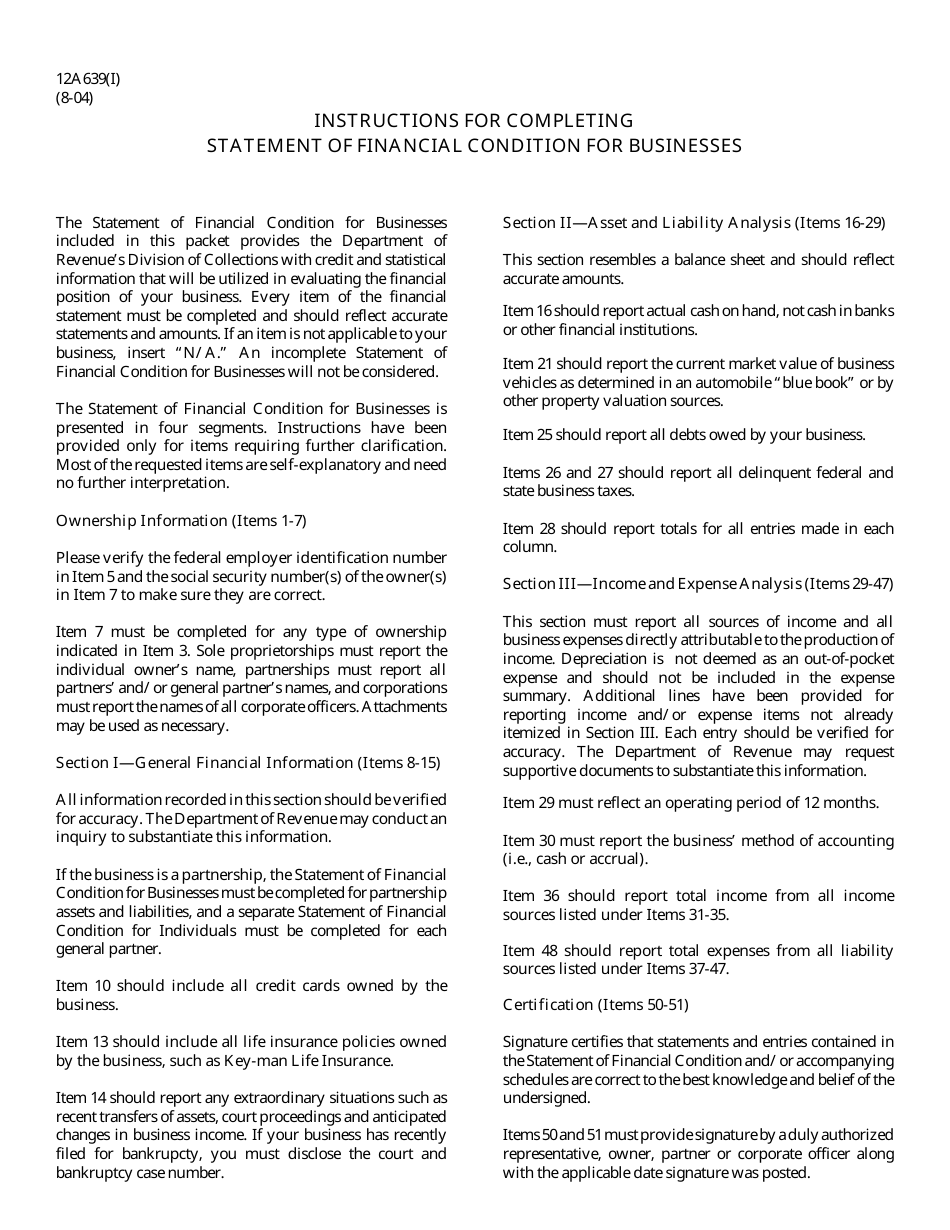

Form 12A639 Statement of Financial Condition for Businesses - Kentucky

What Is Form 12A639?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 12A639?

A: Form 12A639 is the Statement of Financial Condition for Businesses in Kentucky.

Q: Who needs to file Form 12A639?

A: Businesses operating in Kentucky may need to file Form 12A639.

Q: What is the purpose of Form 12A639?

A: Form 12A639 is used to report the financial condition of businesses to the Kentucky Department of Revenue.

Q: When is Form 12A639 due?

A: The due date for filing Form 12A639 varies and depends on the fiscal year-end of the business.

Q: Are there any fines or penalties for late filing?

A: Yes, there may be fines or penalties for late filing of Form 12A639. It is important to file the form on time.

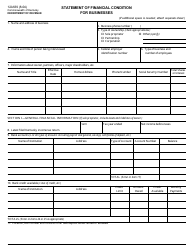

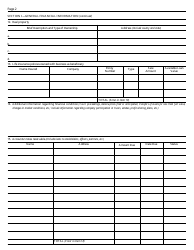

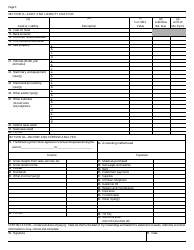

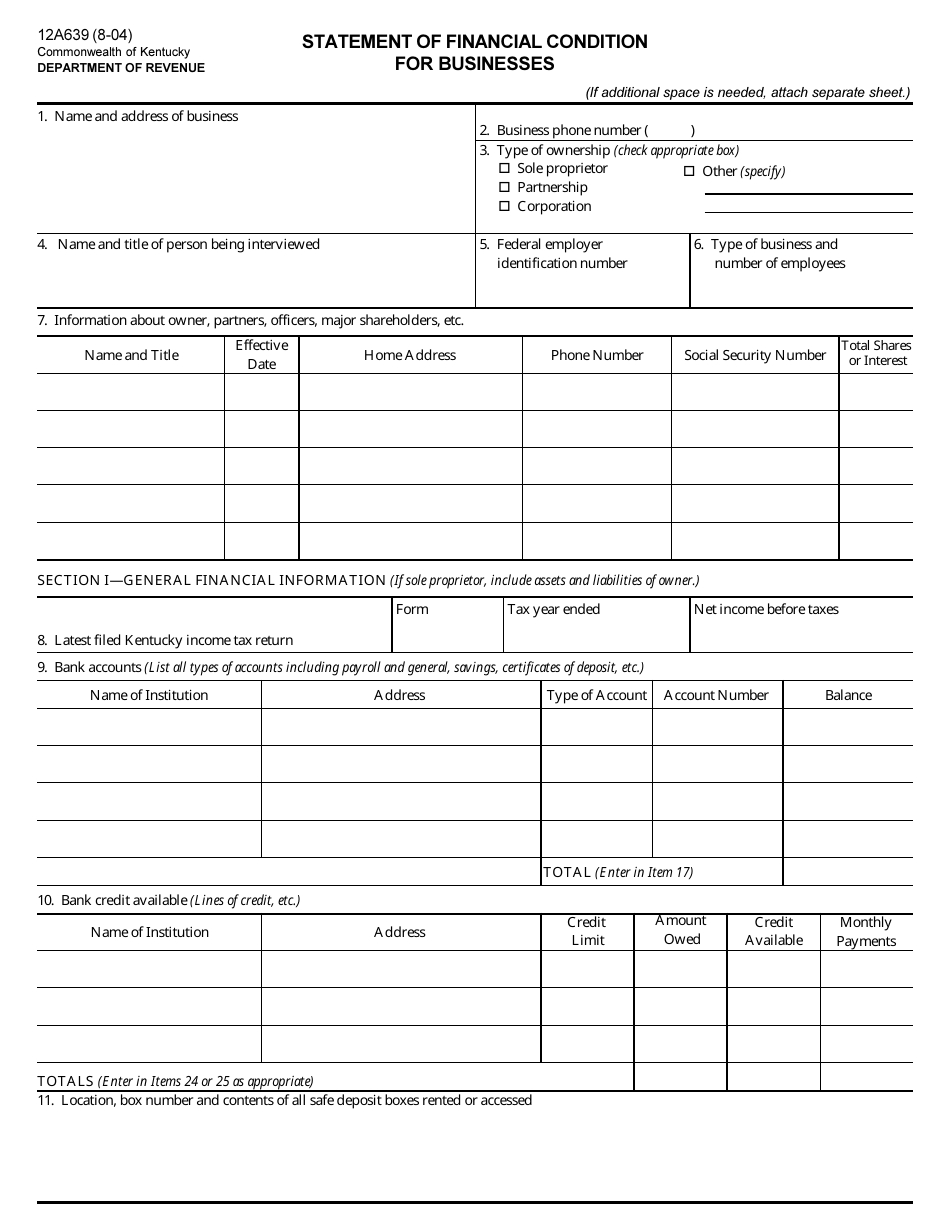

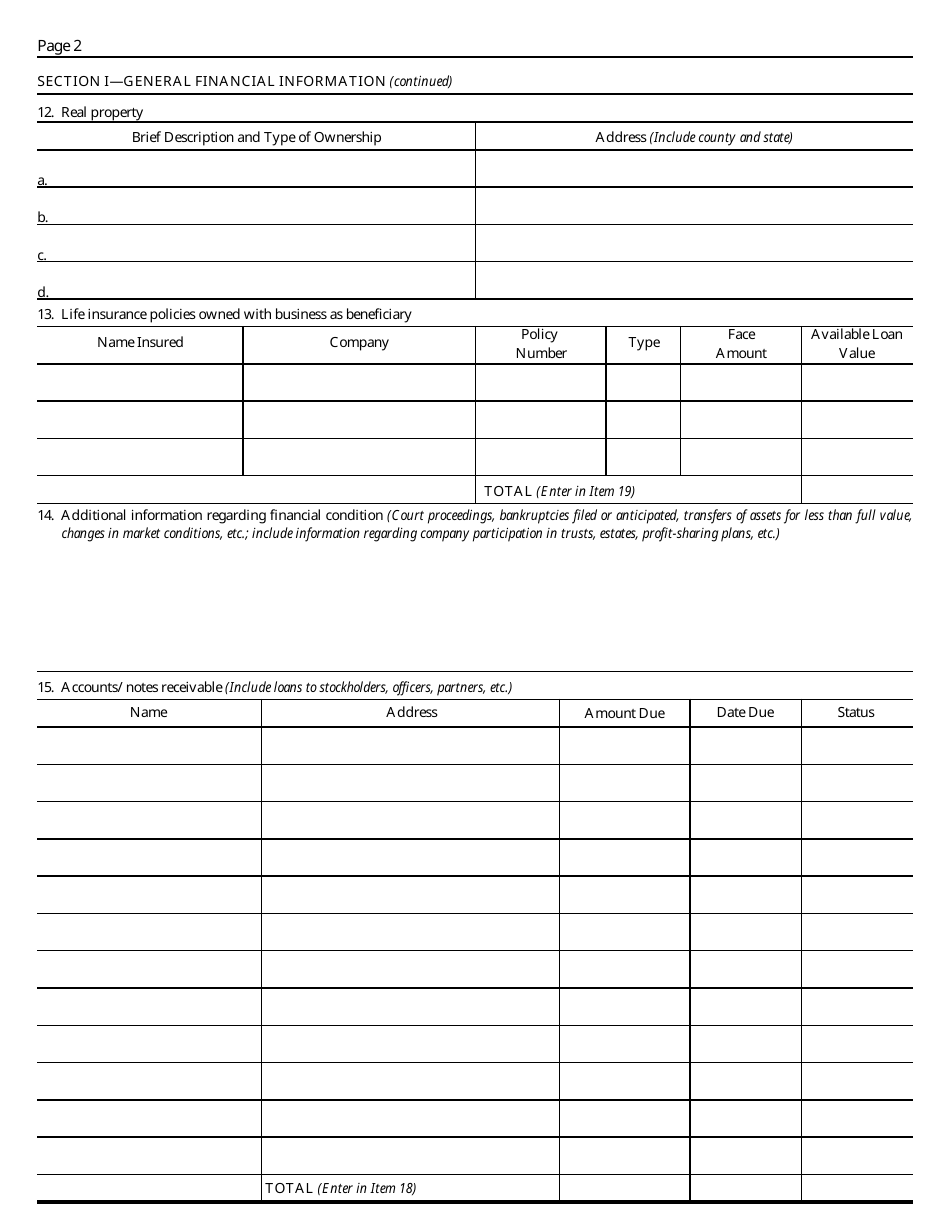

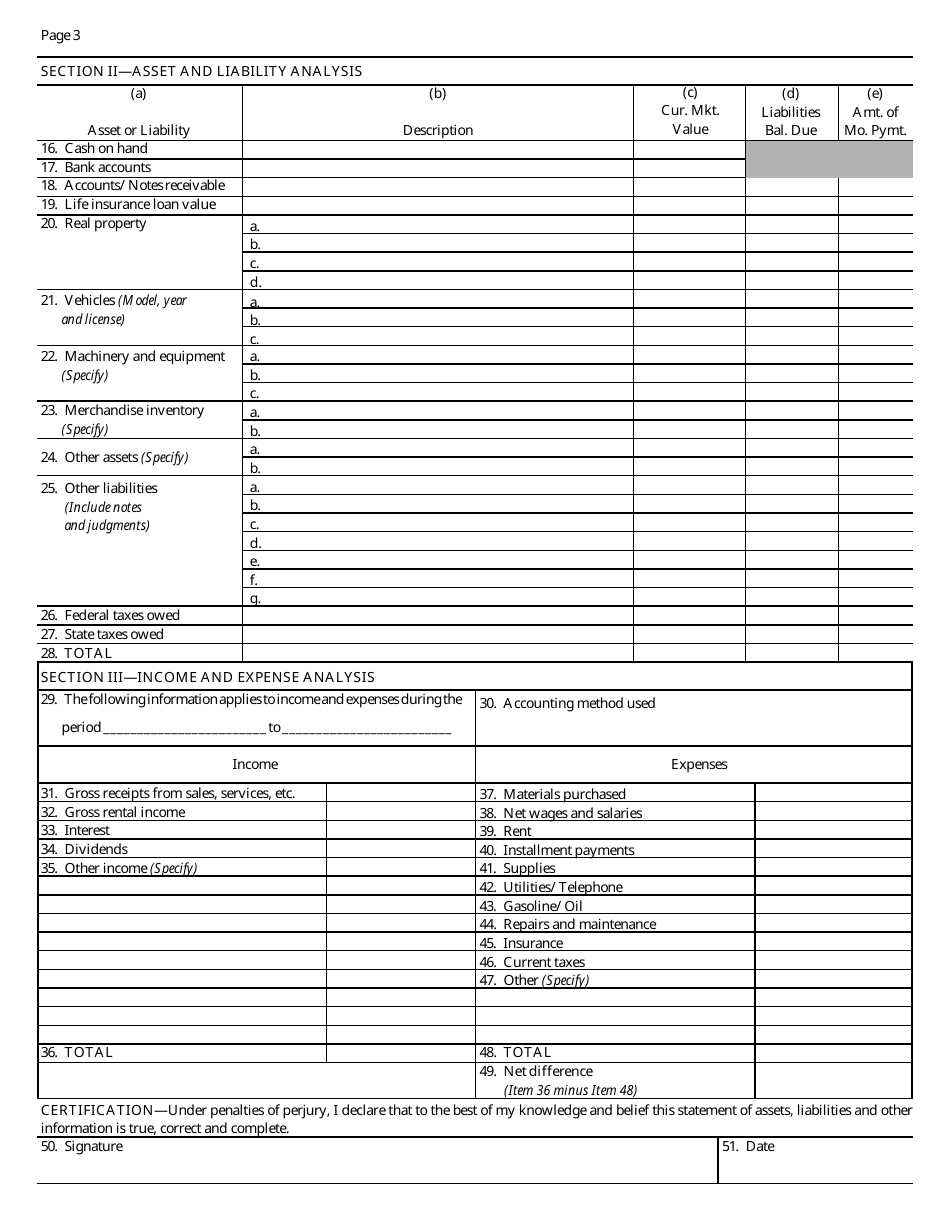

Q: What information is required on Form 12A639?

A: Form 12A639 requires information about the business's assets, liabilities, income, expenses, and other financial details.

Q: Do I need to attach any supporting documents with Form 12A639?

A: You may be required to attach supporting documents such as balance sheets, profit and loss statements, or other financial records to Form 12A639.

Form Details:

- Released on August 1, 2004;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 12A639 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.