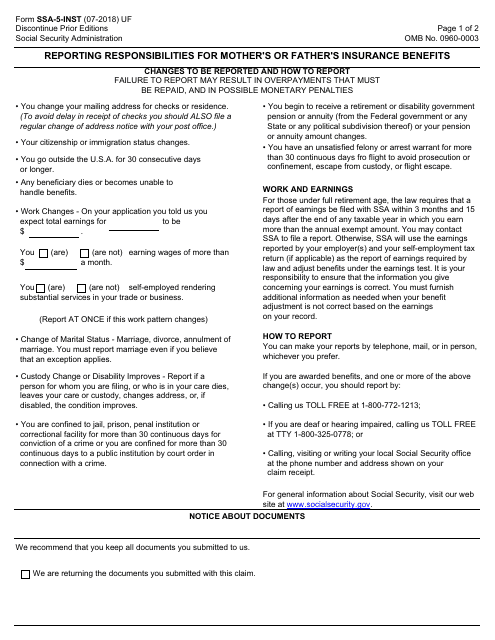

Form SSA-5-INST Reporting Responsibilities for Mother's or Father's Insurance Benefits

What Is Form SSA-5-INST?

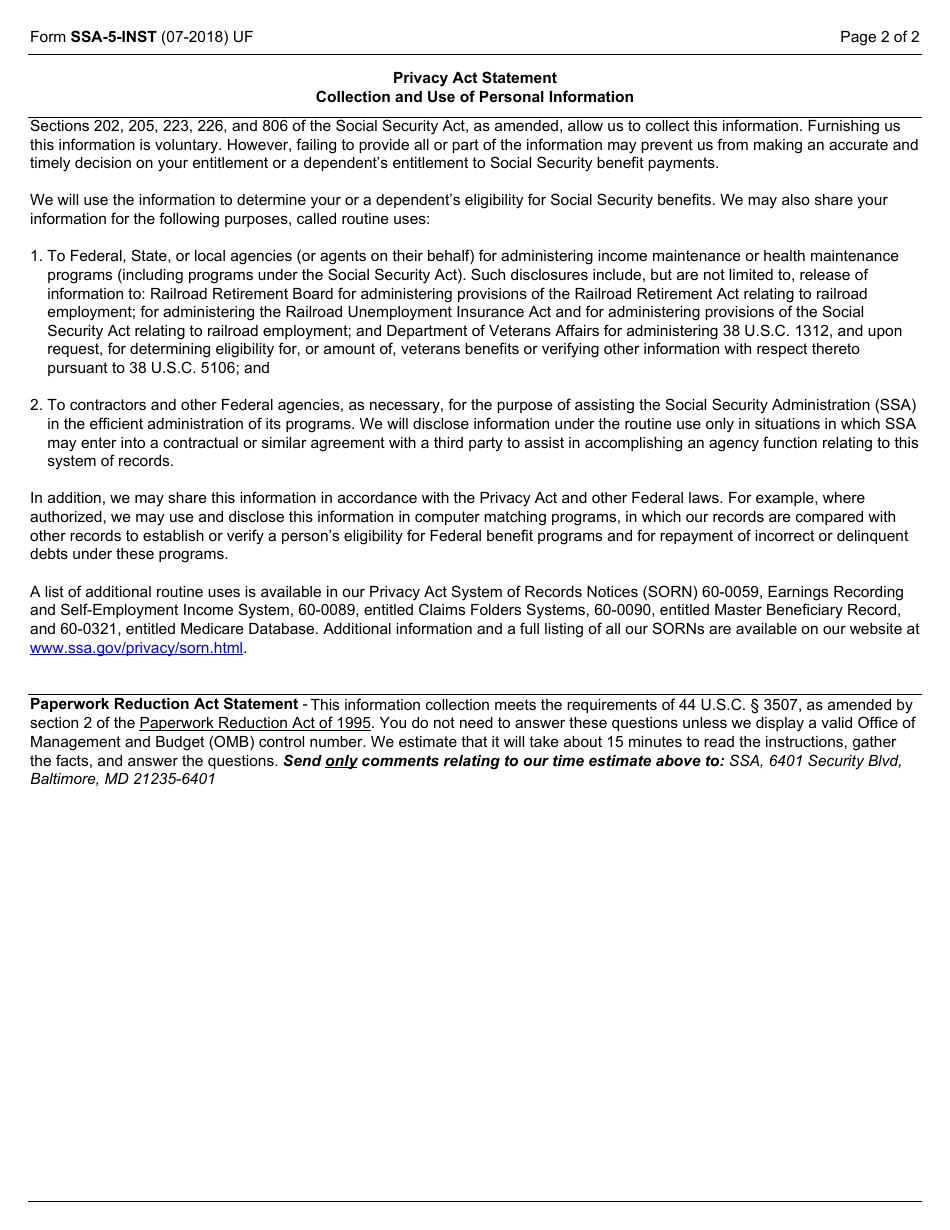

This is a legal form that was released by the U.S. Social Security Administration on July 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-5-INST?

A: Form SSA-5-INST is a document that provides information about reporting responsibilities for mother's or father's insurance benefits.

Q: What are mother's or father's insurance benefits?

A: Mother's or father's insurance benefits are Social Security benefits that can be received by a child if one of their parents is disabled, retired, or deceased.

Q: Who is responsible for reporting these benefits?

A: The child or the child's representative payee is responsible for reporting these benefits.

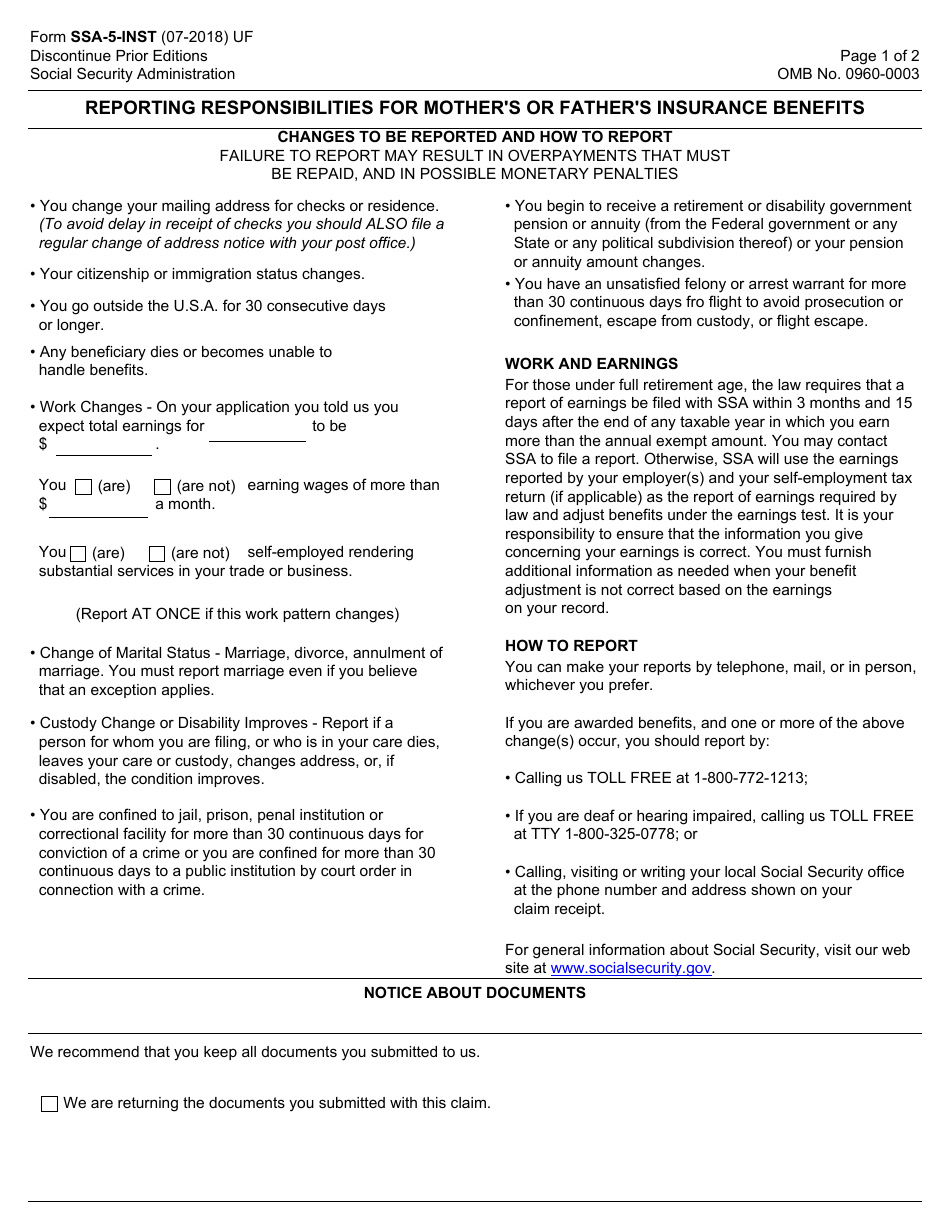

Q: What should be reported?

A: All changes in the child's life that could affect their eligibility for benefits, such as changes in income, marital status, or disability, should be reported.

Q: How should the benefits be reported?

A: The child or the child's representative payee should report the benefits by completing and submitting Form SSA-5-INST to the Social Security Administration.

Q: When should the benefits be reported?

A: Any changes that could affect eligibility for benefits should be reported as soon as possible, but no later than 10 days after the end of the month in which the change occurred.

Q: What happens if the benefits are not reported?

A: Failure to report changes that could affect eligibility for benefits may result in overpayment or underpayment of benefits.

Q: Is there any penalty for not reporting?

A: There may be penalties, including fines or imprisonment, for knowingly providing false information or failing to provide information that could affect eligibility for benefits.

Form Details:

- Released on July 1, 2018;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-5-INST by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.