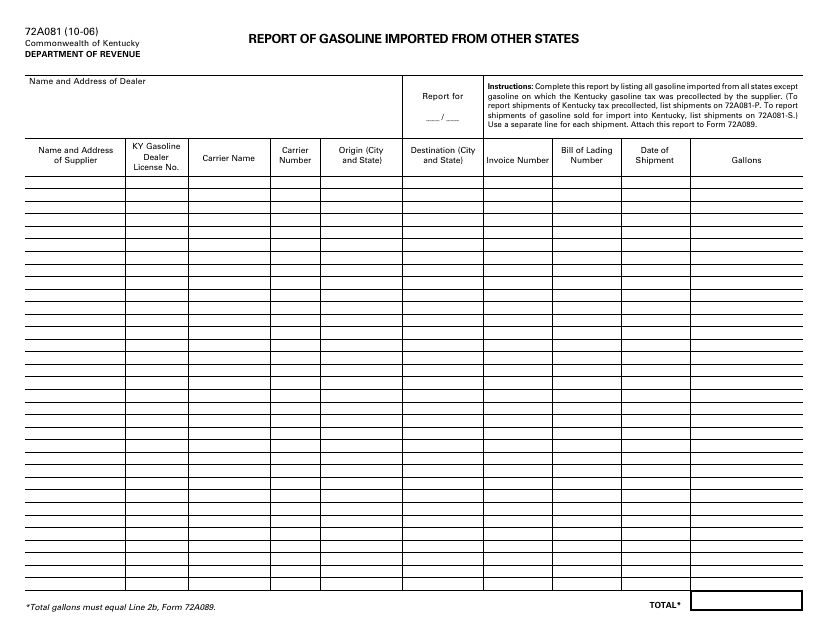

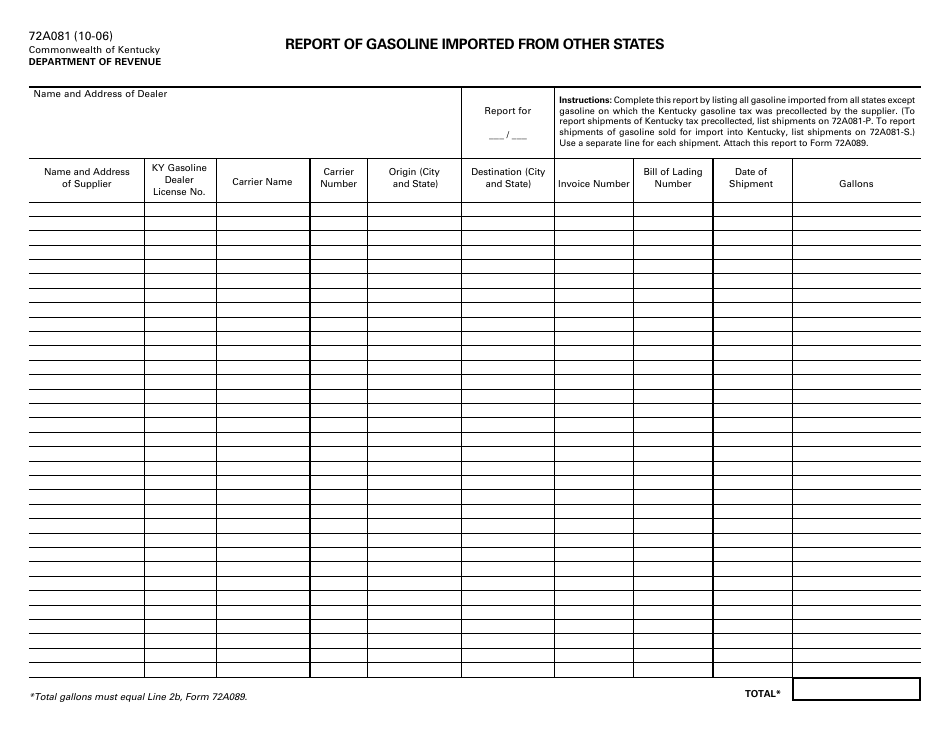

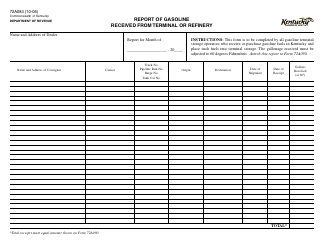

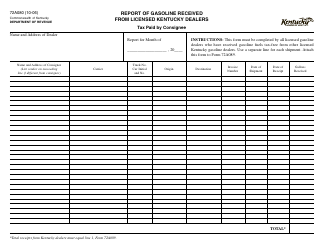

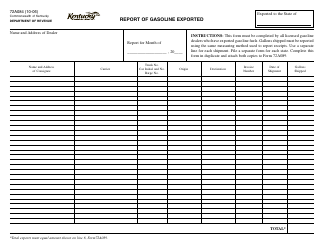

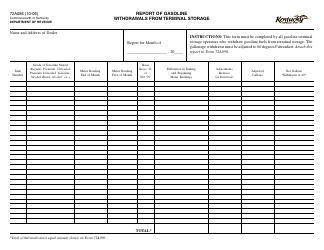

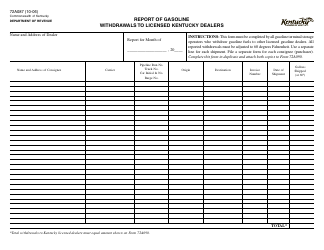

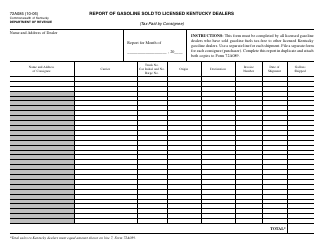

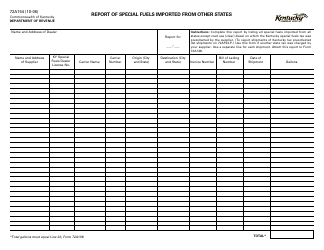

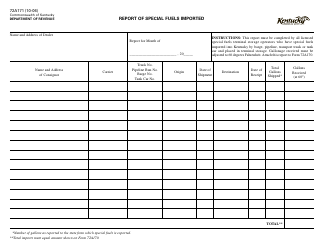

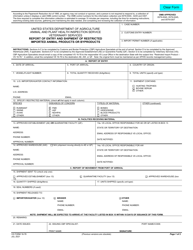

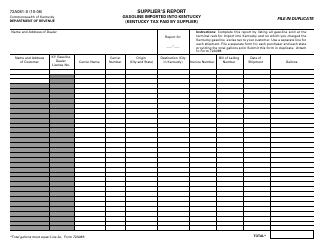

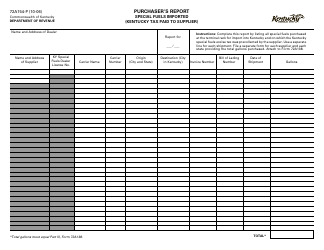

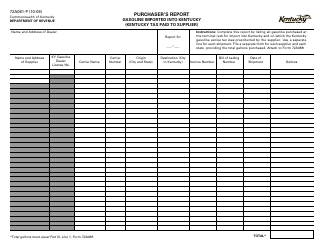

Form 72A081 Report of Gasoline Imported From Other States - Kentucky

What Is Form 72A081?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form 72A081?

A: Form 72A081 is used to report gasoline imported from other states into Kentucky.

Q: Who needs to file Form 72A081?

A: Individuals or businesses that import gasoline from other states into Kentucky need to file Form 72A081.

Q: What information is required on Form 72A081?

A: Form 72A081 requires information such as the type and quantity of gasoline imported, the origin state, and the date of import.

Q: Are there any filing fees for Form 72A081?

A: No, there are no filing fees for Form 72A081.

Q: What is the deadline for filing Form 72A081?

A: Form 72A081 must be filed by the 20th day of the month following the month of import.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A081 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.