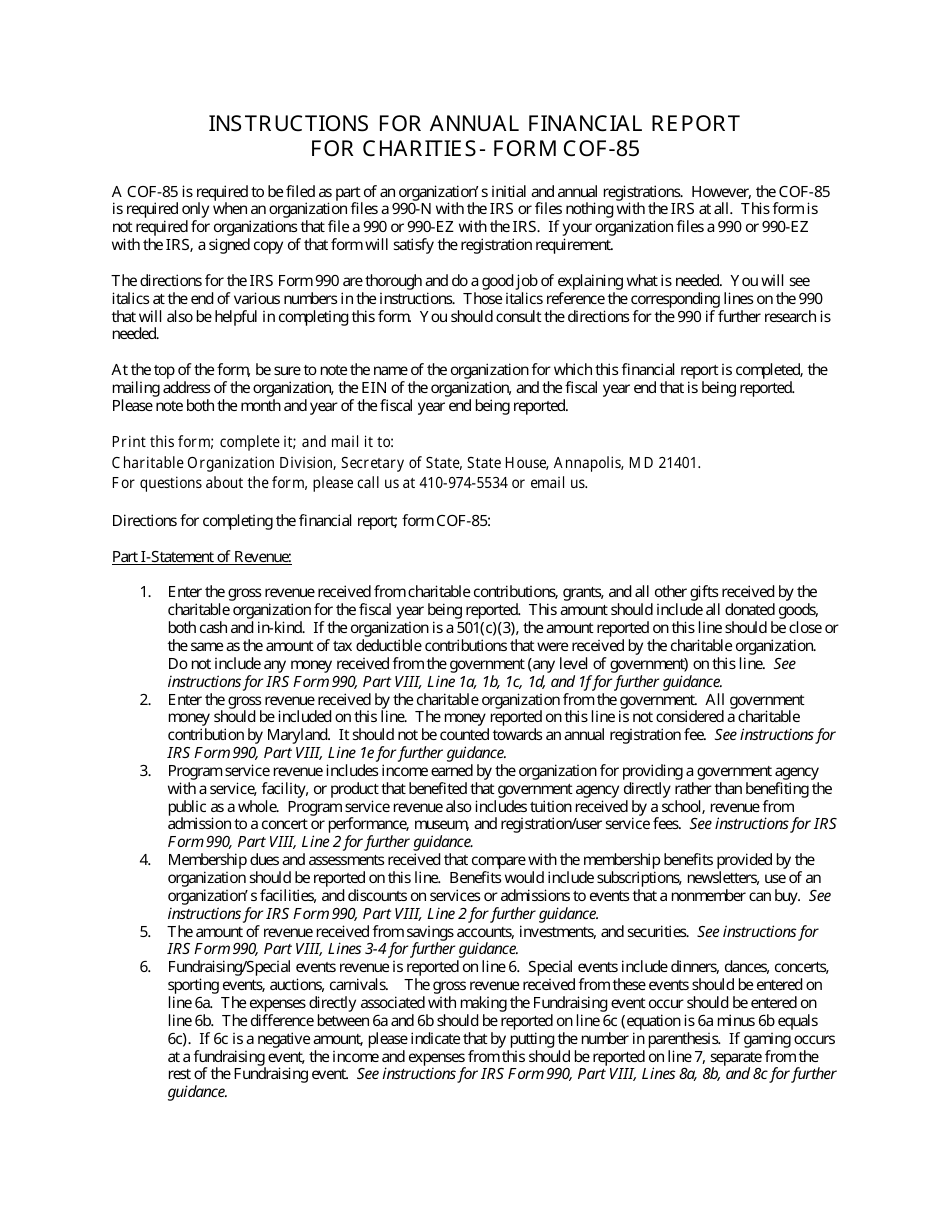

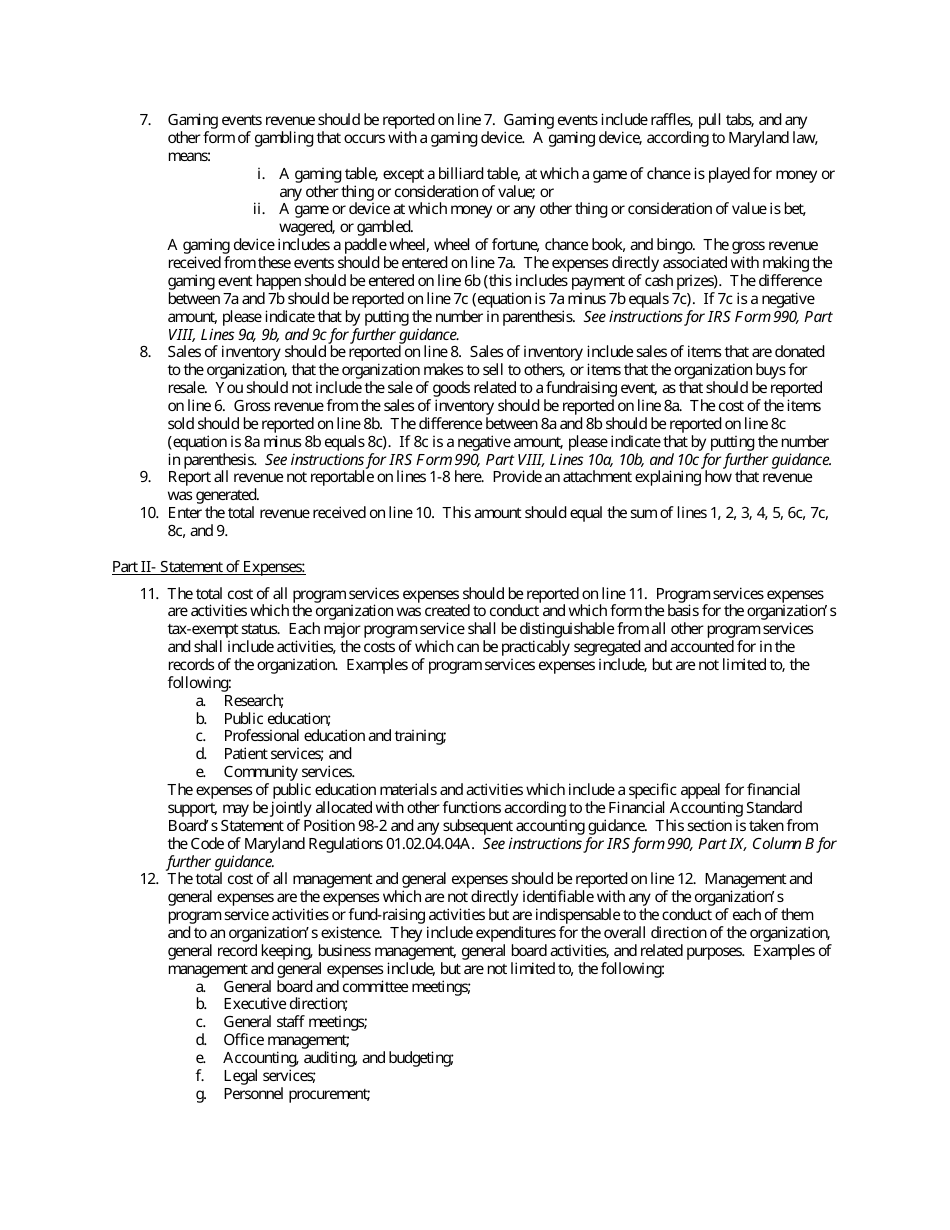

Q: What information is included in Form COF-85?

A: Form COF-85 includes detailed financial information such as revenue, expenses, assets, and liabilities of the charity.

Q: When is Form COF-85 due?

A: Form COF-85 is due on or before the 15th day of the fifth month following the end of the charity's fiscal year.

Q: Are there any penalties for not filing Form COF-85?

A: Yes, failure to file Form COF-85 or filing a late or incomplete form may result in penalties and the charity may lose its exemption.

Q: Is there a fee for filing Form COF-85?

A: Yes, there is a filing fee associated with Form COF-85. The fee amount depends on the gross contributions of the charity.

Form Details:

- The latest edition provided by the Maryland Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COF-85 by clicking the link below or browse more documents and templates provided by the Maryland Secretary of State.