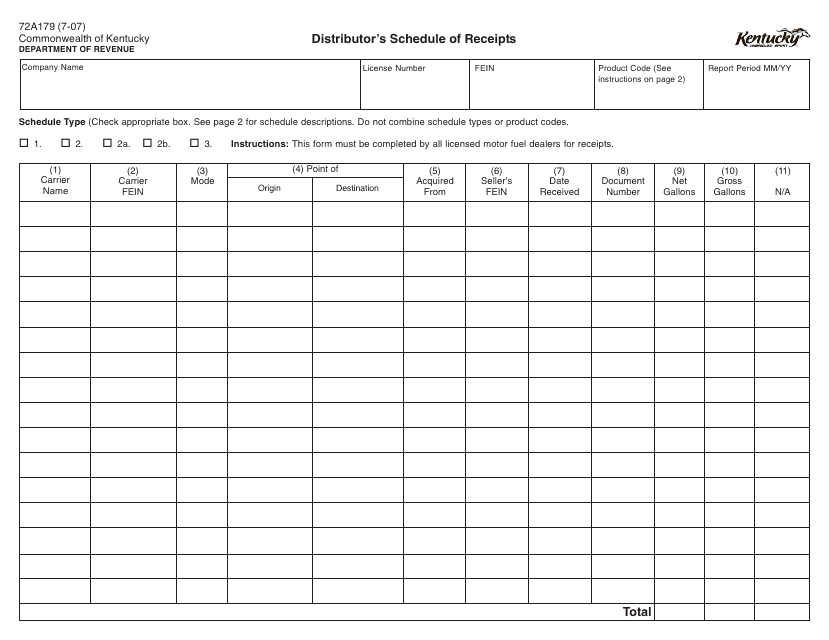

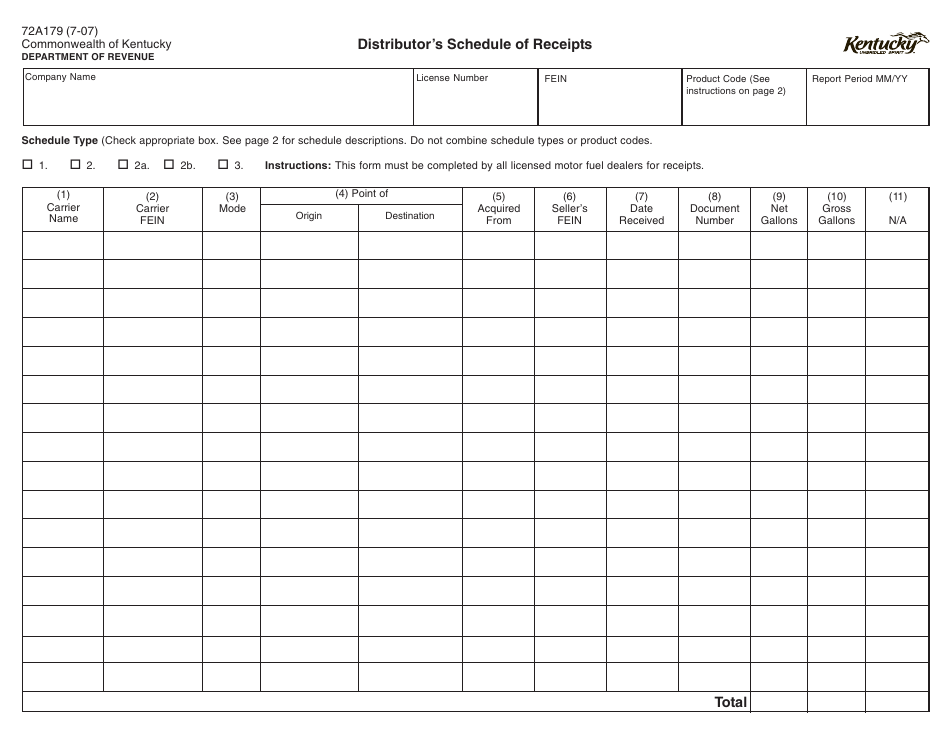

Form 72A179 Distributor's Schedule of Receipts - Kentucky

What Is Form 72A179?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

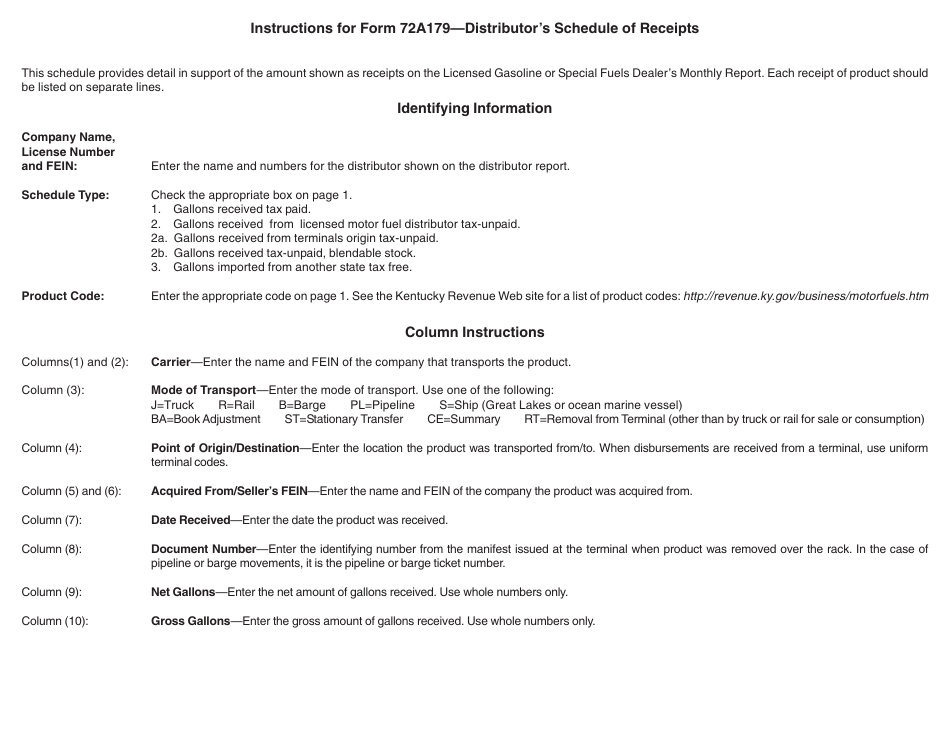

Q: What is Form 72A179 Distributor's Schedule of Receipts?

A: Form 72A179 is a schedule used by distributors in Kentucky to report their receipts for various products.

Q: Who needs to file Form 72A179 in Kentucky?

A: Distributors of certain products, such as tobacco and alcoholic beverages, are required to file Form 72A179 in Kentucky.

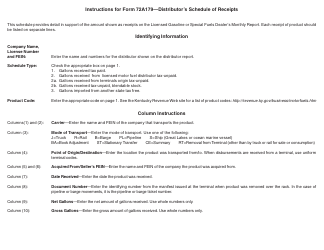

Q: What information is reported on Form 72A179?

A: Form 72A179 requires distributors to report details about their receipts, including the type of product, quantity received, and other relevant information.

Q: When is Form 72A179 due in Kentucky?

A: The due date for filing Form 72A179 in Kentucky is typically the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing Form 72A179?

A: Yes, failure to timely file Form 72A179 or underreporting receipts may result in penalties or interest charges in Kentucky.

Form Details:

- Released on July 1, 2007;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A179 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.