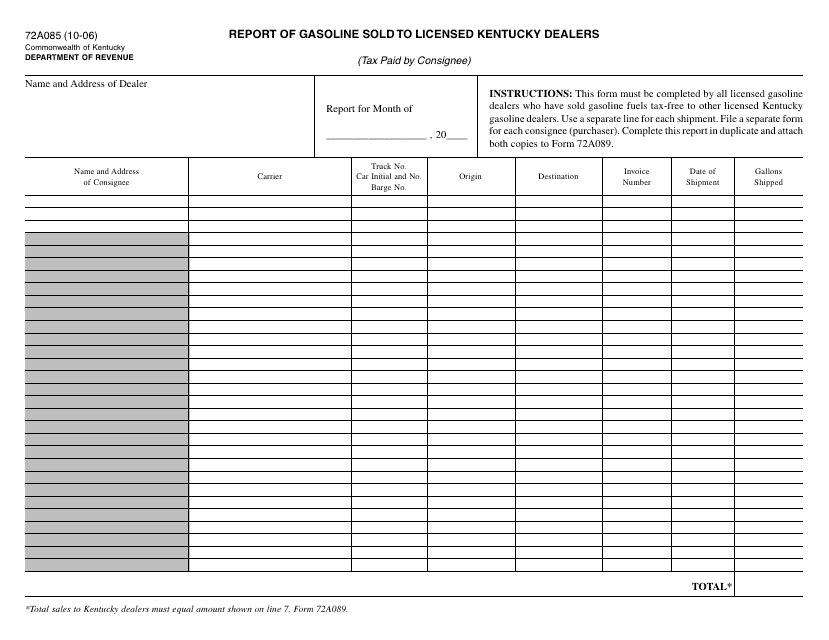

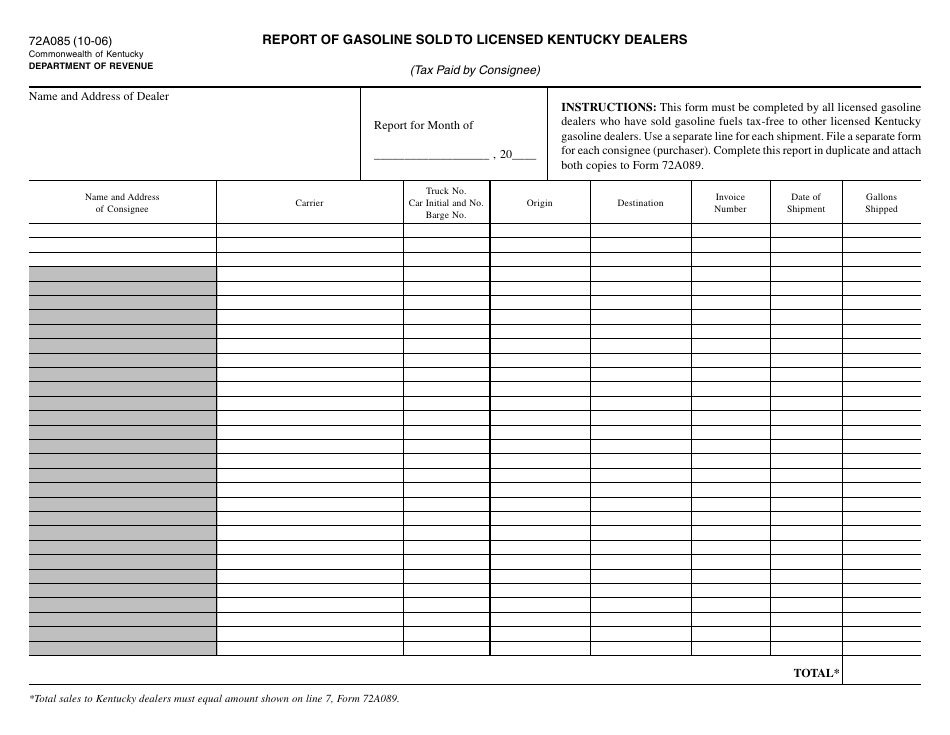

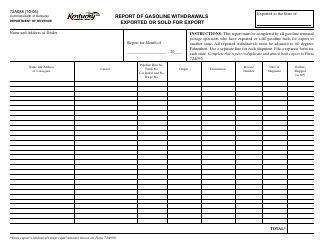

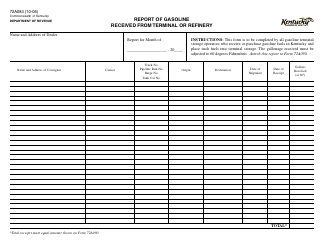

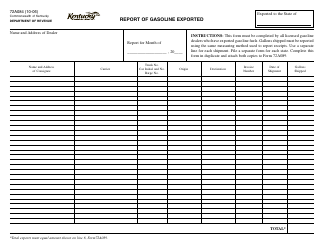

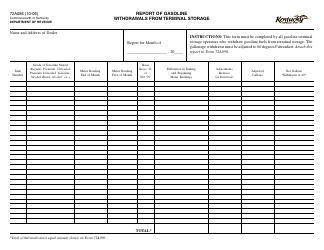

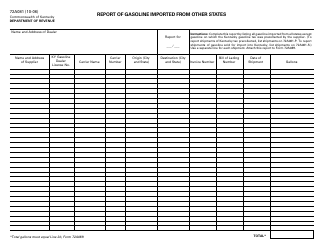

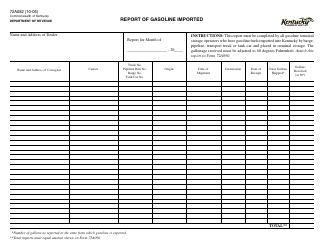

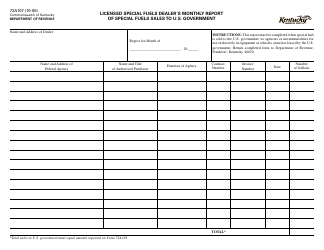

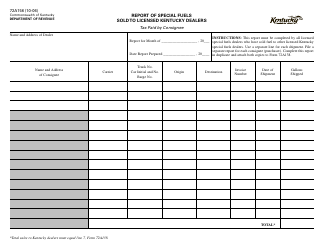

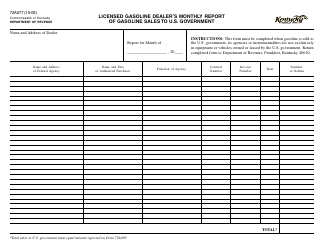

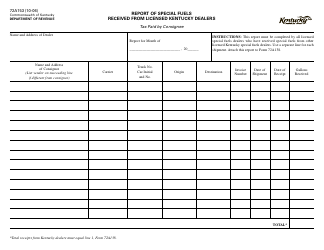

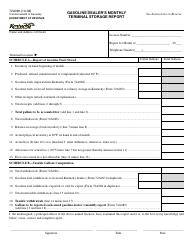

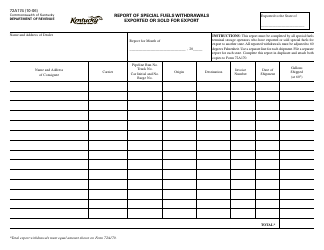

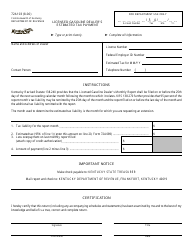

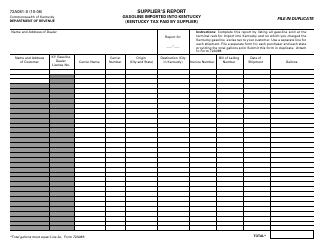

Form 72A085 Report of Gasoline Sold to Licensed Kentucky Dealers - Kentucky

What Is Form 72A085?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A085?

A: Form 72A085 is the Report of Gasoline Sold to Licensed Kentucky Dealers.

Q: Who is required to file Form 72A085?

A: Licensed Kentucky dealers are required to file Form 72A085.

Q: What information is included in Form 72A085?

A: Form 72A085 includes information about the gasoline sold to licensed Kentucky dealers.

Q: What is the purpose of filing Form 72A085?

A: The purpose of filing Form 72A085 is to report the gasoline sold to licensed Kentucky dealers.

Q: How often is Form 72A085 filed?

A: Form 72A085 is filed on a monthly basis.

Q: Are there any penalties for not filing Form 72A085?

A: Yes, there are penalties for not filing Form 72A085. It is important to file the form accurately and timely to avoid penalties.

Q: Is Form 72A085 only for gasoline sales in Kentucky?

A: Yes, Form 72A085 is specifically for reporting gasoline sales to licensed Kentucky dealers.

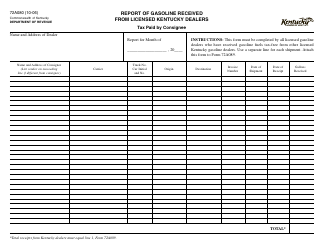

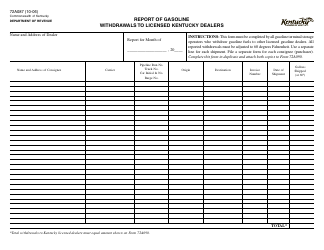

Q: What other forms may be required for gasoline sales in Kentucky?

A: Other forms that may be required for gasoline sales in Kentucky include the Motor Fuel Monthly Report and the Schedule K-1.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A085 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.