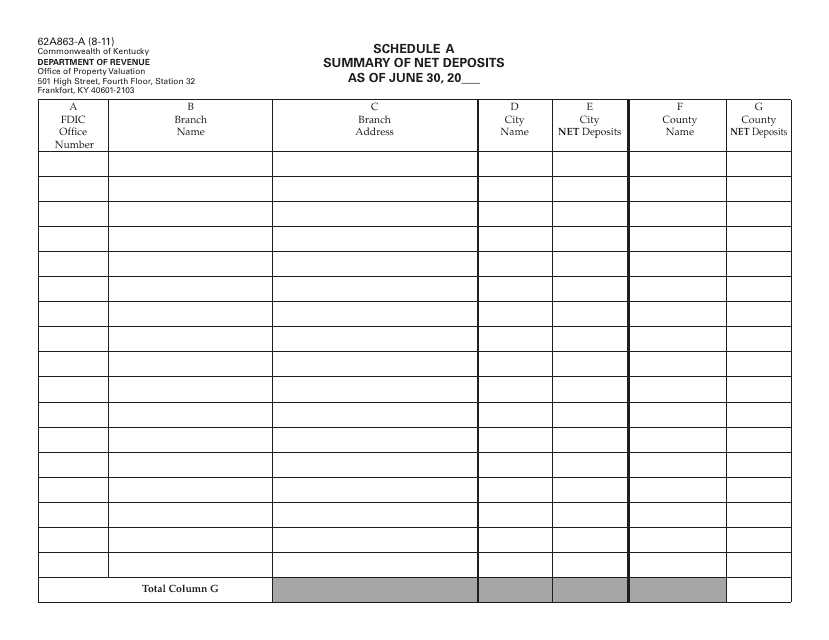

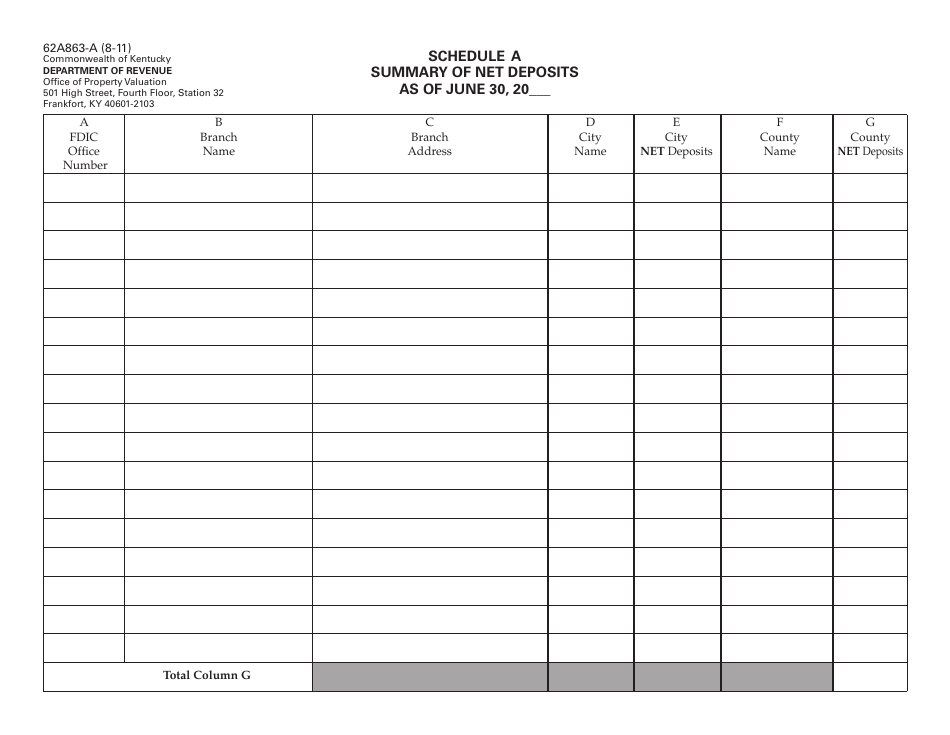

Form 62A863-A Schedule A Summary of Net Deposits - Kentucky

What Is Form 62A863-A Schedule A?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 62A863-A?

A: Form 62A863-A is a schedule that summarizes net deposits in Kentucky.

Q: What is the purpose of Form 62A863-A?

A: The purpose of Form 62A863-A is to provide a summary of net deposits.

Q: Who needs to file Form 62A863-A?

A: Taxpayers in Kentucky who have net deposits need to file Form 62A863-A.

Q: What information is required on Form 62A863-A?

A: Form 62A863-A requires information about the taxpayer's net deposits.

Q: When is the deadline to file Form 62A863-A?

A: The deadline to file Form 62A863-A is usually April 15th, unless an extension is granted.

Q: Is there a penalty for late filing of Form 62A863-A?

A: Yes, there may be penalties for late filing of Form 62A863-A.

Q: Can Form 62A863-A be filed electronically?

A: Yes, Form 62A863-A can be filed electronically.

Q: What should I do if I made a mistake on Form 62A863-A?

A: If you made a mistake on Form 62A863-A, you should contact the Kentucky Department of Revenue for guidance.

Q: Can I claim deductions or credits on Form 62A863-A?

A: No, Form 62A863-A is a schedule that summarizes net deposits and does not allow for deductions or credits.

Form Details:

- Released on August 1, 2011;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 62A863-A Schedule A by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.