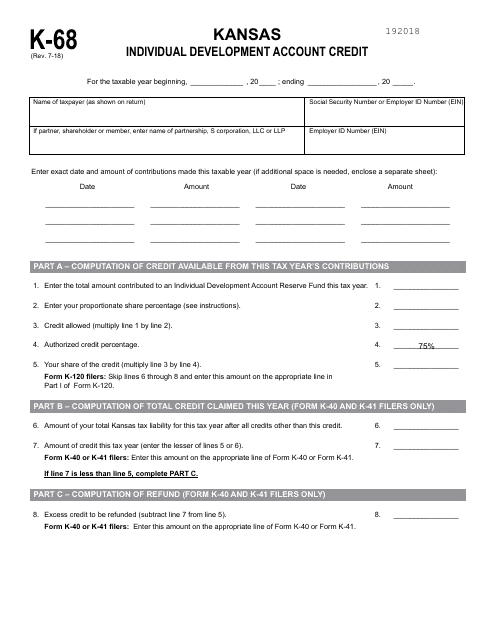

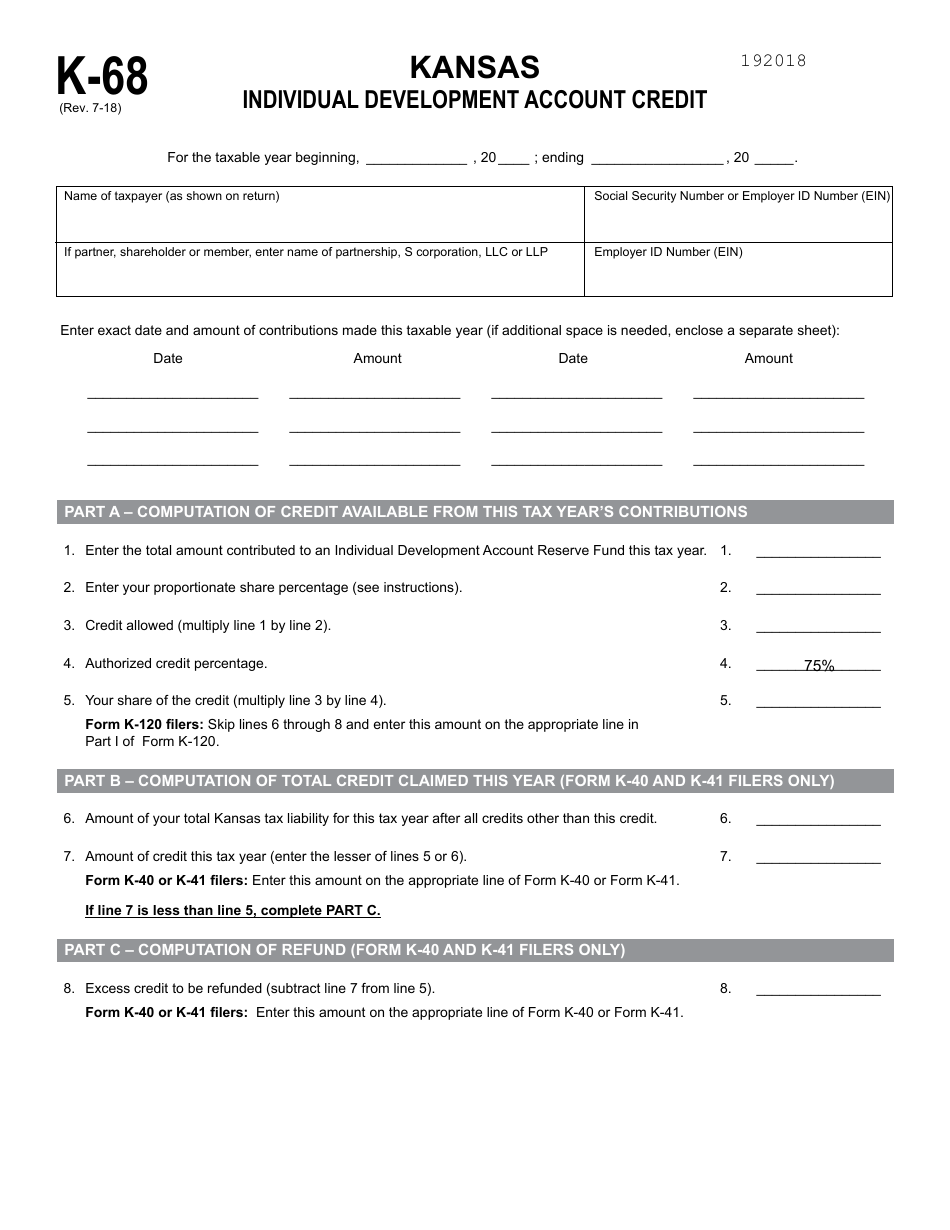

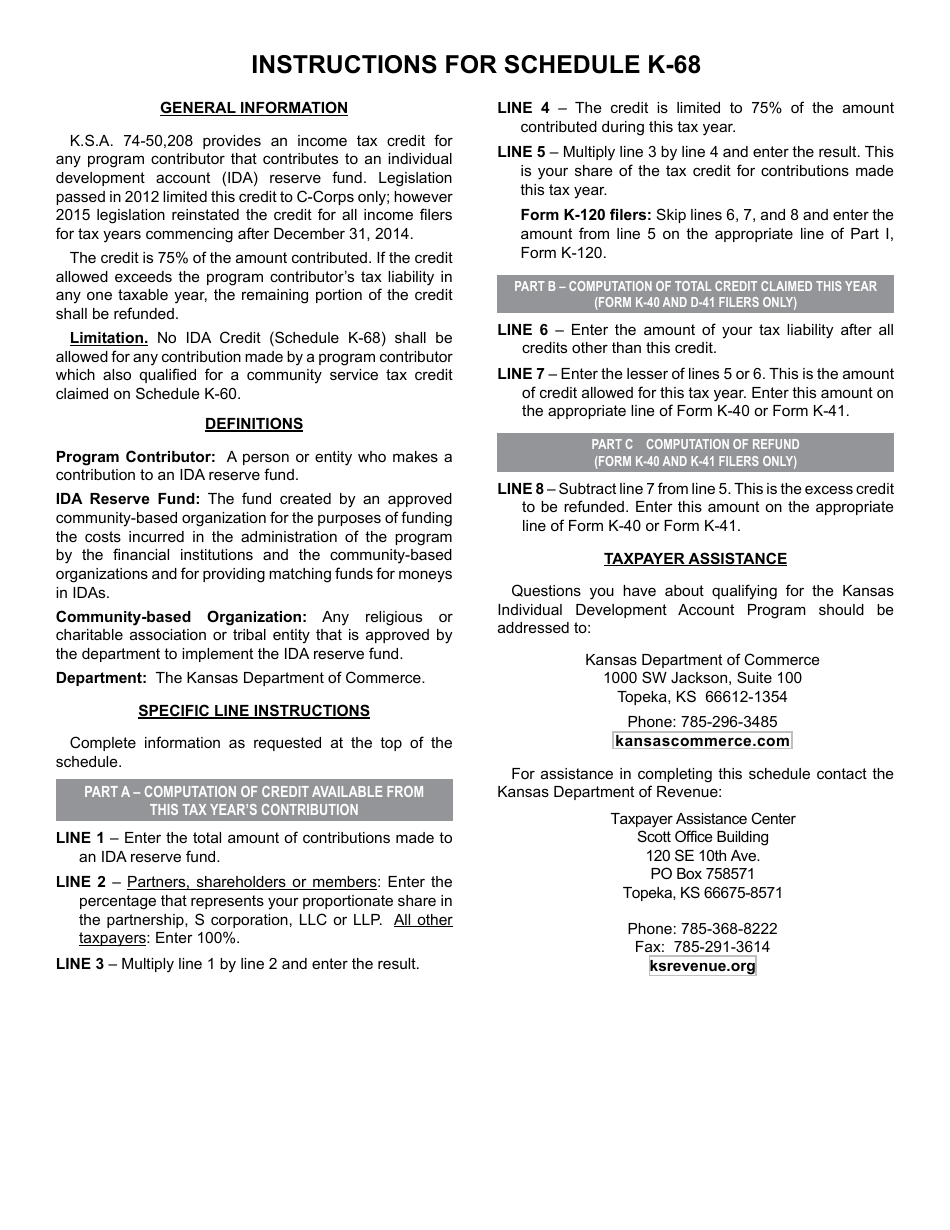

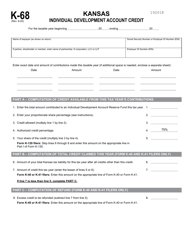

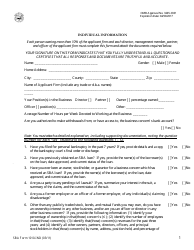

Form K-68 Kansas Individual Development Account Credit - Kansas

What Is Form K-68?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-68?

A: Form K-68 is the Kansas Individual Development Account Credit.

Q: What is the purpose of Form K-68?

A: The purpose of Form K-68 is to claim the Kansas Individual Development Account Credit.

Q: Who can use Form K-68?

A: Any individual who is eligible for the Kansas Individual Development Account Credit can use Form K-68.

Q: How do I qualify for the Kansas Individual Development Account Credit?

A: To qualify for the Kansas Individual Development Account Credit, you must meet certain income and contribution requirements.

Q: What expenses are eligible for the Kansas Individual Development Account Credit?

A: Expenses related to an individual development account, which is a special savings account, are eligible for the Kansas Individual Development Account Credit.

Q: Is there a limit to the amount of credit I can claim with Form K-68?

A: Yes, there is a limit to the amount of credit you can claim with Form K-68. The maximum credit amount is $800.

Q: How do I claim the Kansas Individual Development Account Credit?

A: To claim the Kansas Individual Development Account Credit, you need to complete and submit Form K-68 with your tax return.

Q: Are there any other forms or documents I need to include when filing Form K-68?

A: Yes, you may need to include supporting documentation such as Form K-40 Individual Income Tax Return and proof of contributions to your individual development account.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-68 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.