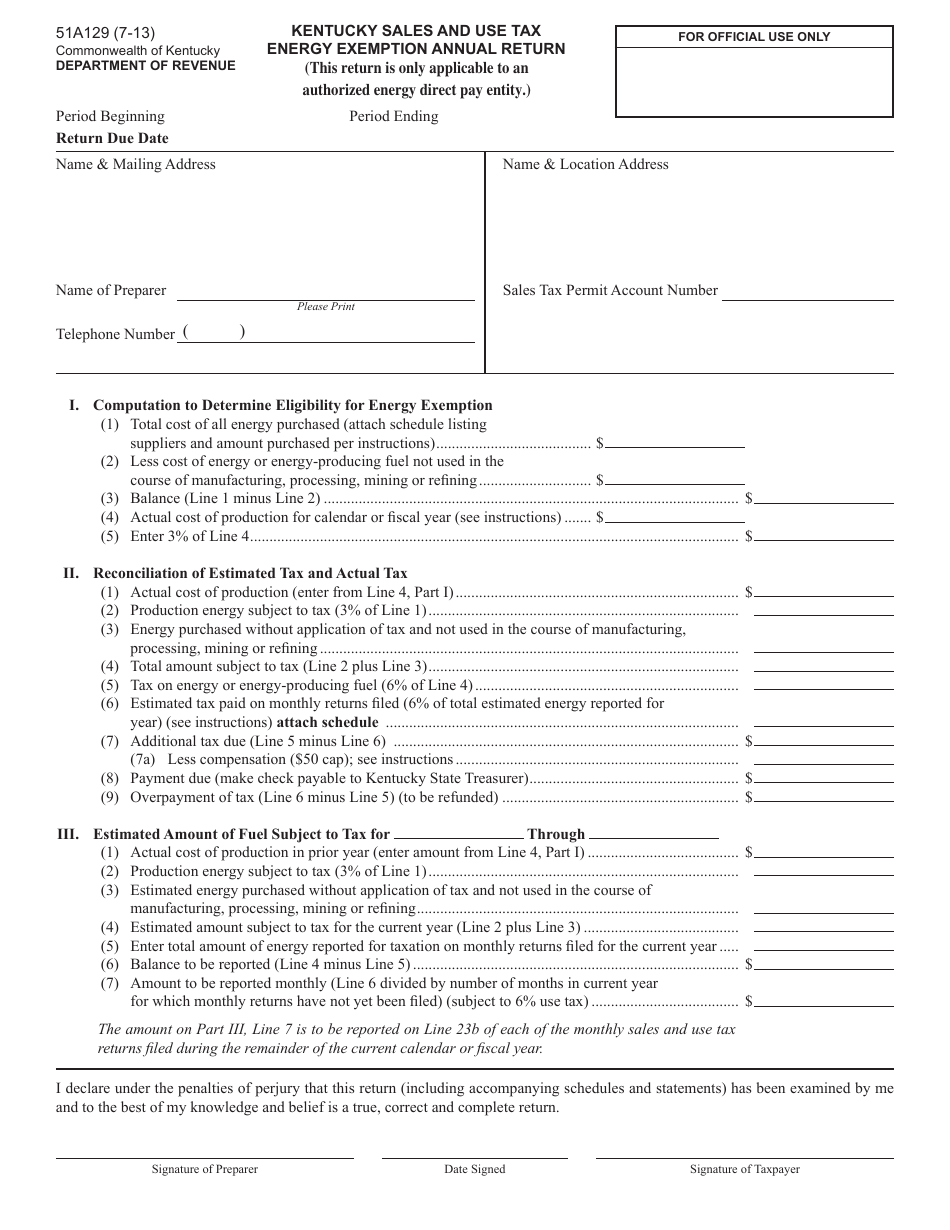

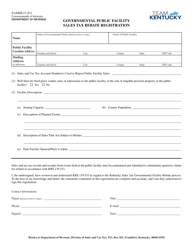

Form 51A129 Energy Exemption Annual Return - Kentucky Sales and Use Tax - Kentucky

What Is Form 51A129?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

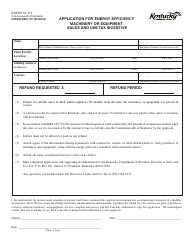

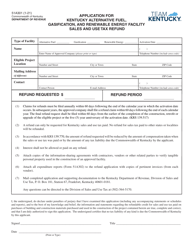

Q: What is Form 51A129 Energy Exemption Annual Return?

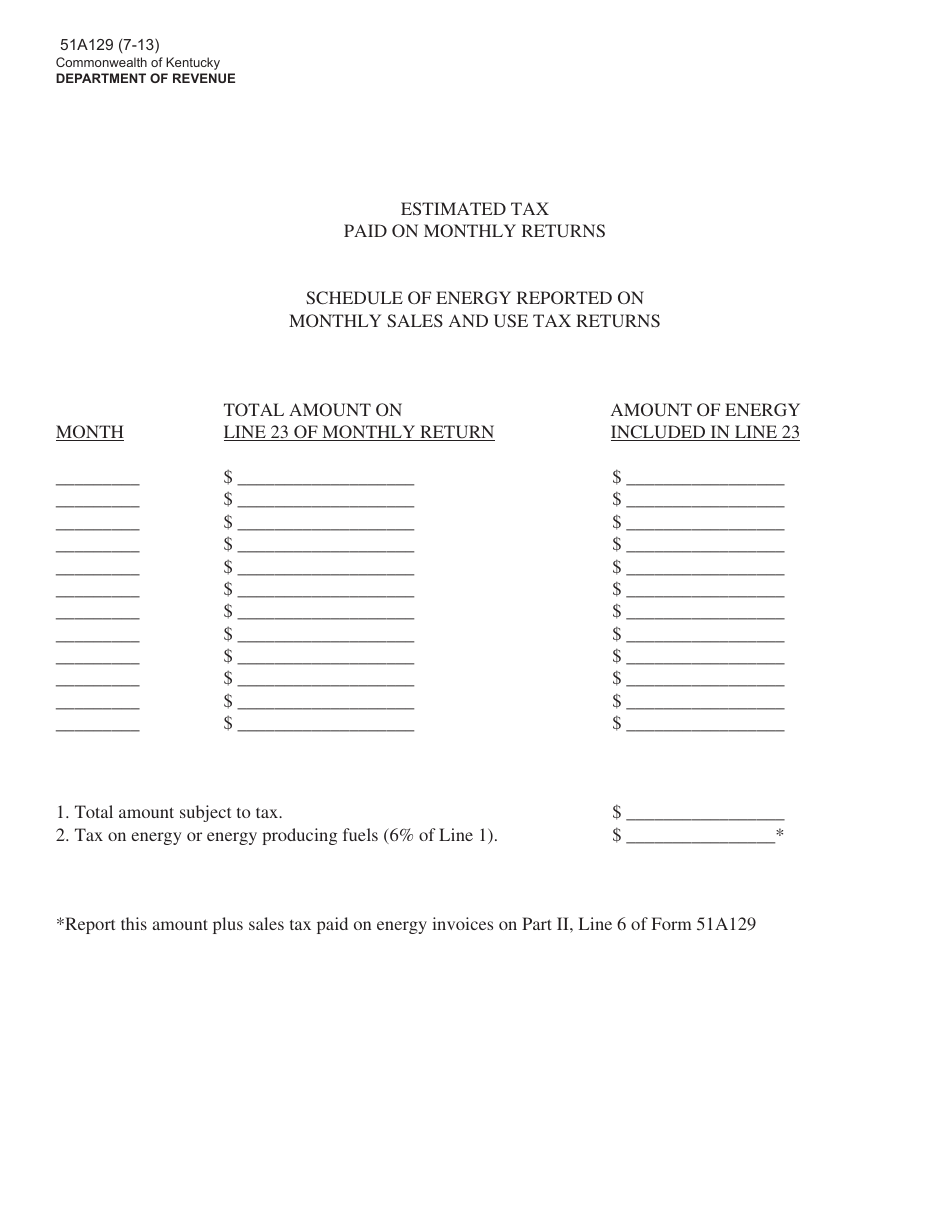

A: Form 51A129 Energy Exemption Annual Return is a form used for reporting and claiming an exemption for energy-related purchases on the Kentucky Sales and Use Tax.

Q: Who needs to file Form 51A129 Energy Exemption Annual Return?

A: Businesses and individuals in Kentucky who have made qualifying energy-related purchases may need to file this form.

Q: What is the purpose of Form 51A129 Energy Exemption Annual Return?

A: The purpose of this form is to allow businesses and individuals to claim an exemption for energy-related purchases that are not subject to the Kentucky Sales and Use Tax.

Q: When is Form 51A129 Energy Exemption Annual Return due?

A: This form is due annually on the 20th day of the month following the end of the calendar year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing or failure to file this form. It is important to submit the form by the due date to avoid penalties.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A129 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.