This version of the form is not currently in use and is provided for reference only. Download this version of

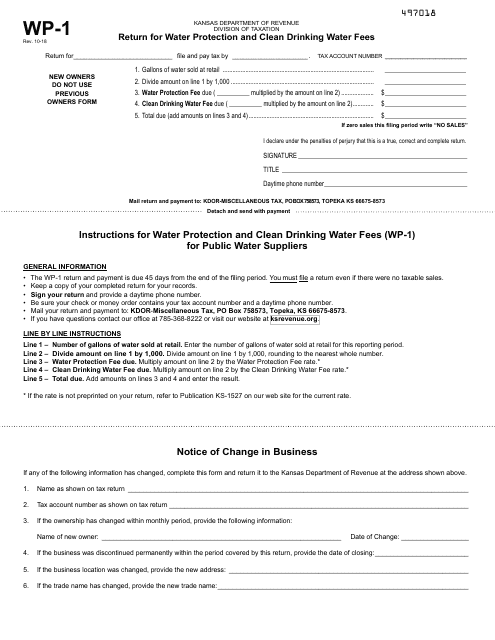

Form WP-1

for the current year.

Form WP-1 Return for Water Protection and Clean Drinking Water Fees - Kansas

What Is Form WP-1?

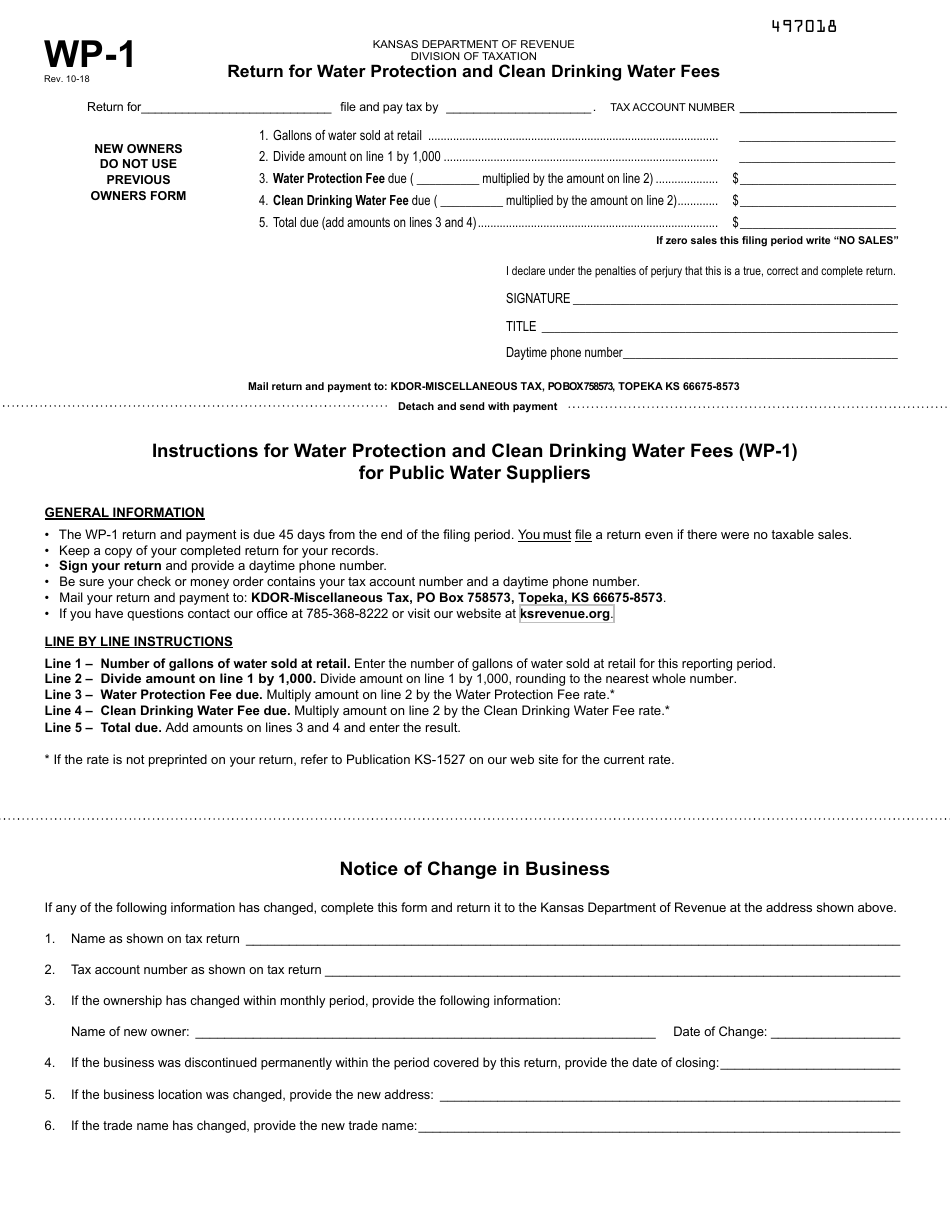

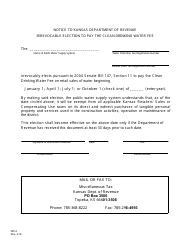

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WP-1?

A: Form WP-1 is a tax form used to report and pay Water Protection and Clean Drinking Water fees in Kansas.

Q: Who needs to file Form WP-1?

A: Businesses in Kansas that are subject to Water Protection and Clean Drinking Water fees need to file Form WP-1.

Q: What are Water Protection and Clean Drinking Water fees?

A: Water Protection and Clean Drinking Water fees are charges imposed on businesses in Kansas to fund programs for protecting and ensuring clean water.

Q: How often do businesses need to file Form WP-1?

A: Form WP-1 must be filed annually by businesses in Kansas.

Q: Are there any deadlines for filing Form WP-1?

A: Yes, Form WP-1 must be filed by April 15th of each year.

Q: Is there a penalty for late filing of Form WP-1?

A: Yes, late filing of Form WP-1 may result in penalties and interest charges.

Q: Are there any exemptions or deductions available for the Water Protection and Clean Drinking Water fees?

A: There are certain exemptions and deductions available. You should consult the instructions for Form WP-1 or contact the Kansas Department of Revenue for more information.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WP-1 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.