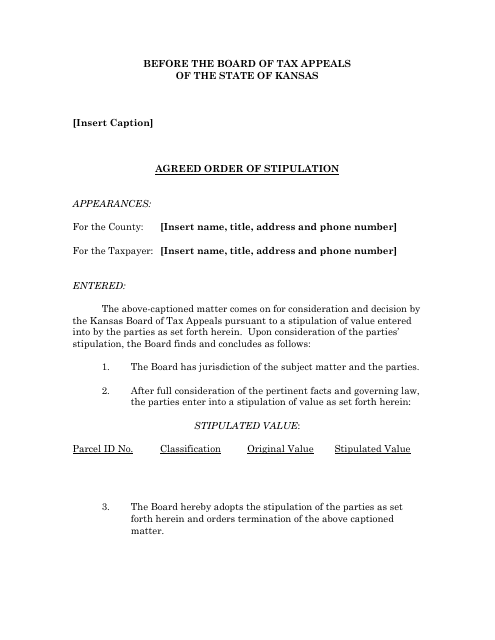

Agreed Order of Stipulation - Kansas

Agreed Order of Stipulation is a legal document that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas.

FAQ

Q: What is an Agreed Order of Stipulation?

A: An Agreed Order of Stipulation is a legal agreement between parties in a case that outlines specific terms and conditions they have agreed upon.

Q: What is the purpose of an Agreed Order of Stipulation?

A: The purpose of an Agreed Order of Stipulation is to provide a written record of the parties' agreement and to have it approved by the court as an enforceable order.

Q: Who can enter into an Agreed Order of Stipulation?

A: Any party involved in a legal case can enter into an Agreed Order of Stipulation, provided all the parties involved are in agreement.

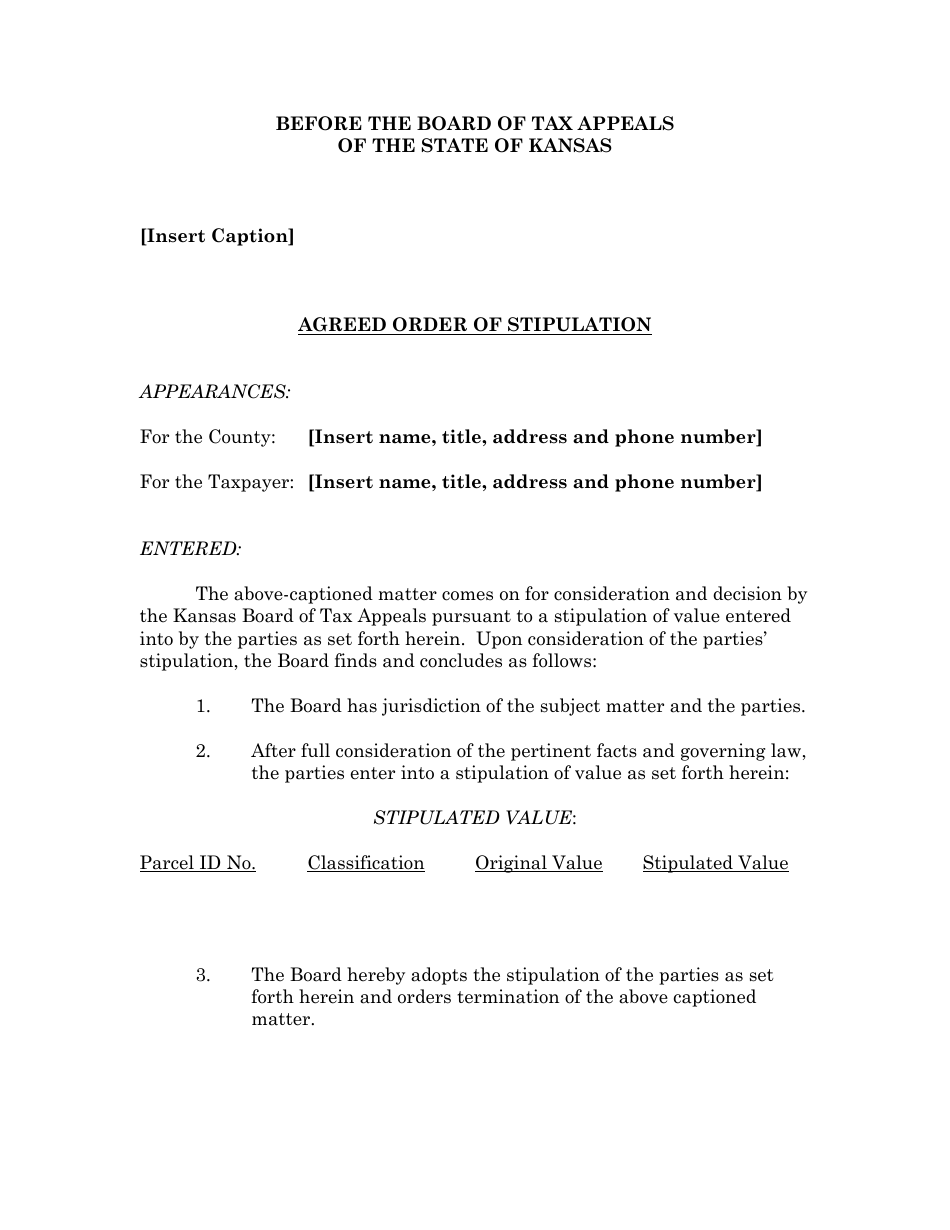

Q: What is the process for obtaining an Agreed Order of Stipulation?

A: To obtain an Agreed Order of Stipulation, the parties involved must negotiate and reach a mutual agreement on the terms and conditions. The agreed-upon order is then submitted to the court for approval.

Q: Can an Agreed Order of Stipulation be modified?

A: An Agreed Order of Stipulation can be modified if all parties involved agree to the changes and the court approves the modifications.

Q: What happens if one party violates an Agreed Order of Stipulation?

A: If one party violates an Agreed Order of Stipulation, the other party can seek enforcement through the court and may be entitled to remedies such as damages or specific performance.

Form Details:

- The latest edition currently provided by the Kansas Board of Tax Appeals;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.