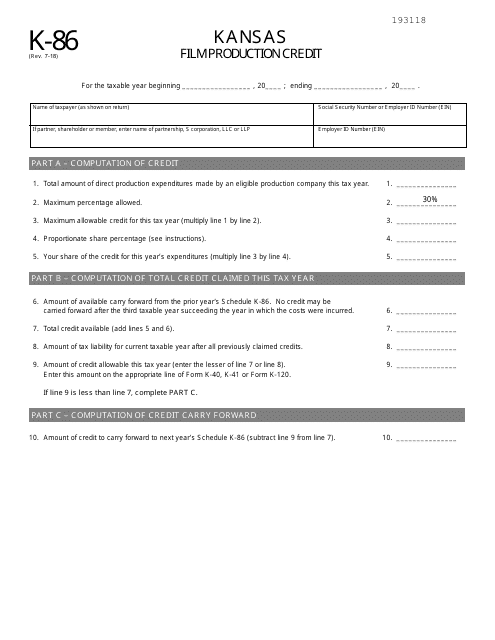

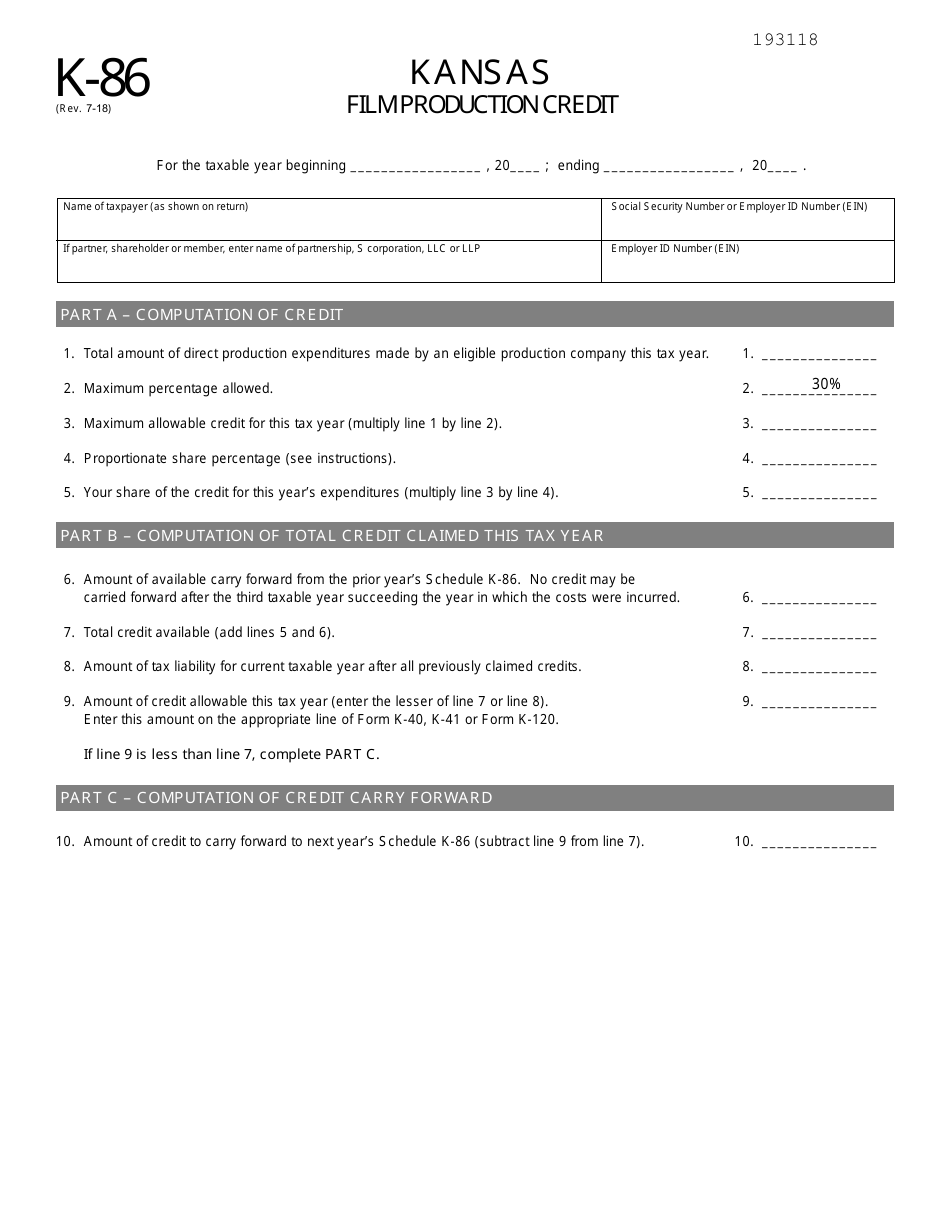

Form K-86 Film Production Credit - Kansas

What Is Form K-86?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-86?

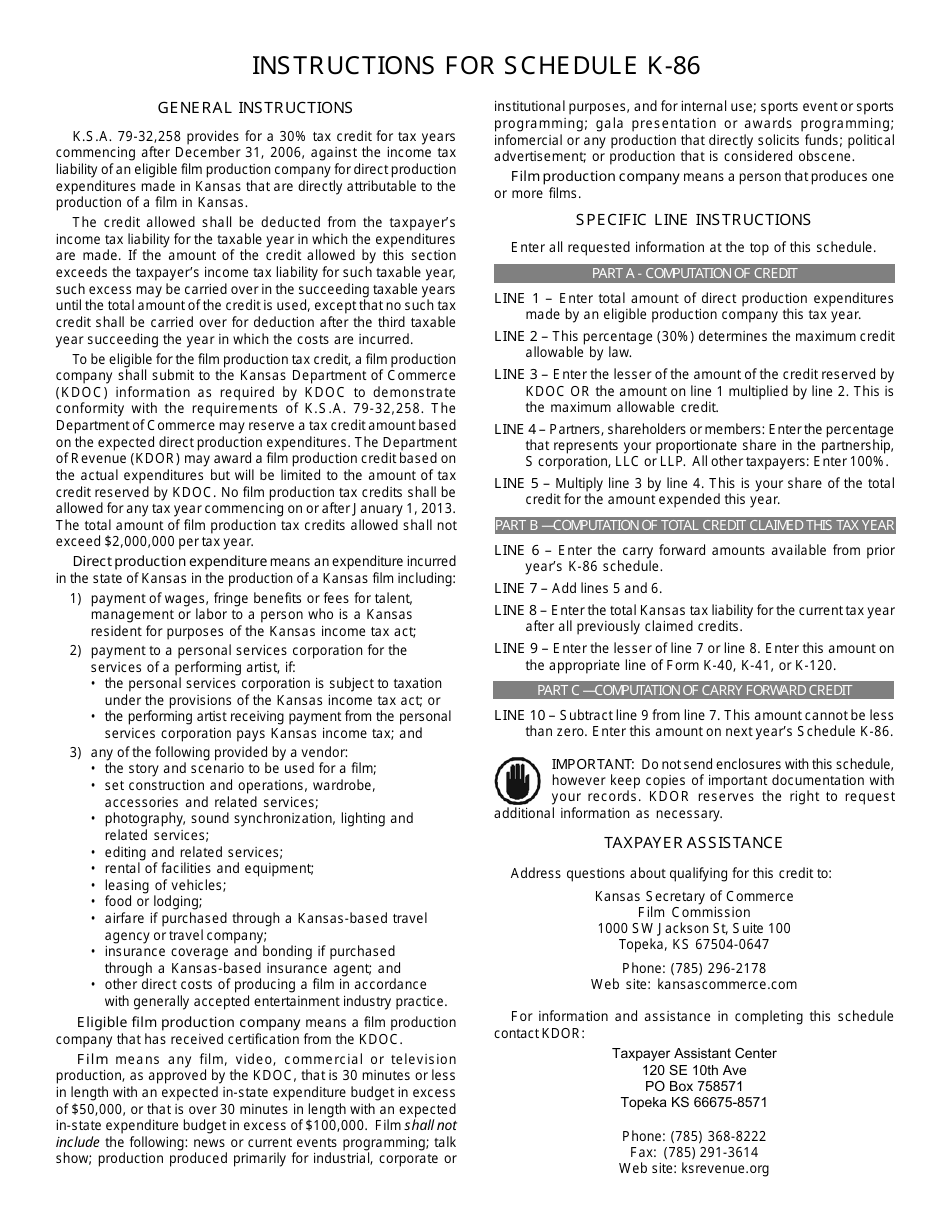

A: Form K-86 is a tax form used in Kansas to claim the Film Production Credit.

Q: What is the Film Production Credit in Kansas?

A: The Film Production Credit is a tax credit available in Kansas for qualifying film production expenses.

Q: Who can claim the Film Production Credit?

A: Film production companies that meet certain criteria can claim the Film Production Credit in Kansas.

Q: What expenses qualify for the Film Production Credit?

A: Qualifying expenses for the Film Production Credit include wages, salaries, and fringe benefits paid to Kansas residents, among other things.

Q: Is the Film Production Credit refundable?

A: Yes, the Film Production Credit in Kansas is refundable, meaning it can result in a cash refund if the credit exceeds the taxpayer's liability.

Q: Are there any limitations or restrictions on the Film Production Credit?

A: Yes, there are limitations and restrictions on the Film Production Credit, including a cap on the total amount of credits that can be claimed each year.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-86 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.