This version of the form is not currently in use and is provided for reference only. Download this version of

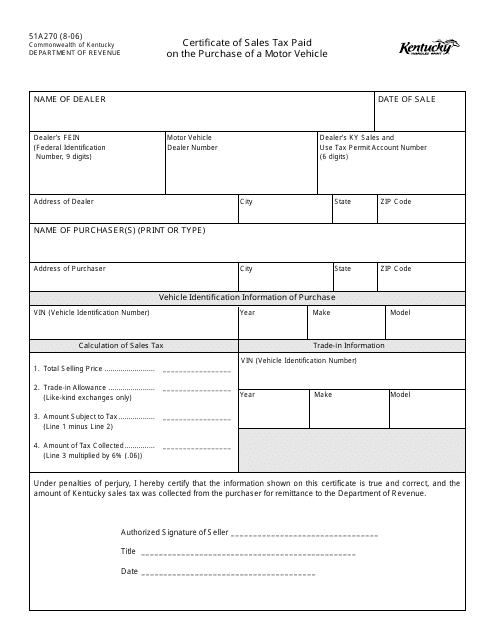

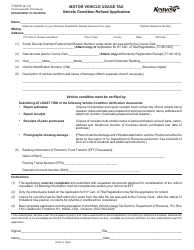

Form 51A270

for the current year.

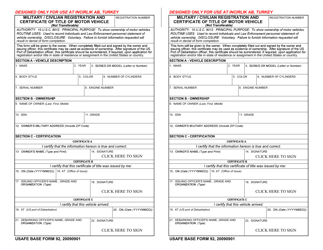

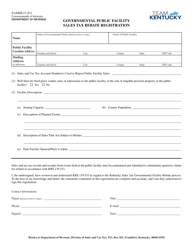

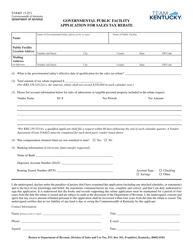

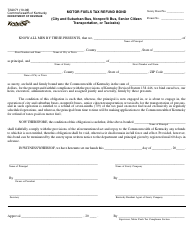

Form 51A270 Certificate of Sales Tax Paid on the Purchase of a Motor Vehicle - Kentucky

What Is Form 51A270?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A270?

A: Form 51A270 is the Certificate of Sales Tax Paid on the Purchase of a Motor Vehicle in Kentucky.

Q: Why do I need Form 51A270?

A: You need Form 51A270 to prove that you have paid the sales tax on the purchase of a motor vehicle in Kentucky.

Q: What information is required on Form 51A270?

A: Form 51A270 requires information such as the vehicle identification number (VIN), purchase price, and the name of the buyer and seller.

Q: When should I submit Form 51A270?

A: You should submit Form 51A270 within 15 days of purchasing the motor vehicle.

Form Details:

- Released on August 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A270 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.