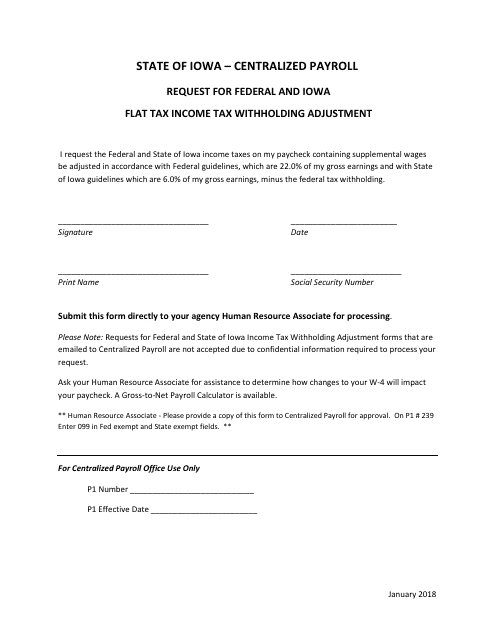

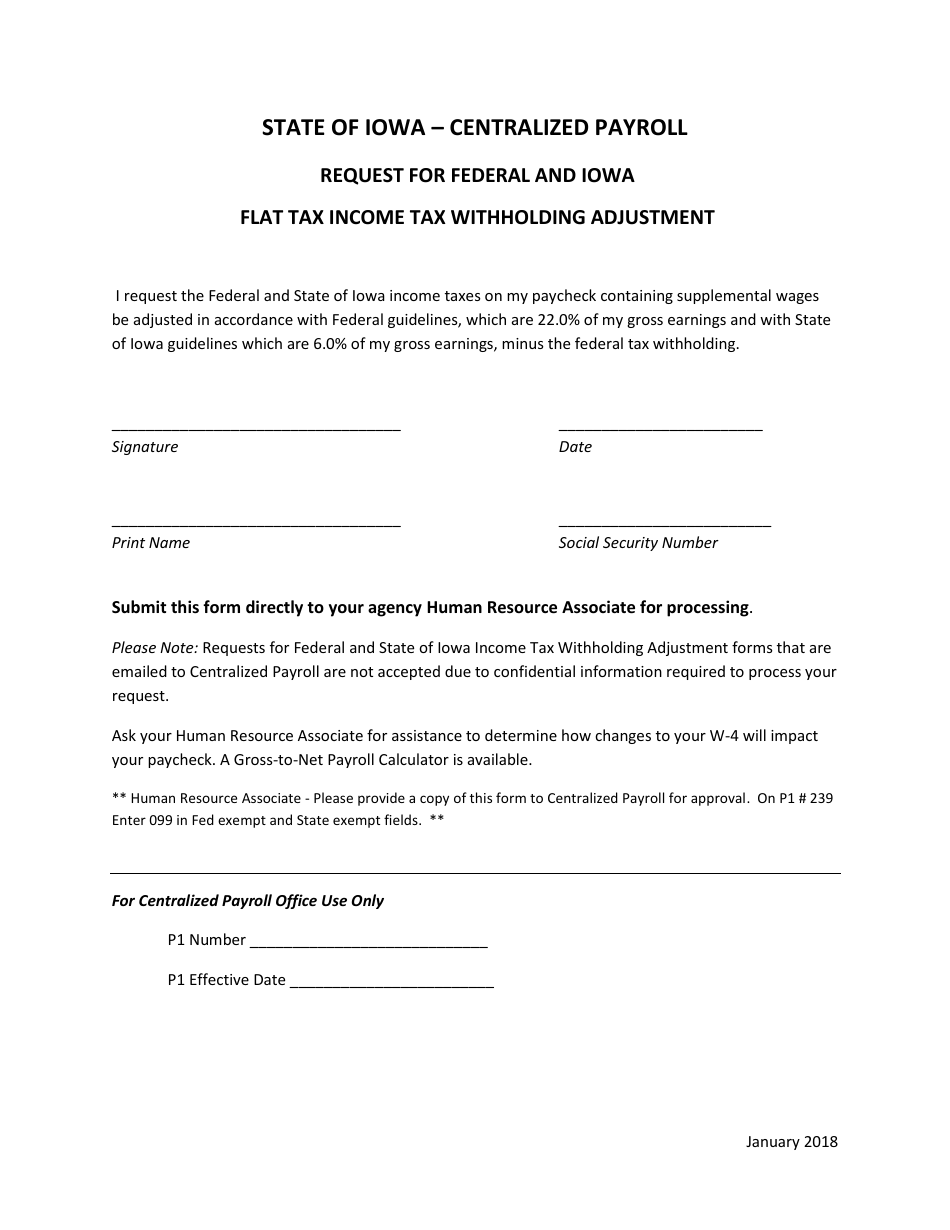

Request for Federal and Iowa Flat Tax Income Tax Withholding Adjustment - Iowa

Request for Federal and Iowa Flat Tax Income Tax Withholding Adjustment is a legal document that was released by the Iowa Department of Administrative Services - a government authority operating within Iowa.

FAQ

Q: What is the Federal and Iowa Flat Tax?

A: The Federal and Iowa Flat Tax is a type of income tax.

Q: What is income tax withholding?

A: Income tax withholding is the amount of money that is taken out of your paycheck for taxes.

Q: Why would I need to adjust my income tax withholding?

A: You may need to adjust your income tax withholding if you want to have more or less tax taken out of your paycheck.

Q: What is a withholding adjustment?

A: A withholding adjustment is a change to the amount of tax taken out of your paycheck.

Q: How can I request a Federal and Iowa Flat Tax income tax withholding adjustment in Iowa?

A: You can request a Federal and Iowa Flat Tax income tax withholding adjustment in Iowa by completing a specific form.

Q: Do I need to file a separate form for Federal and Iowa Flat Tax income tax withholding adjustment?

A: No, you can use the same form for both the Federal and Iowa Flat Tax income tax withholding adjustment.

Q: What information do I need to provide on the form for Federal and Iowa Flat Tax income tax withholding adjustment?

A: You will need to provide your personal information, employer information, and details about the withholding adjustment you are requesting.

Q: How long does it take for a Federal and Iowa Flat Tax income tax withholding adjustment to take effect?

A: The time it takes for a Federal and Iowa Flat Tax income tax withholding adjustment to take effect may vary, so it is best to check with the Iowa Department of Revenue for specific timelines.

Q: Can I make multiple withholding adjustments throughout the year?

A: Yes, you can make multiple withholding adjustments throughout the year if needed.

Form Details:

- Released on January 1, 2018;

- The latest edition currently provided by the Iowa Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Iowa Department of Administrative Services.