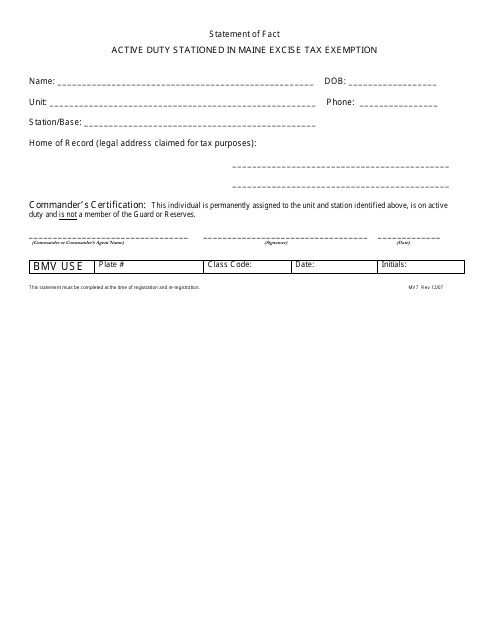

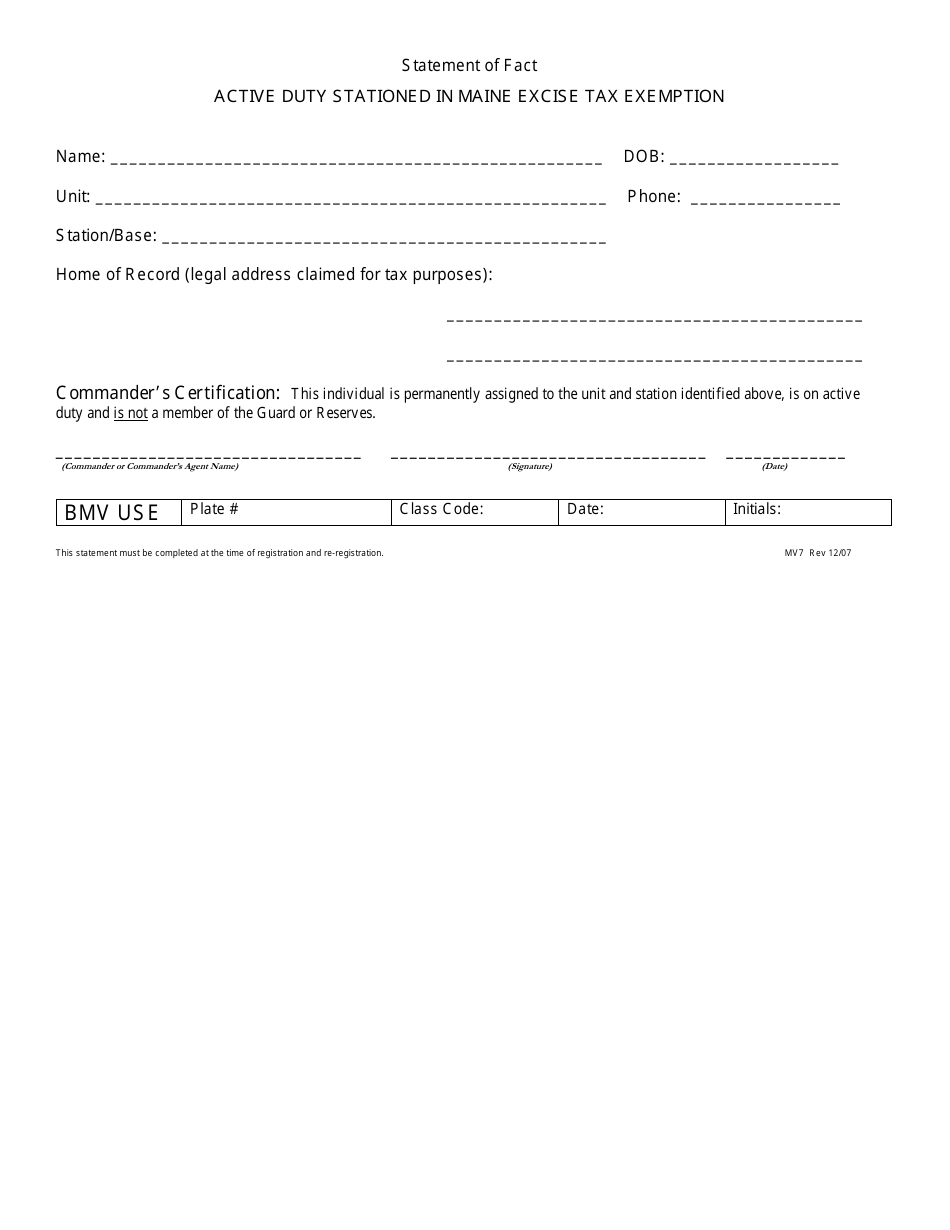

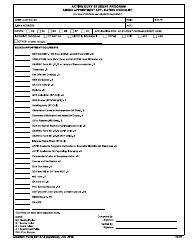

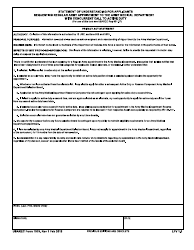

Form MV7 Active Duty Stationed in Maine Excise Tax Exemption - Maine

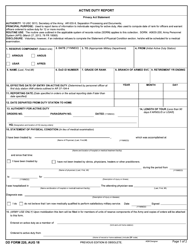

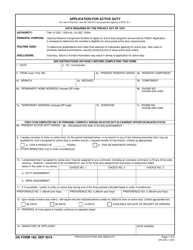

What Is Form MV7?

This is a legal form that was released by the Maine Department of the Secretary of State - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

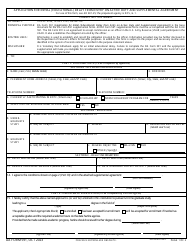

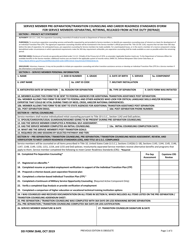

Q: What is Form MV7?

A: Form MV7 is a tax exemption form for active duty military personnel stationed in Maine.

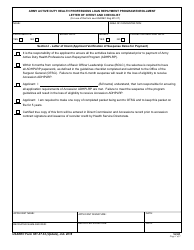

Q: Who is eligible for the excise tax exemption?

A: Active duty military personnel stationed in Maine are eligible for the excise tax exemption.

Q: What does the excise tax exemption cover?

A: The excise tax exemption covers the excise tax on motor vehicles owned by active duty military personnel.

Q: How can I apply for the excise tax exemption?

A: You can apply for the excise tax exemption by completing Form MV7.

Q: What documents do I need to provide with Form MV7?

A: You need to provide a copy of your military ID and orders that prove your active duty status.

Q: When should I submit Form MV7?

A: You should submit Form MV7 within 30 days of registering your vehicle in Maine.

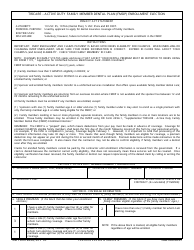

Q: Is there a deadline for applying for the excise tax exemption?

A: Yes, you must apply for the excise tax exemption within 6 months of the date you establish residency in Maine.

Q: Can I get a refund if I already paid the excise tax?

A: Yes, if you paid the excise tax before receiving the exemption, you can apply for a refund.

Q: What happens if I sell my vehicle before the exemption period ends?

A: If you sell your vehicle before the exemption period ends, you may be required to reimburse the town for the remaining exempted excise tax.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the Maine Department of the Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MV7 by clicking the link below or browse more documents and templates provided by the Maine Department of the Secretary of State.