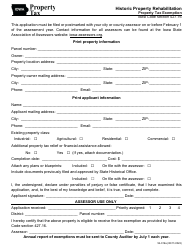

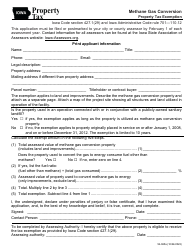

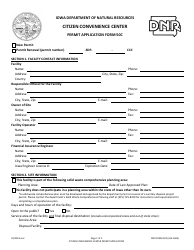

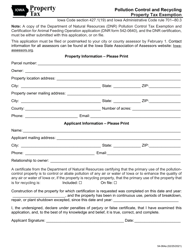

This version of the form is not currently in use and is provided for reference only. Download this version of

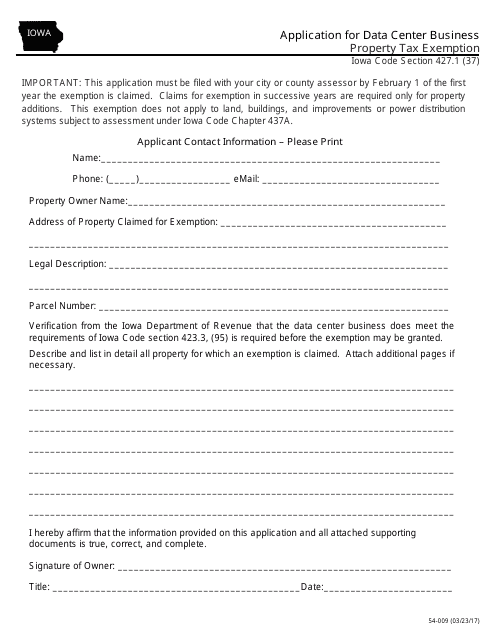

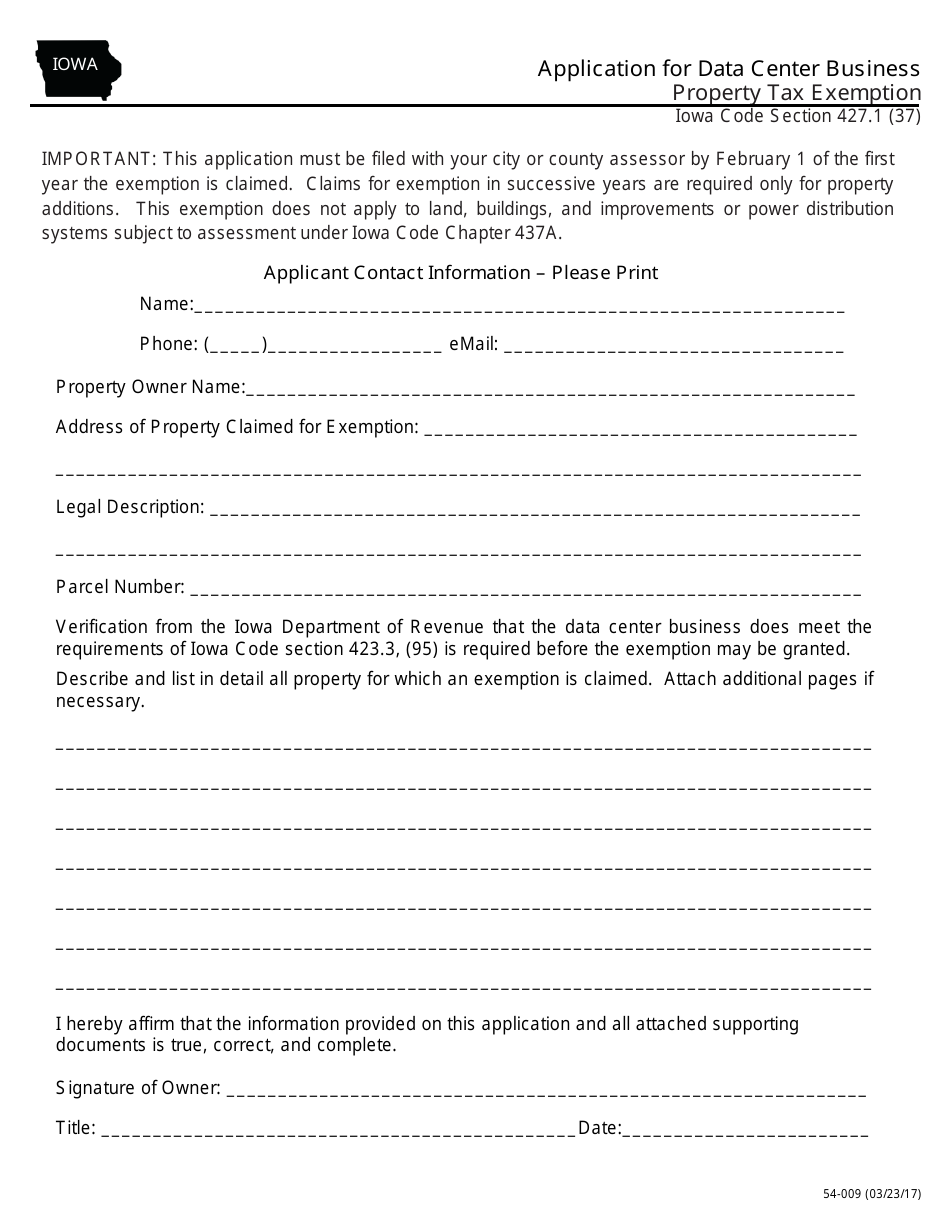

Form 54-009

for the current year.

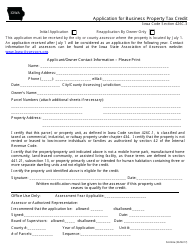

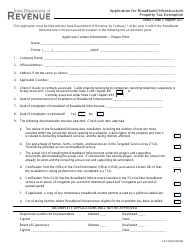

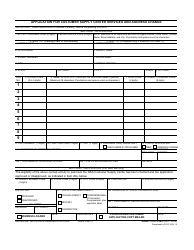

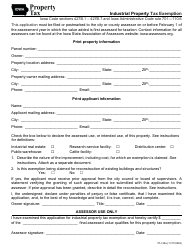

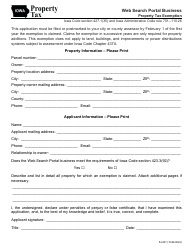

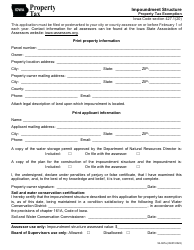

Form 54-009 Application for Data Center Business Property Tax Exemption - Iowa

What Is Form 54-009?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54-009?

A: Form 54-009 is the Application for Data Center Business Property Tax Exemption in Iowa.

Q: Who needs to fill out Form 54-009?

A: Data center businesses in Iowa that want to apply for a property tax exemption need to fill out Form 54-009.

Q: What is the purpose of Form 54-009?

A: The purpose of Form 54-009 is to apply for a property tax exemption for data center businesses in Iowa.

Q: Are there any fees associated with Form 54-009?

A: No, there are no fees associated with Form 54-009.

Q: Is there a deadline for submitting Form 54-009?

A: Yes, Form 54-009 must be submitted by February 1st of each year to be considered for the tax exemption.

Q: What information do I need to provide on Form 54-009?

A: You will need to provide information about your data center business, including its location, square footage, and other details specified on the form.

Q: Who can I contact for assistance with Form 54-009?

A: For assistance with Form 54-009, you can contact the Iowa Department of Revenue or refer to the instructions provided with the form.

Form Details:

- Released on March 23, 2017;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-009 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.