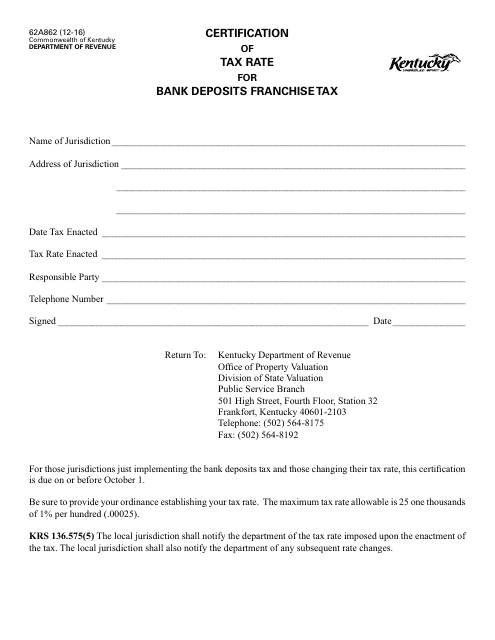

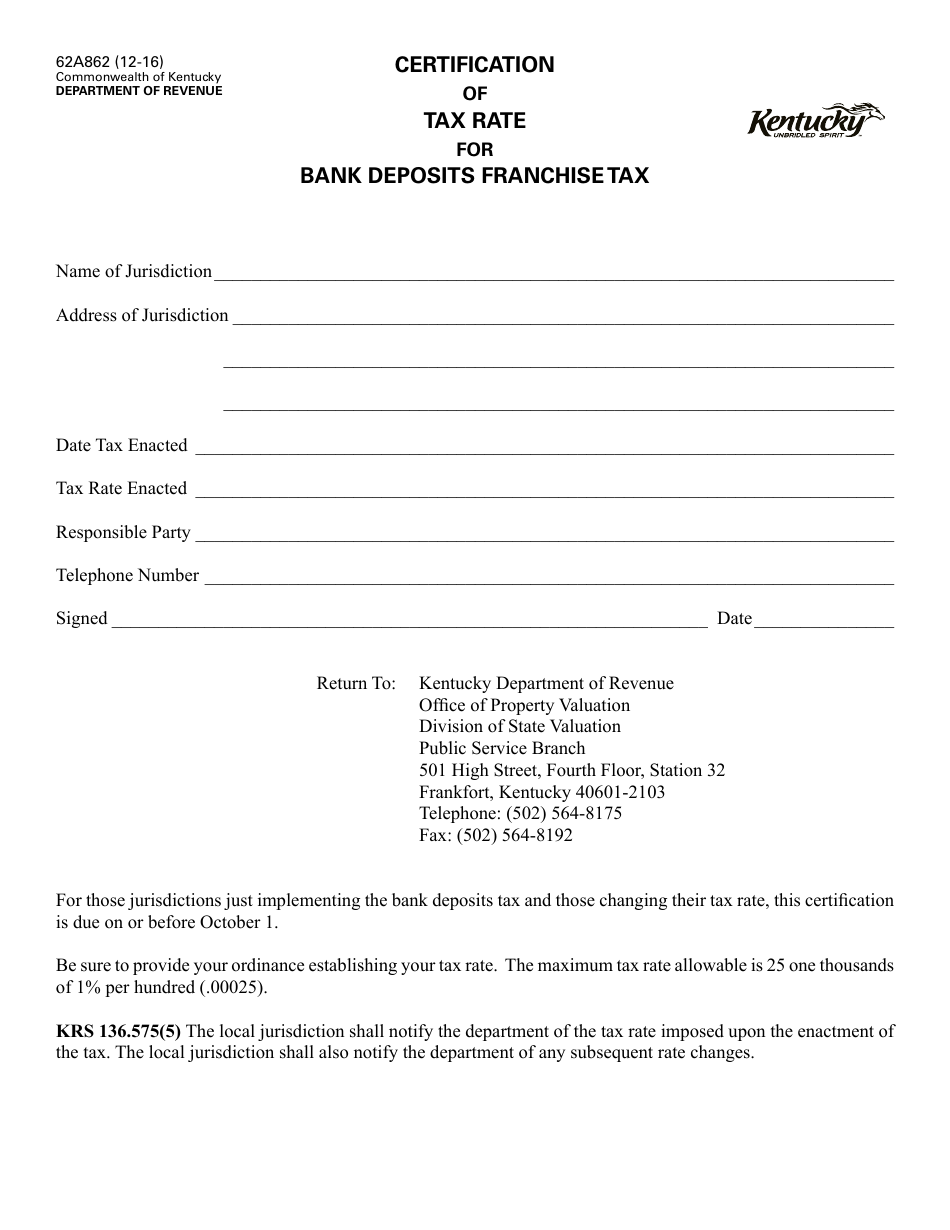

Form 62A862 Certification of Tax Rate for Bank Deposits Franchise Tax - Kentucky

What Is Form 62A862?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 62A862?

A: Form 62A862 is the Certification of Tax Rate for Bank DepositsFranchise Tax in Kentucky.

Q: Who needs to file Form 62A862?

A: Financial institutions that are subject to the Bank Deposits Franchise Tax in Kentucky need to file Form 62A862.

Q: What is the purpose of Form 62A862?

A: The purpose of Form 62A862 is to certify the tax rate applicable to bank deposits for the calculation of the Bank Deposits Franchise Tax.

Q: When is the deadline to file Form 62A862?

A: The deadline to file Form 62A862 is typically the same as the due date for the Bank Deposits Franchise Tax return, which is April 15th for calendar year taxpayers.

Q: Are there any penalties for late filing of Form 62A862?

A: Yes, there may be penalties for late filing of Form 62A862, including potential interest charges on the unpaid tax amount.

Q: Is Form 62A862 required for all financial institutions in Kentucky?

A: No, Form 62A862 is only required for financial institutions that are subject to the Bank Deposits Franchise Tax in Kentucky.

Q: What information is required on Form 62A862?

A: Form 62A862 requires information such as the financial institution's name, address, taxpayer identification number, and the certified tax rate for bank deposits.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 62A862 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.