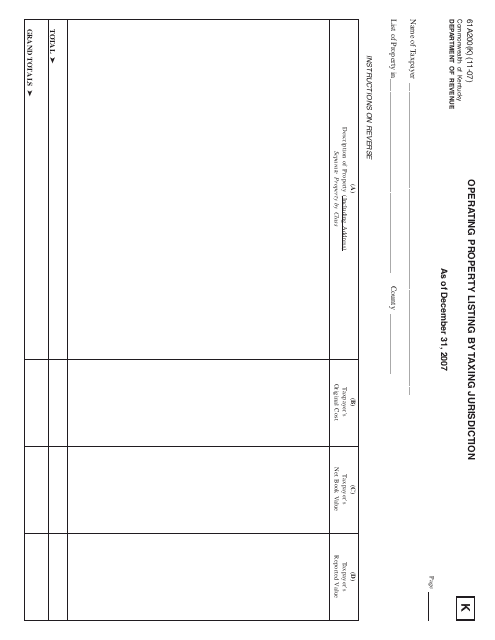

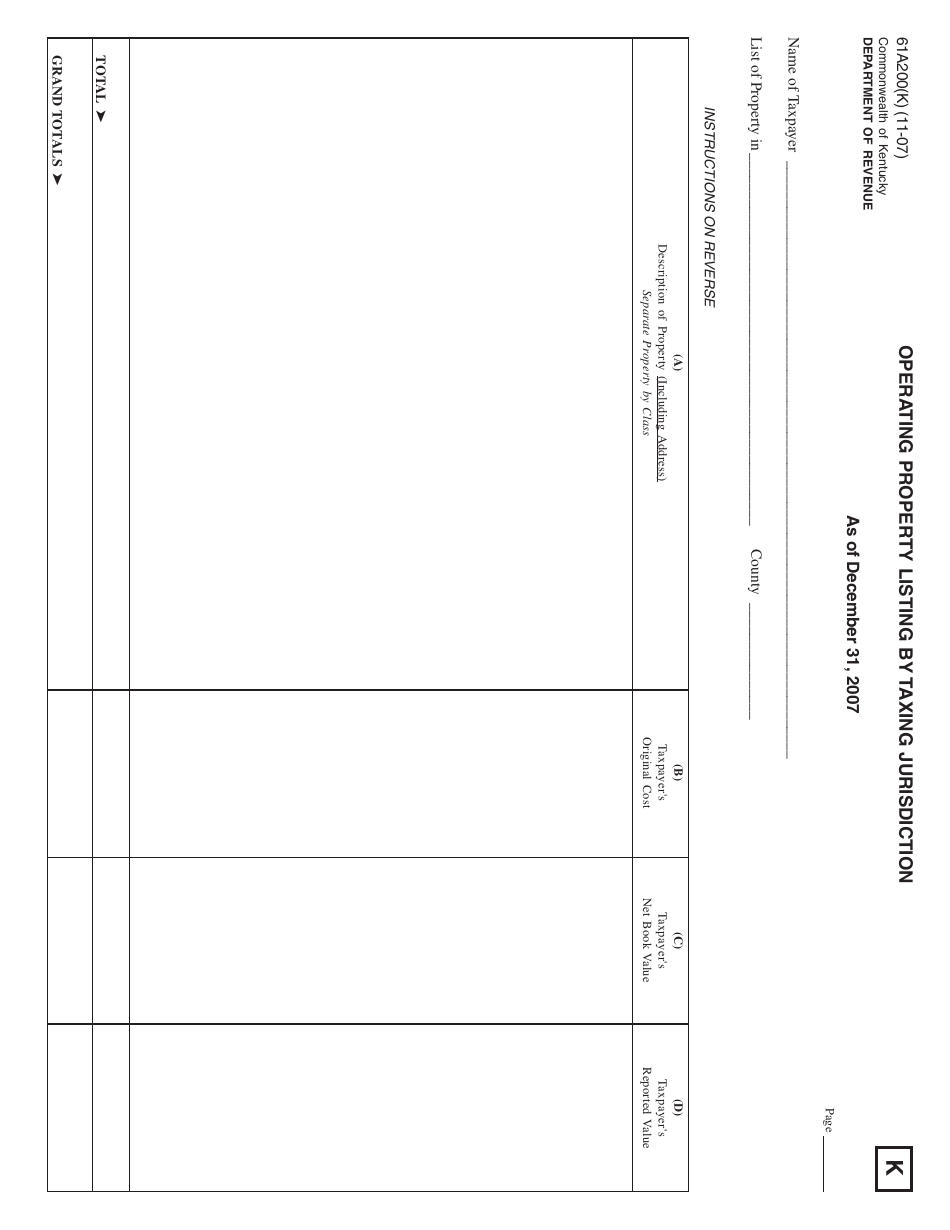

Form 61A200(K) Operating Property Listing by Taxing Jurisdiction - Kentucky

What Is Form 61A200(K)?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 61A200(K)?

A: Form 61A200(K) is the Operating Property Listing by Taxing Jurisdiction for the state of Kentucky.

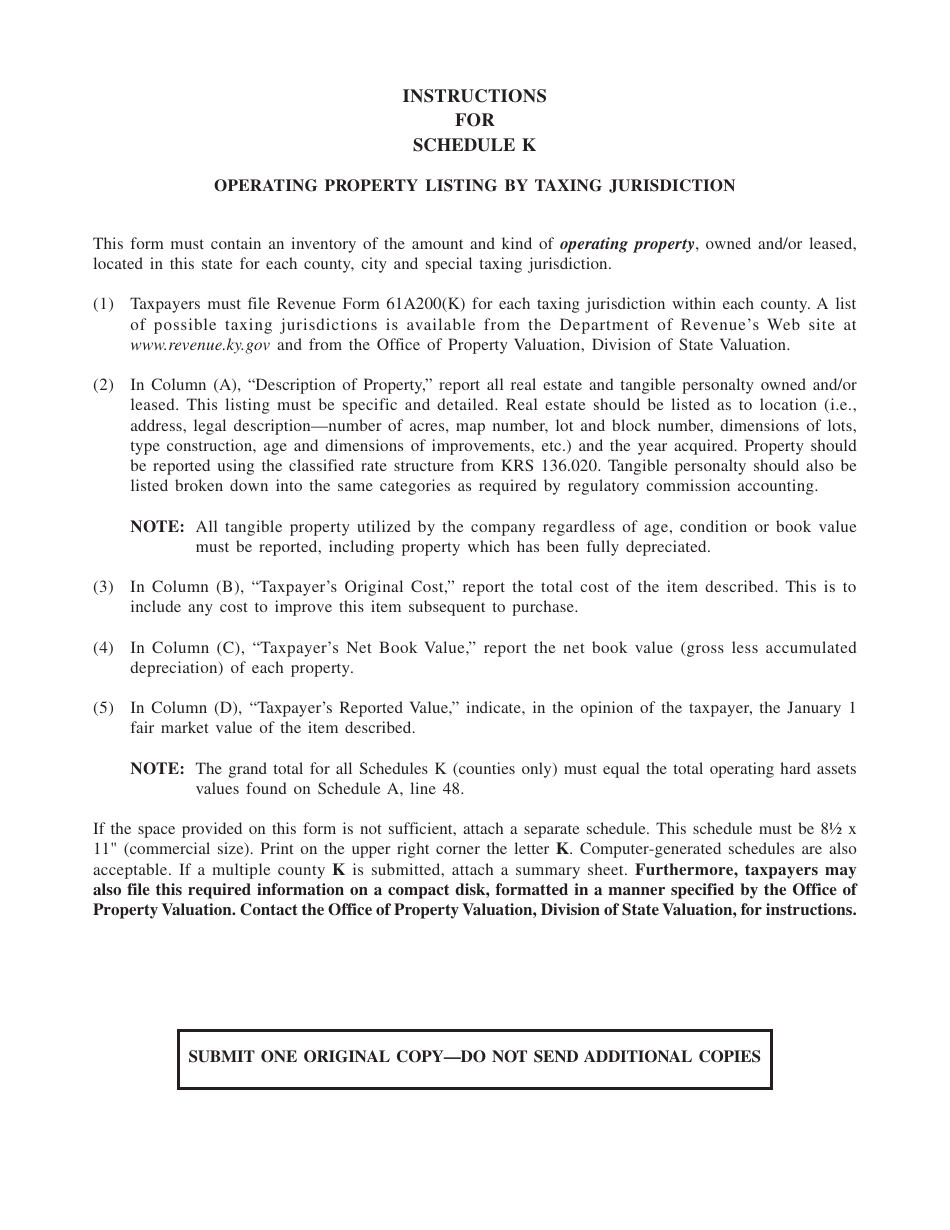

Q: What is the purpose of Form 61A200(K)?

A: The purpose of Form 61A200(K) is to provide a detailed listing of operating property by taxing jurisdiction.

Q: Who needs to file Form 61A200(K)?

A: Property owners and businesses in Kentucky who own operating property are required to file Form 61A200(K).

Q: When is the deadline to file Form 61A200(K)?

A: The deadline to file Form 61A200(K) is typically on or before May 15th of each year.

Q: What information is required on Form 61A200(K)?

A: Form 61A200(K) requires information such as property address, acquired and disposed dates, fair cash value, and taxing district information.

Q: Are there any penalties for not filing Form 61A200(K)?

A: Yes, failure to file Form 61A200(K) or filing late may result in penalties and interest charges.

Q: Can I request an extension to file Form 61A200(K)?

A: Yes, extensions may be granted upon request, but the extension request must be made before the original due date.

Form Details:

- Released on November 1, 2007;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 61A200(K) by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.